YNCE(600792)

Search documents

利好引爆,A股集体飙涨

Zheng Quan Shi Bao· 2025-10-24 04:52

Market Overview - On October 24, the A-share market saw all three major indices rise, with the Shanghai Composite Index reaching a nearly ten-year high, closing up 0.42% [1] - The Shenzhen Component Index increased by 1.3%, the ChiNext Index rose by 2.09%, and the STAR 50 Index surged by 2.98% [2] Trading Volume and Stock Performance - The total trading volume across the market reached 1.24 trillion yuan, showing a significant increase compared to the previous day, with over 2,900 stocks rising [2] - The electronic sector experienced a notable surge, particularly in memory, commercial aerospace, satellite internet, and semiconductor stocks, which led the gains [2][4] Sector Performance - The memory sector saw a rise of 6.40%, with HBM up 4.95% and semiconductors up 3.92% [3] - Conversely, sectors such as coal mining, real estate, and tourism experienced declines, with coal stocks notably retreating [9][10] Notable Stocks - Individual stocks like Huahong Semiconductor rose nearly 12%, leading the Hang Seng Technology Index [3] - Stocks such as Puran Co., Kexiang Co., and Shengyi Technology hit the daily limit up of 20% [5][6] Policy and Future Outlook - The National Development and Reform Commission emphasized the importance of nurturing emerging industries, projecting that the "three new" economy will account for over 18% of GDP by 2024 [7] - The recent announcement from major suppliers like Samsung and SK Hynix indicates a potential price increase of up to 30% for DRAM and NAND flash memory by Q4 2025, signaling a shift towards a "super cycle" in the memory chip industry [8] Specific Company Movements - On the same day, Zhujiang Piano experienced a dramatic price movement, initially hitting the limit down before rebounding to a limit up, closing at 6.81 yuan per share [12][17]

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]

A股午评:沪指涨0.42%创年内新高 存储芯片、商业航天概念股大涨

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:50

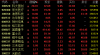

Market Overview - The Shanghai Composite Index rose by 0.42%, reaching a new high for the year, while the ChiNext Index increased by over 2% [1][2] - The total trading volume in the Shanghai and Shenzhen markets was 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [1][2] Sector Performance - The storage chip sector saw significant gains, with companies like Xiangnong Chip and Purun Co. both hitting new highs [1][2] - The commercial aerospace sector experienced a strong surge, with Dahua Intelligent achieving two consecutive trading limit increases, and over ten commercial aerospace stocks hitting the daily limit [1][2] - The computing hardware sector also saw a rebound, with Zhongji Xuchuang reaching a new high [1][2] Declining Sectors - The coal sector faced a collective decline, with companies such as Antai Group and Yunmei Energy hitting the daily limit down [1][2] - Other sectors that experienced declines included local Shenzhen stocks and gas-related stocks [1][2]

煤炭开采加工板块震荡回调,安泰集团跌超9%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 02:01

Core Viewpoint - The coal mining and processing sector is experiencing a significant downturn, with major companies facing substantial declines in stock prices [1] Company Summary - Antai Group has seen a drop of over 9% in its stock price [1] - Yunmei Energy and Liaoning Energy both reported declines exceeding 8% [1] - Baotailong also experienced a similar drop of over 8% [1] - Shaanxi Black Cat and Shanxi Coking Coal followed suit with declines in their stock prices [1]

A股早评:三大指数高开 存储芯片、量子科技强势 煤炭股走低

Ge Long Hui· 2025-10-24 01:31

Core Viewpoint - The A-share market opened with all three major indices rising, indicating positive market sentiment and sector performance, particularly in storage chips, quantum technology, and commercial aerospace sectors [1] Group 1: Market Performance - The Shanghai Composite Index increased by 0.17%, the Shenzhen Component Index rose by 0.51%, and the ChiNext Index gained 0.83% [1] - Notable sectors with significant gains include storage chips, quantum technology, and commercial aerospace [1] Group 2: Sector Highlights - In the storage chip sector, stocks such as Yingxin Development and Shikong Technology hit the daily limit, while Xiangrun Chip surged over 9%, with companies like Xicai Testing and Demingli also showing gains [1] - The satellite navigation sector saw stocks like Shensai Ge and Aerospace Science & Technology reaching the daily limit, with Aerospace Hongtu rising nearly 9%, and other companies like Shanxi Huada and China Satellite also experiencing upward movement [1] Group 3: Declining Sectors - Conversely, gas stocks, coal stocks, and film industry stocks experienced notable declines, with Guo New Energy dropping by 7%, and Shanghai Energy and Yunmei Energy falling over 3% [1]

