玩具

Search documents

10月21日重要资讯一览

Zheng Quan Shi Bao Wang· 2025-10-21 14:01

Group 1: New Stock Offerings - Dana Biological is offering a new stock with a subscription code of 920009, an issue price of 17.10 yuan per share, and a subscription limit of 360,000 shares [1] Group 2: Economic and Trade Developments - The Ministry of Commerce held a roundtable with over 170 foreign enterprises, indicating a commitment to expand foreign investment and support high-quality development in China [2] - The Chinese government is emphasizing the need for equal and respectful negotiations in the ongoing US-China trade discussions, stating that trade wars do not benefit either side [2] Group 3: Industry Standards and Guidelines - The Ministry of Industry and Information Technology is soliciting opinions on a draft guideline for building a computing power standard system by 2027, aiming to revise over 50 standards and promote innovation and collaboration in technology [3] - Guangdong Province has launched an action plan to enhance the quality of manufacturing through artificial intelligence, focusing on various sectors and supporting the development of intelligent factories [4] - Zhejiang Province aims to cultivate 10 leading intelligent development platforms and 1,000 intelligent products by 2027, with a goal of achieving over 70% application rate of intelligent systems [5] Group 4: Consumer and Tourism Initiatives - Guizhou Province is enhancing its tourism sector by creating world-class destinations and improving the quality of existing attractions, while also promoting diverse tourism products [6] - Shanghai is encouraging the integration and upgrading of construction enterprises to foster new growth drivers in the industry [7] - Guangzhou is implementing measures to boost consumer spending and stabilize investor returns through various economic initiatives [7] Group 5: Company Performance Highlights - Pop Mart reported a year-on-year revenue increase of 245% to 250% in the third quarter [8] - Jin Gu shares have been selected for a low-carbon wheel project by a global leading automotive company [9] - China Telecom's net profit for the first three quarters increased by 5.03% year-on-year [9] - Shiyida's net profit surged by 471.34% in the third quarter [9] - Wanchen Group's net profit for the first three quarters increased by 917.04%, with a proposed dividend of 1.5 yuan per 10 shares [9] - Shengnong Development's net profit rose by 202.82% in the first three quarters, proposing a dividend of 3 yuan per 10 shares [9] - China National Materials Technology reported a 234.84% increase in net profit for the third quarter [9] - Grebo secured significant orders for lithium battery outdoor power equipment from a leading US home improvement retailer [9]

中国香港,全球第三!

Zhong Guo Ji Jin Bao· 2025-10-21 13:48

Market Performance - The Hong Kong stock market showed strong performance on October 21, with the Hang Seng Index rising by 0.65% to 26,027.55 points, and the Hang Seng Technology Index increasing by 1.26% to 6,007.94 points [2][3] - The total market turnover for the day was HKD 264.7 billion, showing a slight recovery compared to the previous trading day, with net inflow from southbound funds amounting to HKD 1.171 billion [2] Company Highlights - Pop Mart experienced a significant drop of 8.08% on October 21, despite a remarkable cumulative increase of 180.46% in its stock price since the beginning of 2025. The company reported a year-on-year revenue growth of 245% to 250% for Q3 2025, with domestic revenue increasing by 185% to 190% and overseas revenue soaring by 365% to 370% [4] - Semiconductor company SMIC saw its stock rise by 3.13%, with a year-to-date increase of 132.86%. The current stock price is HKD 74.05, down from a 52-week high of HKD 93.5. The surge in memory prices, particularly DDR4, is expected to benefit domestic manufacturers, with analysts highlighting SMIC's investment value in the semiconductor sector [7] - China Life Insurance's stock rose by 6.06% following a profit forecast announcement, estimating a net profit of approximately RMB 156.785 billion to RMB 177.689 billion for the first three quarters of 2025, representing a year-on-year growth of 50% to 70% [10] ETP Market Insights - As of September 2025, Hong Kong's ETP market ranked third globally in average daily turnover, surpassing South Korea and Japan. The total assets under management for ETPs grew by 34.1% year-on-year to HKD 653.5 billion [10] - The growth in the ETP market is attributed to the popularity of technology-focused ETFs, particularly the flagship Hang Seng Technology Index ETP, and increased investor participation through the Hong Kong Stock Connect [10] - Active ETFs have become a focal point in the global market in 2025, with inflows reaching USD 183 billion in the first half of the year. The number of active ETFs listed in Hong Kong increased to 31 by September 2025, with a total market value of approximately HKD 23.7 billion, reflecting a 143% growth from the previous year [11]

