数据中心

Search documents

欧洲AI基建再扩!英伟达(NVDA.US)联手德国电信(DTEGY.US) 拟豪掷10亿欧元在德建设数据中心

Zhi Tong Cai Jing· 2025-10-28 03:25

Core Viewpoint - Nvidia and Deutsche Telekom are preparing to announce a plan to build a €1 billion data center in Germany, aimed at enhancing AI infrastructure in Europe [1][2] Group 1: Project Details - The project will involve a joint investment of approximately $1.2 billion (€1 billion) from Nvidia and Deutsche Telekom, with SAP as a key customer [1] - The data center is expected to utilize 10,000 advanced GPUs, which is significantly smaller in scale compared to other global data center projects [2] - The announcement is anticipated to be made next month in Berlin, involving executives from Nvidia, Deutsche Telekom, SAP, and the German Minister for Digital Affairs [1][2] Group 2: Industry Context - European policymakers and tech executives have been discussing the need for Europe to develop its own AI ecosystem to compete with the US and China [1] - The EU has previously announced a €200 billion plan to support AI development, aiming to triple the region's AI computing power within 5 to 7 years [3] - Concerns have been raised regarding the slow progress of local AI infrastructure and the need for quicker actions to support businesses while ensuring data remains within Europe [2]

AI算力基建迎来黄金时代,国际巨头与产业资本竞相布局

Xin Lang Cai Jing· 2025-10-28 02:27

Global Trends - The acquisition of Aligned Data Centers for $40 billion by a consortium including BlackRock and NVIDIA highlights the strong confidence in AI infrastructure among top global capital [1][2] - The demand for data centers is expected to surge, with Goldman Sachs predicting a 165% increase in global data center electricity demand by 2030 compared to 2023 [1] - The trend towards specialized and large-scale operations is emerging, with BlackRock's CEO emphasizing the shift to leasing highly specialized data centers to tech giants, allowing for "light asset" operations [2] China's Market Dynamics - China's "East Data West Computing" initiative aims to redirect computing demand from the east to the resource-rich west, facilitating a significant restructuring of the industry [3] - The Chinese data center market is projected to grow from $29.23 billion in 2025 to $56.71 billion by 2030, with a compound annual growth rate of 14.17% [3] - The initiative emphasizes green energy, with strict PUE (Power Usage Effectiveness) requirements, favoring operators with advanced energy-efficient technologies [3] Capital Market Activity - The acquisition of Qinhuai Data by Dongyangguang for approximately 28 billion RMB marks one of the largest mergers in China's data center industry, indicating a new wave of industrial capital entering the computing infrastructure sector [4] Strategic Insights on Dongyangguang's Acquisition - Dongyangguang's acquisition of Qinhuai Data is a strategic move beyond financial investment, aiming to integrate its expertise in new materials and energy into the data center operations [6][7] - The integration of advanced cooling technologies from Dongyangguang can enhance Qinhuai Data's competitiveness in high-performance computing environments [7] - Dongyangguang's existing clean energy capabilities will provide Qinhuai Data with a stable and cost-effective power supply, aligning with national strategies and enhancing operational efficiency [8] Future Demand and Internal Synergies - Dongyangguang's investments in robotics and AI create a strong internal demand for computing resources, positioning Qinhuai Data as a key supplier for future AI applications [9] - This internal demand model ensures a stable revenue stream for Qinhuai Data while allowing Dongyangguang to better understand the computational needs of the AI industry [9] Industry Evolution and Value Reassessment - The competition in computing infrastructure is evolving into a multi-dimensional contest involving technology, energy, capital, and industrial ecosystems, marking the beginning of a golden era for computing infrastructure [10] - Players with deep industry understanding and vertical integration capabilities are expected to have a competitive edge and experience significant value reassessment [10]

立昂技术:未来将结合自身在IDC领域的业务优势,在京津冀、杭州湾、大湾区、成渝等城市开展数据中心业务

Mei Ri Jing Ji Xin Wen· 2025-10-28 01:41

Core Insights - The company, Lian Technology, ranks 26th in the "Top 30 Computing Power Centers" list published by Deben Consulting, indicating its growing presence in the computing power sector [1] - Lian Technology is focusing on building a comprehensive computing power network across key regions in China, leveraging its AI computing power parks in Southwest China and Guangzhou [1] Company Strategy - The company is developing a "computing power + algorithm + application" ecosystem to enhance its innovative applications in the computing power sector [1] - Lian Technology aims to efficiently allocate computing resources by integrating regional systems and resource reuse, contributing to the national integrated computing power network [1] Future Plans - The company plans to expand its data center operations in major urban areas such as Beijing-Tianjin-Hebei, Hangzhou Bay, the Greater Bay Area, Chengdu-Chongqing, Wuhan, and Xinjiang, capitalizing on its strengths in the IDC sector [1]

