非银金融

Search documents

65只股上午收盘涨停(附股)

Zheng Quan Shi Bao Wang· 2025-10-28 04:13

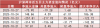

Market Overview - The Shanghai Composite Index closed at 4005.44 points, up 0.21% [1] - The Shenzhen Component Index closed at 13559.57 points, up 0.52% [1] - The ChiNext Index rose by 1.35% and the Sci-Tech 50 Index increased by 0.56% [1] Stock Performance - Among the tradable A-shares, 2937 stocks rose, accounting for 57.03%, while 2001 stocks fell [1] - There were 65 stocks that hit the daily limit up, and 6 stocks hit the limit down [1] - The leading sectors for limit-up stocks included Computer, Machinery Equipment, and Construction Decoration, with 6, 5, and 5 stocks respectively [1] Notable Stocks - ST Zhongdi has achieved 8 consecutive limit-up days, the highest among all stocks [1] - The stock with the highest limit-up order volume was Yingxin Development, with 23384.46 million shares, followed by Pingtan Development and Helitai [1] - In terms of order value, Yingxin Development, Pingtan Development, and Shikong Technology had the highest amounts, with 746 million, 745 million, and 671 million respectively [1] Limit-Up Stocks Summary - A detailed table lists various stocks that hit the limit up, including their closing prices, turnover rates, limit-up order volumes, and industry classifications [1][2][3]

A股Q3业绩暖意足 电子有色金属等行业增长明显

Zheng Quan Shi Bao· 2025-10-28 03:08

(家电网® HEA.CN) A股三季报扎堆披露。Wind数据显示,截至10月26日18时,A股共有1311家上市公司已披露三季报, 773家上市公司实现归属于上市公司股东的净利润同比增长,占比约为58.96%。从行业角度看,建筑材 料、钢铁、电子、有色金属、电力设备、非银金融、计算机、商贸零售等板块业绩增长明显。从分红角 度看,截至目前,A股共有60家上市公司对外发布2025年三季度分红方案,42家公司每10股拟派发现金 股利超过1元(含税)。 ...

这家央企金融机构高管接连被查!

Jin Rong Shi Bao· 2025-10-28 02:44

Core Points - The former chief professional of China Three Gorges Finance Co., Cheng Zhiming, is under investigation for serious violations of discipline and law, highlighting ongoing scrutiny of state-owned financial institutions [1][3] - This incident follows a pattern of investigations into high-ranking officials within the company, indicating a stringent regulatory environment [3] Summary by Sections Company Investigation - Cheng Zhiming, who was approved as chairman of China Three Gorges Finance Co. in November 2020, is currently undergoing disciplinary review and investigation by the Central Commission for Discipline Inspection [1] - The company has seen previous high-level investigations, including that of former deputy general manager Bi Jiajun in January 2024 for similar violations [3] Regulatory Environment - The investigation of Cheng Zhiming reflects a broader trend of increased oversight and enforcement actions against misconduct in state-owned financial institutions [3] - Other financial companies in the power sector, such as China Power Finance Co. and China Shipbuilding Group Finance Co., have also faced similar scrutiny, with multiple high-ranking officials being investigated since 2019 [3]

