智能手机

Search documents

Omdia:印度智能手机市场增长3%,各品牌为节日季做准备,vivo继续蝉联榜首,苹果出货量创历史新高

Canalys· 2025-10-22 01:02

Core Insights - The Indian smartphone market is projected to grow by 3% year-on-year in Q3 2025, reaching a shipment volume of 48.4 million units, driven by pre-festival inventory replenishment and retail promotions [2][7]. Market Performance - Vivo leads the market with a shipment of 9.7 million units, capturing a 20% market share. Samsung follows with 6.8 million units and a 14% share, while Xiaomi and OPPO are nearly tied with 6.5 million units each, both holding a 13% share. Apple returns to the top five with 4.9 million units, driven by demand from lower-tier cities [2][7]. Sales Strategies - The market momentum in Q3 is primarily driven by channel incentives rather than pure consumer demand recovery. Manufacturers are reallocating marketing budgets to impactful retail incentive programs, including dealer competitions with rewards such as cash bonuses and travel [4][6]. Brand Strategies - Vivo's strong market position is attributed to a balanced product portfolio and aggressive retail strategies. Samsung is making progress in the mid-to-high-end market with new models but faces challenges in the entry-level segment. OPPO's growth is supported by targeted promotional plans centered around the F31 series [4][5]. Apple’s Performance - Apple achieved its highest-ever shipment volume in India during Q3, with a market share of 10%. Growth is fueled by demand for high-end models and effective promotional strategies, particularly in smaller cities [5]. Future Outlook - Despite a strong early performance in Q3, growth is not expected to continue into the year-end peak period. Urban consumers remain cautious due to job uncertainty and cost sensitivity, leading to delayed upgrades. The overall smartphone market is anticipated to see a slight decline in 2025, reflecting a fragile recovery sensitive to economic conditions [6].

8点1氪:卢浮宫劫案可能是粉红豹所为;王自如入职雷鸟创新;阿迪达斯羽绒服被指由雪中飞代工

36氪· 2025-10-22 00:15

Group 1 - The Pink Panther gang, an international crime organization established in 1999, is suspected of being involved in a recent jewelry theft at the Louvre, with stolen items potentially already smuggled out of France [4][5] - The gang specializes in high-value jewelry and watch robberies, with over 150 cases worldwide and a total value exceeding €250 million [4][5] - Experts suggest that the gang prefers targets that are easier to dismantle and conceal, indicating a high likelihood that the stolen jewelry has been quickly processed [5] Group 2 - Adidas faced criticism regarding the quality of its down jackets, which were allegedly produced by a third-party manufacturer, Snow Flying, leading to questions about brand value and product quality [6][7] - The jacket in question has a retail price of 579 yuan, while a similar product from Snow Flying is priced at 519 yuan, raising concerns about pricing strategies and consumer perception [6][7] - The Chinese government has responded to the election of a new Japanese Prime Minister, emphasizing the importance of maintaining bilateral relations and adhering to historical commitments [8] Group 3 - The U.S. stock market showed mixed results, with the Dow Jones increasing by 0.47% while the Nasdaq fell by 0.16%, reflecting varied performance among major tech stocks [11] - NIO reported over 10,000 vehicle deliveries in a week, with the L90 model achieving record sales, indicating strong demand and production capacity improvements [14] - Coca-Cola HBC announced a $2.6 billion acquisition of Coca-Cola Beverages Africa, aiming to consolidate its position in the African beverage market [18]

