存储芯片

Search documents

科技股 全线爆发!

Shang Hai Zheng Quan Bao· 2025-10-24 05:00

Market Performance - Major A-share indices experienced a strong rally, with the Shanghai Composite Index breaking previous highs and reaching a new high for the year at 3938.98 points, up 0.42% [1] - The Shenzhen Component Index rose by 1.3% to 13195.25 points, while the ChiNext Index increased by 2.09% to 3126.05 points [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.23 trillion yuan, indicating a significant increase in trading activity [1] Sector Performance - The technology growth sector showed strong performance across the board, with notable activity in storage chips, computing hardware, quantum technology, and commercial aerospace [2][5] - Specific stocks such as Shengyi Electronics surged by 20% to hit the daily limit, while other companies like Zhongji Xuchuang and Xiangnong Chip Innovation reached new highs [2][5] - The storage chip sector saw a collective rise in stock prices, driven by strong demand and supply constraints, with Zhongji Xuchuang increasing over 6% and Shengyi Electronics achieving a 20% limit up [5][8] Quantum Technology Developments - The quantum technology sector remained active, with companies like Dahua Intelligent and Geer Software achieving consecutive gains [10] - Recent advancements in quantum computing were reported, including Google's announcement of a verifiable quantum advantage and significant progress by China Telecom in quantum key distribution [13] - Analysts noted that quantum computing is becoming a disruptive frontier technology, with ongoing research and development expected to yield substantial progress in the next 5 to 10 years [13]

科技股,全线爆发!

Shang Hai Zheng Quan Bao· 2025-10-24 04:50

Market Performance - A-shares experienced a strong rally, with the Shanghai Composite Index breaking previous highs and reaching a new high for the year at 3938.98 points, up 0.42% [1] - The Shenzhen Component Index rose by 1.3% to 13195.25 points, while the ChiNext Index increased by 2.09% to 3126.05 points [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.23 trillion yuan, indicating a significant increase in trading activity [1] Sector Performance - The technology growth sector showed strong performance across the board, with notable activity in storage chips, computing hardware, quantum technology, and commercial aerospace [2][3] - Shengyi Electronics saw a 20% limit-up increase, while stocks like Zhongji Xuchuang and Xiangnong Chip Innovation reached new highs [2][3] - The storage chip sector experienced a collective surge, with multiple stocks in the computing hardware segment also showing significant gains [3] Company Highlights - Shengyi Electronics reported third-quarter earnings that exceeded expectations, with projected revenue between 6.6138 billion yuan and 7.0338 billion yuan, representing a year-on-year increase of 108% to 121% [5] - The company's net profit attributable to shareholders is expected to be between 1.074 billion yuan and 1.154 billion yuan, reflecting a year-on-year increase of 476% to 519% [5] Industry Trends - The storage market is experiencing a price surge due to supply constraints and rising production costs, particularly in NAND and DRAM segments [6][7] - The sentiment among storage manufacturers is leaning towards controlling inventory and holding back sales, which may lead to continued price increases in storage products [7] - Quantum technology remains a vibrant sector, with companies like Dahua Intelligent and Geer Software achieving consecutive gains, driven by advancements in quantum computing and communication technologies [10]

上证指数盘中再创10年新高 科创50大涨

Zheng Quan Shi Bao Wang· 2025-10-24 04:46

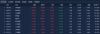

| 名称 | 序号 | 现价 | 涨跌 | 涨跌幅 | | --- | --- | --- | --- | --- | | 上证指数 | 1 | 3938.98 | 16.57 | 0.42% | | 深证成指 | 2 | 13195.25 | 169.81 | 1.30% | | 北证50 | 3 | 1470.49 | 15.12 | 1.04% | | 万得全A | 4 | 6293.82 | 52.42 | 0.84% | | 科创50 | 5 | 1442.98 | 41.72 | 2.98% | | 创业板指 | 6 | 3126.05 | 63.89 | 2.09% | | 沪深300 | 7 | 4636.93 | 30.59 | 0.66% | | 中证500 | 8 | 7215.22 | 72.27 | 1.01% | | 中证800 | 9 | 5068.27 | 38.06 | 0.76% | | 中证1000 | 10 | 7391.06 | 82.96 | 1.14% | 国防军工、芯片、消费电子、通信设备等板块涨幅居前。 今日早盘,A股整体高开走强,上证指数再创10年来新高,上 ...