推动产业转型升级项目提质提效 持续塑造高质量发展新优势新动能

Zheng Zhou Ri Bao· 2025-10-28 00:50

Group 1 - The mayor emphasizes the importance of industrial development and project construction as key drivers for high-quality economic growth [1][2] - The focus is on accelerating industrial transformation and upgrading, enhancing innovation, and promoting the integration of industrial and innovation chains [2] - The mayor encourages companies to invest in technology research and development to improve market share and core competitiveness [1] Group 2 - The government aims to optimize the policy environment and provide support to create a favorable industrial ecosystem [1] - There is a call for companies to seize opportunities in the fourth quarter to ensure project implementation and achieve annual goals [2] - The emphasis is placed on enhancing project execution through weekly scheduling and monitoring to ensure timely completion and effectiveness [2]

高通,大消息!中国资产,大爆发!

Zhong Guo Ji Jin Bao· 2025-10-28 00:15

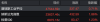

Group 1: Market Overview - The US stock market experienced a significant rally, with all major indices reaching new historical highs on October 27, 2023. The Dow Jones increased by 0.71% to 47,544.59 points, the S&P 500 rose by 1.23% to 6,875.16 points, and the Nasdaq composite climbed by 1.86% to 23,637.46 points [3][4]. - The Nasdaq China Golden Dragon Index saw a rise of 1.59%, driven by positive developments in US-China trade negotiations, which contributed to the strength of Chinese stocks listed in the US [11]. Group 2: Qualcomm's AI Chip Announcement - Qualcomm announced its entry into the AI data center market, launching a new AI chip, the AI200, which is set to begin shipping in 2024. This move aims to compete with Nvidia in the data center sector [8][9]. - Following the announcement, Qualcomm's stock surged by 20% during trading and closed up by 11.08%. The company is targeting significant new revenue streams through this initiative, with the AI200 chip expected to be available in various forms, including standalone components and complete server cabinets [9][10]. Group 3: Performance of Major Tech Stocks - Major technology stocks experienced gains, with Apple rising by 2.26% to nearly a $4 trillion market cap, and Tesla increasing by 4.30%. Other notable performers included Google (up 3.58%), Nvidia (up 2.78%), and Microsoft (up 1.51%) [5][6][7]. - The upcoming earnings reports from major tech companies, including Microsoft, Google, and Meta, are anticipated to be crucial, especially amid rising concerns about the risks associated with the AI bubble [6]. Group 4: International Gold Market - The international gold market saw a significant decline, with COMEX gold prices dropping below $4,000 per ounce. Analysts attribute this adjustment to reduced demand for safe-haven assets following positive US-China trade talks [13]. - The chairman of the London Bullion Market Association indicated that the recent price surge in gold was driven by speculative bubbles, suggesting a potential for further price corrections before a new upward trend [13]. Group 5: Nvidia and Deutsche Telekom Partnership - Nvidia and Deutsche Telekom are preparing to build a data center in Germany, valued at €1 billion (approximately $1.16 billion). This project is part of their strategy to enhance AI infrastructure in Europe [17]. - SAP SE is expected to be a key client for this facility, highlighting the collaboration between major tech firms to support AI systems [17].

