硬科技

Search documents

一级“退出”路径通了!券商系创投“躁动”,硬科技成必看项

Xin Lang Cai Jing· 2025-10-28 03:16

Core Insights - The investment landscape is showing signs of recovery, particularly in the private equity market, with an increase in newly established funds and a positive outlook for exits through IPOs and mergers [2][4][9]. Group 1: Company Developments - Muxi Co., a prominent player in the domestic GPU market, successfully passed its IPO review, raising over 10 billion yuan in funding and achieving a valuation exceeding 21 billion yuan within five years [1]. - The company has attracted significant investment from top-tier venture capital firms and securities companies, indicating strong market confidence [1]. Group 2: Market Trends - In the first three quarters of 2025, the number of newly established VC/PE funds in China reached 1,475, marking a 16% increase from the previous period and an 18% year-on-year growth [2]. - The private equity market is experiencing a recovery, with a notable increase in the number of funds and total capital raised, suggesting a more favorable investment environment [5][10]. Group 3: Exit Strategies - The primary exit strategies in the private equity market include IPOs, mergers and acquisitions, and secondary share transfers, with IPOs being the most favorable option for returns [5][9]. - In 2025, 161 Chinese companies went public, a 25.8% increase year-on-year, with total fundraising amounting to approximately 193.73 billion yuan, reflecting a robust IPO market [5]. Group 4: Investment Focus - There is a growing emphasis on hard technology and deep industry sectors, with a shift away from consumer and internet sectors towards areas like AI, robotics, and commercial aerospace [12][18]. - The investment direction has become increasingly focused on "new quality productivity" and hard technology, indicating a strategic pivot in the investment landscape [12][18]. Group 5: Regulatory and Policy Environment - Recent regulatory changes, such as the optimization of the Hong Kong IPO process, have boosted confidence in the primary market, leading to increased activity and interest in IPOs [8][9]. - The government is implementing policies to support venture capital development, including differentiated assessments for government-funded venture capital funds [19]. Group 6: Challenges and Opportunities - Despite the positive trends, challenges remain, including market concentration and difficulties for smaller investment firms in accessing quality projects [18]. - The collaboration between securities firms and leading enterprises to establish large-scale funds is seen as a way to enhance investment capabilities and project acquisition [16][20].

上交所邱勇:不拘一格支持具有参与全球竞争潜力的“硬科技”企业上市

Di Yi Cai Jing· 2025-10-28 02:03

三是坚持强监管,持续提升监管效能,切实做到严而有度、严而有方、严而有效,积极探索适应科技创 新规律的监管方式,不断增强市场对科创企业的信心和预期。 一是坚持"硬科技"定位,进一步发挥科创板"试验田"作用,把好准入关,更好识别优质科创企业,支持 人工智能、商业航天、低空经济等更多前沿科技领域适用第五套标准,不拘一格支持具有参与全球竞争 潜力的"硬科技"企业上市。 二是坚持以改革促发展,提升制度包容性、适应性,深化发行承销、再融资、并购重组等领域的适配性 改革,引导各类要素资源加快向科创领域集聚。 10月28日,在科创板科创成长层首批新注册企业上市仪式上,上交所理事长邱勇表示,今年6月,科创 板改革"1+6"政策正式发布,上交所全力以赴抓落实,在四个多月时间内,完成了规则、技术、市场就 绪准备工作,今天迎来科创成长层首批新注册企业上市。 邱勇同时称,下一步,上交所将坚决贯彻落实党中央决策部署,更好服务高质量发展。 四是坚持以投资者保护为中心,推进投融资协调发展,提升市场吸引力、竞争力,持续深化投资端改 革,着力培育耐心资本、长期资本,大力发展指数化投资,持续提升上市公司质量和投资价值,加快营 造"资金愿意来、企业 ...

