Bank Of Shanghai(601229)

Search documents

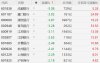

A股银行股集体下跌:成都银行跌5%,浦发银行跌超3%

Ge Long Hui A P P· 2025-10-29 04:03

Group 1 - The A-share market saw a collective decline in bank stocks, with Chengdu Bank dropping by 5% and several others, including Xiamen Bank, Shanghai Pudong Development Bank, and Qingdao Bank, falling over 3% [1] - Specific declines included Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank, all experiencing drops exceeding 2% [1] Group 2 - Chengdu Bank's market capitalization is reported at 72.9 billion, with a year-to-date increase of 5.28% despite the recent decline of 5.08% [2] - Xiamen Bank has a market capitalization of 18.1 billion, with a year-to-date increase of 24.69%, but it fell by 3.92% today [2] - Shanghai Pudong Development Bank's market capitalization stands at 396.7 billion, with a year-to-date increase of 19.25%, experiencing a decline of 3.87% [2] - Qingdao Bank's market capitalization is 29.2 billion, with a year-to-date increase of 33.50%, and it dropped by 3.28% [2] - Jiangsu Bank has a market capitalization of 194.5 billion, with a year-to-date increase of 13.38%, and it fell by 3.11% [2] - Other banks like Jiangyin Bank, Qilu Bank, Hangzhou Bank, Shanghai Bank, and Hu Nong Commercial Bank also reported declines, with respective market capitalizations of 11.8 billion, 36.4 billion, 114.4 billion, 133.3 billion, and 82.1 billion [2]

A股银行股普跌,浦发银行跌超5%

Ge Long Hui· 2025-10-28 02:14

Core Viewpoint - The A-share market experienced a widespread decline in bank stocks, with notable drops in several major banks [1] Group 1: Market Performance - Shanghai Pudong Development Bank saw a decline of over 5% [1] - Other banks such as Minsheng Bank, Chongqing Rural Commercial Bank, Xi'an Bank, Jiangyin Bank, Jiangsu Bank, Zhangjiagang Bank, Shanghai Bank, Everbright Bank, Wuxi Bank, Bank of Communications, and China Construction Bank all experienced declines of over 1% [1]

行业深度报告:零售风险及新规影响有限,兼论信贷去抵押化

KAIYUAN SECURITIES· 2025-10-27 05:44

Investment Rating - The investment rating for the industry is "Positive" (maintained) [1] Core Insights - The report highlights that retail non-performing loan (NPL) rates and generation rates are currently high, indicating ongoing pressure on bank profitability. Despite a low overall NPL rate, the retail sector shows signs of risk, with a marginal increase in the NPL rate to 1.28% [14][15] - The transition period for new risk regulations is nearing its end, with concerns about the impact on banks' provisioning levels. However, the report suggests that the actual impact may be less severe than market expectations [16] - The trend of de-collateralization in bank lending is evident, driven by both business characteristics and strategic choices made by banks to reduce reliance on collateralized loans [17] Summary by Sections 1. Retail NPL and Generation Rates - The retail NPL rate has increased to 1.28%, with a steepening curve indicating ongoing risk. The generation rate for retail loans remains high, with significant increases noted in certain banks [14][18] - The report indicates that while the overall NPL rate is low, the divergence between overdue and NPL indicators suggests underlying risks in the retail sector [19] 2. Impact of New Risk Regulations - The new risk regulations will require banks to classify impaired loans as NPLs, potentially increasing reported NPL rates. However, the report anticipates that the actual provisioning pressure may be manageable [16][17] 3. De-Collateralization in Lending - The report notes a significant decline in the proportion of collateralized loans, with banks shifting towards non-collateralized lending strategies. This shift is influenced by the need to manage risk more effectively [17][18] 4. Investment Recommendations - The report recommends certain state-owned banks due to their customer base advantages and manageable retail risk pressures. It also highlights specific banks such as CITIC Bank and Agricultural Bank of China as beneficiaries of this trend [6]

银行股三季报陆续披露 多家银行业绩均有改善 银行业净息差或企稳(附概念股)

