锂电产业链

Search documents

「每日收评」创业板指放量跌近2%,全市场4100股收绿,量子科技概念逆势活跃

Sou Hu Cai Jing· 2025-10-30 09:23

Market Overview - The market experienced volatility with all three major indices showing a significant drop, particularly the ChiNext Index which fell nearly 2% and the Shanghai Composite Index dropping below 4000 points [1] - The total trading volume in the Shanghai and Shenzhen markets reached 2.42 trillion yuan, an increase of 165.6 billion yuan compared to the previous trading day [1] - A total of 4100 stocks in the market declined, indicating a broad-based sell-off [1] Sector Performance - The lithium mining sector showed strong performance, with Tianqi Lithium hitting the daily limit [2][3] - Quantum technology stocks were notably active, with Shenzhou Information achieving consecutive gains and Geer Software performing well over six days [2] - The battery sector also saw gains, with companies like Shida Shenghua and Tianji Shares reaching their daily limits [1][2] - Conversely, the computing hardware sector faced significant declines, with stocks like Tianfu Communication and Xinyi Sheng dropping sharply due to slowing quarterly performance [5] Individual Stock Highlights - In the computing hardware sector, Tianfu Communication fell over 10% and Xinyi Sheng nearly 7%, attributed to a slowdown in quarterly growth [5] - Quantum technology stocks demonstrated strong continuity, with Geer Software achieving four consecutive gains and Shenzhou Information three [5] - The lithium battery sector continued to strengthen, with companies like Tianji Shares and Jiangte Electric hitting their daily limits, driven by rising prices of lithium hexafluorophosphate [5][6] Future Market Outlook - The market's mid-term trend remains bullish, provided there are no significant sell-offs that disrupt the current structure [7] - The performance of the computing hardware sector will be crucial in determining market sentiment moving forward [7] - The ability of the lithium and energy storage sectors to maintain their upward momentum will also be a key focus for future market developments [7]

A股突变!688027,再创新高

证券时报· 2025-10-30 09:07

Market Overview - A-shares experienced a decline on October 30, with the Shanghai Composite Index falling below the 4000-point mark, and the ChiNext and STAR Market indices dropping nearly 2% [1][2] - The Shanghai Composite Index closed down 0.73% at 3986.9 points, while the Shenzhen Component Index fell 1.16% to 13532.13 points [2] Sector Performance - The coal sector saw significant declines, with companies like Kailuan Energy and Antai Group hitting the daily limit down [2] - The brokerage sector weakened, with firms such as China International Capital Corporation and Oriental Fortune dropping over 3% [2] - The AI industry chain stocks plummeted, with companies like Tengjing Technology and Tianfu Communication falling over 10% [2] - The innovative drug concept also faced downturns, with Hanyu Pharmaceutical dropping over 10% and WuXi AppTec falling over 8% [2][13] Lithium Battery Sector - The lithium battery industry chain stocks surged, with Penghui Energy hitting the daily limit up with a 20% increase, and Tianhua New Energy rising nearly 15% [5][6] - Other notable performers included Wanrun New Energy and Xinwangda, both rising over 10% [5] - The overall market for lithium battery stocks is bolstered by increasing demand for household energy storage batteries and the growth of AI computing centers [7] Quantum Technology Sector - The quantum technology sector saw renewed activity, with Fujida rising nearly 20% and Guodun Quantum exceeding a 17% increase, reaching a price above 600 yuan [9][10] - The government has emphasized the importance of quantum technology in future economic growth, with expected policy support [11] Innovative Drug Sector - The innovative drug sector showed weakness, with Hanyu Pharmaceutical reporting a significant drop in stock price despite a strong revenue growth of 82.06% year-on-year [13] - WuXi AppTec announced plans for a share reduction by its controlling shareholder, which may have contributed to its stock price decline [13]