盘前资讯|科创50、半导体等主题ETF昨日强势“吸金”

Sou Hu Cai Jing· 2025-10-28 01:15

Group 1 - On October 27, A-shares saw a collective rise in the three major indices, with the Shanghai Composite Index approaching 4000 points. The "hard technology" sectors, including storage chips, optical modules, and semiconductor equipment, led the gains, with some 5G communication-themed ETFs rising over 5% and several communication, semiconductor, and artificial intelligence-themed ETFs increasing over 3% [1][1][1] - In the context of a strong technology growth style, on October 27, the net inflow for ETFs tracking the Sci-Tech 50 and the CSI All-Share Semiconductor exceeded 600 million yuan, ranking among the top in the market. Conversely, due to adjustments in international gold prices, gold ETFs experienced a net outflow of over 1.5 billion yuan, while ETFs tracking the CSI Bank saw a net outflow of over 1.1 billion yuan [1][1][1] Group 2 - On October 27, Pan Gongsheng, Governor of the People's Bank of China, stated at the 2025 Financial Street Forum Annual Meeting that the central bank had suspended government bond trading earlier this year due to significant supply-demand imbalances and accumulated market risks. Currently, the bond market is operating well, and the central bank will resume open market operations for government bonds [1][1][1] - Multiple fund managers announced on October 27 that there are risks of premium for cross-border ETFs, including the Nikkei 225 ETF, US 50 ETF, S&P 500 ETF, Nasdaq 100 ETF, and Southeast Asia Technology ETF. As of October 27, several ETFs tracking indices like Nasdaq 100 and Nikkei 225 had premium rates exceeding 5% [1][1][1]

中信证券“保荐+持股”双企新股申购,开市前持股市值已达8亿元

Quan Jing Wang· 2025-10-27 23:10

Group 1 - The core viewpoint of the news highlights the dual role of CITIC Securities as both a sponsor and shareholder in the IPOs of Xi'an Yicai and Bibete, showcasing confidence in the companies with a combined shareholding value of approximately 800 million yuan [1][2] Group 2 - Xi'an Yicai is the largest 12-inch silicon wafer manufacturer in mainland China, focusing on R&D and production, with a market value of 34.806 billion yuan at the time of IPO application [1] - The company aims to break the monopoly of overseas firms and has achieved global leading levels in key performance indicators, with a planned production capacity of 710,000 wafers per month by the end of 2024, accounting for about 7% of the global market [1] - CITIC Securities holds 2.2% of Xi'an Yicai, making it the largest shareholder, with a shareholding value of approximately 76.573 million yuan [1] Group 3 - Bibete, founded in 2012, focuses on innovative drug development for oncology and autoimmune diseases, with its core product BEBT-908 already approved for lymphoma treatment [1] - The company is preparing to initiate Phase III trials for its promising pipeline drug BEBT-209, which has shown superior clinical data for metastatic triple-negative breast cancer compared to existing therapies [1] - CITIC Securities holds 0.5206% of Bibete, with a shareholding value of approximately 3.333 million yuan [1] Group 4 - CITIC Securities' dual role in sponsoring and holding shares reflects its strategic positioning in the hard technology sector, particularly in semiconductor material localization and innovative drug development [2] - The firm aims to facilitate the capital realization of innovative results while participating deeply in industrial upgrades, promoting synergy between finance and the real economy [2]

首批增量科创成长层公司今日上市

Shang Hai Zheng Quan Bao· 2025-10-27 20:50

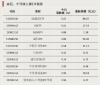

Core Insights - The article discusses the emergence of three companies, He Yuan Bio, Xi'an Yicai, and Bibet, as leaders in the newly established Sci-Tech Growth Tier, despite all being unprofitable firms. These companies have demonstrated strong capabilities in "hard technology" [1][3] Group 1: Company Highlights - Xi'an Yicai is a rising star in the semiconductor industry, ranking as the top domestic and sixth globally in 12-inch silicon wafer production, with a projected monthly shipment volume and capacity accounting for approximately 6% and 7% of the global market, respectively [1] - He Yuan Bio has developed a globally pioneering "rice-derived blood" technology, with its recombinant human albumin injection approved for market in July, addressing the long-standing reliance on imported human serum albumin in China [2] - Bibet focuses on innovative drug development for major diseases, with its first-class innovative drug BEBT-908 approved for market in June, targeting relapsed or refractory diffuse large B-cell lymphoma patients [2] Group 2: Industry Trends - The introduction of the "1+6" policy by the China Securities Regulatory Commission has led to the establishment of the Sci-Tech Growth Tier, which includes 32 unprofitable listed companies primarily in strategic emerging industries such as new-generation information technology and biomedicine [3] - These 32 companies have collectively invested 30.6 billion yuan in R&D, with a median R&D expenditure to revenue ratio of 65.4%, indicating a strong commitment to innovation [3] - The growth of innovative drug companies in the Sci-Tech Growth Tier has resulted in the launch of 20 new national class 1 drugs, showcasing significant potential for development and commercialization [3] Group 3: Market Opportunities - Several innovative drug companies have successfully executed overseas licensing agreements, with potential transaction values totaling nearly 5 billion USD, indicating a robust international market presence [4] - In the semiconductor sector, companies like ChipLink Integrated have become major players in the automotive-grade IGBT market, while firms like Cambricon are enhancing AI computing capabilities [5] - The growth of the Sci-Tech Growth Tier reflects the quality of growth among hard technology enterprises and the capacity of the reform "testbed" [5]

