L'Oreal(LRLCY)

Search documents

欧莱雅豪赌高端化:向“全奢美妆”巨头迈进

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 12:27

Core Insights - L'Oréal has made significant moves in the beauty industry, including a €4 billion acquisition of Kering's beauty business, which includes long-term beauty licenses for Gucci and Balenciaga, indicating a strategy to enhance its high-end beauty portfolio and secure luxury brand resources for the next 50 years [1][3] - The company aims to transition from a brand manager to an "ecosystem builder," exploring new growth opportunities through partnerships, particularly with Kering [2] - L'Oréal's Q3 2025 financial results show a total sales of €32.81 billion, with a like-for-like growth of 3.4%, driven by recovery in North America and mainland China [2][6] Acquisition Strategy - The acquisition of Kering's beauty business includes the buyout of the high-end niche fragrance brand Creed and long-term beauty licenses for Gucci, Bottega Veneta, and Balenciaga, which are expected to enhance L'Oréal's position in the luxury beauty market [3][4] - L'Oréal has also acquired professional hair care brand ColorWow and skincare brand Medik8, filling gaps in its high-end salon hair care and professional skincare segments [3] Market Performance - L'Oréal's sales growth in the North Asia region has turned positive for the first time in two years, with a 0.5% increase, attributed to the recovery of high-end cosmetics and innovative products from brands like Lancôme and Helena Rubinstein [6] - The professional products division led growth with a 7.4% increase, while the fragrance category continues to show strong performance [6] Competitive Landscape - The beauty industry is witnessing a shift towards brand matrix, channel innovation, and digital transformation, with L'Oréal's aggressive expansion in luxury beauty positioning it well against competitors like Estée Lauder [7][8] - Estée Lauder's recent acquisition of Tom Ford for $2.8 billion highlights a similar strategy in the luxury segment, despite facing challenges in organic sales growth [6][9] Future Outlook - L'Oréal's future collaboration with Kering is anticipated to unlock new growth avenues, particularly in the luxury beauty sector, as the company seeks to leverage its expertise in customer engagement and brand management [5][9]

欧莱雅豪赌高端化:向“全奢美妆”巨头迈进丨美妆变局

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 12:21

Core Insights - L'Oréal has made significant moves in the beauty industry, including a €4 billion acquisition of Kering's beauty business, which includes long-term licenses for brands like Gucci and Balenciaga, indicating a strong ambition for growth and market positioning [1][3] - The company aims to transition from a brand manager to an "ecosystem builder," exploring new growth avenues through partnerships [2] - L'Oréal's recent acquisitions fill gaps in its high-end beauty portfolio, particularly in niche luxury fragrances, enhancing its competitive edge in a challenging market [3][6] Financial Performance - L'Oréal reported sales of €32.807 billion for the first three quarters, reflecting a 3.4% growth on a comparable basis, with North America and mainland China showing recovery [1][6] - The North Asia region achieved its first positive growth in two years, with a 0.5% increase in the first nine months [1] Strategic Moves - The acquisition of Creed and long-term licenses for Gucci, Bottega Veneta, and Balenciaga is a strategic effort to strengthen L'Oréal's position in the luxury beauty segment [3][4] - The company aims to replicate the success of the Armani beauty line, which saw sales exceed €500 million within four years of joining L'Oréal [3] Market Dynamics - The luxury beauty market is experiencing a shift, with brands needing to focus on customer engagement and operational efficiency to navigate rising costs and changing consumer preferences [4][5] - Competitors like Estée Lauder are also pursuing acquisitions to bolster their market presence, highlighting the competitive landscape in the beauty industry [6][7] Future Outlook - L'Oréal's ability to leverage its new partnerships with Kering and enhance its brand portfolio will be crucial for future growth [8] - The company is positioned to capitalize on emerging trends in consumer behavior and market demands, which may provide a competitive advantage in the evolving beauty landscape [7][8]