与字节豆包大模型深度合作,国产AI手机再迈关键一步

Xuan Gu Bao· 2025-10-21 23:15

Group 1 - Nubia's recent flagship devices, including the Red Magic 11 Pro series and Nubia Z80 Ultra, have integrated AI capabilities from the Doubao model, featuring functions such as multi-modal intelligent recognition, AI assistants, AI gaming coaches, and virtual idols [1] - According to Canalys, the global penetration rate of AI smartphones is expected to reach 34% by 2025, driven by the optimization of edge models and upgrades in chip computing power [1] - New mid-range SoCs, such as Snapdragon 8s Gen4 and Dimensity 9400e, are anticipated to support the smooth operation of large edge models, with the emergence of DeepSeek significantly reducing the computational requirements for these models [1] Group 2 - ByteDance and Nubia are collaborating on AI smartphones, focusing on optimizing the thermal module and AI computing power, indicating a trend towards enhanced thermal solutions for AI smartphones [1] - Companies like Bowei Alloy and Changxin Technology are key players in the supply of thermal materials and advanced technologies for AI smartphones, with Bowei Alloy being a major supplier of VC thermal materials for high-end AI devices [2] - Changxin Technology has a strong technological reserve in areas like UTG and provides products to leading consumer electronics brands such as Honor, VIVO, and OPPO [2]

崩了!黄金创12年来最大单日跌幅;泽连斯基称已准备好结束俄乌冲突;剑指谷歌,OpenAI推出浏览器;中荷围绕安世半导体交换意见丨每经早参

Mei Ri Jing Ji Xin Wen· 2025-10-21 22:13

Market Overview - The US stock market showed mixed results, with the Dow Jones increasing by 0.47%, reaching a new historical high, while the Nasdaq fell by 0.16% [4] - International gold and silver prices saw significant declines, with spot gold dropping by 5.31% to $4124.36 per ounce, marking the largest single-day drop since April 2013 [4] - Oil prices rose, with West Texas Intermediate (WTI) crude oil increasing by 0.98% to $57.58 per barrel [5] Company Performance - Pop Mart reported a substantial revenue increase of 245% to 250% in Q3 2025, with Chinese market revenue growing by 185% to 190% and overseas market revenue by 365% to 370% [17] - Coca-Cola's Q3 2025 revenue grew by 5% to $12.455 billion, with net profit increasing by 29% to $3.683 billion, driven by a 14% increase in sales of sugar-free Coca-Cola [25] - Beyond Meat, known as the "first stock of artificial meat," surged over 146%, with a cumulative increase of approximately 600% over the past three trading days [4] Regulatory and Strategic Developments - The Chinese Ministry of Commerce emphasized the importance of maintaining global supply chain stability during discussions with the Netherlands regarding semiconductor issues [8] - The Chinese government announced the establishment of 650 new Moutai specialty stores across the country, aiming to penetrate previously untapped markets [18] - SpaceX's lunar lander development is reportedly behind schedule, prompting NASA to reopen bidding for the contract, allowing other companies to participate [18] Economic Indicators - Domestic tourism in China saw 4.998 billion trips taken in the first three quarters of 2025, an increase of 18% year-on-year, with total spending reaching 4.85 trillion yuan [10] - The minimum wage standards across various provinces in China were updated, with Shanghai leading at 2740 yuan per month [8]

示例公司 :通过一般授权配售新股及发行可转债募资约50.0亿港元拓展业务及技术研发

Xin Lang Cai Jing· 2025-10-21 18:26

Core Viewpoint - The company announced a financing plan through the placement of new H-shares and the issuance of convertible bonds, aiming to raise approximately HKD 50 billion for business expansion and technology development [1] Group 1: Financing Details - The company plans to issue 800,000,000 new H-shares at a price of HKD 5.00, raising HKD 40 billion, which represents a discount of approximately 9.1% compared to the previous trading day's closing price of HKD 5.50 [1] - The total principal amount of the convertible bonds to be issued is HKD 10 billion, with an initial conversion price set at HKD 6.00, reflecting a premium of about 9.1% over the previous trading day's closing price [1] - The total funds raised, after deducting expenses, are expected to be approximately HKD 49.5 billion [1] Group 2: Use of Proceeds - Approximately HKD 30 billion of the raised funds will be allocated for core business expansion, while HKD 10 billion will be directed towards technology research and development, with the remainder for general corporate purposes [1] Group 3: Shareholder Impact - The new H-shares will represent about 10.0% of the existing issued share capital, and upon completion, will account for approximately 9.1% of the enlarged share capital [1] - The conversion of the convertible bonds could result in the issuance of approximately 166,666,667 shares, representing about 2.1% of the existing issued share capital [1]