碳酸锂日报-20251030

Guang Da Qi Huo· 2025-10-30 05:19

Report Summary 1. Investment Rating No investment rating for the industry is provided in the report. 2. Core View - The lithium carbonate futures 2601 contract rose 0.8% to 82,900 yuan/ton yesterday. Spot prices of battery - grade lithium carbonate, industrial - grade lithium carbonate, and battery - grade lithium hydroxide (coarse particles) all increased. The warehouse receipt inventory increased by 190 tons to 27,525 tons [3]. - Supply is expected to increase overall on a month - on - month basis. Weekly production increased by 242 tons to 21,308 tons, with different lithium extraction methods all showing growth. On the demand side, weekly production and inventory of ternary materials and lithium iron phosphate both increased. Weekly inventory decreased by 2,292 tons to 130,366 tons, and the total inventory days dropped to around 32 days, close to the lowest level in the past three years [3]. - With a slight increase in weekly supply, rapid inventory depletion, improved macro - sentiment, repeated disturbances in supply - side news, and the demand side still in the peak season, along with continuous depletion of social and warehouse receipt inventories and firm lithium ore prices, the price support is gradually strengthened, and the bottom price is lifted. In the short term, the price may still be strong, but cautious optimism is needed as there are still expectations of project resumption [3]. 3. Summary by Directory 3.1 Ore Prices - The report presents price charts of lithium spodumene concentrate (6%, CIF), lithium mica (1.5% - 2.0%), lithium mica (2.0% - 2.5%), and lithiophilite (6% - 7%, 7% - 8%) from 2024 to 2025, sourced from SMM and the Everbright Futures Research Institute [6][8]. 3.2 Lithium and Lithium Salt Prices - Price charts of metal lithium, battery - grade lithium carbonate average price, industrial - grade lithium carbonate average price, battery - grade lithium hydroxide price, industrial - grade lithium hydroxide price, and lithium hexafluorophosphate price from 2024 to 2025 are provided, with data from SMM and the Everbright Futures Research Institute [10][12][14]. 3.3 Spreads - Charts show the spreads between battery - grade lithium hydroxide and battery - grade lithium carbonate, battery - grade lithium carbonate and industrial - grade lithium carbonate, CIF Japan - South Korea battery - grade lithium hydroxide and domestic battery - grade lithium hydroxide, battery - grade lithium carbonate (CIF Asia) and domestic battery - grade lithium carbonate, and the basis from 2024 to 2025, sourced from SMM, IFinD, and the Everbright Futures Research Institute [17][18][20]. 3.4 Precursor & Cathode Materials - Price charts of ternary precursors, ternary materials, lithium iron phosphate, lithium manganate, and lithium cobaltate from 2024 to 2025 are presented, with data from SMM and the Everbright Futures Research Institute [23][25][28]. 3.5 Lithium Battery Prices - Charts display the prices of 523 square ternary cells, square lithium iron phosphate cells, lithium cobaltate cells, and square lithium iron phosphate batteries from 2024 to 2025, sourced from SMM and the Everbright Futures Research Institute [31][33]. 3.6 Inventory - Charts show the downstream inventory, smelter inventory, and other环节 inventory of lithium carbonate from March to October 2025, with data from SMM and the Everbright Futures Research Institute [36][38]. 3.7 Production Costs - A chart shows the production costs of lithium carbonate, including cash production profits from purchasing ternary pole piece black powder, lithium iron phosphate pole piece black powder, lithium mica concentrate, and lithium spodumene concentrate from 2024 to 2025, sourced from SMM and the Everbright Futures Research Institute [40][41]. 4. Research Team Members - Zhan Dapeng, a science master, is the director of non - ferrous research at the Everbright Futures Research Institute, a senior precious metals researcher, and has won multiple industry awards [44]. - Wang Heng, a finance master from the University of Adelaide, Australia, is a non - ferrous researcher at the Everbright Futures Research Institute, focusing on aluminum and silicon research [45]. - Zhu Xi, a science master from the University of Warwick, UK, is a non - ferrous researcher at the Everbright Futures Research Institute, focusing on lithium and nickel research [45].

