MICROSOFT(04338)

Search documents

微软谷歌Meta亚马逊本周财报,市场最关注的只有一个数字

Hua Er Jie Jian Wen· 2025-10-27 13:45

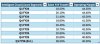

Core Insights - The focus of Wall Street is shifting from traditional metrics like revenue and profit to capital expenditure, particularly in light of the AI investment plans by major tech companies [1][2] - The upcoming earnings reports from Microsoft, Alphabet, Meta, Amazon, and Apple will provide insights into how these companies are positioning themselves in the AI landscape [1][2] - The competition for AI capabilities is driving significant capital investments, with OpenAI leading a $1 trillion infrastructure plan that sets a high benchmark for the industry [2] Group 1: Capital Expenditure Trends - Major tech companies are expected to increase their capital expenditures significantly, with Morgan Stanley predicting a 24% growth to nearly $550 billion next year [2] - Microsoft anticipates a capital expenditure of $30 billion for the current quarter, with a year-over-year growth rate exceeding 50% [4] - Alphabet has raised its capital expenditure forecast for the year from $75 billion to $85 billion, with plans for further increases in 2026 [5] Group 2: Company-Specific Plans - Meta has increased its 2025 capital expenditure forecast by $1 billion to $69 billion, emphasizing the role of AI infrastructure in enhancing advertising capabilities [6] - Amazon plans to spend over $100 billion on capital expenditures this year, with a focus on chips, data centers, and logistics [7] - Apple’s capital expenditure for fiscal year 2024 is projected at $9.4 billion, with a strategy of leasing cloud services rather than operating its own [8]

澳大利亚监管机构起诉微软,指控其误导用户高价续订服务

Sou Hu Cai Jing· 2025-10-27 13:23

Core Viewpoint - The Australian Competition and Consumer Commission has filed a lawsuit against Microsoft, accusing the company of misleading practices in its subscription service affecting millions of users [1][3]. Group 1: Lawsuit Details - The lawsuit was filed in the Federal Court against Microsoft Corporation and Microsoft Australia due to misleading behavior in the Microsoft 365 subscription service since late October 2024 [3]. - Microsoft allegedly informed users that to maintain their subscription, they must accept the integration of an AI assistant and pay a higher subscription price, without disclosing that users could continue using the original features at the original price without the AI assistant [3]. Group 2: Impact on Users - Approximately 2.7 million Australian users are reported to have been misled by Microsoft's practices [5]. - If the allegations are proven, Microsoft may face significant fines, corrective actions, and potential compensation to affected users [5].

微软(MSFT.US)评级获Guggenheim上调 华尔街“买入”呼声一边倒

智通财经网· 2025-10-27 13:13

Core Viewpoint - Guggenheim upgraded Microsoft's stock rating from "Hold" to "Buy," reflecting a strong consensus among Wall Street analysts regarding the company's potential in the AI sector [1][2] Group 1: Analyst Ratings - Following the upgrade, nearly 99% of Wall Street analysts now give Microsoft a "Buy" rating, with only one analyst maintaining a "Neutral" stance and no sell recommendations [1] - Guggenheim's target price for Microsoft is set at $586, indicating approximately a 12% upside from the latest closing price [1] Group 2: Market Sentiment and Performance - The upgrade highlights optimistic market expectations for Microsoft's ability to capitalize on AI breakthroughs, with analysts noting that the company is positioned among the beneficiaries in the AI landscape [1] - Microsoft's stock rose by 1.41% in pre-market trading, contributing to a year-to-date increase of 24%, which outpaces the Nasdaq 100 index's rise of about 21% [1] Group 3: Business Strengths - Microsoft's Azure cloud computing business is expected to benefit from AI advancements, while the company maintains a near-monopoly in the productivity suite market with its Office products [1] - The integration of AI services, such as Copilot, with the Office suite is anticipated to continue driving profitability for Microsoft [1]

财报前瞻 | 微软(MSFT.US)能否“云”开见日,借AI重燃股价?

