Feng Huang Wang

Search documents

库克电话会议:iPhone Air致中国区收入下滑 假日季营收将创纪录

Feng Huang Wang· 2025-10-31 04:59

Core Insights - Apple reported record revenue of $102.466 billion for Q4 FY2025, an 8% increase from $94.930 billion in the same quarter last year, with net profit rising 86% to $27.466 billion from $14.736 billion [2] Revenue Performance - Revenue from Greater China in Q4 was $14.493 billion, a 3.6% decline from $15.033 billion year-over-year, falling short of analyst expectations of $16 billion [2] - CEO Tim Cook indicated strong demand for the iPhone 17, projecting double-digit percentage growth in iPhone revenue for Q1 FY2026, with overall revenue expected to grow 10% to 12% year-over-year [2] Product Demand and Market Strategy - Apple faced challenges in meeting market demand for multiple iPhone 17 models and some older iPhone 16 models during Q4 [2] - The decline in Greater China revenue was attributed to the delayed launch of iPhone Air, which Cook identified as the "main reason" for the drop, but he expressed optimism for recovery in Q1 [2] AI Development and Strategic Plans - Cook reported positive progress in the development of a more personalized Siri, with plans to launch it sometime next year [2] - The company is open to AI acquisition deals and aims to collaborate with more AI companies, similar to integrating ChatGPT into Apple Intelligence [4] Financial Impact - Apple incurred $1.1 billion in tariff-related costs in Q4, with an expected increase to $1.4 billion in Q1 FY2026 [3] Market Reaction - Following the earnings report, Apple's stock price rose by 2.73% in after-hours trading [5]

午评:创业板指半日跌超1% 医药、AI应用概念股逆势走强

Feng Huang Wang· 2025-10-31 03:43

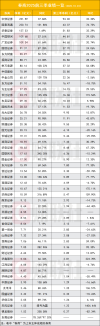

涨停表现 封板率 封板 45 触及 34 10月31日,市场早盘市场早间震荡调整,三大指数集体下挫。沪深两市半日成交额1.56万亿,较上个交易日放量274亿。 昨涨停今表现 盘面上热点快速轮动,全市场超3800只个股上涨。板块方面,影视院线、医药、电池等板块涨幅居前,保险、存储芯片、煤炭、CPO等板块跌幅居前。 截至收盘,沪指跌0.63%,深成指跌0.62%,创业板指跌1.49%。 从板块来看,医药板块逆势上涨,三生国健20cm涨停,联环药业、昂利康涨停。锂电板块表现活跃,天际股份2连板,恩捷股份等多股涨停。福建板块再度 走强,平潭发展11天8板。AI应用概念股持续走高,荣信文化、福石控股双双20cm涨停。下跌方面,算力硬件概念股集体下跌,"易中天"光模块三巨头大幅 调整。存储芯片概念股震荡走弱,江波龙跌超10%。可控核聚变概念股下挫,中国核建跌停。 57.00% 0.43% 高开率 50% 获利率 ...

券商集体迎来业绩高歌猛进,5家净利破百亿,12家翻倍

Feng Huang Wang· 2025-10-31 01:28

Core Insights - The securities industry is experiencing a significant performance boost, with a notable increase in profitability and market activity as of October 30, 2025 [1] Financial Performance - The total net profit of 52 securities firms for the first three quarters of 2025 reached 183.78 billion yuan, marking a year-on-year increase of 61.25% [1] - In Q3 alone, the net profit totaled 70.36 billion yuan, reflecting a year-on-year increase of 59.08% and a quarter-on-quarter increase of 26.45% [1] Leading Firms - Five firms reported net profits exceeding 10 billion yuan: CITIC Securities (23.16 billion yuan), Guotai Junan (22.07 billion yuan), Huatai Securities (12.73 billion yuan), China Galaxy (10.97 billion yuan), and GF Securities (10.93 billion yuan) [5] - Twelve firms achieved a net profit growth of over 100%, with Guolian Minsheng leading at 345.30% [6] Business Segments - Brokerage income surged by 74.64% year-on-year, totaling 111.78 billion yuan across 42 comparable firms [10] - Proprietary trading income reached 186.86 billion yuan, up 43.83% year-on-year, with 88.1% of firms reporting positive growth [13] - Investment banking revenue increased by 23.46% year-on-year, totaling 25.15 billion yuan, with 64.29% of firms showing positive growth [16] Asset Management - Asset management income showed a modest recovery, totaling 33.25 billion yuan, with a year-on-year increase of 2.77% [19] Market Trends - The total assets of CITIC Securities and Guotai Junan both surpassed 2 trillion yuan, with CITIC's assets at 2.03 trillion yuan, up 18.45% year-on-year, and Guotai's at 2.009 trillion yuan, up 91.7% [8]