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

锂电产业链11月预排产:电解液产量大增8%

鑫椤锂电· 2025-10-29 08:43

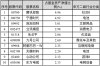

Key Points - The article highlights the current performance of domestic and overseas battery sample enterprises, indicating a total capacity of 144.14 GWh for domestic companies, which represents a month-on-month increase of 1.76% [1] - Overseas battery sample enterprises maintained a capacity of 24.4 GWh, showing no change compared to the previous month [1] - The production of positive electrodes reached 176,600 tons, reflecting a month-on-month increase of 7.35% [1] - The production of negative electrodes was 155,000 tons, which indicates a month-on-month decrease of 1.89% [1] - The production of separators was 1.89 billion square meters, with a month-on-month increase of 3.56% [1] - The production of electrolyte reached 107,000 tons, showing a month-on-month increase of 8% [1]

光大期货碳酸锂日报-20251024

Guang Da Qi Huo· 2025-10-24 09:33

1. Report Industry Investment Rating No relevant content provided. 2. Core View of the Report - On October 23, 2025, the lithium carbonate futures 2601 contract rose 4.17% to 79,940 yuan/ton. The average price of battery - grade lithium carbonate increased by 450 yuan/ton to 74,800 yuan/ton, and the average price of industrial - grade lithium carbonate increased by 450 yuan/ton to 72,550 yuan/ton. The inventory of warehouse receipts decreased by 260 tons to 28,759 tons [3]. - In terms of supply, the weekly production increased by 242 tons to 21,308 tons. In September, China imported 710,000 physical tons of spodumene, a month - on - month increase of 14.8%, equivalent to about 67,000 tons of LCE; the import volume of lithium carbonate was 19,600 tons, a month - on - month decrease of 10.3%. In terms of demand, the weekly production of ternary materials increased by 519 tons to 17,766 tons, and the inventory increased by 629 tons to 18,592 tons; the weekly production of lithium iron phosphate increased by 1,264 tons to 86,303 tons, and the inventory increased by 1,529 tons to 104,347 tons. The weekly inventory decreased by 2,292 tons to 130,366 tons [3]. - Recently, there have been disturbances in the supply - side news. Demand is still in the peak season. The social inventory and warehouse receipts of lithium carbonate have continued to decline. Coupled with the firm price of lithium ore, the price support has been gradually consolidated, and the bottom price has been raised. With the warming of macro - sentiment, the price may still fluctuate strongly in the short term, but there is still an expectation of project resumption [3]. 3. Summary According to Relevant Catalogs 3.1 Daily Data Monitoring - The prices of most products in the lithium - battery industry chain increased on October 23, 2025. For example, the main contract closing price of futures rose by 2,820 yuan/ton to 79,940 yuan/ton, and the price of lithium ore, lithium carbonate, and other products also showed varying degrees of increase [5]. - There were also changes in price differences. For example, the price difference between battery - grade lithium hydroxide and battery - grade lithium carbonate decreased by 300 yuan/ton to - 1,420 yuan/ton [5]. 3.2 Chart Analysis 3.2.1 Ore Prices - The report provides charts of the prices of lithium ore products such as spodumene concentrate, lithium mica, and amblygonite from January 2024 to October 2025, including lithium mica (1.5% - 2.0%), lithium mica (2.0% - 2.5%), and amblygonite (6% - 7%) [8][9]. 3.2.2 Lithium and Lithium Salt Prices - Charts show the prices of lithium products such as metallic lithium, battery - grade lithium carbonate, industrial - grade lithium carbonate, battery - grade lithium hydroxide, industrial - grade lithium hydroxide, and lithium hexafluorophosphate from January 2024 to October 2025 [10][11][12]. 3.2.3 Price Differences - The report presents charts of price differences including the difference between battery - grade lithium hydroxide and battery - grade lithium carbonate, and the difference between battery - grade lithium carbonate and industrial - grade lithium carbonate from January 2024 to October 2025 [17][18]. 3.2.4 Precursors & Cathode Materials - Charts show the prices of precursors and cathode materials such as ternary precursors, ternary materials, lithium iron phosphate, lithium manganate, and lithium cobalt oxide from January 2024 to October 2025 [24][25][27]. 3.2.5 Lithium Battery Prices - The report includes charts of lithium battery prices such as 523 square ternary battery cells, square lithium iron phosphate battery cells, lithium cobalt oxide battery cells, and square lithium iron phosphate batteries from January 2024 to October 2025 [33][34][35]. 3.2.6 Inventory - The report provides charts of lithium carbonate inventory in downstream, smelter, and other links from March to October 2025 [38][39][40]. 3.2.7 Production Costs - A chart shows the production profit of lithium carbonate from different raw materials such as recycled ternary pole piece black powder, recycled lithium iron phosphate pole piece black powder, lithium mica concentrate, and spodumene concentrate from January 2024 to October 2025 [42][43]. 3.3 Research Team Introduction - The research team of Everbright Futures Institute consists of Zhan Dapeng, Wang Heng, and Zhu Xi, who have rich experience in the field of non - ferrous metals research [46][47].

