L'Oreal(LRLCY)

Search documents

欧莱雅将在进博会首发26项新品

Bei Jing Shang Bao· 2025-10-30 14:04

Core Insights - L'Oréal will participate in the 8th China International Import Expo with the theme "Essentiality of Beauty" [1] - The company will showcase three major exhibition areas: consumer goods exhibition area, French pavilion, and innovation incubation zone [1] - A total of 26 new products will be launched, including three Asian debut brands: Dr.G, Miu Miu, and Shu Uemura Professional Hair Care [1] Group 1 - The main exhibition area will focus on the concept of "Beauty Universe," featuring five sub-areas that highlight the company's latest achievements in R&D, products, sustainability, open innovation, and the philosophy of beauty [1] - The exhibition will include four globally and China debut beauty technologies and 19 new product launches [1]

欧莱雅集团考虑独立或联合投资阿玛尼;海底捞将开汉堡店

Sou Hu Cai Jing· 2025-10-30 13:51

Group 1: L'Oréal and Armani Group - L'Oréal's CEO Nicolas Hieronimus expressed willingness to negotiate with Armani Group as per the late Mr. Armani's will [3] - The will stipulates that heirs must sell 15% of Armani Group's shares within 18 months and transfer an additional 30%-54.9% within 3-5 years to the same buyer [3] - L'Oréal recently acquired Kering Beauty for €4 billion and has sufficient cash reserves, indicating capability for independent or partnered investment in Armani [3] Group 2: Brownes Dairy - Brownes Dairy plans to seek buyers or investors next year, with the sale process already underway [5] - The company has garnered significant interest from potential investors and aims for an IPO in 2026 [5] - Brownes Dairy was previously put up for sale after a loan recovery by Mengniu, amounting to AUD 200 million (approximately RMB 92 million) [5] Group 3: Qingdao Beer - Qingdao Beer terminated its plan to acquire 100% of Jimo Yellow Wine due to unmet conditions in the share transfer agreement [7] - The acquisition was expected to enhance Qingdao Beer's market position and open new growth avenues [7] Group 4: KKR and Costa Coffee - KKR is among a few companies negotiating to acquire Costa Coffee from Coca-Cola [10] - Costa Coffee, the largest coffee chain in the UK, has seen a reduction in store numbers in China since its acquisition by Coca-Cola for £3.9 billion in 2018 [10] - KKR's expertise in the food supply chain and digital integration could enhance Costa's business model and cash flow if the acquisition proceeds [10] Group 5: Haidilao - Haidilao is set to open its first hamburger store, "Xiao Hai Ai Zha hiburger," in Hunan, indicating a shift towards expanding its product line [13] - The new store is an upgrade from an existing brand and aims to attract younger consumers with its hamburger offerings priced between RMB 28-39.9 [13] Group 6: 7-Eleven Japan - 7-Eleven Japan will launch hydrogen-roasted coffee in collaboration with UCC, using hydrogen as a heat source for roasting [17] - The new coffee product is priced at 149 yen (approximately RMB 7), slightly higher than regular hot coffee [17] - This initiative aims to enhance 7-Eleven's brand image and attract a more niche consumer base through an environmentally friendly narrative [17] Group 7: IKEA - IKEA's global retail sales fell by 1% in the 2025 fiscal year, marking the second consecutive year of decline [19] - Despite the sales drop, product sales and customer numbers increased by 3%, with 66 new sales points opened globally [19] - IKEA continues to implement a pricing strategy aimed at attracting more consumers amid intense market competition [19] Group 8: Moutai Group - Moutai Group announced a significant leadership change, appointing Chen Hua, the former head of Guizhou Energy Bureau, as the new chairman [22] - This marks the fourth leadership change in five years for the liquor giant, with expectations for Chen to drive expansion into new consumer segments [22] Group 9: Wahaha - Reports indicate that Zhu Lidan, a core executive at Wahaha, has left the company, with her office vacated [25] - This departure follows a leadership transition at Wahaha, where Zong Fuli took over, leading to the exit of several long-standing executives [25] - The loss of Zhu, known for her cost control expertise, may impact the company's operational efficiency and negotiation capabilities [25] Group 10: Alexander McQueen - Alexander McQueen announced a three-year strategic review, initiating a restructuring plan that includes cutting approximately 55 jobs, or 20% of its London headquarters staff [27] - The brand aims to simplify its international market structure to restore growth confidence [27] - The restructuring reflects a shift towards a more pragmatic approach for the luxury brand, known for its unique niche [27]