中国香港,全球第三!

中国基金报· 2025-10-21 13:43

Market Performance - The Hang Seng Index rose by 0.65% to 26,027.55 points, while the Hang Seng Technology Index increased by 1.26% to 6,007.94 points, and the Hang Seng China Enterprises Index climbed by 0.76% to 9,302.66 points on October 21 [2][3] - The total market turnover was HKD 264.7 billion, showing a slight recovery compared to the previous trading day, with net inflow from southbound funds amounting to HKD 1.171 billion [2] Company Highlights - Pop Mart experienced a significant drop of 8.08% on October 21, but its stock price has increased by 180.46% since the beginning of 2025. The company reported a year-on-year revenue growth of 245% to 250% for Q3 2025, with domestic revenue growing by 185% to 190% and overseas revenue by 365% to 370% [5] - Semiconductor company SMIC saw its stock rise by 3.13%, with a year-to-date increase of 132.86%. The company is benefiting from a surge in DDR4 memory prices, which have more than doubled this year, presenting significant business opportunities for domestic manufacturers [9] - China Life Insurance's stock rose by 6.06% following a profit forecast announcement, projecting a net profit of approximately RMB 156.785 billion to RMB 177.689 billion for the first three quarters of 2025, representing a year-on-year growth of 50% to 70% [13] ETP Market Insights - As of September 2025, Hong Kong's ETP market ranked third globally in average daily turnover, surpassing South Korea and Japan. The total assets under management for ETPs grew by 34.1% year-on-year to HKD 653.5 billion [14] - The growth in the ETP market is attributed to the popularity of technology-focused ETFs, particularly the flagship Hang Seng Technology Index ETP, and increased investor participation through the Hong Kong Stock Connect [14] - The number of actively managed ETFs listed in Hong Kong reached 31 by September 2025, up from 26 at the end of 2024, with a total market value of approximately HKD 23.7 billion, reflecting a 143% increase from HKD 9.8 billion in 2024 [16]

重大资产重组告吹,群兴玩具跌停 宣布收购计划时曾收获3个涨停

Mei Ri Jing Ji Xin Wen· 2025-10-21 13:17

Core Viewpoint - The company, Qunxing Toys, faced a significant stock price drop after announcing the termination of its major asset restructuring plan to acquire a controlling stake in Hangzhou Tiankuan Technology Co., Ltd. This decision was influenced by the inability to reach an agreement on key terms of the transaction after eight months of negotiations [1][2]. Group 1: Acquisition Details - Qunxing Toys initially proposed to acquire at least 51% of Tiankuan Technology for approximately 4.08 billion yuan, based on the company's overall valuation of around 8 billion yuan [2][5]. - Tiankuan Technology is recognized as a "little giant" enterprise by the Ministry of Industry and Information Technology, specializing in AI computing center construction and operation, digital services, and intelligent security [2][3]. - The acquisition was expected to position Qunxing Toys among the top players in the domestic intelligent computing center sector, as stated by the company's chairman [3][6]. Group 2: Financial Position - As of mid-2025, Qunxing Toys reported current assets of only 1.63 billion yuan, with cash and cash equivalents amounting to approximately 210 million yuan, which is insufficient to fund the proposed acquisition [1][5]. - The company's revenue from its intelligent computing business was only 18.11 million yuan, accounting for 10.32% of total revenue, indicating limited scale in this new business area [5][6]. Group 3: Historical Context - Qunxing Toys has a history of attempting cross-industry acquisitions since 2014, including failed attempts to acquire companies in nuclear power equipment and new energy vehicle batteries [4][5]. - The termination of the acquisition reflects ongoing challenges in the company's efforts to diversify beyond its traditional toy business, which has been underperforming [4][5].

