互联网电商

Search documents

若羽臣(003010):25Q3归母净利润同比增长73%自有品牌表现强劲

Hua Yuan Zheng Quan· 2025-10-30 08:58

Investment Rating - The investment rating for the company is "Accumulate" (maintained) [5] Core Views - The company reported a 73% year-on-year growth in net profit attributable to shareholders for Q3 2025, driven by strong performance in its proprietary brands [5][7] - The company achieved a revenue of 2.14 billion yuan in the first three quarters of 2025, representing an 85% year-on-year increase [7] - The proprietary brand business contributed significantly to revenue, accounting for 55.1% of total revenue in Q3 2025 [7] Financial Performance Summary - Revenue projections for the company are as follows: - 2023: 1,366 million yuan - 2024: 1,766 million yuan (12.25% growth) - 2025E: 3,159 million yuan (78.89% growth) - 2026E: 4,146 million yuan (31.27% growth) - 2027E: 5,005 million yuan (20.71% growth) [6] - Net profit attributable to shareholders is projected to grow from 54 million yuan in 2023 to 350 million yuan in 2027, with growth rates of 60.83%, 94.58%, 70.93%, 42.90%, and 35.61% respectively [6] - The company's gross margin improved by 12.0 percentage points to 58.5% in the first three quarters of 2025 [7] Brand Performance - The proprietary brand "Zhanjia" generated 227 million yuan in revenue in Q3 2025, marking a 118.9% year-on-year increase [7] - The brand "Feicui" achieved revenue of 203 million yuan in Q3 2025, with a sequential growth of over 98.8% [7] - The newly launched brand "Niuyibei" contributed 12.13 million yuan in revenue by September 2025, with significant growth in GMV [7] Brand Management - The brand management business generated 539 million yuan in revenue in the first three quarters of 2025, a 71.1% year-on-year increase [7] - The company focuses on the health and personal care sectors, enhancing its brand management ecosystem and operational capabilities [7]

