元件

Search documents

每周股票复盘:澳弘电子(605058)可转债申请获上交所审核通过

Sou Hu Cai Jing· 2025-10-25 20:35

Group 1 - The stock price of Aohong Electronics (605058) increased by 13.29% this week, closing at 30.95 yuan, compared to 27.32 yuan last week [1] - The highest intraday price reached 31.2 yuan on October 24, while the lowest was 27.65 yuan on October 20 [1] - The current total market capitalization of Aohong Electronics is 4.423 billion yuan, ranking 49th out of 57 in the components sector and 3609th out of 5160 in the A-share market [1] Group 2 - Aohong Electronics has received approval from the Shanghai Stock Exchange Listing Review Committee for its application to issue convertible bonds to unspecified objects [2][3] - The issuance is subject to approval from the China Securities Regulatory Commission, and there is uncertainty regarding whether the registration will be granted and the timeline for registration [2][3]

东山精密(002384):前三季度稳中有增,静待AIPCB+光通信双翼齐飞

GOLDEN SUN SECURITIES· 2025-10-25 11:58

Investment Rating - The report maintains a "Buy" rating for the company [7]. Core Views - The company has shown steady growth in the first three quarters of 2025, with revenue reaching 27.071 billion yuan, a year-on-year increase of 2.28%, and a net profit of 1.223 billion yuan, up 14.61% year-on-year. However, the net profit for Q3 2025 saw a slight decline of 8.19% due to increased management expenses and insufficient new capacity conversion [1][2]. - The company is strategically positioned to benefit from the growth in AI PCB and optical communication sectors, with a focus on high-end PCB production and expansion into the optical chip and module markets [2][4]. - The company has a comprehensive investment plan of 1 billion USD for Multek to enhance high-end PCB capacity, aiming to capture market opportunities in AI servers [3][4]. Summary by Sections Financial Performance - For the first three quarters of 2025, the company achieved a revenue of 27.071 billion yuan, with a net profit of 1.223 billion yuan. Q3 2025 revenue was 10.115 billion yuan, showing a 2.82% year-on-year increase, while net profit decreased by 8.19% [1]. - The revenue from the new energy business for the first nine months of 2025 was 7.520 billion yuan, reflecting a growth of 22.08% and accounting for 27.78% of total revenue [2]. Business Segments - The soft board business benefited from increased demand for new consumer electronics, while the hard board business saw revenue and profit growth driven by AI demand for high-layer and HDI boards [2]. - The company is focusing on AI PCB and optical communication, with plans to expand its product offerings in optical chips and modules, leveraging the acquisition of Solstice Optoelectronics [2][4]. Future Outlook - The company is expected to achieve revenues of 42.060 billion yuan, 60.004 billion yuan, and 73.917 billion yuan in 2025, 2026, and 2027, respectively, with year-on-year growth rates of 14.4%, 42.7%, and 23.2% [4]. - The net profit forecast for the same years is 2.197 billion yuan, 6.042 billion yuan, and 8.011 billion yuan, with significant growth rates of 102.4%, 175.0%, and 32.6% [4].

科技股领涨,沪指再创十年新高

Jin Rong Shi Bao· 2025-10-24 10:35

Market Performance - The A-share market saw all three major indices rise collectively, with the Shanghai Composite Index reaching a new high for the year [1] - As of October 24, the Shanghai Composite Index closed at 3950.31 points, up 0.71%, while the Shenzhen Component Index closed at 13289.19 points, up 2.02%, and the ChiNext Index closed at 3171.57 points, up 3.57% [1][2] Trading Volume and Stock Movement - The total trading volume in the Shanghai and Shenzhen markets was approximately 19742.09 billion yuan, an increase of about 3303 billion yuan compared to the previous trading day [2] - Out of 3028 stocks, 2274 stocks declined, indicating a mixed performance across the market [2] Sector Performance - The leading sectors included components, semiconductors, electronic chemicals, and military electronics, with significant gains [2][3] - Conversely, sectors such as coal mining, oil and gas extraction, and liquor experienced notable declines [2][3] Conceptual Sector Highlights - Technology sectors such as computing hardware, storage chips, and commercial aerospace showed strong performance, with chip stocks like Cambrian Technology rising over 7% [4] - The market is expected to continue showing structural opportunities, supported by rising policy expectations and upcoming quarterly performance reports [4]

元件板块10月24日涨6.98%,N超颖领涨,主力资金净流入60.12亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:21