24.5亿委托贷款疑云!一纸清盘申请,千亿房企与小贷公司“反目成仇”

Feng Huang Wang· 2025-10-31 01:20

Core Viewpoint - The incident highlights a rare case of a client actively reporting serious violations by a lender, involving a significant dispute between the Hong Kong-listed property company Kaisa Group and a small loan company, Sunshine New World [1][2]. Group 1: Incident Overview - Kaisa Group filed a complaint against Sunshine New World for serious operational violations and illegal fundraising after the latter initiated a winding-up petition against Kaisa for approximately 642 million yuan in unpaid loans and 136 million yuan in accrued interest [1]. - The case marks the first cross-border winding-up petition initiated by a domestic small loan company against a large property enterprise, drawing significant market attention [1]. Group 2: Allegations Against Sunshine New World - Kaisa Group claims that Sunshine New World engaged in systemic violations by using shell companies to circumvent core regulatory requirements related to loan concentration, funding sources, and operational scope [1][3]. - The total amount of entrusted loans from Kaisa to Sunshine New World reached 2.45 billion yuan, with disputes primarily arising from loans issued in 2021 and 2022 [3][8]. Group 3: Regulatory Context - The small loan industry has seen a trend where certain regions, like Shandong, previously allowed entrusted loans, but these practices have faced increasing scrutiny and regulatory restrictions [4][5]. - Kaisa's allegations include that Sunshine New World continued to conduct entrusted loan activities despite a change in its business scope that removed such activities, amounting to 1.17 billion yuan in loans post-change [6][8]. Group 4: Industry Implications - The incident is expected to bring to light hidden practices within the small loan industry, potentially leading to broader discussions and regulatory scrutiny [2][10]. - The ongoing dispute has implications for the regulatory landscape, as Kaisa's complaint has prompted local authorities to review Sunshine New World's compliance with existing policies [10].

中国区收入再度下滑,苹果第四财季净利润同比增长86%

Feng Huang Wang· 2025-10-30 23:53

苹果第四财季营收、每股收益均超出分析师一致预期,推动股价在盘后上涨超4%。 苹果股价盘后上涨4.66% 苹果股票周四在纳斯达克交易所开盘报271.99美元。截至周四收盘,苹果股价上涨1.70美元,报收于 271.40美元,涨幅为0.63%。截至发稿,苹果股价在盘后交易中上涨12.65美元至284.05美元,涨幅为 4.66%。过去52周,苹果股价最高为274.14美元,最低为169.21美元。 凤凰网科技讯 北京时间10月31日,苹果公司(NASDAQ:AAPL)今天发布了截至9月27日的2025财年第四 季度及全年财报。财报显示,苹果第四财季总营收为1024.66亿美元,创纪录,较上年同期的949.30亿美 元增长8%;净利润为274.66亿美元,较上年同期的147.36亿美元增长86%。 2025财年全年,苹果营收为4161.61亿美元,较2024财年的3910.35亿美元增长6%;净利润为1120.10亿 美元,较2024财年的937.36亿美元增长19%。 苹果第四财季大中华区营收为144.93亿美元,较上年同期的150.33亿美元下降3.6%,远不及分析师预计 的164亿美元。 股价表现: 第四财季 ...