美妆消费占国内三分之一,上海不只想当“美妆消费第一城”

Xin Lang Cai Jing· 2025-10-30 12:19

Core Insights - The global beauty industry is experiencing rapid development driven by technological innovation and consumer upgrades, with significant growth in the light medical beauty market [1] - China has become the largest cosmetics market globally, with the beauty industry expected to exceed 1,073.82 billion yuan in 2024 and 1,100 billion yuan by the end of 2025, indicating strong growth momentum [1] - The safety of medical beauty procedures and the difficulty in securing investments for innovative medical research companies remain challenges for industry development [1] Industry Development - The Chinese beauty industry has evolved beyond a single market dividend logic, integrating multiple disciplines such as medicine, bioengineering, and fine chemistry, focusing on product safety, effectiveness, and cultural value [3] - Shanghai is emerging as a core area for the beauty industry's development, with the city accounting for approximately one-third of the national retail sales of cosmetics, reaching 68.5 billion yuan in the first half of 2025 [3] - The "Meichuang Jingjie" beauty health innovation ecosystem community in Shanghai is actively capturing development opportunities in the beauty industry, integrating beauty technology, clinical transformation, and first-release economy [3][4] Policy Support - The Jing'an District government is committed to creating an efficient, orderly, and law-based business environment to support the beauty industry's development through various measures, including market access reforms and strengthening property rights protection [4] - The "Jing'an District Action Plan for Promoting High-Quality Development of the Beauty Health Industry (2025-2028)" aims to establish a 100 billion yuan beauty health industry cluster by 2028, fostering leading enterprises and international brands [5] Innovation Ecosystem - The "Meichuang Jingjie" initiative has attracted over 40 local beauty companies with core technologies and professional talent, creating an ecosystem for efficient innovation and market transformation [7] - The collaboration between research institutions and market needs is emphasized, with "Meichuang Jingjie" providing a platform for researchers and companies to exchange ideas and accelerate the commercialization of scientific achievements [7][8] Financial Support - The establishment of the "Kaihui Chuangmei Future Fund" aims to support new-generation beauty enterprises with effective scientific characteristics, providing financial backing for innovation [9] - The beauty industry is undergoing a technological transformation, with AI and biotechnology identified as key drivers for future development [9] Future Outlook - Experts suggest that technological innovation and globalization will be crucial for the future development of China's beauty industry, with increasing influence in Southeast Asia and Europe [10] - Predictions indicate significant growth in production capacity, technology research centers, and raw material manufacturing centers in the next five years, with a focus on global market expansion [11]

研报丨全球多肽化妆品竞赛,TOP3是谁?