AI热潮推高美科技企业负债

Huan Qiu Shi Bao· 2025-10-27 22:47

Core Insights - The explosive growth in demand for AI services and data centers has led to a tripling of the interest-bearing debt of approximately 1,300 major tech companies to around $1.35 trillion over the past decade [1] - The shift in business models from low-capital software operations to AI-driven businesses requiring large-scale data centers is a key factor behind this debt increase [1] - The total interest-bearing debt of the five major U.S. tech giants—Amazon, Microsoft, Apple, Meta, and Alphabet—has reached $457 billion, 2.8 times higher than a decade ago [1] Group 1 - The increase in debt reflects intense competition among global tech companies in the AI sector [2] - Meta's CEO Mark Zuckerberg highlighted the high stakes of investing in AI, suggesting that the risk of not investing is greater than the risk of misallocating funds [2] - Strong investor demand is supporting corporate debt financing, with Oracle's recent bond issuance receiving orders approximately five times the issuance size [2] Group 2 - Concerns have arisen among some investors regarding the profitability of AI-related businesses supported by tech companies [3] - The proportion of companies with a debt-to-equity ratio exceeding 1 has risen to 13.8%, an increase of 4.9 percentage points over the past decade [3] - While nearly 90% of companies currently have the financial strength to manage debt repayments, the number of companies with excessively high debt-to-equity ratios, such as Oracle at 4.6, is increasing [3]

AI电力需求测算

2025-10-27 15:22

Summary of Key Points from Conference Call Industry Overview - The conference call focuses on the **data center industry** in China, particularly its transformation driven by AI and government policies [2][3][4]. Core Insights and Arguments - **Government Support**: The Chinese government aims for intelligent computing to account for 35% of total computing power by 2025, as outlined in the "High-Quality Development Action Plan for Computing Infrastructure" [4]. - **Electricity Consumption**: Data center electricity consumption is projected to reach **166 billion kWh** in 2024, representing **1.7%** of total national electricity consumption. This is expected to grow significantly due to AI demands and projects like "East Data West Computing" [2][5]. - **Future Projections**: By 2030, total electricity consumption by data centers is expected to reach **411.4 billion kWh**, and by 2035, it could rise to **1,026.2 billion kWh**, with a compound annual growth rate (CAGR) of approximately **16.33%** from 2024 to 2030 [2][11]. - **Power Usage Effectiveness (PUE)**: The average PUE is currently **1.46**, with a target to reduce it to **1.25** by 2035. This indicates limited room for improvement in energy efficiency [8]. - **IT Equipment Power Consumption**: The power consumption of IT equipment per unit of computing capacity is expected to decrease by **8% annually**, reaching **162 million kWh** by 2035 [9][10]. Additional Important Insights - **Load Characteristics**: The demand for AI is causing a shift in load characteristics from stable to frequent short-term fluctuations, necessitating more flexible energy sources like thermal power [12]. - **Role of Thermal Power**: Thermal power is evolving from merely providing electricity to becoming a key stabilizing force in the new energy system, essential for balancing supply and demand fluctuations [13]. - **Future Demand for Thermal Power**: By 2030, the additional electricity demand from data centers is expected to require an increase of **40 million kW** in thermal power capacity, with an average load of **27.98 million kW** [14]. - **Market Performance of Thermal Power**: Despite a decline in competitiveness, thermal power remains strong in northern regions due to less impact from renewable energy fluctuations [15]. - **Valuation and Investment Outlook**: Current market valuations for thermal power companies are around **10 times earnings**, but there is potential for revaluation due to increasing energy demands and the unique role of thermal power in the new energy landscape [16][17].

中美俄水资源对比:俄超27万亿m³,美国2.95万亿m³,中国多少?

Sou Hu Cai Jing· 2025-10-27 11:26

Group 1: Water Resources Overview - Russia has abundant water resources, with a total annual runoff of 4.31 trillion cubic meters, supported by major rivers like the Volga and Yenisei [1][3] - The United States has a total water resource of 2.95 trillion cubic meters, with significant contributions from the Great Lakes and a renewable internal supply of 1.91 trillion cubic meters [5][7] - China has 2.57 trillion cubic meters of water resources, with a renewable internal supply of 2.81 trillion cubic meters, ranking sixth globally [9][11] Group 2: Water Management and Infrastructure - Russia faces challenges with aging infrastructure, with a pipeline leakage rate exceeding 15%, and plans to allocate funds in 2024 to improve water networks [3][15] - The U.S. has a strict water rights trading market, with farmers in drought areas buying water rights, and California continuing water restrictions into 2024 [7][15] - China has implemented the South-to-North Water Diversion Project, which has transferred over 60 billion cubic meters of water by 2024, stabilizing water supply for major cities [11][15] Group 3: Economic Impact of Water Resources - Russia's economy is resource-driven, with hydropower accounting for 27% of renewable energy, but fossil fuels remain dominant [13] - The U.S. modern agriculture relies heavily on water for exports, with a projected grain output of 400 million tons in 2024 [13][15] - China's water scarcity drives innovation in water-saving agriculture, with a projected 1% increase in grain production in 2024 [15][18] Group 4: Technological Innovations and Environmental Protection - China is focusing on water-saving technologies, with a target of 50% penetration of water-saving devices by 2024 [18] - Russia is revising water laws to enhance protection of water resources, particularly around Lake Baikal, with increased penalties for pollution [15][19] - The U.S. Environmental Protection Agency (EPA) is actively enforcing regulations, with a projected $5 billion in penalties for polluting companies in 2024 [15]