云业务强劲增长 亚马逊第三季度净利润增长38%、股价大涨13%

Feng Huang Wang· 2025-10-30 23:48

Core Viewpoint - Amazon's AWS cloud business demonstrated strong growth, contributing to a significant increase in overall revenue and net profit for the third quarter of fiscal year 2025 [1][2]. Financial Performance - Total revenue for Q3 was $180.17 billion, a 13% increase from $158.88 billion in the same period last year [1][4]. - Net profit reached $21.19 billion, up 38% from $15.33 billion year-over-year [1][4]. - Diluted earnings per share were $1.95, a 36% increase from $1.43 in the previous year [5]. Business Segmentation - AWS cloud computing revenue for Q3 was $33.01 billion, a 20% increase from $27.45 billion year-over-year [6]. - North America segment revenue was $106.27 billion, an 11% increase from $95.54 billion, but operating profit decreased by 15% [6]. - International segment revenue was $40.90 billion, a 14% increase from $35.89 billion, with operating profit down 8% [6]. Cash Flow and Special Items - Operating cash flow for the trailing twelve months was $130.70 billion, a 16% increase from $112.70 billion [5]. - Free cash flow decreased by 69% to $14.80 billion from $47.70 billion year-over-year [5]. - Operating profit included special expenses of $2.5 billion related to a legal settlement and $1.8 billion for anticipated severance costs [4]. Future Outlook - For Q4 of fiscal year 2025, revenue is expected to be between $206.00 billion and $213.00 billion, reflecting a year-over-year growth of 10% to 13% [7]. - Operating profit is projected to be between $21.00 billion and $26.00 billion, compared to $21.20 billion in the same quarter last year [7].

融信中国原计划10月推出的境内债务重组方案仍未确定

Feng Huang Wang· 2025-10-30 23:02

Core Viewpoint - The debt restructuring plan of Ronshine China (03301.HK) has not been launched as scheduled, with the issuer seeking more time to finalize the plan [1] Group 1: Debt Restructuring Plan - Ronshine China previously indicated that a restructuring plan would be released in October, but it remains uncertain [1] - The restructuring plan is intended to cover both public and private bonds, referencing restructuring plans from other companies like Sunac [1] - In January, Ronshine initiated a vote for an extension, which was approved, postponing payments due in March to October 28 [1] Group 2: Payment and Bond Status - As of October 28, the issuer announced that the necessary funds for debt repayment were not in place [1] - Six existing corporate bonds, totaling 7.0148 billion yuan, were suspended from trading starting October 29, with the resumption date to be determined [1] - The issuer is required to pay interest accrued from April 28, 2023, to October 28, 2025, as per the extension plan, with grace periods ranging from 30 to 90 days for the bonds [1]

美股收盘:三大指数集体下跌,科技巨头股价大起大落

Feng Huang Wang· 2025-10-30 22:21

Market Overview - On October 30, US stock indices collectively declined, with the Dow Jones down 0.23% to 47,522.12 points, the S&P 500 down 0.99% to 6,822.34 points, and the Nasdaq down 1.57% to 23,581.14 points, ending a streak of record highs [1][2]. Technology Sector Performance - Meta's stock fell 11.33% following its quarterly earnings report, while Microsoft dropped 2.92%, as investors expressed concerns over rising expenditures in artificial intelligence (AI) [2][5]. - The Philadelphia Semiconductor Index decreased by 1.53%, with 22 out of 30 component stocks declining. Notable declines included AMD down 3.59%, Broadcom down 2.46%, and Nvidia down 2%, with its market cap falling below $500 billion [2][5]. - Overall, large tech stocks faced pressure due to a decrease in the probability of a Federal Reserve rate cut in December, which dropped from around 95% to 72.8% [2]. Company Earnings Reports - Apple reported Q4 revenue of $102.47 billion, exceeding market expectations of $102.19 billion, with a net profit of $27.47 billion and earnings per share of $1.85, up 90.72% year-over-year [7]. - Amazon's Q3 net sales reached $180.17 billion, surpassing the forecast of $177.82 billion, with a net profit of $21.19 billion and earnings per share of $1.95, exceeding the expected $1.58 [9]. - Reddit's Q3 revenue was $585 million, above market expectations, with a net profit of $162.7 million [10]. Future Projections - Apple's CEO Tim Cook projected a 10% to 12% year-over-year growth in overall sales for Q1 of the fiscal year, despite supply constraints for certain iPhone models [8]. - Amazon anticipates Q4 net sales between $206 billion and $213 billion, slightly below market expectations of $208.45 billion [9]. AI Investments - OpenAI announced plans for the "Stargate" data center project in Michigan, with a planned capacity exceeding 8 gigawatts and an investment of over $450 billion over the next three years [11].