反攻!沪指盘中创10年新高,5000亿巨头疯狂拉涨,创历史新高!还有这两个板块,掀起涨停潮...

雪球· 2025-10-24 04:34

Market Overview - The three major indices collectively rose in early trading, with the Shanghai Composite Index breaking previous highs, reaching a 10-year high. As of midday, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component by 1.3%, and the ChiNext Index by 2.09% [1] - The total trading volume in the Shanghai, Shenzhen, and Beijing markets reached 12,393 billion yuan, an increase of 1,813 billion yuan compared to the previous day, with over 2,900 stocks rising [2] Sector Performance - The storage chip, commercial aerospace, computing hardware, and quantum technology sectors saw significant gains, while coal mining, oil and gas extraction, real estate, liquor, and steel sectors experienced declines [3] - The computing hardware stocks continued to strengthen, with Zhongji Xuchuang reaching a historical high, increasing nearly 6% and achieving a market value of 522.2 billion yuan [4] Industry Insights - Citi Research issued a "buy" rating for Zhongji Xuchuang, indicating that recent pullbacks present better buying opportunities. The report suggests that demand in the optical module industry may exceed current market expectations due to strong prospects and increased attachment rates of optical devices [8][9] - The report predicts that the attachment rate of 1.6T optical transceivers to GPUs in the VR200 NVL144 rack will increase from 1:2.5 to 1:5, potentially doubling the demand for 1.6T optical modules by 2026 from an estimated 8 million units to over 20 million units, provided suppliers can meet the orders [9] Satellite Navigation Sector - The satellite navigation sector experienced a surge, with significant gains in satellite internet and commercial aerospace concepts. Notable stocks included Tongyi Aerospace, which rose by 22%, and Aerospace Huanyu, which increased by 15% [12] - Recent successful satellite launches and government support for satellite internet infrastructure are driving growth in this sector, as outlined in the "14th Five-Year Plan" [15] Storage Chip Sector - The storage chip sector saw a remarkable increase, with a sector-wide gain of 4.87%, leading among concept sectors. Stocks like Purun Co. and Kexiang Co. hit the daily limit of 20% increase [17][18] - Analysts suggest that the domestic storage manufacturers will benefit significantly from a new wave of price increases in storage chips, with a gradual recovery in industry demand [22]

「午报」沪指涨0.42%刷新年内新高,科技股集体反弹,存储芯片板块强势领涨

Sou Hu Cai Jing· 2025-10-24 04:25

Market Overview - The market experienced a strong upward trend in the morning session, with the Shanghai Composite Index reaching a new high for the year and the ChiNext Index rising over 2% [1] - The total trading volume in the Shanghai and Shenzhen markets was 1.23 trillion, an increase of 180.8 billion compared to the previous trading day [1] - Key sectors showing significant activity included storage chips, commercial aerospace, and computing hardware, while the coal sector faced a collective decline [1][10] Storage Chip Industry - Major memory suppliers like Samsung Electronics and SK Hynix are set to increase DRAM and NAND flash prices by up to 30% in Q4 2023 to meet the surging demand driven by AI [3][13] - Morgan Stanley predicts a "super cycle" for the storage chip industry, with global revenues expected to exceed $200 billion by 2025 [3] - Companies such as SanDisk saw stock prices rise over 13%, reaching historical highs, reflecting the strength of the storage sector [3] Commercial Aerospace Sector - The commercial aerospace sector saw a strong performance, with multiple stocks hitting the daily limit up, including Aerospace Intelligent Equipment and Shanghai Port Bay [3][4] - The sector's growth is attributed to increased investments and developments in space technology [3] Computing Hardware Sector - The computing hardware sector also showed robust performance, with stocks like Zhongji Xuchuang reaching new highs [1][4] - The demand for computing hardware is expected to grow significantly, driven by advancements in AI and related technologies [4] Coal Sector - The coal sector faced a downturn, with companies like Antai Group and Yunnan Coal Energy hitting the daily limit down [1][10] - The decline in coal stocks is attributed to market corrections following previous gains [1] Company Performance - Companies like Shengyi Technology forecast a net profit increase of 476% to 519% year-on-year for the first three quarters of 2025, driven by the rapid growth of the AI industry [6][18] - The stock performance of companies in the storage chip sector, such as Puran and Kexiang, saw significant gains, with some stocks hitting the daily limit up [1][19]