FBeauty未来迹· 2025-10-30 11:29

Core Viewpoint - The cosmetics industry is undergoing a strategic transformation from basic moisturizing to efficacy-driven and scientific approaches, with peptides emerging as key active ingredients in anti-aging skincare products [3][4]. Market Size and Growth Trends - The global peptide cosmetics market is rapidly growing, with projections indicating a market size of $2.566 billion in 2024, expected to reach $5.716 billion by 2031, reflecting a compound annual growth rate (CAGR) of 12.3% during the forecast period [6][8]. - In 2024, over 55 million consumers are expected to use peptide skincare products, with 68% targeting wrinkle reduction and skin tightening [9]. Regional Market Performance - The Asia-Pacific region is the largest market for peptide cosmetics, accounting for 36% of global sales, with South Korea alone selling over 12.7 million units in 2023 [10][11]. - North America follows closely, representing 34% of global sales, with the U.S. having over 16.2 million active peptide skincare users [12][13]. - Europe contributes 28% of global sales, with Germany, the UK, and France leading the market [11][12]. Segment Market Performance - Serums are the largest segment, accounting for 38% of global sales, with over 480 peptide serums launched in 2023 [15]. - Moisturizing repair creams hold a 26% market share, while anti-aging creams account for 17% [15]. - Eye creams represent 11% of the segment, with 95 peptide SKUs recorded in 2023 [15]. Sales Channel Performance - Online sales dominate the market, accounting for 46% of total sales, with over 37 million peptide products sold through e-commerce platforms in 2023 [16]. - Specialty cosmetics stores contribute 27% to global sales, while supermarkets account for 18% [16]. Capital Flow and Investment Trends - In 2023, the global peptide cosmetics market attracted over $1.12 billion in funding, primarily directed towards R&D, clinical trials, and sustainable packaging [18][19]. - North America received over $360 million in investments, focusing on biotechnology-based peptide platforms [18]. Product Innovation - Over 110 new peptide products were launched globally between 2023 and 2024, showcasing a trend towards multi-peptide formulations and precision delivery systems [20]. - Brands are increasingly integrating AI for personalized skincare solutions, with over 145 brands utilizing AI skin diagnostic systems [20]. Competitive Landscape - The competitive landscape is shifting, with L'Oréal leading the market, followed by Estée Lauder and emerging brands like Han Shu [21][22]. - Han Shu's Red Waist 2.0 series achieved remarkable sales, emphasizing innovative raw material development and effective marketing strategies [22][25]. Raw Material Market Expansion - The peptide manufacturing market is projected to reach $2.574 billion by 2025, with a CAGR of 5.4% from 2025 to 2035 [26]. - There is a growing trend towards sustainable sourcing of peptides, with plant-based peptides gaining traction [26]. Challenges and Development - High costs and stability issues remain significant challenges, with 41% of brands reporting delays in product launches due to packaging and preservation difficulties [27]. - Regulatory fragmentation is also a concern, with only 27 countries having established guidelines for peptide ingredients [27]. Conclusion - The global peptide cosmetics market is in a phase of high growth and innovation, driven by technological advancements and evolving consumer demands, with a competitive landscape characterized by both established leaders and emerging players [29][31].

欧莱雅兰珍珍:科技女生赋能计划已触达20万学子,中国模式创新正在走向世界

Huan Qiu Wang Zi Xun· 2025-10-28 03:31

Core Insights - The article emphasizes the role of companies in scientific education as not just supporters but as innovators and connectors, aiming to bridge the gap between scientific resources and young female scientists [1][4][10] Group 1: Empowerment Initiatives - The "Empowerment Program for Tech Girls" has reached over 200,000 middle school girls across more than 100 schools in 9 provinces since its launch, showcasing a significant outreach effort [4][5] - The program includes inviting local female scientists to share their experiences, which helps break gender barriers in scientific research [4][5] - The initiative has also gained international recognition, with the Chinese model being promoted globally, highlighting its potential as a source of inspiration for science education [5][6] Group 2: Practical Engagement - The program facilitates hands-on experiences for girls, such as visiting advanced factories and participating in workshops, which enhances their understanding of science and technology [5][10] - Activities like the "Tech Girls Empowerment Camp" have led to remarkable transformations in participants, such as mastering AI tools and presenting findings in English [5][6] - The collaboration with institutions like the Chinese Academy of Sciences aims to provide girls with direct exposure to scientific environments, reinforcing the message that science is accessible to all genders [9][10] Group 3: Global Recognition - The recognition of female scientists, such as Wang Xiaoyun receiving the "World Outstanding Female Scientist Award," has elevated the visibility of Chinese female scientists on international platforms [3][5] - The program's success has led to partnerships with organizations like UNESCO, further promoting the empowerment of tech girls on a global scale [5][6]

震惊!致癌物质苏丹红从“餐桌”跑到“脸上”

Jing Ji Guan Cha Wang· 2025-10-27 05:28

Core Viewpoint - Multiple cosmetic products have been found to contain the banned substance Sudan Red, leading to a significant safety crisis in the beauty industry, affecting over 800 products and more than 400 brands [1][2][3]. Group 1: Detection and Impact - A third-party testing agency, "Old Dad Testing," discovered Sudan Red in a skin care product, prompting further testing of similar products, all of which tested positive for the substance [1][2]. - The detected Sudan Red levels in various products ranged from 435 to 1982 micrograms per kilogram (ug/kg), with one raw material containing as much as 1170 parts per million (ppm) [2][3]. - The incident has implicated well-known brands such as Kiehl's, FARMACY, and others, with a total of over 800 products identified as containing the problematic ingredient [3][6]. Group 2: Regulatory and Supply Chain Issues - The presence of Sudan Red in cosmetics highlights a significant regulatory oversight in the supply chain, where manufacturers may have added the banned substance to enhance visual appeal [7][8]. - The source of the banned substance is traced back to a supplier in Singapore, which specializes in natural ingredients but has been linked to the inclusion of industrial dyes in cosmetic products [7][8]. - The incident has raised concerns about the reliance of smaller companies on overseas suppliers and the lack of independent testing capabilities, which could lead to safety vulnerabilities [8]. Group 3: Brand Responses and Consumer Guidance - Following the revelation, brands like Kiehl's and Huaxizi have responded by halting sales of affected products and initiating internal investigations [5][6]. - Consumers are advised to check their skincare products for specific ingredients, including Eclipta Prostrata extract, Melia Azadirachta leaf extract, and Moringa Oleifera seed oil, and to refrain from using products containing these until further testing results are available [9].

