Hui Lyu Ecological Technology Groups (001267)

Search documents

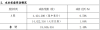

基础建设板块10月20日涨0.08%,汇绿生态领涨,主力资金净流出1.35亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-20 08:27

Market Overview - The infrastructure sector increased by 0.08% compared to the previous trading day, with Hui Lv Ecological leading the gains [1] - The Shanghai Composite Index closed at 3863.89, up 0.63%, while the Shenzhen Component Index closed at 12813.21, up 0.98% [1] Top Gainers in Infrastructure Sector - Hui Lv Ecological (001267) closed at 16.25, up 10.02% with a trading volume of 257,000 shares and a transaction value of 417 million [1] - Chengbang Co., Ltd. (603316) closed at 12.99, up 9.99% with a trading volume of 240,700 shares and a transaction value of 310 million [1] - Beautiful Ecology (000010) closed at 4.15, up 7.24% with a trading volume of 530,000 shares and a transaction value of 217 million [1] Decliners in Infrastructure Sector - ST IF Ping (603843) closed at 5.54, down 4.97% with a trading volume of 438,800 shares and a transaction value of 245 million [2] - ST Yuan Cheng (603388) closed at 1.22, down 4.69% with a trading volume of 2,280 shares and a transaction value of 278,200 [2] - Xinjiang Jiaojian (002941) closed at 19.19, down 3.08% with a trading volume of 170,500 shares and a transaction value of 1.37 billion [2] Capital Flow Analysis - The infrastructure sector experienced a net outflow of 135 million from institutional investors, while retail investors saw a net inflow of 138 million [2] - Major stocks like Hui Lv Ecological and Chengbang Co., Ltd. had significant net inflows from retail investors, despite overall institutional outflows [3]

暴涨!盘后突发大消息!

天天基金网· 2025-10-20 08:12

Market Overview - The A-share market experienced an overall increase on October 20, with the Shanghai Composite Index rising by 0.63%, the Shenzhen Component Index by 0.98%, and the ChiNext Index by 1.98% [5] - A total of 4,064 stocks rose, with 95 stocks hitting the daily limit up, while 1,253 stocks declined [6] Sector Performance - The coal and gas sectors saw significant gains, with multiple stocks such as Zhengzhou Coal Power and Guo Xin Energy reaching their daily limit up [8] - CPO and other computing hardware stocks also surged, with companies like Cambridge Technology and Hui Lv Ecology hitting the limit up [10] Notable Stocks - In the coal sector, notable performers included: - Shaanxi Black Cat: +10.13% [9] - Zhengzhou Coal Power: +10.10% [9] - In the gas sector, key stocks included: - Kai Tian Gas: +10.43% [10] - Guo Xin Energy: +10.00% [10] International Market Trends - Japanese and Korean stock markets reached new highs, with the Nikkei 225 index soaring by 1,600 points, surpassing 49,000 points [16] - The Seoul Composite Index increased by 1.6%, driven by substantial progress in tariff negotiations with the U.S. [18]

暴涨!关税,突发!

中国基金报· 2025-10-20 08:00

Market Overview - The A-share market experienced an overall increase on October 20, with the Shanghai Composite Index rising by 0.63%, the Shenzhen Component Index by 0.98%, and the ChiNext Index by 1.98% [1][2] - A total of 4,064 stocks rose, with 95 stocks hitting the daily limit up, while 1,253 stocks declined [2][3] Stock Performance - Notable stocks that reached the daily limit up include Shaanxi Black Cat (10.13%), Antai Group (10.10%), and Zhengzhou Coal and Electricity (10.10%) [4] - CPO and computing hardware stocks saw significant gains, with companies like Cambridge Technology and Huilv Ecology hitting the limit up [5][6] - The robotics sector was active, highlighted by Yushu Technology's launch of a new humanoid robot capable of dance and martial arts [7] International Market Highlights - The Japanese stock market saw a historic surge, with the Nikkei 225 index rising by 1,600 points, surpassing 49,000 points, driven by expectations of more aggressive fiscal policies following the formation of a new coalition government [12][13] - The South Korean stock market also rose by 1.6%, buoyed by reports of substantial progress in tariff negotiations with the United States [15] Sector Analysis - The precious metals sector faced a downturn, with companies like Hunan Silver and Western Gold hitting the daily limit down [9][10] - The overall trading volume in the market reached 113,774.6 million, indicating a robust trading environment [3]