智通财经网· 2025-10-27 09:33

Core Viewpoint - Microsoft is expected to report strong earnings driven by its cloud segment, particularly Azure, which is projected to show significant growth, potentially revitalizing its stock price after a period of stagnation [1][7]. Group 1: Financial Performance Expectations - Microsoft will announce its Q1 FY2026 earnings on October 29, with investors anticipating a strong performance that exceeds expectations [1]. - Analysts predict a nearly 11% profit growth for Microsoft, primarily attributed to Azure's robust performance, with revenue expected to surge over 30% year-over-year [1]. - The Intelligent Cloud segment's year-over-year growth rates are projected to be around 26.5% for Q1 FY2026, with operating margins expected to be around 40% [3][4]. Group 2: Analyst Insights - UBS analyst Karl Keirstead notes an improvement in enterprise customer sentiment and expects Azure's growth trend to accelerate, setting a target price of $650, which is 25% above the current stock price [2]. - CFRA Research analyst Angelo Zino maintains a "strong buy" rating with a target price of $620, suggesting that capital expenditure growth will slow and shift towards more profitable AI growth [4]. - Allspring LT Growth ETF manager Jack Selz believes Microsoft's recent underperformance is unjustified given its dominance in Azure and cloud computing [6]. Group 3: Valuation Analysis - Despite Microsoft's stock nearing historical highs and having risen nearly 25% year-to-date, its valuation remains reasonable with a price-to-earnings ratio of about 28 times expected earnings for the next fiscal year, consistent with its five-year average [5].

微软Xbox 负责人:将降低玩家在 PS5 和 Switch 2 上玩 Xbox 游戏的门槛

Huan Qiu Wang· 2025-10-27 08:41

Core Insights - Microsoft Xbox is lowering the barriers for players on PS5 and Switch 2 to access Xbox games [1][2] - The company is shifting from direct competition with other platforms to embracing them, providing services to players on those platforms [2] Group 1 - Phil Spencer, head of Xbox, stated that the company is executing a multi-platform strategy to allow users on other platforms to easily play their released games [2] - Xbox's strategy has proven beneficial, as games like "Indiana Jones" have performed well on PlayStation 5 [2]

外媒:隐瞒低价选项,微软在澳大利亚因“套路”用户被起诉

Huan Qiu Wang Zi Xun· 2025-10-27 06:14

Group 1 - The Australian Competition and Consumer Commission (ACCC) has filed a lawsuit against Microsoft Australia and its parent company Microsoft, accusing them of misleading approximately 2.7 million Australian customers regarding subscription options and price increases after integrating the AI assistant Copilot into Microsoft 365 plans [1][2] - Starting from October 31, 2024, Microsoft informed subscribers of the Microsoft 365 Personal and Family plans with auto-renewal that they must accept the integration of Copilot and pay a higher price to maintain their subscription or cancel it [2] - ACCC claims that the information provided by Microsoft to subscribers is false or misleading, as there is an undisclosed third option, the Microsoft 365 Personal or Family Classic plan, which allows subscribers to retain existing plan features at a lower price without Copilot [2]

外媒:隐瞒低价选项,微软在澳大利亚因Copilot“套路”用户被起诉

Huan Qiu Wang· 2025-10-27 05:56

Core Points - The Australian Competition and Consumer Commission (ACCC) has filed a lawsuit against Microsoft Australia and its parent company Microsoft, accusing them of misleading approximately 2.7 million Australian customers regarding subscription options and price increases after integrating the AI assistant Copilot into Microsoft 365 plans [1][2] Group 1 - ACCC states that starting from October 31, 2024, Microsoft informed subscribers of the Microsoft 365 Personal and Family plans with auto-renewal that they must accept the integration of Copilot and pay a higher price to maintain their subscription or cancel it [2] - The ACCC claims that the information provided by Microsoft to subscribers is false or misleading, as there is an undisclosed third option, the Microsoft 365 Personal or Family Classic plan, which allows subscribers to retain existing plan features at a lower price without Copilot [2] - The ACCC indicates that Microsoft did not mention the existence of the "Classic" plan in communications with subscribers, and the only way for subscribers to access this plan is by initiating the cancellation process [2]

瑞银:企业云支出稳定且健康 亚马逊(AMZN.US)、谷歌(GOOGL.US)及微软(MSFT.US)将受益

智通财经网· 2025-10-27 02:30

Group 1 - UBS indicates that Amazon, Google, and Microsoft are expected to benefit from "stable" and "healthy" cloud spending ahead of their earnings reports [1] - Analyst Karl Keirstead notes a positive atmosphere around core cloud infrastructure spending, with AI inference and training spending also expected to provide upside potential [1] - The overall tone of discussions has improved compared to three months ago, with no Fortune 500 companies planning to cut or delay spending [1] Group 2 - Microsoft Azure is reportedly gaining market share, with partners indicating accelerated Azure business in Q3 and further expected acceleration in Q4 [2] - AWS business performance was described as "slightly below expectations" in Q3, but stability is anticipated in Q4 [2] - Microsoft and Google are set to release their quarterly earnings on October 29, while Amazon will follow on October 30 [2]