研报掘金丨华源证券:华友钴业业绩有望实现大增,上调至“买入”评级

Ge Long Hui· 2025-10-24 07:35

Core Viewpoint - Huayou Cobalt achieved a net profit attributable to shareholders of 4.216 billion yuan in Q1-Q3 2025, representing a year-on-year increase of 39.59% [1] - The company is expected to benefit from rising cobalt prices due to a shift from oversupply to shortage as inventory is consumed [1] Financial Performance - In Q3 alone, the net profit attributable to shareholders was 1.505 billion yuan, showing a year-on-year growth of 11.53% and a quarter-on-quarter increase of 3.18%, aligning with expectations [1] Industry Outlook - Cobalt prices are anticipated to continue rising as supply-demand dynamics improve [1] - The company, as a leading player in the cobalt industry, has abundant cobalt raw material sources from Indonesia, positioning it to benefit significantly from price increases [1] Nickel Business Expansion - The company is expanding its nickel business counter-cyclically, with a planned capacity of 405,000 tons in Indonesia (both pyrometallurgical and hydrometallurgical processes) [1] - A potential reversal in nickel prices could lead to substantial increases in the company's performance [1] Competitive Positioning - The signing of large contracts is expected to enhance the company's core competitiveness in the lithium battery supply chain, effectively improving long-term profitability [1] - Current cobalt prices are on the rise, while nickel and lithium are at historical low prices, indicating potential for significant performance growth once prices recover [1]

曼恩斯特:公司上半年业绩承压

Zheng Quan Ri Bao Wang· 2025-10-23 10:44

Core Viewpoint - The lithium battery industry chain has shown signs of recovery this year, but the company faced pressure on its performance in the first half due to significant upfront investments in new businesses and the lack of scale effects [1] Company Performance - The company anticipates improvement in gross margin levels as new orders are gradually scheduled for production and delivery, leading to a steady increase in capacity utilization [1] - The company is committed to enhancing the quality of production and operations to increase intrinsic value and provide better returns to investors [1]