杠杆&ETF资金分化:流动性&交易拥挤度&投资者温度计周报-20251027

Huachuang Securities· 2025-10-27 15:36

Group 1: Liquidity and Fund Flow - The supply side of funds continues to shrink, with public fund issuance maintaining historical median levels, while leveraged funds have seen a net inflow returning to high levels[3] - Equity financing has expanded to a historical high, reaching a new peak since July this year, with southbound funds accumulating a net inflow of over 570 billion CNY in the past five months[3][10] - The net inflow of margin financing reached approximately 267.3 billion CNY, marking a significant turnaround from a previous outflow of 140 billion CNY, placing it in the 83rd percentile over the past three years[17] Group 2: Trading Congestion and Market Sentiment - The trading heat for insurance, central enterprises, and banks has increased, with insurance rising by 32 percentage points to 48%, central enterprises by 26 percentage points to 49%, and banks by 25 percentage points to 56%[3][57] - Conversely, the trading heat for electronics, home appliances, and media has decreased, with electronics down 23 percentage points to 53%, home appliances down 17 percentage points to 59%, and media down 14 percentage points to 13%[3][70] - Retail investor net inflow in the A-share market was 682.6 billion CNY, a decrease of 1,225.1 billion CNY from the previous value, placing it in the 23.1 percentile over the past five years[3] Group 3: ETF and Repurchase Trends - Stock-type ETFs experienced a net outflow of 299.2 billion CNY, a significant drop from a previous net inflow of 260.8 billion CNY, placing the sentiment at a low point in the past three years[24] - The amount of repurchase by listed companies decreased to 13.1 billion CNY from 16.0 billion CNY, which is in the 36th percentile over the past three years[27] Group 4: Sector Performance - The net inflow in the electronics sector was 148.6 billion CNY, while the automotive sector saw a net outflow of 13.5 billion CNY[23] - The net inflow in the communication sector was 46.2 billion CNY, with a net outflow in the pharmaceutical sector of 3.0 billion CNY[23]

非银金融行业周报:把握非银三季报业绩增长和金融街论坛政策催化机遇-20251027

Donghai Securities· 2025-10-27 14:59

Investment Rating - The report assigns an "Overweight" rating to the non-bank financial industry, indicating that it is expected to outperform the CSI 300 index by at least 10% over the next six months [34]. Core Insights - The non-bank financial index rose by 2% last week, outperforming the CSI 300 index by 1.2 percentage points. The brokerage and insurance indices also saw increases of 2.1% and 1.8%, respectively, indicating a synchronized upward trend in these sectors [3][8]. - The report highlights the rapid growth in third-quarter earnings for brokerages, driven by a market recovery. Major brokerages like CITIC Securities and Huaxin Securities reported year-on-year profit increases of 37.9% and 66.4%, respectively, with a significant rise in average daily A-share trading volume [4][8]. - The upcoming Financial Street Forum is expected to provide policy-driven catalysts that could further enhance market activity and valuations in the brokerage sector [4]. Market Data Tracking - The average daily trading volume for stock funds was 23,307 billion yuan, a decrease of 16.2% from the previous week. The margin trading balance increased by 1.1% to 2.46 trillion yuan, while the stock pledge market value rose by 2.1% to 2.99 trillion yuan [16][22]. - The report notes that the insurance sector is also experiencing strong earnings growth, with major insurers like China Life and New China Life projecting profit increases of 50%-70% and 45%-65%, respectively, for the first three quarters of 2025 [4][14]. Industry News - The China Securities Regulatory Commission (CSRC) emphasized the importance of enhancing the resilience and risk management capabilities of the capital market during a recent meeting. This includes improving the inclusiveness and adaptability of market regulations and promoting deeper capital market openness [32]. - The report mentions that the new regulatory framework aims to support high-quality development in the financial sector, focusing on risk prevention and regulatory compliance [32].

【27日资金路线图】电子板块净流入逾34亿元居首 龙虎榜机构抢筹多股

Zheng Quan Shi Bao· 2025-10-27 13:54

Market Overview - The A-share market experienced an overall increase on October 27, with the Shanghai Composite Index closing at 3996.94 points, up 1.18%, the Shenzhen Component Index at 13489.4 points, up 1.51%, and the ChiNext Index at 3234.45 points, up 1.98%. The North Star 50 Index decreased by 0.2%. Total trading volume reached 23,567.99 billion yuan, an increase of 3,649.94 billion yuan compared to the previous trading day [1]. Capital Flow - The A-share market saw a net outflow of 75.9 billion yuan in main funds, with an opening net outflow of 19.28 billion yuan and a closing net inflow of 1.68 billion yuan [2]. - The CSI 300 index recorded a net outflow of 37.83 billion yuan, while the ChiNext saw a net outflow of 49.68 billion yuan, and the Sci-Tech Innovation Board had a net inflow of 11.01 billion yuan [4]. Sector Performance - Among the 14 sectors, the electronics industry led with a net inflow of 34.32 billion yuan, followed by public utilities with 28.22 billion yuan and non-ferrous metals with 21.67 billion yuan. The power equipment sector experienced the largest net outflow at -50.06 billion yuan [6][7]. Individual Stock Highlights - Shenghong Technology topped the list with a net inflow of 9.47 billion yuan [8]. - Institutions showed significant interest in several stocks, with notable net purchases in Jingzhida and others, while stocks like Demingli saw net selling [10]. Institutional Focus - Recent institutional ratings highlighted several stocks with potential upside, including Tian Nai Technology with a target price of 78.00 yuan, representing a 39.73% upside from the latest closing price [12].