欧莱雅重押“放缓明显”的香水市场

36氪未来消费· 2025-10-24 08:05

Core Viewpoint - L'Oréal's third-quarter revenue increased by 3.4% year-on-year, with North Asia, including China, growing by 4.7%, surpassing analyst expectations of 3.2% [3] Revenue Performance - The mass cosmetics segment showed the lowest growth at 0.4%, while luxury beauty and professional hair care grew by 1.5% and 1.1%, respectively. The skin science beauty segment led with a growth rate of 6.1%, although this growth has noticeably slowed [4] - In China, all segments except mass cosmetics achieved growth exceeding market levels, with notable performances from brands like Lancôme, Helena Rubinstein, and YSL [4] Strategic Acquisition - L'Oréal announced a €4 billion acquisition of Kering's beauty business, which includes the luxury perfume brand Creed and the fragrance rights for Balenciaga and Bottega Veneta [4][5] - This acquisition is seen as a significant move for L'Oréal in the high-end fragrance market, which is expected to enhance its market share in this segment from 13.7% to potentially 19.7% [5] Market Dynamics - The luxury beauty sector remains competitive, with L'Oréal's luxury division still showing growth despite overall high-end consumption slowing down [4][5] - The global fragrance market's annual sales growth has slowed from 13% last year to 11% this year, with high-end fragrances experiencing a more pronounced slowdown [6] Challenges Ahead - The Gucci fragrance business, currently licensed to Coty until 2028, poses a challenge as L'Oréal will need to invest significantly to reshape the brand's image upon acquisition [6][7] - Creed, while a promising asset, currently generates approximately $400 million in annual sales, indicating that L'Oréal will need to invest heavily to expand the sales network for Creed and the other brands acquired [7]

豪掷332亿“联姻”开云后 欧莱雅CEO放话准备收购阿玛尼

Yang Zi Wan Bao Wang· 2025-10-24 04:15

Core Insights - L'Oréal is aggressively reshaping the beauty industry landscape through significant capital operations, including a €4 billion acquisition of Kering's beauty business and securing a 50-year beauty license for Gucci, Balenciaga, and Bottega Veneta [1][2] - The CEO has indicated readiness to negotiate the acquisition of the Armani brand, signaling a dual strategy of "licensing + acquisition" to intensify competition against rivals like Estée Lauder [1][4] Group 1: Strategic Acquisition - The €4 billion deal with Kering includes the outright purchase of the high-end niche fragrance brand Creed and a 50-year beauty license for Gucci, Bottega Veneta, and Balenciaga, alongside exploring new opportunities in health and longevity sciences [2] - The transaction is expected to be completed in the first half of 2026, with L'Oréal also required to pay royalties to Kering, positioning L'Oréal to lead in the high-growth niche fragrance market [2] Group 2: Financial Performance - L'Oréal's recent financial report shows a sales figure of €32.8 billion for the first three quarters of 2025, reflecting a year-on-year growth of 3.4%, with a notable acceleration to 4.9% in the third quarter [3] - The North Asia region has achieved its first positive growth in two years, with the Chinese mainland market showing single-digit growth in the third quarter, driven by the recovery of premium cosmetics and innovative products from brands like Lancôme and Helena Rubinstein [3] Group 3: Competitive Strategy - L'Oréal's strategic moves clearly demonstrate its ambition to compete with Estée Lauder, particularly in light of Estée Lauder's $2.8 billion acquisition of Tom Ford's entire business [4] - L'Oréal employs a flexible long-term licensing model for luxury brands like Gucci, allowing it to leverage their influence without the operational burden of fashion business management [4] Group 4: Industry Expansion - The collaboration between L'Oréal and Kering signifies a broader competitive landscape in the beauty industry, extending beyond traditional cosmetics into the health and longevity sectors [5] - L'Oréal's latest financial report highlights double-digit growth in online channels and strong performance in hair care and fragrance categories, indicating a focus on high-growth segments and digital channels [7] - The competition among beauty giants is evolving beyond product offerings to encompass brand matrices, channel innovation, and future technologies, intensifying the battle for market positioning [7]