光大期货碳酸锂日报(2025 年 10 月 23)-20251023

Guang Da Qi Huo· 2025-10-23 03:21

1. Report Industry Investment Rating No information provided regarding the report industry investment rating in the given content. 2. Core View of the Report - The price of the lithium carbonate futures 2601 contract rose 1.63% to 77,120 yuan/ton yesterday. The average price of battery - grade lithium carbonate increased by 250 yuan/ton to 74,350 yuan/ton, and the average price of industrial - grade lithium carbonate rose by 250 yuan/ton to 72,100 yuan/ton. The price of battery - grade lithium hydroxide (coarse particles) increased by 100 yuan/ton to 73,230 yuan/ton. The warehouse receipt inventory decreased by 873 tons to 29,019 tons [3]. - Supply is expected to increase month - on - month overall. The weekly production increased by 431 tons to 21,066 tons, and the lithium carbonate production in October increased by 3% month - on - month to about 90,000 tons. On the demand side, in the week, the production of ternary materials increased by 271 tons to 17,247 tons, and the inventory increased by 114 tons to 17,963 tons; the production of lithium iron phosphate increased by 572 tons to 85,039 tons, and the inventory increased by 970 tons to 102,818 tons; the weekly cell production increased by 1.2% to 28.27GWh, among which lithium iron increased by 1.4% to 21.12GWh, and ternary increased by 0.8% to 7.4GWh. In October, the peak season continued, and the consumption of lithium carbonate by the two major main materials increased by 2% month - on - month to 104,800 tons, and the total consumption of lithium carbonate by cathode + electrolyte + others increased by 7% month - on - month to 123,800 tons. In terms of inventory, the total inventory continued to decline to 133,000 tons, and the total inventory turnover days decreased significantly [3]. - Recently, due to the peak demand season, lithium carbonate destocking, and firm lithium ore prices, there is still support below the short - term price. Yesterday, there was news disturbance on the supply side, and the price strengthened again in the afternoon. However, according to publicly available market information, there is still an expectation of project resumption for lithium ore projects in Jiangxi in November. Therefore, it is recommended to be cautiously bullish and pay attention to the warehouse receipt inventory [3]. 3. Summary by Relevant Catalogs 3.1 Daily Data Monitoring - **Futures**: The closing price of the main contract was 77,120 yuan/ton, up 1,140 yuan from the previous day; the closing price of the continuous contract was 76,180 yuan/ton, up 380 yuan [5]. - **Lithium Ore**: The price of lithium spodumene concentrate (6%, CIF China) was 857 US dollars/ton, up 3 US dollars; the price of lithium mica (Li2O: 1.5% - 2.0%) remained unchanged at 1,115 yuan/ton; the price of lithium mica (Li2O: 2.0% - 2.5%) remained unchanged at 1,845 yuan/ton; the price of amblygonite (Li2O: 6% - 7%) was 6,475 yuan/ton, up 115 yuan; the price of amblygonite (Li2O: 7% - 8%) was 7,650 yuan/ton, up 130 yuan [5]. - **Lithium Carbonate and Lithium Hydroxide**: The price of battery - grade lithium carbonate (99.5% battery - grade/domestic) was 74,350 yuan/ton, up 250 yuan; the price of industrial - grade lithium carbonate (99.2% industrial zero - grade/domestic) was 72,100 yuan/ton, up 250 yuan; the price of battery - grade lithium hydroxide (coarse particles/domestic) was 73,230 yuan/ton, up 100 yuan; the price of battery - grade lithium hydroxide (micropowder) was 78,200 yuan/ton, up 100 yuan; the price of industrial - grade lithium hydroxide (coarse particles/domestic) was 67,930 yuan/ton, up 80 yuan; the price of battery - grade lithium hydroxide (CIF China, Japan, and South Korea) remained unchanged at 9.45 US dollars/kg [5]. - **Lithium Hexafluorophosphate**: The price was 87,000 yuan/ton, up 5,000 yuan [5]. - **Price Spreads**: The price spread between battery - grade lithium carbonate and industrial - grade lithium carbonate remained unchanged at 2,250 yuan/ton; the price spread between battery - grade lithium hydroxide and battery - grade lithium carbonate was - 1,120 yuan/ton, down 150 yuan; CIF China, Japan, and South Korea battery - grade lithium hydroxide - SMM battery - grade lithium hydroxide was - 6,178.47 yuan/ton, down 77 yuan [5]. - **Precursors and Cathode Materials**: The prices of various ternary precursors and cathode materials generally increased, such as the price of ternary precursor 523 (polycrystalline/power - type) was 102,850 yuan/ton, up 200 yuan; the price of ternary material 523 (polycrystalline/consumer - type) was 142,925 yuan/ton, up 3,500 yuan [5]. - **Cells and Batteries**: The prices of various cells and batteries also showed an upward trend, such as the price of 523 square ternary cells was 0.493 yuan/Wh, up 0.097 yuan; the price of 523 soft - pack ternary cells was 0.51 yuan/Wh, up 0.1 yuan [5]. 3.2 Chart Analysis - **Ore Prices**: Charts show the price trends of lithium spodumene concentrate (6%, CIF), lithium mica (1.5% - 2.0%), lithium mica (2.0% - 2.5%), and amblygonite (6% - 7%, 7% - 8%) from 2024 to 2025 [6][8] - **Lithium and Lithium Salt Prices**: Charts display the price trends of metallic lithium, battery - grade lithium carbonate average price, industrial - grade lithium carbonate average price, battery - grade lithium hydroxide price, industrial - grade lithium hydroxide price, and lithium hexafluorophosphate price from 2024 to 2025 [10][12][14] - **Price Spreads**: Charts present the price spreads between battery - grade lithium hydroxide and battery - grade lithium carbonate, battery - grade lithium carbonate and industrial - grade lithium carbonate, CIF China, Japan, and South Korea battery - grade lithium hydroxide - battery - grade lithium hydroxide, battery - grade lithium carbonate (CIF Asia) - domestic battery - grade lithium carbonate, and basis from 2024 to 2025 [17][18][19] - **Precursors and Cathode Materials**: Charts show the price trends of ternary precursors, ternary materials, lithium iron phosphate, lithium manganate, and lithium cobaltate from 2024 to 2025 [21][22][25] - **Lithium Battery Prices**: Charts display the price trends of 523 square ternary cells, square lithium iron phosphate cells, lithium cobaltate cells, and square lithium iron phosphate batteries from 2024 to 2025 [28][30] - **Inventory**: Charts show the inventory trends of downstream, smelters, and other links of lithium carbonate from February to October 2025 [33][35] - **Production Costs**: The chart shows the production profit trends of lithium carbonate from different raw materials such as purchased ternary pole piece black powder, purchased lithium iron phosphate pole piece black powder, purchased lithium mica concentrate, and purchased lithium spodumene concentrate from 2024 to 2025 [37][38]

