潮玩

Search documents

港美股看台丨炸裂!泡泡玛特,最新业绩出炉→

证券时报· 2025-10-21 15:23

泡泡玛特再一次交出了一份"炸裂"的业绩报告! 10月21日,泡泡玛特披露了2025年第三季度业绩情况。公告显示,在该季度,泡泡玛特总体收益较2024 年第三季度增长245%—250%,其中中国市场收益同比增长185%—190%,海外市场收益同比增长365% —370%。 同时,在中国市场的渠道收益方面,线下渠道同比增长130%—135%,线上渠道同比增长300%— 305%。 最为值得关注的是,在总体业绩高速增长下,泡泡玛特第三季度海外市场收益表现亮眼,尤其是欧美市场 持续高增长。具体来看,美洲市场收益的同比增速最高,达到1265%—1270%;欧洲及其他地区市场收 益同比增长735%—740%;亚太市场收益同比增长170%—175%。 今年以来,泡泡玛特持续加速海外市场的布局。 2025年中期报告显示,上半年泡泡玛特在全球18个国家布局,运营571家门店,今年上半年净增40家, 运营2597台机器人商店,今年上半年净增105台。 在中国市场,泡泡玛特聚焦提升顾客的品牌体验,持续提高服务质量及渠道精细化运营效率。上半年净 增12家线下门店,门店数量增至443家。 在亚太市场,泡泡玛特加强精细化运营,有效执行旅 ...

240小时免签下北京入境游|故宫长城稳坐景区C位,labubu带火泡泡玛特乐园

Bei Jing Shang Bao· 2025-10-21 14:49

Core Insights - The influx of international tourists to Beijing's attractions has increased, with popular sites like the Forbidden City and the Great Wall remaining top destinations during the recent holiday period [1][3] - The Beijing Universal Resort has gained popularity due to its international IPs and local features, while the Pop Mart City Park has emerged as a surprising favorite among young international visitors [1][10] Group 1: Popular Attractions - The Forbidden City, Mutianyu Great Wall, and Badaling Great Wall are consistently ranked among the top attractions for inbound tourists, showcasing their enduring appeal as world cultural heritage sites [3][5] - The Mutianyu Great Wall received approximately 580,000 inbound visitors by September this year, marking a 55% increase compared to the same period last year [3][4] Group 2: Changing Tourist Preferences - Inbound tourists are increasingly interested in deep cultural experiences rather than just sightseeing, seeking to understand the historical and cultural significance of attractions like the Great Wall [4][5] - Cultural activities such as intangible cultural heritage performances and traditional tea breaks are being organized to meet tourists' demands for immersive experiences [5] Group 3: Emerging Attractions - The Beijing Universal Resort has re-entered the list of top inbound tourist attractions, attracting a diverse range of international visitors, including those from Southeast Asia [7][8] - Pop Mart City Park has risen to the sixth position in the ranking of popular attractions for inbound tourists, up from ninth place the previous year, highlighting its growing appeal [10][11]

每10元收入约有5元来自名创优品集团 潮玩品牌TOP TOY闯关港交所,递表前“补课”

Mei Ri Jing Ji Xin Wen· 2025-10-21 13:00

Core Insights - TOP TOY has submitted its IPO application to the Hong Kong Stock Exchange, marking a significant milestone for the company which has achieved profitability and rapid growth in under five years [1][3][6] Company Overview - TOP TOY is recognized as one of the fastest-growing collectible toy brands in China, achieving a GMV (Gross Merchandise Volume) exceeding 1 billion yuan in a remarkably short time [1][3] - The company operates 293 stores globally as of June 2025, with a revenue of 1.9 billion yuan and a net profit of 294 million yuan in 2024, reflecting growth rates of 30.6% and 38.2% respectively [3][9] - The company has experienced accelerated revenue growth in the first half of 2025, reaching a rate of 58.5% [3] Financial Support and Business Model - TOP TOY benefits significantly from the support of its major shareholder, Miniso Group, which provides financial backing and operational resources [4][5] - Approximately 50% of TOP TOY's revenue in 2023 and 2024 came from Miniso Group, indicating a strong reliance on this partnership [5][6] - The company employs a unique partnership model that allows for rapid expansion, with partners covering store costs while TOP TOY manages operations [5] Challenges and Future Outlook - Despite its rapid growth, TOP TOY faces short-term liquidity pressures, with current assets not covering current liabilities until mid-2025 [9] - The company is working on developing its own intellectual property (IP), with current self-developed IP revenue being less than 1% of total income [9] - TOP TOY has recently acquired multiple designer IPs, increasing its proprietary IP count from 8 to 17, indicating a strategic move towards enhancing its product offerings [9]