开云集团以40亿欧元将美妆业务出售给欧莱雅集团

Xi Niu Cai Jing· 2025-10-24 03:29

Core Insights - Kering Group and L'Oréal Group have announced a long-term strategic partnership in the high-end beauty and health sectors [1][4] Group 1: Transaction Details - Kering Group will sell its beauty business, including the Creed salon fragrance brand, to L'Oréal Group [4] - L'Oréal will gain exclusive rights to Gucci brand fragrances and beauty products for 50 years after the expiration of the existing licensing agreement with Coty Group [4] - Kering will also grant L'Oréal exclusive rights for 50 years for the development, production, and distribution of fragrances and beauty products for Balenciaga and Bottega Veneta brands [4] - The total value of the transaction is €4 billion, to be paid in cash upon completion, which is expected in the first half of 2026 [4] Group 2: Strategic Initiatives - A strategic committee will be established to coordinate the collaboration between Kering's brands and L'Oréal Group [4] - Beyond beauty, Kering and L'Oréal will explore business opportunities in the high-end, health, and longevity sectors, planning to form a joint venture with equal equity stakes [4] Group 3: Business Performance - Kering Group's beauty division generated revenue of €150 million in the first half of 2025, reflecting a 9% year-on-year growth, primarily driven by the strong performance of the Creed brand [4] - The sale of the beauty division may be part of a significant restructuring initiative by Kering's new CEO [5]

40亿欧元,欧莱雅又从开云集团进货了

3 6 Ke· 2025-10-23 23:58

Core Viewpoint - The transaction between L'Oréal and Kering, valued at €4 billion, signifies a strategic alignment where Kering divests its beauty segment under financial pressure, while L'Oréal expands its market presence in the luxury beauty sector [1][2]. Group 1: Kering's Strategic Shift - Kering has sold its high-end fragrance brand Creed to L'Oréal, marking a significant move as Creed has a rich history of over 265 years and was previously acquired for €3.5 billion [3][5]. - The sale reflects Kering's need to address its financial challenges, with a debt of €9.5 billion and a 16% decline in total revenue in the first half of 2025 [6][7]. - Kering's new CEO, Luca de Meo, is implementing a strategy focused on simplifying and restructuring the brand portfolio, which includes delaying the acquisition of Valentino to prioritize financial health [6][7]. Group 2: L'Oréal's Growth Strategy - L'Oréal's acquisition of Kering's beauty division is seen as a strategic opportunity to enhance its luxury beauty portfolio, particularly with the potential of Gucci's beauty business, which is currently under Coty until 2028 [8][9]. - L'Oréal's CEO, Nicolas Hieronimus, expressed confidence in replicating the success of YSL beauty with Gucci, which has a market potential three times larger than YSL [11]. - The company has been actively investing in the high-end fragrance market, indicating a clear intent to strengthen its position in this lucrative segment [12][16]. Group 3: Market Dynamics and Future Outlook - The global high-end fragrance market is projected to reach $400 billion by 2025, with significant growth expected in the Chinese market, where high-end fragrances are gaining traction [15][18]. - Competitors like Estée Lauder and LVMH are also intensifying their efforts in the high-end fragrance space, indicating a competitive landscape that L'Oréal will need to navigate effectively [15][16]. - The integration of multiple luxury brands into L'Oréal's portfolio will test its ability to manage brand transitions and capitalize on market opportunities in the high-end beauty sector [14][18].

欧莱雅第三季度销售额增长4.2%

Bei Jing Shang Bao· 2025-10-23 13:51

北京商报讯(记者 张君花)近日,欧莱雅发布2025年三季度财报称,2025年第三季度销售额达103.3亿 欧元,同比增长4.2%,显著高于第二季度的2.4%增速;2025年前三季度累计销售额为328.07亿欧元,同 比增长3.4%。 ...