伏笔与本能

财富FORTUNE· 2025-10-21 13:04

Core Viewpoint - The article highlights the historical significance and evolution of the LEGO Group, emphasizing its commitment to sustainability and innovation in toy manufacturing, rooted in the vision of its founder, Ole Kirk Christiansen [5][18]. Group 1: Historical Background - The LEGO Group's origins trace back to a small woodworking shop established by Ole Kirk Christiansen in 1932, initially producing wooden toys during the Great Depression [6][8]. - The name "LEGO" was officially adopted in 1936, derived from the Danish phrase "Leg Godt," meaning "play well" [9]. - The company transitioned from wooden toys to plastic products after acquiring an injection molding machine in 1946, leading to the creation of the first LEGO bricks [12][19]. Group 2: Innovation and Product Development - The introduction of the stud-and-tube coupling system in 1958 allowed for more stable and versatile constructions, which became a cornerstone of LEGO's product design [14][17]. - The "LEGO System in Play" concept was developed to encourage creativity and extend the product lifecycle through standardized, compatible components [12][13]. Group 3: Sustainability Efforts - LEGO Group has committed to sustainability by investing in research for alternative materials, with a focus on reducing carbon emissions in production processes [18][19]. - The company has tested over 600 materials to find sustainable options, including bio-based polyethylene and recycled materials, aiming to replace traditional ABS plastic [19][20]. - Initiatives like the LEGO Replay program aim to recycle and donate used bricks, promoting a circular economy within the toy industry [21][22].

第138届广交会于10月15日开幕

Shang Wu Bu Wang Zhan· 2025-10-21 11:59

Core Insights - The 138th Canton Fair opened on October 15, featuring a total exhibition area of approximately 1.55 million square meters, providing a comprehensive trade platform for global buyers [1] Group 1: Exhibition Scale and Structure - The exhibition scale is larger, with 74,500 booths and over 32,000 participating companies, marking an increase of over 1,000 companies compared to the previous session [1] - The product structure is optimized, featuring 55 exhibition areas categorized into 13 major product categories, focusing on advanced manufacturing, quality home products, and lifestyle enhancements [1][3] Group 2: Quality of Exhibitors - Over 31,000 export exhibitors have been rigorously evaluated, with more than 10,000 high-quality enterprises recognized for their technological advancements, accounting for 34% of total exhibitors [2] - The number of exhibitors in emerging industries has reached 4,134, with a notable increase in companies specializing in service robots [2] Group 3: Innovative Products - A wide array of innovative products will be showcased, including humanoid robots, smart appliances, and VR devices, emphasizing design innovation and sustainability [3] Group 4: Enhanced Services - New services include pre-registration and remote certification, partnerships with travel agencies for discounts, and an upgraded smart navigation system within the Canton Fair app [4] - The fair will also host various activities aimed at facilitating trade connections and sharing industry insights, including themed forums and product launches [4] Group 5: App Functionality - The Canton Fair app serves as a practical online platform, offering extensive product information, itinerary planning, and real-time communication features to enhance the efficiency of trade interactions [5]