预增超245%!泡泡玛特公告第三季度业绩

Zhong Guo Zheng Quan Bao· 2025-10-21 12:12

Core Viewpoint - The company, Pop Mart, announced a significant increase in overall revenue for Q3 2025, with a projected growth of 245% to 250% year-on-year, driven by strong performance in both domestic and overseas markets [1] Group 1: Revenue Growth - The revenue from the Chinese market is expected to grow by 185% to 190%, while overseas market revenue is projected to increase by 365% to 370% [1] - In Q3, the offline channels in China are anticipated to grow by 130% to 135%, and online channels are expected to see a growth of 300% to 305% [1] Group 2: Product and Channel Strategy - The company launched new IP products such as Mini Labubu and SP Unrest Theater, which, along with increased production capacity, contributed to the revenue growth in Q3 [1] - The company plans to balance product categories while continuously investing in new IP exposure and growth, ensuring a consistent consumer experience across different channels [1] Group 3: Organizational Changes and Global Expansion - In April, the company underwent its largest organizational restructuring in five years to enhance its global layout, which included adding new regions and strengthening its middle office [2] - The restructuring aims to promote globalization and streamline decision-making processes, allowing for more efficient responses to local market needs [2] - The overseas market revenue saw substantial growth, with the Asia-Pacific region increasing by 170% to 175%, the Americas by 1265% to 1270%, and Europe and other regions by 735% to 740% [2] Group 4: Future Outlook - The CEO expressed confidence in the growth of the North American and Asia-Pacific markets, projecting that their sales could match last year's domestic sales despite having fewer stores [3] - The company's ongoing globalization efforts have begun to yield positive results, indicating a successful initial phase of international expansion [3]

泡泡玛特,收益猛增245%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-21 10:13

Group 1 - The core viewpoint of the news is that Pop Mart has reported significant revenue growth for the third quarter of 2024, with overall revenue increasing by 245% to 250% year-on-year [1] - Revenue from China has increased by 185% to 190% year-on-year, while overseas revenue has surged by 365% to 370% [1] - As of October 21, Pop Mart's stock has dropped over 8%, with a market capitalization of HKD 336.3 billion [4] Group 2 - The Labubu series has previously generated significant consumer interest, and the new Star People series has also sparked a buying frenzy [6]

泡泡玛特,收益猛增245%

21世纪经济报道· 2025-10-21 10:10

Core Viewpoint - Pop Mart announced a significant increase in overall revenue for the third quarter, with a year-on-year growth of 245%-250% compared to the same period in 2024, driven by strong performance in both domestic and international markets [1]. Group 1: Revenue Growth - Overall revenue for the third quarter is expected to grow by 245%-250% year-on-year [1]. - Revenue from China is projected to increase by 185%-190% year-on-year [1]. - International revenue is anticipated to rise by 365%-370% year-on-year [1]. Group 2: Market Performance - As of October 21, Pop Mart's stock price has dropped over 8%, with a market capitalization of 336.3 billion HKD [4]. Group 3: Product Demand - The Starry People series from Pop Mart has sparked another buying frenzy, following the success of the Labubu series [5].

新华财经晚报:2025年中国电影海外票房收入已超2024年全年

Xin Hua Cai Jing· 2025-10-21 10:04

Group 1 - In 2025, China's overseas box office revenue has already exceeded the total for 2024, reaching approximately $140 million, equivalent to around 1 billion RMB [1] - Pop Mart reported a 365%-370% year-on-year increase in overseas revenue for Q3 2025, with overall revenue growth of 245%-250% compared to Q3 2024 [2] - The Guangdong provincial government has released an action plan to empower high-quality development in the manufacturing industry through artificial intelligence from 2025 to 2027, supporting the application of industrial computing power [1] Group 2 - The Ministry of Commerce has set the total import quota for fertilizers in 2026 at 13.65 million tons, including 3.3 million tons of urea, 6.9 million tons of diammonium phosphate, and 3.45 million tons of compound fertilizers [2] - The DeepSeek-OCR model has been launched on the supercomputing internet AI community, allowing enterprises and developers to quickly deploy and develop the model [2]