领跑苹果 中国影像赛道成关键

Nan Fang Du Shi Bao· 2025-10-21 15:46

Core Viewpoint - OPPO's Find X9 series marks a significant advancement in mobile imaging technology, positioning smartphones as viable alternatives to traditional cameras, particularly with the Find X9 Pro being touted as the best camera under 10,000 yuan [1][5][13]. Group 1: Product Features and Innovations - The Find X9 Pro features a 200-megapixel telephoto lens, setting a new standard in the sub-10,000 yuan imaging market, achieving detail resolution comparable to medium format cameras [7][19]. - OPPO has integrated advanced imaging algorithms and hardware solutions, such as the "instant triple exposure" technology, which enhances image quality in dynamic scenes and low-light conditions [19]. - The collaboration with Hasselblad has led to the development of natural color algorithms, ensuring accurate color reproduction without excessive digital manipulation [11][19]. Group 2: Market Position and Trends - Over the past decade, Chinese brands have transitioned from following Apple to leading in key areas such as imaging, communication, and fast charging, with OPPO being a representative of this shift [4][17]. - Research indicates that nearly 95% of high-end smartphone users have high expectations for imaging capabilities, making it a core feature in their purchasing decisions [5][9]. - The Chinese imaging market is projected to capture 17.4% of the global smart imaging device market share by 2024, with a significant push towards domestic production in consumer-grade panoramic cameras [21][22]. Group 3: Industry Impact and Future Outlook - OPPO's advancements in mobile imaging reflect a broader trend of innovation within the Chinese tech industry, which has evolved from a follower to a global leader in mobile imaging technology [21][22]. - The complete ecosystem for smart imaging in China includes upstream components like CMOS modules and DSP chips, as well as downstream applications, indicating a robust and integrated industry [21][22]. - The future of imaging technology is expected to be driven by Chinese companies like OPPO, which are building comprehensive ecosystems that encompass hardware development, software innovation, content creation, and platform operation [22].

荣耀CEO李健:手机机器人,或许就是手机未来的样子

Guan Cha Zhe Wang· 2025-10-21 14:31

Core Viewpoint - Honor has launched its flagship product, the Honor Magic 8 series, along with the self-evolving AI operating system MagicOS 10, marking a significant step towards the future of smartphones and AI integration [1][4]. Group 1: Product Launch and Features - The Honor Magic 8 series features a unique AI key that allows users to perform tasks such as connecting to Wi-Fi simply by instructing the AI, showcasing a breakthrough in interaction methods [2][3]. - The new AI system, YOYO, can now execute 3,000 scenarios autonomously, a 15-fold increase from the previous model, indicating rapid advancements in AI capabilities [3]. Group 2: AI Evolution and Future Vision - Honor emphasizes the self-evolving nature of its AI, suggesting that the AI's capabilities will continue to grow and improve over time, unlike traditional AI assistants that reach a performance ceiling upon release [3]. - The company is transitioning from a smartphone manufacturer to a leading AI terminal ecosystem company, with plans to invest over $10 billion in AI terminal development over the next five years [5]. Group 3: Industry Positioning - Honor positions the Magic 8 as a pivotal product in the transition from the smartphone era to the AI Phone era, suggesting that future devices may resemble "robot phones" with advanced AI capabilities [4]. - The company aims to enhance AI's role in daily life, making it a partner in human growth and service, reflecting a broader trend in the industry towards integrating AI into consumer technology [4].