算力硬件股涨势扩大

Di Yi Cai Jing· 2025-10-20 05:32

Core Viewpoint - The stock of Yuanjie Technology reached a 20% limit-up, indicating strong market interest and potential investor confidence in the company [1] Group 1: Stock Performance - Yuanjie Technology hit a 20% limit-up, showcasing significant upward momentum in its stock price [1] - Other companies such as Huilv Ecology, Cambridge Technology, and Jingwang Electronics also experienced limit-up gains [1] - Tianfu Communication, Zhongji Xuchuang, and Shijia Photon saw increases of over 10% [1] - Companies like Changguang Huaxin, Dongshan Precision, and Xinyisheng recorded gains exceeding 7% [1]

个股异动 | 汇绿生态涨停 加码光模块领域布局

Shang Hai Zheng Quan Bao· 2025-10-20 05:22

Group 1 - The core viewpoint of the article highlights the active performance of optical modules, particularly the strong surge in the stock price of Hui Lv Ecology, which reached a limit increase of 10.02% to 16.25 yuan [1] - Hui Lv Ecology plans to acquire a 49% stake in Junheng Technology, enhancing its control over the company and strengthening its position in the optical module industry [1] - The global market for optical modules is projected to grow at a CAGR of 22% from 2024 to 2029, potentially exceeding $37 billion by 2029 [1] Group 2 - The Chinese optical module market is expected to reach approximately 60.6 billion yuan in 2024, with an anticipated increase to 67 billion yuan by 2025 [1]

今日1088只个股突破五日均线

Zheng Quan Shi Bao Wang· 2025-10-20 04:33

Market Overview - The Shanghai Composite Index closed at 3866.09 points, below the five-day moving average, with a change of 0.69% [1] - The total trading volume of A-shares reached 1,170.861 billion yuan [1] Stocks Performance - A total of 1,088 A-shares have surpassed the five-day moving average today [1] - Stocks with significant deviation rates include: - Haike Xinyuan (14.44%) - Huarui Co., Ltd. (13.38%) - Zhongwei Electronics (10.11%) [1] Notable Stocks - Top stocks with the highest deviation rates from the five-day moving average: - Haike Xinyuan: Today's change of 19.98%, latest price 31.22 yuan, five-day moving average 27.28 yuan [1] - Huarui Co., Ltd.: Today's change of 20.00%, latest price 12.66 yuan, five-day moving average 11.17 yuan [1] - Zhongwei Electronics: Today's change of 20.00%, latest price 12.42 yuan, five-day moving average 11.28 yuan [1] Additional Stocks - Other notable stocks with positive performance: - Zhuhai Guanyu: Change of 13.88%, latest price 25.52 yuan, five-day moving average 23.35 yuan [1] - Feiwo Technology: Change of 18.35%, latest price 45.15 yuan, five-day moving average 41.36 yuan [1] - Hui Green Ecology: Change of 10.02%, latest price 16.25 yuan, five-day moving average 14.97 yuan [1]

需求业绩双炸,CPO板块全线沸腾!行业“高光时刻”已至?

Ge Long Hui· 2025-10-20 04:11

Core Viewpoint - The CPO (Co-Packaged Optics) sector in the A-share market is experiencing a strong performance driven by the explosive demand for AI computing power, leading to significant price increases in multiple stocks [1][4]. Industry Overview - The CPO technology effectively overcomes traditional optical module limitations in bandwidth, power consumption, and density, making it well-suited for high-frequency data interactions required in AI scenarios [4]. - Recent reports indicate a positive outlook for CPO and related optical modules, with major overseas clients increasing their procurement plans for 1.6T optical modules from 10 million to 20 million units due to rising bandwidth demands [4]. - The global Ethernet optical module market is projected to grow significantly, with expectations of a 35% increase to $18.9 billion by 2026 and surpassing $35 billion by 2030 [4]. Company Performance - Companies like Dongshan Precision are experiencing a significant supply shortage in the optical chip market, particularly for high-speed products (800G and above), which is expected to persist in the short term [5]. - Zhongji Xuchuang has begun shipping 1.6T optical modules and anticipates continued mass production and delivery in the upcoming quarters [6]. - Yuanjie Technology expects a substantial increase in demand for 400G/800G optical modules in the second half of the year, driven by customer transitions from GPU to ASIC chips [6]. Financial Results - Shijia Photon reported a revenue of 1.56 billion yuan for the first three quarters, a year-on-year increase of 113.96%, with a net profit of 299 million yuan, reflecting a staggering growth of 727.74% [8]. - Luxshare Precision's net profit for the first three quarters is projected to be between 10.89 billion and 11.34 billion yuan, marking a year-on-year growth of 20% to 25% [8]. - Zhongshi Technology expects a net profit of 230 million to 270 million yuan for the first three quarters, a significant increase of 74.16% to 104.45% year-on-year [8]. Market Outlook - Institutions maintain an optimistic view on the sustained growth of optical module demand, driven by the ongoing explosion in AI computing needs [9]. - Leading optical module companies are expected to maintain strong profitability and competitive advantages due to the global data center construction and upgrade wave [9]. - The increasing reliability requirements and shortened iteration cycles for optical modules are raising industry technical barriers, further highlighting the advantages of leading manufacturers [9].