Zhi Tong Cai Jing· 2025-10-27 02:12

Core Viewpoint - The A-share listed banks are expected to show overall revenue and net profit growth in the third quarter of 2025, with improvements in asset quality and a narrowing decline in net interest margins [1][2][3]. Group 1: Financial Performance - Huaxia Bank reported operating income of 64.881 billion yuan, a year-on-year decrease of 8.79%, and net profit attributable to shareholders of 17.982 billion yuan, down 2.86%, with a narrowing decline of 5.09 percentage points compared to the first half of the year [1]. - Chongqing Bank achieved operating income of 11.740 billion yuan, a year-on-year increase of 10.40%, and net profit of 5.196 billion yuan, up 10.42% [2]. - Ping An Bank reported operating income of 100.668 billion yuan, a year-on-year decrease of 9.8%, and net profit of 38.339 billion yuan, down 3.5%, with a narrowing decline compared to the first half of the year [2]. Group 2: Market Trends - Ten banks have seen shareholding increases from shareholders and executives this year, indicating a positive outlook for the banking sector amid macroeconomic stabilization and easing monetary policy [3]. - Analysts expect cumulative revenue and net profit for listed banks in the first three quarters of 2025 to grow by 0.4% and 1.1% year-on-year, respectively, driven by a narrowing decline in net interest margins and reduced credit costs [3]. Group 3: Interest Margin Outlook - Zhongtai Securities suggests that the net interest margin for banks may stabilize in the third quarter due to reduced re-pricing pressure on assets and a greater decline in deposit rates compared to the Loan Prime Rate (LPR) [4]. - The projected increase in net interest margin for the third and fourth quarters is 0.7 basis points and 0.3 basis points, respectively, indicating stability in the banking sector [4]. Group 4: Related Stocks - Goldman Sachs reported that the A-shares and H-shares of major banks have recorded absolute returns of 12% and 21% year-to-date, driven by improvements in asset quality and narrowing declines in net interest margins [5]. - Ping An Insurance increased its stake in Postal Savings Bank, acquiring 6.416 million shares at an average price of 5.3638 HKD per share [6].

本周在售部分纯固收产品近3月年化收益率逼近10%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 01:20

Core Insights - The article emphasizes the abundance of bank wealth management products with similar names and vague characteristics, urging investors to carefully select and differentiate among them [1] - The South Finance Wealth Management team focuses on pure fixed-income products issued by wealth management companies, providing a performance ranking of these products to assist investors in making informed choices [1] Summary by Category Product Performance - The ranking showcases annualized performance over the past month, three months, and six months, sorted by the three-month annualized yield to reflect multi-dimensional performance amid recent market fluctuations [1] - A total of 28 distribution institutions are involved in the ranking, including major banks such as Industrial and Commercial Bank of China, Bank of China, and Agricultural Bank of China [1] Product Availability - The ranking is based on the "on-sale" status of wealth management products, which may vary due to factors like sold-out quotas or differences in product listings for different customers [1] - Investors are advised to refer to the actual display on the distribution bank's app for the most accurate information regarding product availability [1]

银行渠道本周在售最低持有期产品榜单(10/27-11/2)

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 01:20

Core Insights - The article emphasizes the abundance of bank wealth management products with similar names and vague characteristics, urging investors to carefully select and differentiate among them [1] - The South Finance Wealth Management team aims to reduce investors' selection costs by focusing weekly on the performance of wealth management products available through various distribution channels [1] Summary by Category Performance Rankings - The current focus is on the performance of public offering products with a minimum holding period in RMB, categorized by holding periods of 7 days, 14 days, 30 days, and 60 days, with annualized returns as the performance metric [1] - The ranking includes 28 distribution institutions such as Industrial and Commercial Bank of China, Bank of China, Agricultural Bank of China, and others [1] Product Availability - The list of products is based on their "on-sale" status, which is determined by their investment cycle; however, actual availability may vary due to factors like sold-out quotas or differences in product listings for different customers [1] - Investors are advised to refer to the actual display on the distribution bank's app for the most accurate information [1] Weekly Updates - The article provides a weekly update on the performance of wealth management products, with specific attention to the lowest holding period products for the week of October 27 to November 2 [5][8][11]

本周聚焦:黄金波动下的机遇与挑战:银行贵金属业务有望成重要增长极

GOLDEN SUN SECURITIES· 2025-10-27 00:58

Investment Rating - The report maintains an "Accumulate" rating for the banking sector, indicating a positive outlook despite challenges in the gold market in 2025 [1]. Core Insights - The gold market is expected to present both opportunities and challenges for banks, with a trend towards deepening precious metal business driven by central bank purchases [1][2]. - The demand for gold bars and coins has increased significantly, reflecting a growing need for gold as a hedge and store of value among residents [4]. - The establishment of a market-making system for gold trading is anticipated to enhance market liquidity and stability, positioning listed banks as key players [3][4]. Summary by Sections 1. Policy and Market Environment - As of September 2025, China's official gold reserves reached 74.06 million ounces, marking an increase for 11 consecutive months [2]. - In Q2 2025, global central banks added 166 tons of gold to their reserves, with 95% of surveyed central banks expecting further increases in the next 12 months [2]. - New policies allowing insurance funds to invest in gold are expected to create new opportunities for banks to provide services to insurance institutions, enhancing their intermediary income [2]. 2. Business Dynamics and Revenue Contribution - In the first half of 2025, China's gold consumption was 505.205 tons, a year-on-year decrease of 3.54%, with significant growth in gold bar and coin consumption by 23.69% [4]. - The decline in gold jewelry consumption is prompting banks to shift focus from traditional jewelry sales to investment-oriented precious metal businesses [4]. - The growth in investment demand for gold bars and coins is expected to stabilize income from investment-related businesses, enhancing the profitability of the precious metals segment for banks [4]. 3. Industry Trends - The report highlights a structural shift in gold consumption, with investment demand rising while jewelry demand declines, indicating a need for banks to adapt their business strategies [4]. - The performance of the banking sector is expected to benefit from expansionary policies aimed at stabilizing the economy, with specific banks like Ningbo Bank and Jiangsu Bank recommended for investment due to positive fundamental changes [8]. 4. Key Data Tracking - The report includes various financial metrics, such as average daily trading volume and margin financing balances, which are essential for assessing market conditions [9][10].