北水动向|北水成交净买入11.71亿 泡泡玛特(09992)盘后发布盈喜 北水全天抢筹超11亿港元

智通财经网· 2025-10-21 09:59

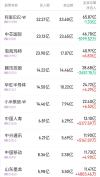

智通财经APP获悉,10月21日港股市场,北水成交净买入11.71港元,其中港股通(沪)成交净买入25.24亿港元,港股通(深)成 交净卖出13.53亿港元。 港股通(深)活跃成交股 泡泡玛特(09992)获净买入11.2亿港元。消息面上,今日盘后,泡泡玛特发布三季度最新业务状况公告,2025年第三季度整体 收益同比增长245%-250%。其中,中国收益同比增长185%-190%,海外收益同比增长365%-370%。小摩预计,泡泡玛特未来 催化剂包括:圣诞强劲销售,"Labubu&Friends"动画预期在12月发布,Labubu4.0料在明年3至4月出炉。 小米集团-W(01810)获净买入4.81亿港元。消息面上,小米集团披露,10月17日,公司回购1070万股,每股作价45.9港元至 46.76港元,涉及总额约4.94亿港元。今年以来该股累计进行12次回购,合计回购3412.52万股,累计回购金额15.37亿港元。 内资重新加仓芯片股,华虹半导体(01347)、中芯国际(00981)分别获净买入4.41亿、1.28亿港元。消息面上,华金证券表示, 持续看好人工智能推动半导体超级周期,建议关注半导体全产业 ...

泡泡玛特股价大跌8.08%,创下近半年来单日最大跌幅

Xin Lang Cai Jing· 2025-10-21 09:42

Core Viewpoint - The stock of Pop Mart (09992.HK) experienced a significant decline of 8.08% on October 21, closing at 250.4 HKD per share, influenced by a broader downturn in new consumer stocks in the Hong Kong market [1] Group 1: Stock Performance - Pop Mart's stock price reached a historical high of 339.8 HKD per share on August 26, 2023, but has since declined nearly 15% over the past three days [1] - The total market capitalization of Pop Mart is approximately 336.27 billion HKD [1] Group 2: Financial Performance - For Q3 2025, Pop Mart expects overall revenue to increase by 245%-250% compared to Q3 2024, with Chinese revenue projected to grow by 185%-190% and overseas revenue by 365%-370% [1] - Revenue from offline channels in China is anticipated to rise by 130%-135%, while online channels are expected to grow by 300%-305% [1] - Overseas revenue growth is expected to be 170%-175% in the Asia-Pacific region, 1265%-1270% in the Americas, and 735%-740% in Europe and other regions [1] Group 3: Product Performance - Several new products from Pop Mart have become bestsellers, including the "WHY SO SERIOUS" Halloween blind box series, which sold out within minutes [2] - The price of the LABUBU-themed "Moon Shadow Mask" surged from 159 RMB to a peak transaction price of 2289 RMB, representing a premium of 13.4 times [2] - The "Delicious Moments Series" featuring the Starry People character saw a peak price increase from 59 RMB to 929 RMB, with a premium of nearly 14.7 times [2] Group 4: Analyst Ratings - On October 16, JPMorgan upgraded Pop Mart's investment rating to "Overweight," raising the target price from 300 HKD to 320 HKD [2] - The bank adjusted its earnings estimates for 2025 to 2027 upwards by 5% to 7%, forecasting a year-on-year sales increase of 165% and a 276% rise in adjusted profit for this year [2][4] - JPMorgan noted that Pop Mart's stock price has significantly corrected from its August peak, suggesting that investor expectations have become overly conservative [5]

广博股份(002103) - 002103广博股份投资者关系管理信息20251021

2025-10-21 09:28

Group 1: Company Overview and Strategy - Guangbo Group is transitioning from a traditional stationery manufacturer to a cultural creative enterprise, establishing a diverse brand matrix with sub-brands like "kinbor," "fizz," and "papiest" to cater to various consumer needs [3] - The company is focusing on the explosive growth of the trendy toy market, expanding its product offerings to include badges, cards, and plush toys, aligning with current market trends [3][4] - Guangbo aims to enhance its product competitiveness in the trendy toy segment through a well-structured product matrix that emphasizes design and quality [4] Group 2: Product Development and IP Strategy - The company is deepening its strategy of synergistic development between leading IPs and niche IPs, leveraging both to attract different consumer segments and enhance product value [4] - Recent participation in the "CTE China Toy & Trendy Play Expo" showcased a diverse range of trendy toy products, including collaborations with popular IPs like "Detective Conan" and "HUNTER×HUNTER" [6] - The launch of the "Detective Conan M28: The One-Eyed Phantom" food play series exemplifies the company's innovative approach, integrating content, product, and experience to engage Gen Z consumers [6] Group 3: International Expansion and Production - Guangbo is increasing its overseas presence, particularly in Southeast Asia, where there is a growing demand for culturally rich and creatively designed trendy toys [7] - The company currently operates production bases in Vietnam, Cambodia, and Malaysia, with plans to expand the Vietnam facility to enhance its global supply chain resilience [8] - This multi-regional production strategy aims to mitigate operational risks and optimize cost structures, strengthening the company's competitive edge in international markets [8]