SMIC(688981)

Search documents

A股三大指数集体上涨,科创50指数翻绿,盘初一度涨近2%!半导体产业链冲高回落,寒武纪、中芯国际、海光信息均跌超1%

Ge Long Hui· 2025-10-27 02:20

(责任编辑:宋政 HN002) 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com 【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 格隆汇10月27日|科创50指数翻绿,盘初一度涨近2%。半导体产业链冲高回落,寒武纪、中芯国际、 海光信息均跌超1%。 | 代码 | 名称 | | 淵陽%↓ | 总市值 | 年初至今涨幅% | | --- | --- | --- | --- | --- | --- | | 300655 | 晶瑞电材 | 1 | 17.10 | 189亿 | 89.04 | | 920015 | 锦华新材 | 1 | 14.00 | 73.21亿 | 43.67 | | 002643 | 万润股份 | 美 | 10.00 | 129亿 | 17.47 | | 603931 | 格林达 | 3 | 10.00 | 62.14亿 | 35.46 | | 603650 | 彤程新材 | -06 | 10.00 | 274Z | 32.92 | | 9 ...

存储芯片板块部分回调,中芯国际转跌

Mei Ri Jing Ji Xin Wen· 2025-10-27 02:09

Group 1 - The storage chip sector experienced a partial pullback on October 27, with notable declines in certain companies [1] - SMIC (中芯国际) turned negative, while Dahua Technology (大华股份) opened flat [1] - Aisen Technology (艾森股份) and Feikai Materials (飞凯材料) saw a decrease in their growth rates, and Huahong Semiconductor (华虹公司) dropped over 3% [1]

机构:市场情绪正在升温修复,港股通科技ETF(513860)涨近3%,药明康德涨超6%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-27 02:00

Group 1 - The Hong Kong stock market opened higher on October 27, with technology and semiconductor stocks showing strength [1] - The Hong Kong Stock Connect Technology ETF (513860) rose by 1.96% with a trading volume exceeding 30 million yuan, indicating strong investor interest [1] - Notable performers among the ETF's constituent stocks included Hongteng Precision, which increased by over 7%, and WuXi AppTec and WuXi Biologics, both rising by over 6% [1] Group 2 - According to Xinda Securities, the derivatives market is showing positive signals despite a reduction in positions, with the basis of the Shanghai 50 index futures turning to a premium, indicating improved sentiment in blue-chip stocks [2] - Huatai Securities noted that southbound capital has accumulated inflows exceeding 500 billion HKD since the second half of the year, suggesting a balanced risk outlook in the market [2] - The current high prosperity in sectors such as metals, materials, and energy, along with technology, contrasts with the recent bottoming or upward revision signs in consumer sectors and high-dividend stocks [2]

注意!多只绩优基金大调仓!

天天基金网· 2025-10-27 01:18

Core Viewpoint - The article discusses the recent adjustments made by top-performing fund managers in their portfolios during the third quarter of 2025, highlighting a focus on high positions and significant changes in holdings, particularly in the semiconductor and hard technology sectors [3][4][12]. Group 1: Fund Manager Adjustments - Many top-performing fund managers maintained high positions in their portfolios, with notable adjustments made to their holdings, primarily reducing positions in previously high-performing stocks [3][4]. - For instance, the Galaxy Innovation Growth Mixed Fund, managed by Zheng Weishan, had an equity investment ratio of 94.65% by the end of Q3, with a focus on the semiconductor industry and a positive outlook on domestic production [5][6]. - The Ping An Research Preferred Mixed Fund, managed by Zhang Xiaoqian, increased its stock position from 80.75% to 92.82% by the end of Q3, with significant changes in its top ten holdings [7][8]. Group 2: Investment Focus Areas - The primary investment direction for funds in Q3 was the hard technology sector, particularly the semiconductor industry, with expectations of continued investment in this area due to emerging demands from AI and the recovery of the semiconductor cycle [5][12]. - Fund managers expressed optimism about structural opportunities in the equity market, focusing on companies with clear competitive advantages and strong fundamentals, particularly in AI, energy storage, and new energy vehicles [12][13]. - The China Europe Digital Economy Mixed Fund, managed by Feng Ludan, saw its scale increase significantly, with a focus on AI infrastructure and a cautious approach to reducing positions in previously high-performing stocks [9][12]. Group 3: Market Outlook - Fund managers believe that the overall market remains healthy, with opportunities in undervalued stocks, especially in the consumer sector, as macroeconomic conditions improve [13]. - The AI sector presents both opportunities and risks, with high valuations leading to increased scrutiny on performance, making it susceptible to market sentiment and macroeconomic changes [13][12]. - There is a consensus among fund managers that the technology growth sector has moved from pessimistic to reasonable valuations, with no significant bubble in high-quality leading companies [12][13].