晨会纪要:2025年第184期-20251030

Guohai Securities· 2025-10-30 01:02

Group 1: Coal Industry Insights - In Q3 2025, the proportion of coal stocks in actively managed funds decreased to 0.30%, indicating a low level of investment in the coal sector, which is at its lowest since 2008 [4][5][6] - Coal prices have been recovering, with the price of thermal coal reaching 770 RMB/ton by October 24, 2025, marking a new high for the year [6] - The coal mining industry is expected to maintain upward price trends due to seasonal demand and supply constraints from production regulations, with long-term price increases driven by rising operational costs and regulatory pressures [6] Group 2: Easy Point Technology - In Q3 2025, Easy Point Technology reported a revenue of 9.8 billion RMB, a year-on-year increase of 46.8%, driven by the growth of its programmatic advertising platform [10] - The company’s gross margin decreased to 13.06%, primarily due to rising traffic acquisition costs and increased R&D and sales expenses [10][11] - The programmatic advertising platform has seen significant growth, with daily ad requests reaching 220 billion, and the company is investing heavily in R&D to enhance its service capabilities [11][12] Group 3: Amway Corporation - Amway reported a revenue of 16.79 billion RMB in the first three quarters of 2025, a year-on-year decrease of 6.8%, with net profit declining by 19.2% [14][15] - The company is optimizing its product structure and expanding into emerging markets, with a focus on maintaining strong relationships with global clients like Nike and Adidas [17] - Despite challenges, Amway is seeing improvements in its operational performance, particularly in its Vietnam operations [16][18] Group 4: Nanjing Bank - Nanjing Bank achieved a revenue of 419.49 billion RMB in Q3 2025, reflecting an 8.79% year-on-year growth, with net profit increasing by 8.06% [19][20] - The bank's total assets reached 2.96 trillion RMB, a 14.31% increase from the previous year, with a notable growth in corporate loans [20] - The bank's non-performing loan ratio improved to 0.83%, indicating a strengthening of its asset quality [21] Group 5: Linglong Tire - Linglong Tire reported a revenue of 181.61 billion RMB in the first three quarters of 2025, a 13.87% increase, although net profit fell by 31.81% due to rising raw material costs [22][24] - The company’s tire production and sales volumes increased, with a focus on expanding its global footprint through its "7+5" strategy [27][28] - Linglong Tire is positioned as a leader in the domestic market and is actively pursuing international expansion, including a significant investment in Brazil [27][29] Group 6: Wuxi Bank - Wuxi Bank's revenue grew by 3.87% year-on-year in the first three quarters of 2025, with a net profit increase of 3.78% [30][31] - The bank's loan growth exceeded 10%, with a significant increase in corporate loans, indicating strong demand for financing [31] - The non-performing loan ratio remained stable at 0.78%, reflecting effective risk management practices [32] Group 7: China Aluminum - China Aluminum reported a revenue of 1,765 billion RMB in the first three quarters of 2025, with a net profit increase of 20.65% [33][34] - The company benefited from lower costs and rising prices for aluminum and alumina, contributing to improved profitability [34][35] - Production volumes for key products increased, supporting the overall positive performance of the company [34] Group 8: Jin Zai Food - Jin Zai Food achieved a revenue of 18.08 billion RMB in the first three quarters of 2025, with a slight increase of 2.05%, while net profit declined by 19.51% [37][38] - The company’s Q3 revenue growth of 6.55% indicates a recovery in its core product lines, although profitability remains under pressure due to increased costs [38][39] - Jin Zai Food is focusing on quality and new product development to enhance its market position [39] Group 9: China Coal Energy - China Coal Energy reported a revenue of 1,105.8 billion RMB in the first three quarters of 2025, a decrease of 21.2%, with net profit down by 14.6% [40][41] - The company’s Q3 performance improved due to rising coal prices and cost reductions, with a notable increase in profit margins [41] - The coal production and sales volumes showed resilience despite price pressures, indicating operational efficiency [41]

青木科技(301110):业绩大幅增长,关注双十一表现

Guohai Securities· 2025-10-29 14:45

Investment Rating - The investment rating for the company is "Buy" (maintained) [1] Core Insights - The company reported significant year-on-year growth in Q3 2025, with operating revenue of 350 million yuan, up 34% year-on-year, and a net profit attributable to shareholders of 28 million yuan, up 440% year-on-year [5][6] - The company is expected to benefit from the upcoming Double Eleven shopping festival in Q4 2025, which is a key focus for performance [6] - The company has a strong position as a leading e-commerce service provider, offering comprehensive services and has expanded into trendy toy categories, with notable clients like Jellycat and Pop Mart [6] Financial Performance Summary - In Q3 2025, the company achieved an operating revenue of 350 million yuan, with a net profit margin of 7.5% and a gross margin of 55% [6] - For the first three quarters of 2025, the company reported total operating revenue of 1.02 billion yuan, a 26% increase year-on-year, and a net profit of 80 million yuan, a 10% increase year-on-year [6] - The company’s sales expenses increased by 57% year-on-year to 325 million yuan, primarily due to market promotion costs associated with brand incubation [6] Earnings Forecast - The company is projected to achieve operating revenues of 1.5 billion yuan in 2025, 2.1 billion yuan in 2026, and 2.8 billion yuan in 2027, with corresponding net profits of 131 million yuan, 208 million yuan, and 356 million yuan respectively [7][8] - The expected price-to-earnings (P/E) ratios for 2025, 2026, and 2027 are 54.7, 34.4, and 20.1 respectively [6][8]