首批增量科创成长层公司今日上市 科创板包容性集聚“硬科技”动能

Shang Hai Zheng Quan Bao· 2025-10-27 20:32

Core Points - Three companies, He Yuan Bio, Xi'an Yicai, and Bibete, will be listed on the Shanghai Stock Exchange, marking the first batch of companies in the newly established Sci-Tech Innovation Board Growth Layer [1] - The total number of companies in the Sci-Tech Innovation Board will reach 592, with the Growth Layer companies totaling 35 [1] - The introduction of the "1+6" policy by the China Securities Regulatory Commission aims to deepen reforms in the Sci-Tech Innovation Board, highlighting its support for hard technology enterprises [1][4] Company Summaries - Xi'an Yicai is a leading player in the 12-inch silicon wafer market, ranking first in China and sixth globally, with a market share of approximately 6% in monthly shipments and 7% in production capacity [2] - He Yuan Bio has developed a globally innovative "rice-derived blood" technology, with its recombinant human albumin injection approved for market, addressing the long-standing reliance on imported human serum albumin in China [3] - Bibete focuses on innovative drug development for major diseases, with its product BEBT-908 recently approved for treating relapsed or refractory diffuse large B-cell lymphoma [3] Industry Insights - The Sci-Tech Innovation Board Growth Layer has attracted 32 existing unprofitable companies, primarily in strategic emerging industries such as new-generation information technology and biomedicine [4] - These companies have shown strong innovation potential, with a combined R&D investment of 30.6 billion yuan in 2024, representing a median R&D investment ratio of 65.4% of their revenue [4] - The Growth Layer has seen 13 innovative drug companies successfully launch 20 new drugs, demonstrating significant development potential and the ability to achieve breakthrough therapy designations [5] Market Trends - Several innovative drug companies are accelerating their transition from R&D to commercialization, with potential transaction values nearing 5 billion USD from various licensing agreements [5] - In the semiconductor sector, companies like Xinlian Integrated Circuits have become major players, supplying over 90% of domestic new energy vehicle manufacturers [6] - The Growth Layer's expansion reflects the quality of growth among hard technology enterprises and the capacity of the reform "testbed" [6]

科创板“1+6”改革落地有多重意义

Zheng Quan Ri Bao Zhi Sheng· 2025-10-27 17:08

Core Viewpoint - The successful listing of three companies on the Sci-Tech Innovation Board marks the substantial implementation of the "1+6" reform, aimed at supporting unprofitable but technologically advanced enterprises [1][2]. Group 1: Reform Significance - The establishment of the Sci-Tech Growth Layer demonstrates the inclusiveness of the system and its alignment with the development of "hard tech" enterprises, providing institutional support for unprofitable companies with significant technological breakthroughs [2][3]. - The reform facilitates financing channels for "hard tech" companies, accelerating the gathering of new enterprises in the Sci-Tech Growth Layer, with 26 new companies accepted post-reform, including 8 unprofitable ones [3][4]. Group 2: Valuation Logic and Market Dynamics - The reform reshapes the valuation logic for "hard tech" companies, encouraging the market to focus on long-term value and technological barriers rather than short-term profits, which fosters a patient capital environment [4][5]. - The introduction of 21 new Sci-Tech Board ETFs since the reform, with a total scale of 300 billion yuan, directs funds towards key development areas in new productivity [4]. Group 3: Company Performance Post-Listing - Companies must maintain a focus on technological breakthroughs and commercialization after going public, as demonstrated by successful cases like ChipLink and Suzhou Zejing Biopharmaceutical, which have achieved significant market penetration and product approvals [5][6].