近3000股上涨,商业航天股批量涨停,有新股半日涨近400%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 04:00

Market Performance - The A-share market experienced a morning rally on October 24, with the Shanghai Composite Index breaking the previous high of 3936.58 points, reaching a new high of 3946.16 points during the session [1] - By midday, the Shanghai Composite Index rose by 0.42%, the Shenzhen Component Index increased by 1.3%, and the ChiNext Index gained 2.09%, with a total trading volume of 1.24 trillion yuan [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Changjiang Storage and Puran Co. hitting new highs [1] - The commercial aerospace sector experienced a strong surge, with multiple stocks, including Dahua Intelligent, achieving consecutive gains and over ten stocks hitting the daily limit [1][2] - The computing hardware sector also showed upward movement, with Zhongji Xuchuang reaching a new high [1] Investment Opportunities - The commercial aerospace sector is expected to accelerate with the increasing frequency of domestic commercial rocket launches and a faster IPO process for related companies, indicating a growing market [2] - The storage chip market is on an upward cycle, driven by increased capital expenditure from major internet companies like Alibaba and ByteDance, which is expected to boost domestic manufacturers' market share [3] Institutional Outlook - Zhongyin Securities noted that a resonance between policy and economic bottoms is forming, which may support the upward movement of A-share indices [4] - Long-term capital, particularly from public funds and insurance, is expected to concentrate on industries with strategic support value [4] - Foreign institutional investors are showing increased interest in A-shares, with QFII becoming a significant shareholder in multiple companies [4] Foreign Investment Sentiment - Major foreign investment firms like Goldman Sachs and Morgan Stanley have expressed optimism about the Chinese market, predicting a slow bull market with a potential 30% increase in major indices by the end of 2027 [5][6] - Morgan Stanley highlighted that global investors' allocation to Chinese equities remains low, suggesting room for growth in investment [6]

A股午评:沪指刷新年内新高,商业航天板块强势爆发

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 03:57

Market Performance - The market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year, while the ChiNext Index rose over 2% [1] - As of the morning close, the Shanghai Composite Index increased by 0.42%, the Shenzhen Component Index rose by 1.3%, and the ChiNext Index gained 2.09% [1] Sector Highlights - The storage chip sector saw significant gains, with companies like Chang'an Chip and Puran Co. both hitting new highs [1] - The commercial aerospace sector had a strong performance, with Dahua Intelligent Technology achieving two consecutive trading limit ups, and over ten commercial aerospace stocks hitting the daily limit [1] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [1] Trading Volume and Individual Stocks - The total trading volume for the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [3] - Zhongji Xuchuang led individual stock trading with a transaction volume exceeding 13.2 billion yuan, followed by Shenghong Technology, Luxshare Precision, and Xinyi Sheng with high trading volumes [4]