焦点科技(002315):剔除股权费用表现稳健,买家侧AI顺利落地

GOLDEN SUN SECURITIES· 2025-10-29 11:43

Investment Rating - The report maintains a "Buy" rating for the company [5] Core Views - The company has shown robust performance in its core business, with significant growth in revenue and net profit. The revenue for the first three quarters of 2025 reached 1.403 billion yuan, a year-on-year increase of 16.29%, while the net profit attributable to shareholders was 416 million yuan, also up by 16.38% [1] - The company's AI initiatives are progressing well, with a notable increase in the number of members purchasing AI services, indicating a successful implementation of AI solutions to enhance buyer decision-making efficiency [1][2] Financial Performance Summary - For Q3 2025, the company reported revenue of 487 million yuan, a year-on-year increase of 17.01%, but a slight decline in net profit by 1.98% [1] - The gross margin for Q3 2025 was 78.52%, down by 1.40 percentage points year-on-year, attributed to increased spending on buyer-side traffic [2] - The company expects to achieve revenues of 1.911 billion yuan, 2.160 billion yuan, and 2.420 billion yuan for the years 2025, 2026, and 2027 respectively, with net profits projected at 510 million yuan, 600 million yuan, and 734 million yuan for the same years [2][4] Membership and Market Expansion - As of Q3 2025, the number of paid members on the China Manufacturing Network platform reached 29,214, an increase of 2,546 members year-on-year [1] - The international market, particularly in the Middle East, Latin America, Africa, and Europe, has shown strong traffic growth, with the Middle East experiencing a 45% increase [1] AI Business Development - The cumulative number of members who have purchased AI services reached 15,687 by Q3 2025, reflecting a growth of 2,687 members from Q2 2025 [1] - The launch of the AI Global Procurement Assistant—SourcingAI 2.0 is expected to further enhance buyer decision-making efficiency [1]

焦点科技(002315):25Q3收款增速18%,买卖双方AI赋能生态闭环

Tianfeng Securities· 2025-10-29 11:23

Investment Rating - The investment rating for the company is "Buy" with a target price not specified [5] Core Views - The company has shown steady growth with a 17% year-over-year increase in revenue for Q3 2025, reaching 489 million yuan, while net profit slightly decreased by 1.98% to 122 million yuan [1] - The company is leveraging AI technology to enhance its services, with the launch of SourcingAI 2.0 expected to improve procurement efficiency by 35% for buyers [3] - The company is positioned as a comprehensive service provider in the cross-border B2B platform sector, with strong growth in AI business and organizational restructuring aimed at improving operational efficiency [3] Financial Performance Summary - For Q3 2025, the company reported a revenue of 489 million yuan, a 17% increase year-over-year, and a net profit of 122 million yuan, down 1.98% year-over-year [1] - The total revenue for the first three quarters of 2025 reached 1.4 billion yuan, reflecting a 16% year-over-year growth, with net profit also increasing by 16% to 416 million yuan [1] - The company’s gross margin stood at 79%, a decrease of 1.4 percentage points year-over-year, while the net profit margin was 25%, down 4.8 percentage points year-over-year [1] Membership and Market Growth - As of Q3 2025, the company had 29,200 paying members, a 9.5% year-over-year increase, with a cash collection of 504 million yuan, representing an 18% year-over-year growth [2] - The company anticipates future growth driven by an increase in membership and improvements in ARPPU (Average Revenue Per Paying User) [2] - The Middle East region saw a 45% year-over-year increase in traffic, with Latin America, Africa, and Europe also experiencing traffic growth exceeding 30% [2] AI Business Development - By the end of Q3 2025, the AI service "AI 麦可" had accumulated 15,700 paying members, with a quarterly increase of 2,687 members, indicating accelerated growth [3] - The company expects significant revenue growth from its AI business throughout the year, supported by the enhanced penetration of AI services [3] Financial Projections - The company’s projected net profits for 2025-2027 are 520 million yuan, 610 million yuan, and 720 million yuan respectively, with corresponding P/E ratios of 28, 23, and 20 [3] - Revenue projections for 2023 to 2027 are 1.53 billion yuan, 1.67 billion yuan, 1.92 billion yuan, 2.19 billion yuan, and 2.50 billion yuan, with growth rates of 3.51%, 9.32%, 14.97%, 14.32%, and 14.09% respectively [4]