煤炭化工ETF领涨

Zhong Guo Zheng Quan Bao· 2025-10-23 20:12

Core Insights - The A-share and Hong Kong stock markets saw a positive turn towards the end of trading on October 23, with over half of the more than 1,300 ETFs in the market rising, particularly in sectors like coal, chemicals, and non-ferrous metals [1][2] - The coal sector led the market with a 1.75% increase, and the coal ETF (515220) rose by 2.46%, ranking second in overall ETF performance [1] - Despite a significant drop in gold ETFs, there was still a net inflow of approximately 45.5 billion yuan into gold-related ETFs, indicating a continued interest in safe-haven assets [2] ETF Market Performance - On October 22, the overall ETF market experienced a net inflow of about 2.5 billion yuan, with notable inflows into gold ETFs despite their decline [1][2] - The coal ETF's performance was particularly strong, with 29 out of 30 constituent stocks rising, including seven hitting the daily limit up [1] - Other sectors, such as chemicals and rare metals, also saw good performance attributed to global liquidity easing and expectations of resource price increases [2] Investment Sentiment - The market is currently exhibiting signs of risk aversion, with funds flowing into safer assets like gold ETFs and bond ETFs, while high-volatility ETFs faced net outflows [2] - Analysts suggest that the current market dynamics are influenced by factors such as liquidity conditions, event impacts, and changes in trading sentiment, which may provide good entry points for investors [2] - Long-term outlook remains positive for the stock market, supported by declining risk-free interest rates, ample liquidity, and favorable corporate earnings expectations [2]

盈利改善预期升温,煤炭板块10月大翻身

Di Yi Cai Jing Zi Xun· 2025-10-23 13:00

Core Viewpoint - The coal sector in the A-share market has experienced a significant turnaround, with a surge in stock prices following a period of underperformance, driven by a combination of supply-demand dynamics and a shift in investor sentiment towards high-dividend stocks [1][2]. Group 1: Market Performance - The coal sector has seen a remarkable increase, with the Shenwan Coal Index rising over 11% in October, contrasting sharply with a 10% decline in the electronic industry index during the same period [1][2]. - Major coal stocks, including Daqo Energy and Shanxi Coking Coal, have reached their daily price limits, indicating strong market interest [1]. - Prior to this surge, the coal sector was the worst-performing segment in the A-share market, with a cumulative decline of 7.16% from January to September [1]. Group 2: Supply and Demand Dynamics - The coal market has benefited from a rebound in prices due to a tight supply-demand balance, with third-quarter coal production dropping to 1.166 billion tons, a year-on-year decrease of 2.98% [3][5]. - The demand for coal has been supported by a recovery in electricity consumption, particularly due to unusual weather patterns that increased coal consumption to historical highs [3][4]. - The upcoming winter heating season is expected to further boost coal demand, with supply constraints anticipated due to ongoing production checks [4][5]. Group 3: Investor Sentiment and Strategy - Investors are shifting focus from overheated technology stocks to undervalued sectors like coal, which are perceived to have improving fundamentals and attractive dividend yields [2][5]. - The coal sector is seen as a defensive play, with its high dividend characteristics appealing to investors amid declining risk appetite [2][5]. - Analysts suggest that the recent price rebound in coal is crucial for restoring confidence in the sector, as it breaks the previous negative sentiment regarding future price declines [2].

A股三大股指尾盘悉数翻红,煤炭板块爆发,深圳国资概念活跃

Zheng Quan Shi Bao· 2025-10-23 10:43

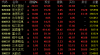

Market Overview - A-shares experienced a weak downward trend in the morning but stabilized and rebounded in the afternoon, with all three major indices closing in the green [1] - The Shanghai Composite Index rose by 0.22% to 3922.41 points, while the Shenzhen Component Index also increased by 0.22% to 13025.45 points [1] - The total trading volume in the Shanghai and Shenzhen markets was 166.09 billion yuan, a decrease of nearly 30 billion yuan from the previous day [1] Sector Performance - The coal sector saw significant gains, with stocks like Daya Energy achieving 9 limit-ups in the last 10 trading days, accumulating a nearly 150% increase [1][16] - The brokerage sector also performed well, with stocks such as Harbin Investment and Guosen Securities leading the gains [1] - The media sector was active, with companies like Rongxin Culture and Haikan Co. hitting the limit-up [1] - The quantum technology concept stocks surged, with Keda Guokuan and Dahua Intelligent both hitting the limit-up [2][3] Quantum Technology - The quantum technology sector saw a substantial late-session rally, with stocks like Keda Guokuan and Dahua Intelligent rising by approximately 10% within five minutes [3] - Keda Guokuan reached a limit-up of 20%, while other stocks like Dahua Intelligent and Shenzhou Information also hit their limit-ups [3][4] - Recent advancements in quantum communication technology by China Telecom's Quantum Research Institute have been recognized internationally, enhancing China's technological standing in this field [5] Coal Sector Insights - The coal sector is expected to see a shift from structural oversupply to a tight balance due to increased demand for winter heating and industrial activity [18] - Regulatory policies are expected to constrain coal supply, while demand is anticipated to rise, supporting coal prices in the short term [18][19] - The overall valuation of the coal sector is considered low, with potential for rebound as market sentiment shifts [19] Shenzhen State-Owned Enterprises - The Shenzhen state-owned enterprises sector saw a collective surge, with stocks like Jian Ke Yuan hitting a limit-up of 20% [21] - The recent action plan released by Shenzhen aims to enhance the quality of listed companies and promote mergers and acquisitions, targeting a total market value of over 20 trillion yuan by 2027 [21]