近3000股上涨,商业航天股批量涨停,有新股半日涨近400%

21世纪经济报道· 2025-10-24 03:56

Market Overview - The A-share market experienced a significant upward movement on October 24, with the Shanghai Composite Index breaking previous highs, reaching 3946.16 points, a new annual high. The index closed up 0.42%, while the Shenzhen Component Index rose by 1.3% and the ChiNext Index increased by 2.09% [1][2]. Sector Performance - The storage chip sector saw substantial gains, with companies like Changsha Chip and Puran Co. achieving new highs. The commercial aerospace sector also experienced a strong surge, with multiple stocks hitting the daily limit [1][4]. - Conversely, the coal sector faced a collective decline, with companies such as Antai Group and Yunmei Energy hitting the daily limit down [3]. Commercial Aerospace Developments - The commercial aerospace sector is witnessing a boom, with several stocks, including Tongyi Aerospace and Aerospace Intelligent Equipment, experiencing significant price increases. The sector is expected to benefit from the acceleration of domestic commercial rocket launches and IPO processes for various companies [4][7]. Storage Chip Market Dynamics - The storage chip market is on an upward trajectory, driven by increased capital expenditure from major internet companies like Alibaba and ByteDance in AI infrastructure. This trend is expected to enhance the market share of domestic storage manufacturers [9]. Foreign Investment Sentiment - Foreign institutions are optimistic about the A-share market's future. Analysts from Zhongyin Securities and Galaxy Securities highlight the potential for a market rebound supported by macroeconomic policies and improved investor confidence [11][12]. - Major foreign investment firms, including Goldman Sachs and Morgan Stanley, have expressed positive outlooks for the Chinese market, predicting a slow bull market and increased allocations to Chinese equities by global investors [13][14].

A股午评 | 沪指涨0.42%刷新年内新高 存储芯片、商业航天概念走强 煤炭等板块回调

智通财经网· 2025-10-24 03:52

Core Viewpoint - The A-share market experienced a rally, with the Shanghai Composite Index reaching a new high for the year, driven by active sectors such as storage chips and commercial aerospace following the Fourth Plenary Session's announcements on technology independence and market expansion [1][3]. Group 1: Market Performance - As of the midday close, the Shanghai Composite Index rose by 0.42%, the Shenzhen Component Index increased by 1.3%, and the ChiNext Index gained 2.09% [1]. - The Fourth Plenary Session's communiqué emphasized accelerating high-level technological self-reliance and building a strong domestic market, which is expected to catalyze market performance in the coming weeks [1]. Group 2: Active Sectors - The storage chip sector showed significant activity, with companies like Xicai Testing and Yingxin Development hitting the daily limit up, driven by anticipated price increases of up to 30% for DRAM and NAND flash memory due to rising AI-driven demand [4]. - The commercial aerospace sector also surged, with stocks like Aerospace Changfeng and Aerospace Science & Technology reaching their daily limit up, spurred by the new focus on becoming a space power in the recent policy announcements [5]. Group 3: Institutional Insights - Tianfeng Securities noted that financial and cyclical sectors are currently at historical low valuations, suggesting potential for a shift towards blue-chip stocks with stable earnings as the market approaches the end of the year [6]. - Debon Securities indicated that despite short-term volatility, the increase in M1 and M2 growth rates could support a medium to long-term market uptrend, with value stocks likely to outperform in the near term [7]. - Oriental Securities expressed concerns about insufficient momentum from main funds, indicating that the market may remain in a narrow range until a breakthrough occurs [9].

沪指,刷新年内新高

财联社· 2025-10-24 03:52

Group 1 - The A-share market experienced a morning surge with increased trading volume, leading to the Shanghai Composite Index reaching a new high for the year and the ChiNext Index rising over 2% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 1.23 trillion yuan, an increase of 180.8 billion yuan compared to the previous trading day [1] - Key sectors showing strong performance included storage chip concepts, with companies like Shannon Chip and Puran Co. both hitting new highs [1] Group 2 - The commercial aerospace sector saw a strong breakout, with Dahua Intelligent achieving two consecutive trading limit ups, and over ten commercial aerospace concept stocks hitting the daily limit [2] - The computing hardware sector also experienced fluctuations, with Zhongji Xuchuang reaching a new high [2] - In contrast, the coal sector faced significant declines, with companies like Antai Group and Yunmei Energy hitting the daily limit down [2]