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]

凭借6倍股翻身的傅鹏博,三季度大幅增持阿里巴巴,减仓胜宏科技、寒武纪近50%……

聪明投资者· 2025-10-29 03:43

Core Viewpoint - The article discusses the significant changes in the investment strategy of the Ruiyuan Growth Value Fund managed by Fu Pengbo, highlighting the reduction in holdings of certain stocks and the focus on sectors like technology and innovation-driven companies. Group 1: Stock Performance and Adjustments - Shenghong Technology's stock price has increased over six times this year, contributing significantly to Fu Pengbo's performance [2] - However, the latest quarterly report reveals that Fu Pengbo has reduced his holdings in Shenghong Technology by nearly 50% [3] - As of October 20, Fu Pengbo's fund participated in a private placement of Shenghong Technology, acquiring 806,400 shares at a total cost of 200 million yuan, representing 0.95% of the fund's net asset value [4] Group 2: Portfolio Composition Changes - New entrants to the top ten holdings of Ruiyuan Growth Value include Alibaba and Dongshan Precision, while Sanuo Biology and Maiwei Shares have exited [5] - Fu Pengbo's portfolio is now heavily weighted towards sectors such as internet technology, optical modules, PCB, chips, and innovative pharmaceuticals [5][7] - The top ten holdings' concentration has reached a historical high of 66.03%, driven by significant price increases in key stocks [15] Group 3: Market Outlook and Investment Strategy - The technology sector has been a major investment theme this year, with the semiconductor and consumer electronics industries showing strong performance [10][9] - Fu Pengbo emphasizes the importance of selecting companies with core competitive advantages and strong governance, focusing on those likely to experience high growth due to favorable industry conditions [7][41] - The article notes that the current market environment has led to high valuations across many sectors, prompting a shift towards more selective stock picking based on fundamentals [27][30] Group 4: Specific Stock Insights - Shenghong Technology, a leader in the PCB industry, reported a revenue of 9.031 billion yuan for the first half of the year, a year-on-year increase of 86%, with net profit soaring by 366.89% [19] - Dongshan Precision, another PCB leader, has also seen significant increases in its stock price, with a P/E ratio of 109.02, indicating it is at a historical high [23] - Newisheng, focusing on optical modules, reported a revenue of 10.437 billion yuan, up 282.64%, and a net profit increase of 355.68% [26]

焦点科技(002315):三季度营收稳健增长 17%,平台及AI 付费会员数量持续扩大

Guoxin Securities· 2025-10-28 01:53

Investment Rating - The investment rating for the company is "Outperform the Market" [6] Core Insights - The company achieved a revenue growth of 17% year-on-year in Q3, with total revenue reaching 487 million yuan and a net profit of 122 million yuan, reflecting a slight decline of 1.98% year-on-year. The decline in net profit was primarily due to short-term impacts from stock incentive expenses [1][2] - The number of paid members on the China Manufacturing Network platform increased to 29,214, up by 2,546 from the previous year, indicating strong growth in membership and value contribution [1] - The company’s operating cash flow for the first three quarters was 417 million yuan, a significant increase of 52.52% year-on-year, supported by increased cash income from the China Manufacturing Network [2] Financial Forecast and Metrics - The company’s projected net profits for 2025-2027 have been adjusted to 517 million, 601 million, and 713 million yuan respectively, with corresponding price-to-earnings (PE) ratios of 28, 24.1, and 20.3 [3][11] - Revenue forecasts for the years 2023 to 2027 are as follows: 1,526.57 million yuan (2023), 1,668.82 million yuan (2024), 1,957.28 million yuan (2025), 2,234.91 million yuan (2026), and 2,540.99 million yuan (2027), reflecting a compound annual growth rate (CAGR) of approximately 13.70% [4][11] - The company’s gross margin for Q3 was 78.52%, a decrease of 1.4 percentage points year-on-year, attributed to increased investments in buyer-side promotions [2][9] Strategic Outlook - The company is expected to benefit from the growing demand in emerging overseas markets and the enhancement of its comprehensive trade service capabilities, which will likely lead to increased market share [2][11] - The leading position in AI tools is anticipated to further strengthen the company's competitive advantage and contribute to performance growth [2][11]