超4200股飘红

Di Yi Cai Jing Zi Xun· 2025-10-20 03:56

Core Viewpoint - The A-share market experienced a significant rebound, particularly in technology stocks, with the Shanghai Composite Index rising by 0.69%, the Shenzhen Component Index by 1.38%, and the ChiNext Index by 2.49% [2]. Market Performance - The total trading volume in the Shanghai and Shenzhen markets reached 1.16 trillion yuan, a decrease of 16.5 billion yuan compared to the previous trading day, with over 4,200 stocks showing gains [4]. - The A-share market's total market capitalization surpassed 24.5 trillion yuan [4]. Sector Highlights - Technology stocks, particularly in CPO, computing power, and 6G concepts, saw significant gains, with companies like Cambrian Technology reporting a revenue increase of 2386.38% year-on-year [4][6]. - Solid-state battery concepts gained traction, with companies like Hekang New Energy and Zhuhai Guanyu rising over 10% following announcements of technological breakthroughs in solid-state battery production [6][8]. - Precious metals experienced a notable decline, with the precious metals sector down by 6.09% [3]. Notable Stocks - Agricultural Bank of China saw its stock price rise over 1%, continuing a streak of 12 consecutive days of gains [4]. - Companies in the CPO sector, such as Huijie Ecology and Cambridge Technology, reached their daily limit up [8]. - The stock of Cambrian Technology expanded its gains to over 5%, trading at 1318.97 yuan [4].

汇绿生态实控人方套现2.77亿 2021重新上市净利降3年

Zhong Guo Jing Ji Wang· 2025-10-20 03:37

Core Viewpoint - The major shareholder of Huylv Ecological (001267.SZ), Ningbo Huining Investment Co., Ltd., has reduced its stake by 2.40%, bringing its ownership down from 18.51% to 16.11% through a share reduction of 18,846,516 shares, resulting in approximately 277 million yuan in cash proceeds [1][2]. Shareholding Changes - Ningbo Huining sold 4,424,200 shares through centralized bidding, accounting for 0.56% of the total shares, and 14,422,316 shares through block trading, accounting for 1.84% [2]. - The reduction in shareholding was executed between October 15 and October 16, 2025, at a weighted average price of 14.69 yuan per share [1]. Previous Announcements - On June 27, 2025, Huylv Ecological disclosed a plan for Ningbo Huining to reduce its holdings by up to 3% (23,524,939 shares) within a three-month period starting from July 18, 2025 [4]. - The planned reduction included a maximum of 7,841,646 shares through centralized bidding and 15,683,293 shares through block trading [4]. Financial Performance - Huylv Ecological has experienced a decline in net profit for three consecutive years since its relisting in 2021, with revenues decreasing from 8.14 billion yuan in 2020 to 5.87 billion yuan in 2024 [6]. - The net profit attributable to shareholders has also decreased from 899 million yuan in 2020 to 653 million yuan in 2024 [6]. Capital Raising Activities - In 2022, Huylv Ecological conducted a non-public offering of 75,446,428 shares at a price of 4.48 yuan per share, raising approximately 338 million yuan, with a net amount of about 332 million yuan after expenses [7].

光通信板块活跃 初灵信息涨幅居前

Xin Lang Cai Jing· 2025-10-20 03:30

Core Viewpoint - The optical communication sector is experiencing significant activity, with multiple stocks reaching their daily limit up [1] Group 1: Stock Performance - Stocks such as Huylv Ecological, Cambridge Technology, Jingwang Electronics, and Ruiskanda have hit the daily limit up [1] - Other notable performers include Chuling Information, Tianfu Communication, Zhongji Xuchuang, Weiergao, Dongshan Precision, and Qingshan Paper, which have shown substantial gains [1]