东海证券晨会纪要-20251027

Donghai Securities· 2025-10-27 05:07

Group 1 - The report emphasizes the importance of maintaining strategic determination and confidence in achieving success, as highlighted in the spirit of the 20th Central Committee's Fourth Plenary Session [6][7] - The "15th Five-Year Plan" is positioned as a critical phase for solidifying the foundation and making comprehensive efforts towards achieving socialist modernization [8][9] - The report indicates that while external risks are increasing, internal advantages remain prominent, urging a focus on economic construction and the realization of the 2035 long-term goals [7][8] Group 2 - The report discusses the positive performance of Weidi Technology in Q3 2025, with net sales reaching $2.676 billion, a year-on-year increase of 29%, and a significant organic order growth of approximately 60% [23][24] - Weidi Technology's adjusted operating profit for Q3 2025 was $517 million, reflecting a 39% year-on-year increase, with an adjusted operating profit margin of 22.3%, up 220 basis points [24][25] - The company is strategically increasing investments in engineering and R&D to strengthen its competitive position in the data center infrastructure sector, with a projected capital expenditure of $250 million for FY 2025 [25][26] Group 3 - The report highlights the growth of the retail sector, with a 3.0% year-on-year increase in social retail sales in September 2025, amounting to 4.1971 trillion yuan [29][30] - Online consumption continues to show positive trends, with a cumulative year-on-year growth of 9.8% in online goods and services retail from January to September 2025 [30][31] - The report notes that while the consumption policy effects are diminishing, the overall demand for goods and services is steadily being released, necessitating attention to future policy support [31][32]

资金、电力、人才都抢不过!美国制造业正在输给AI

Hua Er Jie Jian Wen· 2025-10-27 04:08

Core Insights - The resurgence of American manufacturing is facing unexpected competition from the AI data center boom, which is siphoning resources away from traditional manufacturing sectors, threatening the core policy goals of the Trump administration to revitalize U.S. industry [1][2][3] Investment Trends - Major players are expected to invest up to $4 trillion in AI infrastructure by 2030, comparable to the investment frenzy seen during the 19th-century railroad expansion [1][3] - Data center construction spending has surged by 18% this year, while new factory construction has declined by 2.5% [1][3] - The CEO of ABB noted that data center projects currently offer significantly higher returns compared to traditional manufacturing projects due to tariffs and labor shortages [3] Economic Impact - Pantheon Macroeconomics estimates that without AI-related infrastructure spending, U.S. GDP growth in the first half of 2025 would be only 1%, rather than the actual 1.6% [2] - Bloomberg Economics predicts that as tech giants increase AI capital spending from nearly $400 billion this year to $600 billion next year, AI could contribute an additional 1.5 percentage points to GDP growth [2] Energy Demand - A typical AI data center consumes as much electricity as 100,000 households, with the largest under-construction data center expected to consume 20 times that amount [4] - Bloomberg Industry Research estimates that by 2032, data centers could account for 20% of U.S. electricity demand [4] Labor Market Dynamics - The U.S. is facing a shortage of 439,000 construction workers, exacerbated by the focus on AI infrastructure projects [6] - One-fifth of the American Building Contractors Association's members are currently engaged in data center projects, further straining the labor market [6] Policy Discrepancies - The Trump administration has provided extensive tariff exemptions for tech giants importing data center hardware, while being less responsive to requests for exemptions from manufacturers seeking to expand or build new factories [6][7] - The imposition of tariffs is seen as the largest tax increase on U.S. businesses since the early 1990s, with significant financial impacts on companies like Caterpillar and General Motors [7][8] Case Study: Lordstown - The transformation of the former General Motors plant in Lordstown into a data center equipment manufacturing site symbolizes the broader economic shift [2][9] - The project, expected to employ around 1,600 people, represents a fraction of the jobs lost in the area over the past two decades [10]