互联网电商板块10月27日涨0.8%,新迅达领涨,主力资金净流入7049.67万元

Zheng Xing Xing Ye Ri Bao· 2025-10-27 08:25

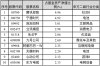

Market Overview - The internet e-commerce sector increased by 0.8% on October 27, with Xin Xun Da leading the gains [1] - The Shanghai Composite Index closed at 3996.94, up 1.18%, while the Shenzhen Component Index closed at 13489.4, up 1.51% [1] Individual Stock Performance - Xin Xun Da (300518) closed at 15.09, with a rise of 11.04% and a trading volume of 338,000 shares, totaling a transaction value of 517 million yuan [1] - Kuaijingtong (002640) closed at 5.12, up 4.07%, with a trading volume of 2.119 million shares [1] - Saiwei Times (301381) closed at 23.66, increasing by 2.65% with a trading volume of 54,100 shares [1] - Other notable performers include Xinghui Co. (300464) and Huakai Yibai (300592), with increases of 2.36% and 1.55% respectively [1] Capital Flow Analysis - The internet e-commerce sector saw a net inflow of 70.5 million yuan from institutional investors, while retail investors experienced a net outflow of 2.2 million yuan [2][3] - Kuaijingtong (002640) had a significant net inflow of 106 million yuan from institutional investors, while retail investors saw a net outflow of 80.8 million yuan [3] - Xin Xun Da (300518) recorded a net inflow of 10.9 million yuan from institutional investors, with retail investors experiencing a net outflow of 52 million yuan [3]

青木科技(301110):AI赋能代运营主业,自有品牌持续高增

Soochow Securities· 2025-10-27 02:16

Investment Rating - The report maintains an "Accumulate" rating for Qingmu Technology [3] Core Views - Qingmu Technology is expanding its e-commerce service offerings, maintaining a leading position in the large apparel brand operation while deepening collaborations with quality brands. The company is also exploring the trendy toy industry to uncover new profit sources in operational categories. The brand incubation business is positioned in the health and pet food sectors, which are expected to grow significantly. The net profit forecasts for 2025-2027 have been revised upwards to 1.2 billion, 1.9 billion, and 2.6 billion respectively, representing year-on-year growth of 31%, 57%, and 40%. The corresponding latest closing price P/E ratios are 56, 36, and 26 [3] Financial Performance Summary - For the first three quarters of 2025, Qingmu Technology achieved revenue of 1.02 billion, a year-on-year increase of 26.3%, and a net profit attributable to shareholders of 79.62 million, up 10.2%. In Q3 alone, revenue reached 350 million, a year-on-year increase of 33.7%, with net profit soaring to 27.96 million, a remarkable increase of 439.7% [10] - The sales net profit margin improved significantly, with the gross margin for the first three quarters of 2025 at 56.3%, up 5.3 percentage points year-on-year. The Q3 gross margin was 55.0%, also up 5.0 percentage points year-on-year. The operating expense ratio for the first three quarters was 48.3%, up 4.8 percentage points year-on-year, while the Q3 operating expense ratio was 49.4%, down 0.7 percentage points year-on-year [10] - The brand incubation and management business continues to grow rapidly, driven by partnerships with European health brands. A strategic cooperation agreement was signed with Dermofarm to explore the Chinese health market, leveraging previous successes in brand growth [10] - The e-commerce operation business is synergistically enhancing its services, including traditional e-commerce operations and live streaming services across major platforms. The company is also advancing AI technology to improve digital service levels [10]