大涨!“硬科技”爆发

Zhong Guo Zheng Quan Bao· 2025-10-27 14:44

Group 1: Market Performance - On October 27, the Shanghai Composite Index approached 4000 points, with the "hard technology" sector, including storage chips and optical modules, leading the gains [1][4] - The three major A-share indices collectively rose, with the ChiNext Index and the Sci-Tech Innovation 50 Index increasing by 1.98% and 1.50%, respectively [4] - Several ETFs related to communication and semiconductors saw gains exceeding 3%, with some 5G communication-themed ETFs rising over 5% [4] Group 2: ETF Trends - The semiconductor ETF (159801) tracking the National Securities Semiconductor Index has seen a net inflow of over 480 million yuan in October, bringing its total size to over 5.1 billion yuan [4] - The Hong Kong Stock Connect Technology ETF (159262) has continuously attracted net inflows for 11 weeks, with its latest size surpassing 5.7 billion yuan [5] - The chip equipment ETF (560780) has gained over 55% this year, with a net inflow of over 300 million yuan in October, bringing its size to over 1.6 billion yuan [5] Group 3: Gold ETFs - Gold ETFs and Shanghai Gold ETFs experienced a net inflow of over 15.5 billion yuan from October 20 to October 23, but saw a net outflow of nearly 2 billion yuan on October 24 [2][11] - The recent decline in gold prices is attributed to high short-term congestion and reduced geopolitical risks, according to Huazhang Fund [7] Group 4: Cross-Border ETF Premium Risks - Several fund managers have issued warnings regarding premium risks associated with cross-border ETFs, with many tracking indices like the Nasdaq 100 and Nikkei 225 showing premium rates above 5% as of October 27 [3][15]

沪指放量大涨1.2%,A500ETF易方达、沪深300ETF易方达等产品受市场关注

Mei Ri Jing Ji Xin Wen· 2025-10-27 14:20

Market Overview - The market experienced a significant upward movement today, with the Shanghai Composite Index rising over 1% and approaching the 4000-point mark, reaching a ten-year high [1] - The total market turnover was 23,566 billion, an increase of 3,650 billion compared to the previous day [1] Sector Performance - Key sectors that saw notable gains included storage chips, small metals, controllable nuclear fusion, steel, and computing hardware [1] - Conversely, sectors that faced declines included wind power equipment, gaming, Hainan Free Trade Zone, Shenzhen, and cultural media [1] Index Performance - The CSI A500 Index increased by 1.3% [1] - The CSI 300 Index rose by 1.2% [1] - The ChiNext Index saw a 2.0% increase [1] - The STAR Market 50 Index gained 1.5% [1] - The Hang Seng China Enterprises Index was up by 1.1% [1] ETF Trading - The A500 ETF from E Fund (159361) had a trading volume of nearly 4 billion throughout the day [1]

科创板科创成长层面面观|培育与硬科技企业发展相适配的“资本生态”

Zheng Quan Ri Bao· 2025-10-27 05:08

Group 1 - The core point of the article highlights the emergence of the "Science and Technology Innovation Growth Layer" in the Chinese capital market, which aims to support high R&D, unprofitable "hard technology" companies, providing them with a platform to connect technological advancements with capital [1][2] - The establishment of the Science and Technology Innovation Growth Layer is a response to the development patterns of hard technology and global tech competition, enhancing market confidence in deepening investments in hard technology [2][3] - Companies like Cambricon Technologies (寒武纪) have benefited from this new layer, securing 3.985 billion yuan in funding for hardware and software development, which enhances their long-term competitiveness in the smart chip industry [1][2] Group 2 - The Science and Technology Innovation Growth Layer has attracted 32 companies to transition into it, with 18 new applications submitted since the introduction of the "1+6" policy, indicating a growing interest and participation in this sector [3] - The layer is designed to address key core technology issues, enabling technological empowerment of the real economy, with a focus on domestic alternatives in the new generation of information technology [4][5] - Companies in the semiconductor manufacturing sector, such as Chipone Technology (芯联), have become significant players, penetrating over 90% of domestic new energy vehicle manufacturers [5][6] Group 3 - Several companies are focusing on long-term R&D investments to seize future growth opportunities, such as Efort Intelligent Equipment (埃夫特) in the industrial robotics sector, which is developing core components for robotic movement [7] - The introduction of the fifth set of standards for listing on the Science and Technology Innovation Board aims to expand the scope for high-quality companies in artificial intelligence, commercial aerospace, and low-altitude economy sectors [8] - The new pre-review mechanism for core enterprises in the information industry is crucial for protecting business secrets and avoiding negative impacts from premature disclosures, especially amid increasing global tech competition [8]