欧莱雅前三季销售额328.07亿欧元,北亚区高档化妆品部Q3恢复正增长

Cai Jing Wang· 2025-10-22 19:15

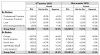

Core Insights - The company has experienced growth across all divisions and regions, with North America and mainland China showing strong recovery momentum [1][4] - The hair care and fragrance categories continue to demonstrate robust growth, while the makeup category is showing improvement [1] - Online channels have achieved double-digit growth [1] By Division - Professional Products reported €1,233.0 million in sales, with a like-for-like growth of +9.3% and a reported growth of +6.1% [2] - Consumer Products achieved €3,763.4 million, with a like-for-like growth of +3.8% and a reported growth of +0.4% [2] - Luxe division saw €3,719.7 million in sales, with a like-for-like growth of +2.5% but a reported decline of -1.5% [2] - Dermatological Beauty reached €1,617.6 million, with a like-for-like growth of +5.1% and a reported growth of +1.1% [2] - Group total sales amounted to €10,333.7 million, with a like-for-like growth of +4.2% and a reported growth of +0.5% [2] By Region - Europe generated €3,572.9 million, with a like-for-like growth of +4.1% and a reported growth of +4.6% [2] - North America reported €2,972.4 million, with a like-for-like growth of +1.4% but a reported decline of -4.3% [2] - North Asia achieved €1,953.2 million, with a like-for-like growth of +4.7% and a reported decline of -0.1% [2] - SAPMENA-SSA® region saw €1,010.2 million, with a like-for-like growth of +12.2% and a reported growth of +5.7% [2] - Latin America reached €825.0 million, with a like-for-like growth of +4.4% but a reported decline of -3.0% [2] Market Trends - North Asia has recorded its first positive growth in two years, with mainland China showing low single-digit growth, surpassing the market's slight growth [4] - The recovery in the high-end cosmetics sector is attributed to innovative product lines and the "Beauty Leap Plan" [4] - The professional hair products division experienced mid-single-digit growth, driven by the Kérastase brand and e-commerce channel growth [4] Strategic Developments - The company announced a strategic alliance with Kering Group, acquiring Creed to lead in the niche fragrance market, while also capitalizing on the growth potential of beauty and fragrance licensing for high-end brands like Gucci and Balenciaga [5]

Sale of beauty assets to L'Oreal will be "net gain" in results, Kering COO says

Reuters· 2025-10-22 16:58

Core Insights - Kering's sale of its beauty business to L'Oreal will lead to a "net gain before tax" in Kering's annual results, as stated by COO Jean-Marc Duplaix during an analyst call [1] Group 1 - The transaction is expected to positively impact Kering's financial performance for the year [1]

欧莱雅Q3业绩再次低于预期

Xin Lang Cai Jing· 2025-10-22 13:41

Core Viewpoint - L'Oréal is transitioning from a growth myth back to operational reality, reflecting a slowdown in the global beauty market, with two consecutive quarters of underperformance against expectations [1] Financial Performance - In Q3, L'Oréal reported sales of €10.33 billion, a 0.5% year-on-year increase, reversing a 1.3% decline in the previous quarter, but still below analyst expectations of €10.44 billion [1] - Same-store sales grew by 4.2%, an improvement from 2.4% in Q2, yet it marked the second consecutive quarter below market expectations of 4.85% [2] Market Reactions - Following the earnings report, L'Oréal's stock initially rose by 2% but quickly fell, with intraday losses reaching up to 6% [3] - Investor concerns are rising regarding the quality of L'Oréal's growth, indicating that the recovery is uneven [4] Regional Performance - North Asia emerged as a significant highlight, with Q3 same-store sales achieving a 4.7% growth, significantly surpassing analyst expectations of 3.2%, following a decline of over 11% in Q2 [5] - The Chinese market recorded moderate single-digit growth, marking the first positive growth in Q3 over two years, driven by a recovery in the high-end skincare market [6] - In contrast, North America experienced a notable slowdown, with Q3 sales down 4.3% and same-store sales only increasing by 1.4%, far below the expected 4.4% [7] Business Segment Performance - The mass cosmetics division saw a sales increase of 0.4%, with same-store sales growing by 3.8%, slightly above the previous quarter's performance [9] - The high-end cosmetics division experienced a 1.5% decline, but the drop was more than halved compared to Q2, indicating signs of recovery in high-end consumption [10] - The professional hair products division reported a same-store sales growth of 5.1%, while the skin science and beauty segment remained the fastest-growing, with sales up 6.1% and same-store sales growth of 9.3% [11] Market Outlook - Despite the recovery signals in North Asia, market reactions suggest that L'Oréal's revival has not met confidence expectations [12] - Analysts view Q3 performance as a signal of recovery from recession rather than a transition to prosperity, highlighting structural fatigue in the global cosmetics giant [14]