鹏华基金罗英宇旗下鹏华国证半导体芯片ETF三季报最新持仓,重仓寒武纪

Sou Hu Cai Jing· 2025-10-26 21:39

Group 1 - The core viewpoint of the article highlights the performance of the Penghua National Semiconductor Chip ETF, which reported a net asset value growth rate of 57.12% over the past year [1] - The largest holding in the fund is Cambricon Technologies (寒武纪), accounting for 12.37% of the portfolio [1] - The report details significant reductions in holdings across various stocks, with Cambricon Technologies seeing a decrease of 32.85% in shares held, valued at 664 million yuan [1] Group 2 - Other notable reductions include Zhongben International (中本国际) with a decrease of 32.75%, holding 4.04 million shares valued at 566 million yuan [1] - Haiguang Information (海光信息) also saw a reduction of 33.13%, with 2.19 million shares valued at 554 million yuan [1] - The report lists multiple companies with similar reductions, indicating a trend of decreased positions in semiconductor-related stocks [1]

品牌工程指数上周涨4.14%

Zhong Guo Zheng Quan Bao· 2025-10-26 21:06

Market Performance - The market rebounded last week, with the China Securities Xinhua National Brand Index rising by 4.14% to 2037.67 points [1] - The Shanghai Composite Index increased by 2.88%, the Shenzhen Component Index by 4.73%, the ChiNext Index by 8.05%, and the CSI 300 Index by 3.24% [1] Strong Stock Performances - Notable strong performers included Zhongji Xuchuang, which surged by 32.23%, followed by Shiyuan Co. with a 14.54% increase, and Sunshine Power with a 14.37% rise [1] - Other stocks that performed well included Anji Technology, Iwubio, and several others, with increases exceeding 10% [1] Year-to-Date Performance - Since the beginning of the second half of the year, Zhongji Xuchuang has risen by 239.03%, while Sunshine Power has increased by 145.06% [2] - Other significant gainers include Lanke Technology and Yiwei Lithium Energy, both up over 70% [2] Market Outlook - According to Fangzheng Fubang Fund, liquidity remains a crucial driver for market development, and future capital inflow will significantly impact market trends [2] - The firm suggests focusing on sectors with solid fundamentals and reasonable valuations, while avoiding those with high previous gains and poor earnings expectations [2] Economic Transition - Xingshi Investment indicates that the domestic economic momentum is expected to shift towards technology and consumption sectors, which will enhance market sentiment and drive stock performance [3] - The stability of mid-term expectations is anticipated to strengthen the fundamental drivers of the market [3]

聚焦科技成长主线绩优基金受资金追捧

Shang Hai Zheng Quan Bao· 2025-10-26 15:37

Core Insights - The report highlights a significant increase in the scale of several high-performing active equity funds in Q3 2025, driven by a steady rise in the stock market and structural opportunities in emerging industries like technology [1][2]. Fund Performance - Notable funds such as Yongying Technology Select Mixed Fund and China Europe Digital Economy Mixed Fund have seen substantial growth in their assets. For instance, Yongying Technology Select Mixed Fund's total assets surged from 11.66 billion to 115.21 billion, marking an increase of 888% [2]. - China Europe Digital Economy Mixed Fund's assets grew from 15.27 billion to 130.21 billion, reflecting a 752% increase, with a one-year net value growth of 156.49% [2][3]. Market Trends - The equity market has shown an upward trend over the past year, with significant performance differentiation among active equity funds. Funds focusing on AI and technology sectors have outperformed, while those centered on consumer and dividend stocks have faced challenges [3]. - Over 160 funds reported negative returns over the past year, with more than 20 funds experiencing losses exceeding 10% [3]. Manager Outlook - Fund managers express optimism regarding future market conditions, citing potential improvements in liquidity and a positive outlook for China's equity market. They anticipate a new market trend emerging, particularly around favorable policy windows in late October [4]. - Long-term expectations remain positive due to declining risk-free interest rates, liquidity easing, and improving profit forecasts, with a focus on AI-related sectors as a key investment area [5].

注意,他们调仓了!