330亿,今年最大美妆收购诞生了

投中网· 2025-10-26 07:04

Core Viewpoint - The acquisition of Kering's beauty division by L'Oréal for €4 billion (approximately ¥33 billion) is a significant strategic move in the luxury beauty market, reflecting both companies' long-term goals and the current challenges faced by Kering [3][12][17]. Group 1: Transaction Details - Kering Group announced the sale of its beauty division to L'Oréal for €4 billion, with the transaction expected to be completed in the first half of 2026 [3]. - The deal includes the acquisition of the high-end perfume brand Creed and a 50-year exclusive licensing agreement for Kering's beauty products [3][4]. - A joint venture will be established to explore opportunities in the luxury and health sectors, indicating a strategic alliance beyond mere acquisition [3][17]. Group 2: Kering's Financial Performance - Kering's beauty division generated €323 million in revenue in 2024, with a 9% growth rate in the first half of 2025, primarily driven by Creed [6]. - In contrast, Kering's overall revenue fell by 16% to €7.587 billion in the first half of 2025, with net profit plummeting by 46% to €474 million [6][7]. - The decline in Kering's performance is largely attributed to the underperformance of its flagship brand, Gucci, which saw a 26% drop in revenue [7]. Group 3: Strategic Shifts and Leadership Changes - Kering's new CEO, Luca de Meo, initiated significant reforms shortly after his appointment, including the decision to sell the beauty division [4][10]. - De Meo's leadership is characterized by a focus on core luxury goods, aiming to streamline operations and reduce costs amid financial challenges [10][11]. - The decision to divest the beauty division, despite its growth potential, reflects a strategic pivot to address Kering's broader financial issues [7][9]. Group 4: L'Oréal's Strategic Intent - L'Oréal's acquisition aligns with its strategy to penetrate the high-end beauty market, enhancing its portfolio with luxury brands [12][16]. - The company has been actively acquiring and licensing high-end fragrance brands, indicating a clear focus on expanding its presence in the luxury segment [15][16]. - L'Oréal's recent financial performance shows a 3% increase in sales, with the fragrance segment growing by 11%, underscoring the potential value of the acquisition [17]. Group 5: Market Impact - The transaction has implications for Coty Group, which has relied on Gucci's beauty products; losing this partnership could significantly impact Coty's business [18]. - The competitive landscape in the luxury beauty market is shifting, with L'Oréal positioning itself as a leader in the niche fragrance market through strategic acquisitions and partnerships [16][17].

苏丹红从餐桌“杀”上脸?科颜氏、花西子卷入,化妆品界上演“罗生门”

Feng Huang Wang Cai Jing· 2025-10-24 14:04

Core Viewpoint - The cosmetics industry is facing a significant controversy as a self-media outlet revealed the presence of the banned substance Sudan Red IV in various skincare products, raising consumer concerns about safety and brand integrity [1][4]. Group 1: Incident Overview - A video by "Old Dad Evaluation" detected Sudan Red IV in multiple skincare products, leading to consumer anxiety and brand scrutiny [1][3]. - The source of the contamination was traced to a questionable raw material group containing three components: mudfish extract, neem leaf extract, and moringa seed oil, with a Sudan Red content of 1170 ppm [1][3]. - Over 800 products have been implicated, affecting more than 400 brands, including both international and domestic names [4]. Group 2: Health Impact - Sudan Red IV is classified as a synthetic industrial dye and is listed as a Group 3 carcinogen by the International Agency for Research on Cancer (IARC), indicating it is an animal carcinogen but not proven to be carcinogenic to humans [5][6]. - The potential health risks from topical application are considered lower than those from ingestion, but long-term exposure could pose cumulative risks [8][9]. Group 3: Brand Responses - Many brands have issued minimal responses, with some products being removed from online platforms, while others remain available for purchase [9][10]. - Brands like Kiehl's and others emphasize compliance with regulations but have not addressed testing plans for Sudan Red [11][12]. - Consumer dissatisfaction is evident, with reports of difficulties in returning products and receiving adequate responses from customer service [13][14].

