软件

Search documents

诚迈科技:10月28日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 12:19

Core Viewpoint - Chengmai Technology (SZ 300598) announced the convening of its 19th board meeting on October 28, 2025, to review the agenda including the third quarter report for 2025 [1] Company Summary - Chengmai Technology's revenue composition for the first half of 2025 is as follows: mobile intelligent terminal software accounts for 47.56%, industrial digital solutions for 26.51%, intelligent connected vehicle software for 22.4%, and other businesses for 0.25% [1] - As of the report, Chengmai Technology has a market capitalization of 11.4 billion yuan [1] Industry Summary - The A-share market has surpassed 4000 points, marking a significant resurgence after a decade of stagnation, with technology leading the market's transformation into a new "slow bull" pattern [1]

知微行易获数亿元人民币投资,凯辉基金独家投资

Sou Hu Cai Jing· 2025-10-28 08:07

Group 1 - The core viewpoint of the news is that Zhiwei Xingyi has completed a new round of financing led by KKR, with the funds aimed at enhancing core R&D, product iteration, and talent expansion in AI-native architecture [1] - The financing amount is several hundred million RMB, indicating significant investor confidence in the company's potential for innovation in the digital industrial sector [1] - KKR partner Li Maoxiang emphasized that Zhiwei Xingyi is not just a software company but a reconstructor of digital transformation methodologies for Chinese enterprises, aiming to position China as a leader in the next paradigm shift in enterprise software [1] Group 2 - Zhiwei Xingyi has integrated deep intelligence into enterprise operations, moving beyond traditional ERP systems that rely on the PDCA cycle, which is less effective in rapidly changing markets [2] - The company has adopted the OODA (Observe-Orient-Decide-Act) loop as the operational core of its native intelligent agents, enabling proactive data sensing and real-time decision-making [2] - This shift allows the system to continuously monitor business data flows, quickly identify anomalies and opportunities, and autonomously drive related systems to execute decisions, enhancing responsiveness to market fluctuations and supply chain disruptions [2]

内外因素边际向好,沪指一度突破4000点,云计算50ETF(516630)涨近1%

Mei Ri Jing Ji Xin Wen· 2025-10-28 07:21

Core Viewpoint - The A-share market experienced fluctuations, with the Shanghai Composite Index reaching a high of 4000 points, the highest since August 19, 2015, indicating positive market sentiment and potential upward trends in the near term [1] Market Performance - The three major A-share indices saw a rise and subsequent pullback, with the ChiNext Index rising over 1% at one point [1] - The cloud computing ETF (516630) gained nearly 1% in the afternoon session, with leading stocks such as Taxfriend Co., Kingsoft Office, Yunsai Zhili, and Guotou Intelligent showing strong performance, including Taxfriend hitting the 10% daily limit [1] Sector Analysis - Concept sectors such as cross-strait integration, lithium battery electrolyte, copper-clad laminates, and circuit boards remained active [1] - The technology sector is expected to be a core focus, particularly in areas related to AI industry trends, including computing power (CPO/PCB/liquid cooling/fiber optics) and applications (robots/games/software) [1] - Other sectors with strong support include power equipment (wind power/storage/batteries/power supply equipment), non-ferrous metals (rare earth permanent magnets/precious metals), and machinery (construction machinery) [1] Economic Outlook - Huashan Securities anticipates a 25 basis point rate cut by the end of October's FOMC meeting, with potential positive developments from the upcoming APEC meeting between the US and China [1] - The emphasis on completing annual goals and clarifying the "14th Five-Year Plan" direction suggests improving internal and external factors, which may lead to a sustained upward trend in the market [1]

刚刚,A股刷屏!

天天基金网· 2025-10-28 05:16

Core Viewpoint - The A-share market is experiencing significant movements, with the Shanghai Composite Index surpassing 4000 points for the first time since August 2015, driven by various sectors such as controllable nuclear fusion, domestic software, PCB, and commercial aerospace [3][5]. Group 1: Market Performance - On October 28, the Shanghai Composite Index reached 4005.44 points, up 0.21%, while the Shenzhen Component Index rose by 0.52% and the ChiNext Index increased by 1.35% [5]. - The onshore RMB appreciated against the USD, breaking the 7.10 mark, which analysts believe may enhance foreign investment in RMB assets [5]. Group 2: Policy Developments - The China Securities Regulatory Commission (CSRC) announced a series of measures to optimize the Qualified Foreign Institutional Investor (QFII) system, aiming to improve its adaptability and attractiveness for foreign investors [5]. - CSRC Chairman Wu Qing indicated plans to introduce a refinancing framework to support mergers and acquisitions, promoting industry consolidation among listed companies [5]. Group 3: Sector Highlights - The controllable nuclear fusion sector saw significant gains, with stocks like Dongfang Tantalum and Antai Technology hitting the daily limit, driven by positive news regarding the domestic industrialization of key materials [3][9]. - PCB stocks collectively surged, with companies like Aisen Co. and Meilian New Materials rising over 11%, and Shengyi Technology reporting a projected revenue increase of 108% to 121% year-on-year for the first three quarters of 2025 [6]. - Domestic software stocks were active, with companies like Rongji Software and Geer Software hitting the daily limit, supported by favorable policy developments for domestic technology [7]. Group 4: Commercial Aerospace Developments - The commercial aerospace sector rebounded, with stocks like Aerospace Development hitting the daily limit, following successful tests of the Tianlong-3 rocket, marking a breakthrough in multi-satellite deployment capabilities [7][9]. Group 5: Controllable Nuclear Fusion Insights - Controllable nuclear fusion is recognized as a key future energy direction, with significant advancements in the development of second-generation high-temperature superconducting materials, crucial for creating strong magnetic fields [10][11]. - The recent breakthroughs in the industrialization of high-purity Hastelloy C276 metal substrates for superconducting materials are expected to reduce reliance on imports and enhance domestic production capabilities [10][11].