天价 AI 薪酬,微软 CEO 年薪 9650 万!Meta AI 裁员竟按代码行数决定去留?拼多多给员工发100g黄金|Q资讯

Sou Hu Cai Jing· 2025-10-26 06:26

Group 1: Meta AI Layoffs - Meta has announced a significant layoff of approximately 600 positions in its AI department, representing about 20% of its workforce in the "superintelligence lab" [1] - The layoffs will affect the FAIR research department and AI teams related to products and infrastructure, but will not impact the newly established TBD Lab, which is still actively hiring [1] - The layoffs have notably impacted prominent AI researcher Tian Yuandong, who publicly shared his experience on social media [2] Group 2: TikTok Organizational Changes - TikTok has restructured its operations, shifting the reporting relationships of its operations department to the product team, which now oversees core functions like content and user growth [3] - This adjustment follows a previous organizational change in August, indicating a trend towards consolidating responsibilities within the company [3] Group 3: Microsoft CEO Compensation - Microsoft CEO Satya Nadella's total compensation for the 2025 fiscal year has reached $96.5 million, marking a 22% increase from the previous year and the highest since he took the role [7][8] - This compensation places Nadella ahead of other tech CEOs, including Apple's Tim Cook and Nvidia's Jensen Huang [7][8] Group 4: Moonshot AI Financing - Moonshot AI is reportedly nearing completion of a new funding round amounting to several hundred million dollars, following a previous valuation exceeding $3.3 billion [9] - The company has experienced a rollercoaster journey since its inception, with significant fluctuations in its market presence [9] Group 5: Mercedes-Benz Voluntary Departures - Mercedes-Benz has initiated a voluntary departure program, with approximately 4,000 employees having opted to leave as part of a broader plan to encourage around 30,000 employees to exit [10] - The program offers substantial severance packages based on tenure, with significant compensation for long-serving employees [10] Group 6: Pinduoduo Employee Rewards - Pinduoduo has begun distributing gold rings and "golden chickens" as anniversary gifts to employees, with the amount of gold awarded based on years of service [11][14] - This initiative is part of the company's celebration of its tenth anniversary, reflecting its commitment to employee recognition [11][14] Group 7: Google Quantum Chip Breakthrough - Google has announced a major breakthrough with its quantum chip "Willow," achieving a speed approximately 13,000 times faster than the fastest supercomputers [16] - This marks the first time a quantum computer has successfully executed a verifiable algorithm that surpasses classical computing capabilities [16] Group 8: OpenAI Acquisitions and Developments - OpenAI has acquired a startup named Software Applications, founded by former Apple employees, to enhance AI-driven user interfaces for Mac [19] - The acquisition aims to integrate the AI assistant "Sky" into ChatGPT, furthering OpenAI's mission to improve task completion through AI [19] Group 9: Ant Group's New AI Application - Ant Group has launched a new AGI multimodal application called "Lingguang," which is currently in internal testing and available on various platforms [21] - The application features capabilities for quick research and summarization, enhancing information processing efficiency for users [21]

微软Win11 将强化AI功能

Jing Ji Ri Bao· 2025-10-25 23:23

Core Viewpoint - Microsoft is evolving Windows 11 into an AI-native operating system, with expectations for significant updates in the near future [1] Group 1: Windows 11 Development - Windows 10 has stopped receiving updates, and Windows 11 has been available for four years [1] - Microsoft executives have indicated that Windows will become an AI-native platform, potentially integrating AI capabilities directly into the next major update of Windows 11 [1] Group 2: AI Features and Functionality - Microsoft Vice President Stefan Kinnestrand stated that Windows 11 will ultimately function as an AI-native operating system, enabling "agentic" capabilities similar to existing AI tools like Perplexity Comet, Chrome Gemini, and ChatGPT [1] - The new features in Windows 11 include Copilot Voice, Copilot Vision, Copilot Action, and Click to Do, which shift traditional keyboard and mouse interactions to multi-modal interactions using voice and visual inputs [1] Group 3: System Design and Security - Windows 11 is designed with security and scalability in mind, specifically tailored for AI agent operations [1]