两市主力资金净流出1.36亿元,沪深300成份股资金净流入

Zheng Quan Shi Bao Wang· 2025-10-27 10:21

Market Overview - On October 27, the Shanghai Composite Index rose by 1.18%, the Shenzhen Component Index increased by 1.51%, the ChiNext Index climbed by 1.98%, and the CSI 300 Index gained 1.19% [1] - Among the tradable A-shares, 3,361 stocks rose, accounting for 61.89%, while 1,862 stocks declined [1] Capital Flow - The main capital saw a net outflow of 136 million yuan for the day [1] - The ChiNext experienced a net outflow of 4.2 billion yuan, while the STAR Market had a net outflow of 241 million yuan [1] - The CSI 300 constituent stocks had a net inflow of 1.492 billion yuan [1] Industry Performance - Out of the 28 first-level industries classified by Shenwan, the top-performing sectors were Communication and Electronics, with increases of 3.22% and 2.96%, respectively [1] - The sectors with the largest declines included Media, Food & Beverage, and Real Estate, with decreases of 0.95%, 0.20%, and 0.11% [1] Industry Capital Inflows and Outflows - The Electronics industry led with a net inflow of 6.112 billion yuan and a daily increase of 2.96% [1] - The Non-ferrous Metals sector followed with a net inflow of 2.529 billion yuan and a daily increase of 2.39% [1] - The Power Equipment industry had the largest net outflow, totaling 3.354 billion yuan, despite a daily increase of 0.73% [1] - The Automotive sector also saw a significant net outflow of 2.176 billion yuan, with a daily increase of 0.66% [1] Individual Stock Performance - A total of 2,207 stocks experienced net inflows, with 875 stocks having inflows exceeding 10 million yuan [2] - The stock with the highest net inflow was Industrial Fulian, which rose by 8.19% with a net inflow of 1.915 billion yuan [2] - Other notable stocks with significant inflows included Zhaoyi Innovation and Hengbao Co., both with net inflows of 953 million yuan [2] - Conversely, 105 stocks had net outflows exceeding 100 million yuan, with CITIC Securities, Kehua Data, and Dongfang Wealth leading the outflows at 1.702 billion yuan, 919 million yuan, and 906 million yuan, respectively [2]

主力动向:10月27日特大单净流入72.63亿元

Zheng Quan Shi Bao Wang· 2025-10-27 09:49

Market Overview - The net inflow of large orders in the two markets reached 7.263 billion yuan, with 54 stocks seeing net inflows exceeding 200 million yuan, led by Industrial Fulian with a net inflow of 1.564 billion yuan [1][2] - The Shanghai Composite Index closed up 1.18%, with a total of 2,141 stocks experiencing net inflows and 2,665 stocks seeing net outflows [1] Industry Performance - Among the 17 industries with net inflows, the electronics sector had the highest net inflow of 5.417 billion yuan, with its index rising by 2.96%. The telecommunications sector followed with a net inflow of 3.483 billion yuan and a rise of 3.22% [1] - The power equipment sector experienced the largest net outflow of 2.905 billion yuan, followed by the media sector with a net outflow of 1.421 billion yuan [1] Individual Stock Performance - A total of 54 stocks had net inflows exceeding 200 million yuan, with Industrial Fulian leading at 1.564 billion yuan, followed by Xinyi Sheng with 1.364 billion yuan [2] - Stocks with significant net outflows included CITIC Securities with a net outflow of 1.799 billion yuan, and CATL with 1.040 billion yuan [2][4] - Stocks with net inflows averaging over 200 million yuan saw an average increase of 7.17%, outperforming the Shanghai Composite Index [2] Top Stocks by Net Inflow - The top stocks by net inflow include: - Industrial Fulian: 1.564 billion yuan, 8.19% increase [2] - Xinyi Sheng: 1.364 billion yuan, 8.31% increase [2] - Zhaoyi Innovation: 1.142 billion yuan, 10.00% increase [2] - Shenghong Technology: 1.011 billion yuan, 10.14% increase [2] - Xiamen Tungsten: 0.995 billion yuan, 10.00% increase [2] Top Stocks by Net Outflow - The top stocks by net outflow include: - CITIC Securities: -1.799 billion yuan, 0.40% increase [4] - CATL: -1.040 billion yuan, 0.11% increase [4] - Kehua Data: -0.904 billion yuan, -10.00% decrease [4] - ST Huatuo: -0.743 billion yuan, -5.01% decrease [4] - SMIC: -0.737 billion yuan, 0.33% increase [4]