光大期货碳酸锂日报-20251022

Guang Da Qi Huo· 2025-10-22 11:22

1. Report Industry Investment Rating No relevant content provided. 2. Core Viewpoints of the Report - On October 21, 2025, the lithium carbonate futures 2601 contract dropped 0.26% to 75,980 yuan/ton. The average price of battery - grade lithium carbonate rose 100 yuan/ton to 74,100 yuan/ton, and the average price of industrial - grade lithium carbonate also rose 100 yuan/ton to 71,850 yuan/ton. The inventory of warehouse receipts decreased by 813 tons to 29,892 tons [3]. - The overall supply is expected to increase month - on - month. The weekly output increased by 431 tons to 21,066 tons, and the production of lithium carbonate in October increased by 3% month - on - month to about 90,000 tons. On the demand side, the production and inventory of ternary materials, lithium iron phosphate, and battery cells all increased. In October, the consumption of lithium carbonate by the two major cathode materials increased by 2% month - on - month to 104,800 tons, and the total consumption of lithium carbonate by cathode materials, electrolytes, and others increased by 7% month - on - month to 123,800 tons. The total inventory continued to decline to 133,000 tons [3]. - Due to the current peak demand season, lithium carbonate inventory reduction, and firm lithium ore prices, there is still support for short - term prices. However, there is an expectation of project restart in Jiangxi lithium ore projects in November, so the price increase should be viewed with caution [3]. 3. Summary by Relevant Catalogs 3.1 Daily Data Monitoring - **Futures and Lithium Ore Prices**: The closing prices of the main and continuous contracts of lithium carbonate futures increased. The prices of some lithium ores, such as lithium spodumene concentrate and certain types of lithium mica, also rose, while the prices of some phosphorus - lithium - aluminum ores decreased [5]. - **Lithium and Lithium Salt Prices**: The average prices of battery - grade and industrial - grade lithium carbonate increased by 100 yuan/ton, while the prices of battery - grade and industrial - grade lithium hydroxide remained unchanged [5]. - **Other Product Prices**: The price of lithium hexafluorophosphate increased by 3,000 yuan/ton. The prices of some ternary precursors, cathode materials, and battery cells also showed varying degrees of increase [5]. 3.2 Chart Analysis - **Ore Prices**: Charts show the price trends of lithium spodumene concentrate, different types of lithium mica, and phosphorus - lithium - aluminum ores from 2024 to 2025 [6][8]. - **Lithium and Lithium Salt Prices**: Charts display the price trends of metal lithium, battery - grade and industrial - grade lithium carbonate, and lithium hydroxide from 2024 to 2025 [10][12]. - **Price Spreads**: Charts present the price spreads between battery - grade lithium hydroxide and battery - grade lithium carbonate, battery - grade and industrial - grade lithium carbonate, etc. from 2024 to 2025 [17]. - **Precursor and Cathode Materials**: Charts show the price trends of ternary precursors, ternary materials, lithium iron phosphate, manganese acid lithium, and cobalt acid lithium from 2024 to 2025 [22][23]. - **Lithium Battery Prices**: Charts display the price trends of 523 square ternary battery cells, square lithium iron phosphate battery cells, cobalt acid lithium battery cells, and square lithium iron phosphate batteries from 2024 to 2025 [29][31]. - **Inventory**: Charts show the inventory trends of downstream, smelters, and other sectors from February to October 2025 [34][36]. - **Production Cost**: A chart presents the production profit trends of lithium carbonate from different raw materials such as purchased ternary pole piece black powder, lithium iron phosphate pole piece black powder, lithium mica concentrate, and lithium spodumene concentrate from 2024 to 2025 [38].