上海银行大零号湾科技支行开业 助力上海科技创新策源功能区建设

Zheng Quan Ri Bao Zhi Sheng· 2025-10-26 09:12

Core Points - Shanghai Bank officially opened its Dazero Bay Technology Branch on October 24, marking a significant step in its strategy to deepen technology finance and support high-quality development in the Dazero Bay area [1][2] - The bank launched a dedicated financial service plan and a co-branded card for tech enterprises, aiming to provide comprehensive financial services throughout their lifecycle [1] - A partnership agreement was signed with Minjin Investment Company, and a collaborative initiative was launched with Shanghai Jiao Tong University and East China Normal University incubators to create an innovative ecosystem integrating government, banking, industry, academia, and investment [1] Company Strategy - The Dazero Bay Technology Branch is positioned as a core component of Shanghai Bank's gradient cultivation system for technology branches, focusing on specialized operations, distinctive development, systematic management, and brand management [2] - The bank aims to serve "early, small, and hard" tech enterprises, aspiring to be the preferred bank for transformation and incubation, a companion for startup growth, and a financial engine for regional development [2]

城商行板块10月24日跌0.76%,厦门银行领跌,主力资金净流出1.42亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-24 08:27

Core Insights - The city commercial bank sector experienced a decline of 0.77% on October 24, with Xiamen Bank leading the drop [1] - The Shanghai Composite Index closed at 3950.31, up 0.71%, while the Shenzhen Component Index closed at 13289.18, up 2.02% [1] Stock Performance - Shanghai Bank closed at 9.67, up 0.73% with a trading volume of 848,400 shares and a transaction value of 822 million [1] - Xiamen Bank closed at 6.68, down 1.76% with a trading volume of 153,100 shares and a transaction value of 103 million [2] - The majority of city commercial bank stocks showed negative performance, with notable declines in Beijing Bank (-0.52%) and Guizhou Bank (-0.66%) [1][2] Capital Flow - The city commercial bank sector saw a net outflow of 142 million from institutional investors, while retail investors contributed a net inflow of 55.9 million [2] - Jiangsu Bank had a net inflow of 70.84 million from institutional investors, while Shanghai Bank experienced a net outflow of 78.96 million from retail investors [3] Individual Stock Analysis - Chengdu Bank had a slight negative net flow from institutional investors of 19.75 million, but a positive inflow from retail investors of 596.99 million [3] - Lanzhou Bank saw a net inflow of 13.36 million from institutional investors, while it faced a net outflow of 1.48 million from retail investors [3]

把服务送到企业身边!第十九届金洽会“园区行”为东方美谷注入金融活水

Guo Ji Jin Rong Bao· 2025-10-24 04:58

Core Insights - The event focused on addressing the needs of small and micro technology enterprises, emphasizing the importance of resource support from financial institutions in addition to funding [4][5] - The "Oriental Beauty Valley" is described as a comprehensive ecological system centered around the "beautiful health" industry, rather than a physical park [4] - The event highlighted the need for precise policies to help enterprises overcome growth challenges and enhance their development cycle [4] Group 1: Enterprise Needs - Enterprises expressed concerns about liquidity due to increased capital expenditure for expansion and sought information on credit products [4][5] - There was interest in employee stock ownership loan products and how to better connect with equity investment institutions [4][5] Group 2: Financial Institution Responses - Financial advisors from various institutions provided detailed answers to enterprise inquiries and discussed improving information exchange between government, enterprises, and financial institutions [5] - Specific recommendations included the introduction of specialized credit products for technology enterprises, support for employee stock ownership loans, and the importance of establishing a legal compliance framework for engaging with equity investors [5] Group 3: Event Overview - The "Golden Fair" commenced on September 29 and plans to host over ten specialized events by the end of the year, with an online exhibition running until September 2026 [5] - The fair aims to enhance the quality of services provided by financial institutions to real economy enterprises through both online and offline matchmaking [5]