巴菲特11月公开信定档,市场热议伯克希尔的“股神溢价”会否褪色

Feng Huang Wang· 2025-10-30 22:21

随着2025年的10月来到最后一天,沃伦·巴菲特的伯克希尔哈撒韦CEO任期也进入了最后两个月倒计时。随着交班节 点临近,资本市场也开始发出质疑:没有巴菲特掌舵的伯克希尔,还值得买么? 在今年5月的股东大会上,年逾九旬的当代股神突然宣布,计划在年底将CEO职务交给他亲自挑选的接班人格雷格· 阿贝尔。自那以来,伯克希尔-B类股下跌了近12%,同期标普500指数上涨了21%。 长期以来,巴菲特的年度股东信被许多投资者奉为投资的金科玉律,不少投资者也愿意为巴菲特的公司支付溢价并 长期持有。 根据周四的最新消息,巴菲特的助理公开确认,明年开始阿贝尔将接手撰写伯克希尔的年度股东信,并主持在奥马 哈举行的年度股东大会。仍担任董事长的巴菲特将在台下与其他董事一同就座。 最新消息也确认,在担任伯克希尔CEO的最后时光里,巴菲特将在11月10日发布一封写给他三个孩子和伯克希尔股 东的感恩节公开信。 当其他投资人纷纷涌入大型科技巨头时,伯克希尔减持了苹果,到二季度时已经将现金及等价物规模增至3440亿美 元。这家公司的其他怪异之处包括但不限于:公司坚持在周六发财报、不发布财务指引,也不举行季度管理层电话 会议。这家公司的财报有时还 ...

TCL科技前三季度归母净利润同比增长99.8%,显示中小尺寸业务成增长引擎

Feng Huang Wang· 2025-10-30 14:56

Financial Performance - TCL Technology Group reported a revenue of 135.9 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 10.5% [1] - The net profit attributable to shareholders reached 3.05 billion yuan, showing a significant increase of 99.8% year-on-year [1] - The core panel business, TCL Huaxing, contributed 78.01 billion yuan in revenue and 6.1 billion yuan in net profit, with year-on-year growth rates of 17.5% and 53.5% respectively [1] Business Segments - The display business exhibited balanced and rapid growth, with the TV and commercial display market share increasing to 25%, maintaining a leading global profit level [1] - In the IT product line, notebook panel sales surged by 63%, and monitor sales grew by 10% year-on-year [1] - In mobile terminals, the market share of tablet panels rose to second globally, while LCD mobile panel shipments increased by 28% [1] - The automotive display sector also experienced rapid growth [1] Technological Advancements - TCL Technology is accelerating the commercialization of advanced display technologies, with the construction of the 8.6 generation printed OLED production line recently commenced [2] - The G5.5 generation printed OLED production line is steadily increasing capacity, with products already applied in the medical display field, and mass production expected in the first half of next year [2] - The company’s Micro LED technology is set to achieve mass production and stable delivery by the end of this year, positioning it to seize opportunities in the new display technology cycle [2] Global Expansion - TCL Technology's capacity layout and globalization strategy are progressing steadily, with the t11 and t9 production lines forming a complementary structure covering mainstream and high-end markets [2] - In the overseas market, the TV large-size products in India have doubled in growth, and a new module factory in Vietnam is expected to start bulk shipments in the fourth quarter, providing new growth points for overseas business [2]