泡泡玛特第三季度营收增长约250%!近2个月股价跌超20%

Di Yi Cai Jing Zi Xun· 2025-10-21 11:13

Core Insights - The company reported a significant increase in overall revenue for Q3 2025, with an expected growth of 245% to 250% year-on-year [1] - The revenue growth in China is projected to be between 185% and 190%, with offline channels growing by 130% to 135% and online channels by 300% to 305% [1] - The overseas revenue is expected to grow by 365% to 370%, with notable increases in different regions: Asia-Pacific (170% to 175%), Americas (1265% to 1270%), and Europe & others (735% to 740%) [1] Revenue Performance - The company achieved a 204% year-on-year revenue growth in the first half of 2025, driven by the popularity of its plush toys, particularly the Labubu series [1] - Despite the strong revenue performance, the company's stock price has seen a decline of over 20% since reaching a peak in late August [2] Market Expansion - The company plans to further expand its overseas market presence, with an expectation to open 200 new stores in the second half of the year [1]

“玩具第一股”沦为重组失败专业户,群兴玩具路在何方?

Di Yi Cai Jing· 2025-10-21 10:44

Core Viewpoint - The company, Qunxing Toys, has attempted five mergers and acquisitions over the past decade, all of which have failed, with the latest attempt to acquire Tian Kuan Technology officially terminated due to disagreements on key terms [1][7]. Group 1: Mergers and Acquisitions Attempts - Qunxing Toys announced on October 20 that it would terminate its plan to acquire at least 51% of Tian Kuan Technology due to a lack of consensus on core issues [1]. - The company has a history of pursuing acquisitions in various sectors, including gaming, nuclear power, military, power batteries, and consumer electronics, but has not succeeded in any of these attempts since its listing in 2011 [1][2]. - The latest acquisition attempt was part of a strategy to enter the computing power leasing industry, which the company began exploring last year [2]. Group 2: Financial Performance and Business Transition - After its listing, Qunxing Toys experienced a decline in net profit from 52 million yuan in its first year to 14.87 million yuan in 2014, prompting a search for quality assets to enhance its business [3]. - The company has gradually shifted away from toy manufacturing to focus on other sectors, including alcohol sales, property leasing, and smart computing power leasing, as indicated in its 2024 annual report [8][9]. - The transition has led to periods where the company had zero revenue from its original toy business, highlighting the challenges of maintaining a coherent business strategy [9]. Group 3: Current Ownership and Control - Following multiple failed acquisitions, the original controlling shareholders, Lin Weizhang and Huang Shiqun, sought to transfer control to strategic investors, ultimately resulting in a change of control to Wang Sanshou in 2018 [6]. - As of September 2024, Qunxing Toys has no controlling shareholder or actual controller, with ownership highly dispersed among individual shareholders [9].

炸裂!泡泡玛特Q3整体收益同比增长245%-250%,海外收益增365%-370%

美股IPO· 2025-10-21 10:03

泡泡玛特2025年第三季度整体收益同比增长245%-250%,其中海外收益增长365%-370%,美洲市场爆发式增长超1265%。尽管增速惊人,但由于增 速较上半年放缓,投资者担忧公司增长神话能否持续,导致泡泡玛特港股周二大跌超8.1%。 随着Labubu系列的全球风靡,泡泡玛特三季度在中国大陆和海外市场的收益均实现了强劲增长。其中,美洲市场表现尤为突出,实现了超过12倍的爆 发式增长。 泡泡玛特港股周二大跌8.1%,创下自4月初以来的最大单日跌幅, 成为恒生中国企业指数中表现最差的成分股。有分析认为,在经历了上半年的爆炸 式增长后,部分投资者对这家消费明星企业的前景正转向谨慎。尽管泡泡玛特股价今年迄今的涨幅仍接近180%,远超同期大盘约28%的涨幅,但市场 的忧虑情绪已然显现。 增长预期回调,投资者担忧增长神话降温 21日,泡泡玛特公告, 2025年第三季度整体收益较2024年同期增长245%-250%。 其中,中国收益同比增长185%-190%,海外收益同比增长 365%-370%。 从渠道来看,中国线上渠道增速(300%-305%)远超线下(130%-135%),显示数字化转型成效显著。 海外市场表现来 ...

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

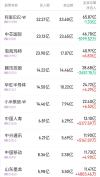

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]