Core Insights - The component sector experienced a significant increase of 6.98% on October 24, with N Chao Ying leading the gains [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Stock Performance - N Chao Ping (603175) saw a remarkable rise of 397.60%, closing at 84.99 with a trading volume of 368,400 shares and a transaction value of 2.764 billion [1] - Other notable performers included: - Kexiang Co. (300903) with a 20.00% increase, closing at 14.76 [1] - Shengyi Electronics (688183) with a 19.99% increase, closing at 88.94 [1] - Fangzheng Technology (600601) with a 10.05% increase, closing at 11.72 [1] Capital Flow - The component sector saw a net inflow of 6.012 billion in main funds, while retail investors experienced a net outflow of 3.761 billion [2][3] - Main funds showed significant interest in N Chao Ying, with a net inflow of 1.010 billion, representing 36.54% of the total [3] - Other companies like Shenghong Technology (300476) and Fangzheng Technology (600601) also attracted main fund inflows, but faced net outflows from retail investors [3]

收评:沪指涨0.71%创十年新高 元件板块领涨

Zhong Guo Jing Ji Wang· 2025-10-24 07:26

Core Viewpoint - The A-share market experienced a collective rise, with the Shanghai Composite Index reaching a ten-year high, driven by strong performances in specific sectors such as components and semiconductors [1] Market Performance - The Shanghai Composite Index closed at 3950.31 points, up by 0.71%, with a trading volume of 858.49 billion yuan - The Shenzhen Component Index closed at 13289.19 points, up by 2.02%, with a trading volume of 1115.72 billion yuan - The ChiNext Index closed at 3171.57 points, up by 3.57%, with a trading volume of 526.38 billion yuan [1] Sector Performance - Leading sectors included: - Components: up by 4.76%, with a trading volume of 183.99 million hands and a net inflow of 7.08 billion yuan - Semiconductors: up by 4.41%, with a trading volume of 296.21 million hands and a net inflow of 22.54 billion yuan - Electronic chemicals: up by 3.63%, with a trading volume of 77.29 million hands and a net inflow of 2.09 billion yuan [2] - Underperforming sectors included: - Coal mining and processing: down by 3.29%, with a trading volume of 281.50 million hands and a net outflow of 2.22 billion yuan - Oil and gas extraction and services: down by 2.66%, with a trading volume of 171.29 million hands and a net outflow of 1.37 billion yuan - Gas: down by 2.01%, with a trading volume of 113.50 million hands and a net outflow of 1.14 billion yuan [2]

午评:三大指数早间高开高走 元件板块涨幅居前

Zhong Guo Jing Ji Wang· 2025-10-24 03:42

Core Viewpoint - The A-share market experienced a positive trend with all three major indices rising, indicating a bullish sentiment among investors [1]. Market Performance - The Shanghai Composite Index closed at 3938.98 points, up by 0.42% - The Shenzhen Component Index closed at 13195.25 points, up by 1.30% - The ChiNext Index closed at 3126.05 points, up by 2.09% [1]. Sector Performance Top Gaining Sectors - Components sector increased by 4.34% with a total trading volume of 1215.66 million hands and a total transaction value of 467.54 billion - Semiconductor sector rose by 3.60% with a trading volume of 1867.55 million hands and a transaction value of 1323.77 billion - Electronic chemicals sector grew by 2.86% with a trading volume of 491.39 million hands and a transaction value of 112.89 billion [2]. Top Losing Sectors - Coal mining and processing sector decreased by 3.65% with a trading volume of 2013.24 million hands and a transaction value of 140.76 billion - Oil and gas extraction and services sector fell by 2.57% with a trading volume of 1232.37 million hands and a transaction value of 66.00 billion - Gas sector declined by 1.95% with a trading volume of 846.26 million hands and a transaction value of 56.42 billion [2].

元件板块10月23日跌1.44%,威尔高领跌,主力资金净流出6.42亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:14

Market Overview - The component sector experienced a decline of 1.44% on October 23, with Weirgao leading the drop [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index closed at 13025.45, also up 0.22% [1] Stock Performance - Notable gainers included: - Maijie Technology (code: 61600E) with a closing price of 12.95, up 8.28% [1] - Shunluo Electronics (code: 002138) with a closing price of 37.28, up 3.96% [1] - Shenghong Technology (code: 300476) with a closing price of 286.22, up 2.74% [1] - Major decliners included: - Weirgao (code: 301251) with a closing price of 56.94, down 12.67% [2] - Shengyi Technology (code: 600183) with a closing price of 55.70, down 4.87% [2] - Dongshan Precision (code: 002384) with a closing price of 65.75, down 4.20% [2] Capital Flow - The component sector saw a net outflow of 642 million yuan from institutional investors, while retail investors had a net inflow of 799 million yuan [2][3] - Weirgao had a net inflow of 86.79 million yuan from institutional investors but a net outflow of 161 million yuan from retail investors [3] - Shenghong Technology experienced a net inflow of 61.1 million yuan from institutional investors, while retail investors had a net outflow of 42.3 million yuan [3]