上证指数逼近4000点,业内这样说→

第一财经· 2025-10-27 08:11

Core Viewpoint - The A-share market is experiencing a strong upward trend, with the Shanghai Composite Index nearing the 4000-point mark, driven by positive sentiment from U.S.-China trade negotiations and domestic policy support [3][4]. Economic Performance - From January to September, profits of industrial enterprises above designated size increased by 3.2% year-on-year, marking the highest cumulative growth rate since August of the previous year, with a notable acceleration of 2.3 percentage points compared to the previous month [3]. - In September alone, industrial profits surged by 21.6% year-on-year, reflecting a 1.2 percentage point increase from August [3]. Market Dynamics - The trading volume in the A-share market has significantly increased, with daily turnover surpassing 1 trillion yuan, and total A-share trading volume reaching approximately 2.3 trillion yuan [3]. - Analysts suggest that the market's positive momentum is supported by expectations of continued policy easing and potential fiscal stimulus measures [4][5]. Investment Sentiment - The current market performance indicates strong investor confidence in future economic growth, with key factors such as a supportive policy environment and sustained foreign capital inflows being crucial for market stability [4]. - The stock market is expected to enter a new upward phase from November to December, with a shift towards low-valuation sectors potentially leading the market [5].

54股获杠杆资金净买入超亿元

Zheng Quan Shi Bao Wang· 2025-10-27 06:51

Core Insights - As of October 24, the total market financing balance reached 2.44 trillion yuan, an increase of 58.95 billion yuan from the previous trading day [1] - A total of 1,619 stocks received net financing purchases, with 472 stocks having net purchases exceeding 10 million yuan, and 54 stocks exceeding 100 million yuan [1] - The top net purchase stock was Zhongji Xuchuang, with a net purchase amount of 1.63 billion yuan, followed by Hanwujing-U and Shenghong Technology [1][2] Financing Balance and Stock Performance - The financing balance in the Shanghai market was 1.235 trillion yuan, increasing by 29.86 billion yuan, while the Shenzhen market's financing balance was 1.197297 trillion yuan, also up by 29.34 billion yuan [1] - The Beijing Stock Exchange saw a decrease in financing balance to 75.21 billion yuan, down by 2.55 million yuan [1] - The average financing balance as a percentage of circulating market value for stocks with significant net purchases was 4.07% [2] Sector Analysis - The industries with the highest concentration of stocks receiving net purchases over 100 million yuan were electronics, power equipment, and non-ferrous metals, with 25, 4, and 4 stocks respectively [1] - The distribution of major net purchase stocks included 34 from the main board, 11 from the ChiNext board, and 9 from the Sci-Tech Innovation board [1] Notable Stocks and Their Financing Ratios - Cambridge Technology had the highest financing balance as a percentage of circulating market value at 7.92%, followed by Xiechuang Data and Yinzhijie at 7.06% and 7.03% respectively [2] - The top net purchase stocks on October 24 included Zhongji Xuchuang (12.05% increase), Hanwujing-U (9.01% increase), and Shenghong Technology (7.95% increase) [2][3]