欧莱雅332亿豪赌高端化背后

21世纪经济报道· 2025-10-24 13:49

Core Viewpoint - L'Oréal is aggressively expanding its high-end beauty portfolio through significant acquisitions, including a €4 billion deal for Kering's beauty business, aiming to enhance its luxury brand matrix and secure long-term growth opportunities in a challenging market environment [1][4]. Group 1: Recent Acquisitions and Strategic Moves - L'Oréal announced the acquisition of Kering's beauty business for €4 billion, gaining 50-year beauty licenses for brands like Gucci and Balenciaga [1]. - The company has also acquired niche luxury fragrance brand Creed and secured long-term minority stakes in other high-end brands, filling gaps in its premium beauty offerings [6]. - L'Oréal's CEO indicated plans to discuss potential collaborations with the Armani Group, reflecting a strategy to leverage high-end brand partnerships for growth [1][4]. Group 2: Financial Performance - L'Oréal reported a sales revenue of €32.81 billion for the first nine months of 2025, with a like-for-like growth of 3.4% [3]. - The North Asia region achieved its first comparable growth in two years, with a 0.5% increase, driven by the recovery of high-end cosmetics [10]. - The professional products division led growth with a 7.4% increase, while the luxury segment saw a modest 2.2% growth [3]. Group 3: Market Positioning and Future Strategy - L'Oréal aims to transition from a brand manager to an "ecosystem builder," seeking to create synergies with Kering to explore new growth avenues [4]. - The company is focusing on enhancing its capabilities in customer engagement and digital innovation, which are critical in the current competitive landscape [8][11]. - The luxury beauty market is experiencing rapid growth, particularly in niche high-end fragrances, which L'Oréal is now better positioned to capitalize on with its recent acquisitions [6][12].

欧莱雅豪赌高端化:向“全奢美妆”巨头迈进

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 12:27

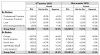

Core Insights - L'Oréal has made significant moves in the beauty industry, including a €4 billion acquisition of Kering's beauty business, which includes long-term beauty licenses for Gucci and Balenciaga, indicating a strategy to enhance its high-end beauty portfolio and secure luxury brand resources for the next 50 years [1][3] - The company aims to transition from a brand manager to an "ecosystem builder," exploring new growth opportunities through partnerships, particularly with Kering [2] - L'Oréal's Q3 2025 financial results show a total sales of €32.81 billion, with a like-for-like growth of 3.4%, driven by recovery in North America and mainland China [2][6] Acquisition Strategy - The acquisition of Kering's beauty business includes the buyout of the high-end niche fragrance brand Creed and long-term beauty licenses for Gucci, Bottega Veneta, and Balenciaga, which are expected to enhance L'Oréal's position in the luxury beauty market [3][4] - L'Oréal has also acquired professional hair care brand ColorWow and skincare brand Medik8, filling gaps in its high-end salon hair care and professional skincare segments [3] Market Performance - L'Oréal's sales growth in the North Asia region has turned positive for the first time in two years, with a 0.5% increase, attributed to the recovery of high-end cosmetics and innovative products from brands like Lancôme and Helena Rubinstein [6] - The professional products division led growth with a 7.4% increase, while the fragrance category continues to show strong performance [6] Competitive Landscape - The beauty industry is witnessing a shift towards brand matrix, channel innovation, and digital transformation, with L'Oréal's aggressive expansion in luxury beauty positioning it well against competitors like Estée Lauder [7][8] - Estée Lauder's recent acquisition of Tom Ford for $2.8 billion highlights a similar strategy in the luxury segment, despite facing challenges in organic sales growth [6][9] Future Outlook - L'Oréal's future collaboration with Kering is anticipated to unlock new growth avenues, particularly in the luxury beauty sector, as the company seeks to leverage its expertise in customer engagement and brand management [5][9]