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

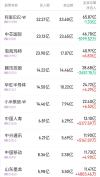

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

北水动向|北水成交净买入11.71亿 泡泡玛特(09992)盘后发布盈喜 北水全天抢筹超11亿港元

智通财经网· 2025-10-21 09:59

智通财经APP获悉,10月21日港股市场,北水成交净买入11.71港元,其中港股通(沪)成交净买入25.24亿港元,港股通(深)成 交净卖出13.53亿港元。 港股通(深)活跃成交股 泡泡玛特(09992)获净买入11.2亿港元。消息面上,今日盘后,泡泡玛特发布三季度最新业务状况公告,2025年第三季度整体 收益同比增长245%-250%。其中,中国收益同比增长185%-190%,海外收益同比增长365%-370%。小摩预计,泡泡玛特未来 催化剂包括:圣诞强劲销售,"Labubu&Friends"动画预期在12月发布,Labubu4.0料在明年3至4月出炉。 小米集团-W(01810)获净买入4.81亿港元。消息面上,小米集团披露,10月17日,公司回购1070万股,每股作价45.9港元至 46.76港元,涉及总额约4.94亿港元。今年以来该股累计进行12次回购,合计回购3412.52万股,累计回购金额15.37亿港元。 内资重新加仓芯片股,华虹半导体(01347)、中芯国际(00981)分别获净买入4.41亿、1.28亿港元。消息面上,华金证券表示, 持续看好人工智能推动半导体超级周期,建议关注半导体全产业 ...

小米ESG评级垫底,舍得酒业ESG报告涉嫌漂绿|ESG热搜榜

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-21 07:09

Group 1 - Xiaomi's negative public sentiment has been heightened by a recent car accident involving its SU7 model, which caught fire after a crash, leading to concerns over product quality and safety [1] - The company's MSCI ESG rating has remained at "B" from 2019 to September 2023, with a slight improvement to "BB" and "BBB" levels, but it ranks 40th out of 46 peers in the technology sector for governance scores [1] - The severity of ESG controversies is assessed by MSCI based on the nature of harm and the scale of impact, indicating that Xiaomi's governance issues are significant [1] Group 2 - Shede Liquor's ESG reports have been accused of "greenwashing," failing to address local conflicts arising from its expansion projects, particularly a 3 billion yuan investment that has faced local opposition [2] - The company has been criticized for omitting significant community impact issues from its ESG disclosures, which are expected to adhere to basic information disclosure principles [2] Group 3 - The "Belt and Road" Green Innovation Conference emphasized the importance of green low-carbon transformation for sustainable global development, with China actively engaging in green initiatives with over 150 countries [3] - Chinese enterprises are implementing energy-saving measures in international projects, such as the first net-zero carbon building in the Middle East and North Africa, showcasing China's commitment to green development [3] Group 4 - The second phase of the China-Australia Wine Talent Exchange Project has been launched to enhance cooperation in the wine industry, focusing on talent development and sustainable practices [5] - The project aims to create a high-level platform for professional exchanges in viticulture and winemaking, fostering deeper integration between the two countries' industries [5] Group 5 - The Industrial and Commercial Bank of China (ICBC) hosted an ESG strategy forum to promote high-quality development, leveraging its extensive experience in ESG consulting [6] - ICBC plans to launch an "ESG Consulting Service System" in November 2024, covering various aspects of ESG strategy and implementation [6] Group 6 - Jiangsu Dashing Group inaugurated its "carbon-neutral smart spinning factory," committing to achieve carbon neutrality by 2027 with an investment of 187 million yuan [7] - The factory aims to increase production capacity by 50% and produce 6,120 tons of zero-carbon yarn annually, aligning with the textile industry's goal of achieving zero carbon by 2050 [7] Group 7 - As of October 17, 2025, 379 state-owned listed companies have released their 2024 ESG reports, achieving nearly full disclosure [8] - The State-owned Assets Supervision and Administration Commission is developing a comprehensive ESG evaluation system to enhance transparency and align with international standards [8]