Shang Hai Zheng Quan Bao· 2025-10-26 15:14

Core Viewpoint - The third quarter of 2025 has seen a significant adjustment in the portfolios of high-performing fund managers, who generally maintained high positions while reducing holdings in previously high-performing stocks [1][2]. Fund Performance and Adjustments - Multiple high-performing funds maintained high equity positions, with the Galaxy Innovation Growth Mixed Fund managed by Zheng Weishan having an equity investment ratio of 94.65% as of the end of Q3 [2]. - The fund made adjustments in its semiconductor industry holdings, adding stocks like Aojie Technology, Huahong Semiconductor, and Zhongke Shuguang to its top ten holdings [2]. - The Ping An Research Preferred Mixed Fund, managed by Zhang Xiaoqian, increased its stock position from 80.75% at the end of Q2 to 92.82% by the end of Q3 [3][4]. Investment Focus - The primary investment direction for funds in Q3 was in the hard technology sector, particularly the semiconductor industry, with a continued optimistic outlook on domestic production prospects and AI-driven demand [2][6]. - Zhang Xiaoqian emphasized dynamic optimization of the portfolio based on individual stock valuation and industry trends, increasing exposure to sectors like semiconductors, robotics, and agriculture while reducing positions in innovative pharmaceuticals and military stocks [6]. Fund Size and Stock Holdings - The China Europe Digital Economy Mixed Fund managed by Feng Ludan saw its size grow from 1.527 billion yuan to 13.021 billion yuan, with a stock position of 90.18% [7]. - The fund's strategy included cautious optimism in the AI infrastructure sector and a shift towards C-end internet platform companies [7]. Market Outlook - Fund managers expressed a positive outlook on structural opportunities in the equity market, focusing on companies with clear competitive advantages and strong fundamentals [9]. - The technology growth sector is viewed as having recovered to reasonable valuations, with a focus on artificial intelligence, energy storage, and new energy vehicles [9][10]. - However, there are warnings about the risks associated with high valuations in the AI sector, which may lead to increased volatility due to market sentiment and macroeconomic factors [10].

AI、半导体:人工智能推动半导体超级周期

Huajin Securities· 2025-10-25 12:41

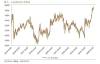

Investment Rating - The industry investment rating is "Outperform the Market" (maintained) [3][36] Core Viewpoints - The report highlights that artificial intelligence (AI) is driving a semiconductor supercycle, with significant investments and collaborations in the sector, such as Anthropic's partnership with Google, which includes a deal for up to one million custom TPU chips [3] - Major memory manufacturers like Samsung and SK Hynix are expected to raise prices of DRAM and NAND storage products by up to 30% in response to the surge in AI-driven demand [3] - Amphenol reported a 53.35% year-on-year increase in revenue for Q3 2025, driven by the growing demand for data center solutions [3] - The report anticipates a substantial increase in overall computing power by 2035, predicting a growth of up to 100,000 times, emphasizing the transformative potential of general artificial intelligence [3] Summary by Sections 1. Market Review - The electronic industry saw a weekly increase of 8.49% from October 20 to October 24, with the communication sector leading at 11.55% [6] - The Philadelphia Semiconductor Index rose from 6,885.03 points to 6,976.94 points during the same period, indicating a positive trend since April 2025 [11] 2. Industry High-Frequency Data Tracking 2.1 Panel Prices - TV panel prices are expected to stabilize due to healthy inventory levels, with no significant changes anticipated for various sizes [17] 2.2 Memory Prices - Prices for DDR5 and DDR4 memory chips have shown an upward trend, with DDR5 increasing from $10.457 to $12.615 and DDR4 from $24.333 to $24.721 between October 20 and October 24 [21]

程强:上证再创十年新高

Sou Hu Cai Jing· 2025-10-25 06:27

Market Overview - The A-share market experienced a strong upward trend, led by technology stocks, with the Shanghai Composite Index reaching a new 10-year high, closing at 3950.31 points, up 0.71% [2] - The total market turnover significantly increased to 1.99 trillion yuan, a 19.9% rise from the previous trading day, indicating active trading and the entry of new capital [2] Stock Market Analysis - The "14th Five-Year Plan" emphasizes the development of high-tech industries, igniting market enthusiasm for technology sectors, which saw substantial gains: communication (4.62%), electronics (4.54%), defense (2.54%), and new energy (1.89%) [3] - Conversely, previously strong dividend sectors like oil, coal, and real estate showed declines, indicating a shift from defensive to aggressive market styles [3] Bond Market Analysis - The bond market saw slight adjustments, with government bond futures generally declining, reflecting market pricing for long-term interest rate pressures [6] - The central bank's liquidity remained stable, with a net injection of 32 billion yuan through reverse repos, keeping short-term funding conditions favorable [6][7] Commodity Market Analysis - Global industrial commodities experienced a broad rally, with crude oil prices continuing to rise due to geopolitical pressures and improved inventory data [8] - Copper prices approached previous highs, supported by low inventory levels and expectations of improved demand from manufacturing sectors [9] Trading Hotspots - Key sectors to watch include artificial intelligence, domestic chip production, and consumer goods, driven by technological advancements and policy support [10] - The market is expected to continue its upward trend, influenced by the focus of the "14th Five-Year Plan" and macroeconomic events such as the upcoming APEC meeting [12]