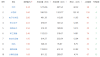

元件板块10月22日跌0.62%,三环集团领跌,主力资金净流出6.33亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:19

| 代码 | 名称 | 收盘价 | 涨跌幅 | 成交量(手) | 成交额(元) | | --- | --- | --- | --- | --- | --- | | 300408 | 三环集团 | 48.06 | -5.00% | 23.59万 | 11.50亿 | | 300814 | 中富电路 | 55.21 | -3.14% | 15.26万 | 8.47 Z | | 301251 | 威尔高 | 65.20 | -3.11% | 9.46万 | 6.19 Z | | 688539 | 高华科技 | 37.26 | -2.84% | 4.90万 | 1.82亿 | | 300903 | 科翔股份 | 12.44 | -2.58% | 13.57万 | 1.69亿 | | 600563 | 法拉电子 | 119.50 | -2.51% | 2.27万 | 2.73亿 | | 300964 | 本川智能 | 43.66 | -2.33% | 1.75万 | 7689.03万 | | 603228 | 景旺电子 | 60.81 | -1.76% | 25.42万 | 15.63亿 | | 300319 | 麦捷 ...

元件板块10月21日涨5.03%,中富电路领涨,主力资金净流入43.96亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-21 08:21

Core Insights - The component sector experienced a significant increase of 5.03% on October 21, with Zhongfu Circuit leading the gains [1] - The Shanghai Composite Index closed at 3916.33, up 1.36%, while the Shenzhen Component Index closed at 13077.32, up 2.06% [1] Sector Performance - Zhongfu Circuit (300814) closed at 57.00, with a rise of 16.02% and a trading volume of 248,100 shares, amounting to a transaction value of 1.362 billion [1] - Weier Gao (301251) saw a closing price of 67.29, increasing by 15.05% with a trading volume of 169,800 shares, totaling 1.09 billion [1] - Gaohua Technology (688539) closed at 38.35, up 13.83% with a trading volume of 109,000 shares, resulting in a transaction value of 0.402 billion [1] - Dongshan Precision (002384) closed at 68.33, increasing by 8.12% with a trading volume of 1,029,400 shares, totaling 6.818 billion [1] - Shengyi Technology (600183) closed at 59.02, up 7.86% with a trading volume of 501,900 shares, amounting to 2.881 billion [1] - Pengding Holdings (002938) closed at 51.96, increasing by 7.78% with a trading volume of 421,400 shares, totaling 2.14 billion [1] - Nanya New Materials (688519) closed at 70.15, up 6.53% with a trading volume of 58,400 shares, resulting in a transaction value of 0.4 billion [1] - Shengyi Electronics (688183) closed at 75.87, increasing by 6.48% with a trading volume of 191,900 shares, totaling 1.427 billion [1] - Victory Technology (300476) closed at 281.15, up 6.41% with a trading volume of 654,700 shares, amounting to 17.884 billion [1] - Maijie Technology (300319) closed at 12.16, increasing by 6.20% with a trading volume of 389,300 shares, totaling 0.466 billion [1] Fund Flow Analysis - The component sector saw a net inflow of 4.396 billion from main funds, while retail funds experienced a net outflow of 2.268 billion [3] - Speculative funds recorded a net outflow of 2.128 billion [3]

收评:沪指涨1.36% 工程机械板块全天领涨

Zhong Guo Jing Ji Wang· 2025-10-21 07:41

Core Viewpoint - The A-share market experienced a collective rise in the three major indices, indicating positive market sentiment and investor confidence [1]. Market Performance - The Shanghai Composite Index closed at 3916.33 points, up by 1.36%, with a trading volume of 837.94 billion yuan - The Shenzhen Component Index closed at 13077.32 points, up by 2.06%, with a trading volume of 1035.96 billion yuan - The ChiNext Index closed at 3083.72 points, up by 3.02%, with a trading volume of 475.63 billion yuan [1]. Sector Performance - The leading sectors in terms of growth included: - Engineering Machinery: increased by 4.10%, with a total trading volume of 930.95 million hands and a total transaction amount of 12.02 billion yuan - Components: increased by 3.52%, with a total trading volume of 1240.65 million hands and a total transaction amount of 58.19 billion yuan - Rubber Products: increased by 3.39%, with a total trading volume of 164.52 million hands and a total transaction amount of 2.75 billion yuan [2]. - Sectors that experienced declines included: - Coal Mining and Processing: decreased by 0.75%, with a total trading volume of 3120.11 million hands and a total transaction amount of 22.58 billion yuan - Gas: decreased by 0.42%, with a total trading volume of 1527.52 million hands and a total transaction amount of 10.63 billion yuan [2].