特朗普收取中国港口费,是问计英国?英国两头下注,谨防挑起三战

Sou Hu Cai Jing· 2025-10-28 03:50

气车关税将有条件降至15%,美国与欧盟就 贸易协定框架达成一致 界墨新闻 2025-08-21 21:04 特朗普在与中国的贸易战中屡屡失利,在此背景下,他神秘地访问了英国。值得注意的是,他在英国访问刚结束后,就对中国采取了严厉的措施,宣布将对 中国船只收取高额港口服务费。这一策略与几百年前英国的做法极为相似,是否是巧合呢? 2025年3月,为了缓解美国日益严峻的财政危机,特朗普开始大幅加征关税。面对美国的挑衅,中国坚持不退让,采取了对等的反制措施:美国加多少关 税,中国就加多少,导致双方的关税不断攀升,最高达到了125%。最终,面对巨大的经济压力,美国不得不主动提出谈判请求,但谈判的过程异常艰难。 两国的博弈在不断谈判和冲突中循环往复,始终未能找到突破口。 据央视新闻消息,当地时间8月21日,美国白宫发表声明宣布,美国与欧盟已就一项 贸易协定的框架达成一致。协议框架主要覆盖19项内容,包括汽车、农产品、飞 机、半导体、能源等。 7月底,关国总统唐纳德·特朗普透露了与欧盟贸易协议的部分内容,包括美国将对 欧盟输美产品征收15%的关税、欧盟将对美增加6000亿美元投资以及购买价值7500 亿美元的美国能源。 然 ...

沪指十年磨一剑再破4000点,科技股成领涨引擎,迎来新纪元!

Sou Hu Cai Jing· 2025-10-28 03:42

Group 1 - The overall market sentiment is positive, with external markets experiencing significant gains while A-shares show modest increases, indicating a potential breakthrough of the 4000-point mark soon [1] - The technology sector is expected to see unprecedented development opportunities during the "14th Five-Year Plan" period, with a focus on high-value-added areas of the industrial chain, driven by product innovation and policy support [1] - The domestic software sector is transitioning from an optional choice to a necessity, with the market size driven by government procurement expected to reach 1.2 trillion yuan by 2027, reflecting a compound annual growth rate of approximately 18% [3] Group 2 - The Shanghai Composite Index has shown resilience, attempting to break through the 4000-point level, influenced by easing global trade tensions and anticipated interest rate cuts by the Federal Reserve [5] - The market is witnessing a shift towards small and mid-cap stocks, with the ChiNext Index also recovering quickly from declines, indicating a broader market trend [5] - The nuclear fusion sector continues to gain momentum, with projections indicating that the global nuclear fusion market could exceed 40 trillion dollars by 2050, highlighting significant growth potential [3]

沪指上探4000点

Zheng Quan Shi Bao· 2025-10-28 03:23

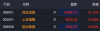

Market Overview - On October 28, the A-share market saw all three major indices open lower but then rise, with the Shanghai Composite Index surpassing the 4000-point mark for the first time in 10 years, closing at 4000.22, up 0.08% [1][2]. Sector Performance - The Shenzhen Component Index reached 13506.13, with a slight increase of 0.12%, while the ChiNext Index surged by 40.55% to 3252.37 [2]. - Sectors that performed well included mineral products, transportation services, and trade agency, while coal, communication equipment, semiconductors, components, internet, and non-ferrous metals sectors faced declines [2]. Fujian Sector Strength - The Fujian sector continued its strong performance, with Pingtan Development (000592) achieving six consecutive trading limits in eight days, and Fujian Cement securing two consecutive trading limits [4]. - The opening of the first fifth freedom passenger route from Cambodia to Fuzhou and Tokyo is seen as a significant milestone for Fujian's openness and business environment [5]. New Listings - Eight Horse Tea's stock surged over 70% on its debut, trading at 85.9 HKD per share, with a global offering of 9 million shares and a net fundraising of approximately 390 million HKD [12][13]. - Cambridge Technology also saw a strong debut, with its stock rising over 50% initially and closing with a 44% increase, focusing on connection and data transmission devices [14][15]. Emerging Concepts - The controllable nuclear fusion concept saw initial gains, with companies like Antai Technology and Dongfang Tantalum Industries experiencing price increases [6][8]. - The domestic software sector also showed upward movement, with stocks like Rongji Software hitting the daily limit [10].