云煤能源涨停,上榜营业部合计净买入6375.55万元

Zheng Quan Shi Bao Wang· 2025-10-23 10:01

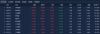

云煤能源(600792)今日涨停,全天换手率5.85%,成交额3.07亿元,振幅15.25%。龙虎榜数据显示,营 业部席位合计净买入6375.55万元。 上交所公开信息显示,当日该股因日涨幅偏离值达9.84%上榜,营业部席位合计净买入6375.55万元。 证券时报·数据宝统计显示,上榜的前五大买卖营业部合计成交1.24亿元,其中,买入成交额为9373.70 万元,卖出成交额为2998.15万元,合计净买入6375.55万元。 具体来看,今日上榜营业部中,第一大买入营业部为开源证券股份有限公司西安西大街证券营业部,买 入金额为3683.22万元,第一大卖出营业部为中信证券股份有限公司上海分公司,卖出金额为1068.33万 元。 资金流向方面,今日该股主力资金净流入1.26亿元,其中,特大单净流入1.40亿元,大单资金净流出 1487.07万元。近5日主力资金净流入1.78亿元。 8月22日公司发布的半年报数据显示,上半年公司共实现营业收入25.68亿元,同比下降28.14%,实现净 利润-1.63亿元。(数据宝) 云煤能源10月23日交易公开信息 | 买/ 卖 | 会员营业部名称 | 买入金额(万元) | 卖出 ...

尾盘突发!多只A股,直拉涨停

Zheng Quan Shi Bao· 2025-10-23 09:45

Market Overview - A-shares experienced a weak downward trend in the morning but stabilized and rebounded in the afternoon, with all three major indices turning positive by the end of the day [1] - The Shanghai Composite Index closed up 0.22% at 3922.41 points, while the Shenzhen Component Index also rose 0.22% to 13025.45 points [1] - The total trading volume in the Shanghai and Shenzhen markets was 166.09 billion yuan, a decrease of nearly 30 billion yuan from the previous day [1] Sector Performance - The coal sector saw significant gains, with several stocks hitting the daily limit, including Daya Energy, which achieved 9 limit-ups in the last 10 trading days, accumulating a nearly 150% increase [1][15] - The brokerage sector also performed well, with stocks like Harbin Investment and Guosen Securities leading the gains [1] - The media sector was active, with stocks such as Rongxin Culture and Haikan Co. hitting the daily limit [1] - The Shenzhen state-owned assets concept stocks surged, with companies like TeFa Information and Shenwei A also reaching the daily limit [1][19] Quantum Technology Sector - The quantum technology concept stocks saw a significant surge, with Keda Guokuan and Dahua Intelligent both hitting the daily limit, and other stocks like Dipu Technology rising over 14% [3][4] - Recent advancements in quantum communication technology by China Telecom's Quantum Research Institute have been recognized internationally, enhancing China's technological standing in this field [4] - The global quantum race is accelerating, with the Chinese government emphasizing quantum technology as a future industry, indicating potential policy support [5] Coal Market Insights - The coal market is expected to experience a tightening supply-demand balance due to seasonal demand for heating and industrial activity, with analysts predicting a rise in coal prices [17][18] - Recent weather patterns and regulatory measures have constrained coal supply, while demand is anticipated to increase during the winter [17] - Analysts recommend focusing on coal sector investments, particularly in elastic varieties, as the market is expected to recover in the fourth quarter [18] Shenzhen State-Owned Assets - The Shenzhen government has launched an action plan to promote high-quality mergers and acquisitions, aiming for a significant increase in the total market value of listed companies by 2027 [20] - The plan includes fostering a robust merger fund ecosystem and completing numerous high-value merger projects, which could enhance the performance of related stocks [20]