破4000点!沪指再创10年新高,哪些行业还有补涨机会

Xin Jing Bao· 2025-10-28 03:04

Core Viewpoint - The Shanghai Composite Index has reached 4000 points for the first time in 10 years, marking a new high since August 2015, driven by positive market sentiment and policy expectations [1][2]. Market Performance - The market showed mixed performance with the cross-strait integration concept rising by 6%, while sectors like software, shipping, aerospace, and the internet also saw gains. Conversely, daily chemicals, motorcycles, precious metals, gas, pharmaceuticals, and education sectors lagged behind [1]. - On October 27, the index nearly reached 4000 points, with significant gains in sectors such as storage, rare earths, and nuclear power, while others like the gaming sector declined [2]. Policy Developments - The 2025 Financial Street Forum highlighted key priorities for China's financial system, including a moderately loose monetary policy and support for hard technology and emerging industries [2]. - The release of two significant documents, the "Qualified Foreign Investor System Optimization Work Plan" and "Opinions on Strengthening Protection for Small Investors in Capital Markets," is expected to impact market dynamics positively [3]. Investment Insights - The "14th Five-Year Plan" has instilled strong confidence in the market, with expectations of a clear growth path for A-shares through technological breakthroughs and industrial upgrades [4]. - Historical data indicates that the week following the announcement of five-year plans typically sees an average increase of 3.08% in the market, with small-cap and technology sectors performing particularly well [4]. - Short-term outlook remains positive for technology stocks, while there is potential for cyclical consumption sectors to catch up as market dynamics shift [5][6]. Sector Focus - Investment firms suggest focusing on technology sectors with high absorption rates, while also considering lower volatility sectors for potential excess returns in the fourth quarter [6]. - Key areas of interest include artificial intelligence, quantum technology, biomanufacturing, hydrogen energy, and sixth-generation mobile communications, as outlined in the "14th Five-Year Plan" [6].

A股异动丨金山办公拉升涨超13%,第三季度WPS 365业务收入同比增超71%

Ge Long Hui A P P· 2025-10-28 02:59

Core Insights - Kingsoft Office (688111.SH) experienced a significant intraday surge, rising over 13% to a price of 359.39 yuan following the release of its Q3 2025 financial report [1] Financial Performance - The company reported Q3 revenue of 1.521 billion yuan, representing a year-on-year increase of 25.33% [1] - Net profit attributable to shareholders reached 431 million yuan, up 35.42% year-on-year [1] - The net profit excluding non-recurring gains and losses was 421 million yuan, reflecting a 39.01% increase year-on-year [1] Cash Flow and R&D Investment - Kingsoft Office generated a net cash flow from operating activities of 538 million yuan, which is a 19.30% increase compared to the previous year [1] - The company invested 536 million yuan in R&D during Q3, marking an 18.08% year-on-year growth, with an R&D expense ratio of 35.24% [1] Business Segments Performance - All three main business segments achieved double-digit revenue growth in Q3 [1] - WPS 365 business revenue surged to 201 million yuan, a substantial increase of 71.61% year-on-year [1] - WPS personal business revenue was 899 million yuan, reflecting an 11.18% year-on-year growth [1] - WPS software business revenue reached 391 million yuan, showing a significant increase of 50.52% year-on-year [1]

金山软件逆市涨近4% 金山办公第三季度纯利同比增近四成 WPS各业务均显著增长

Zhi Tong Cai Jing· 2025-10-28 02:17

Core Viewpoint - Kingsoft Software (03888) saw a nearly 4% increase in stock price, reaching HKD 33.82 with a trading volume of HKD 414 million, following the announcement of its financial results for the first three quarters of the year [1] Financial Performance - For the first three quarters, Kingsoft Office reported a revenue of RMB 4.178 billion, representing a year-on-year growth of 15.21% [1] - The net profit attributable to the parent company was RMB 1.178 billion, up 13.32% year-on-year [1] - The net profit excluding non-recurring items was RMB 1.149 billion, reflecting a year-on-year increase of 15.94% [1] - In the third quarter, the revenue was approximately RMB 1.521 billion, which is a 25.33% increase compared to the same period last year [1] - The net profit for the third quarter was around RMB 463 million, showing a significant year-on-year growth of 39.38% [1] Business Segments - Kingsoft Office's three main business segments all achieved substantial year-on-year revenue growth: - WPS personal business revenue was RMB 899 million, a growth of 11%, accounting for 59% of total revenue [1] - WPS365 business revenue aimed at organizational clients was RMB 201 million, a remarkable increase of 72%, making up 13% of total revenue [1] - WPS software business revenue reached RMB 391 million, up 51%, contributing 26% to total revenue [1]