黑色金属冶炼和压延加工业

Search documents

2025年1-9月黑色金属冶炼和压延加工业企业有6290个,同比增长0.7%

Chan Ye Xin Xi Wang· 2025-11-17 03:51

Core Viewpoint - The report by Zhiyan Consulting highlights the growth and current state of the black metal smelting and rolling industry in China, indicating a slight increase in the number of enterprises in this sector from the previous year [1] Industry Overview - As of January to September 2025, there are 6,290 enterprises in the black metal smelting and rolling industry, which is an increase of 44 enterprises compared to the same period last year, representing a year-on-year growth of 0.7% [1] - The black metal smelting and rolling industry accounts for 1.2% of the total industrial enterprises in China [1] Statistical Data - The data regarding the number of enterprises in the black metal smelting and rolling industry has been compiled from the National Bureau of Statistics and organized by Zhiyan Consulting [1] - The threshold for scale industrial enterprises was raised from an annual main business income of 5 million yuan to 20 million yuan starting from 2011 [1]

西宁特钢申请汽车转向节法兰用高强度F+P型非调质钢及生产方法专利,生产工艺省去传统调质工序

Jin Rong Jie· 2025-11-15 01:10

Group 1 - The core viewpoint of the news is that Xining Special Steel Co., Ltd. has applied for a patent for a high-strength non-quenched steel specifically designed for automotive steering knuckle flanges, which offers economic and environmental benefits by eliminating traditional quenching processes [1] Group 2 - Xining Special Steel Co., Ltd. was established in 1997 and is primarily engaged in black metal smelting and rolling processing, with a registered capital of 3.255 billion RMB [2] - The company has invested in 18 enterprises and participated in 2,155 bidding projects, holding 102 patents and 62 administrative licenses [2]

2025年1-9月全国黑色金属冶炼和压延加工业出口货值为1511.9亿元,累计下滑3.2%

Chan Ye Xin Xi Wang· 2025-11-04 03:46

Core Insights - The report highlights a decline in the export value of China's black metal smelting and rolling industry, with a 10.4% year-on-year decrease in September 2025, amounting to 17.3 billion yuan [1] - Cumulatively, from January to September 2025, the export value reached 151.19 billion yuan, reflecting a 3.2% year-on-year decline [1] Industry Overview - The report is based on data from the National Bureau of Statistics, indicating a downward trend in the black metal smelting and rolling industry [1] - The report is part of a comprehensive market survey and investment outlook for the black metal mining and selection industry in China from 2026 to 2032, published by Zhiyan Consulting [1] Company Insights - The companies mentioned include CITIC Special Steel, Hebei Steel, Zhongnan Shares, Benxi Steel, among others, indicating a focus on key players in the black metal industry [1] - Zhiyan Consulting is recognized as a leading industry consulting firm in China, providing in-depth industry research reports and tailored services [1]

宝钢股份在马鞍山新设钢管公司,注册资本10亿

Qi Cha Cha· 2025-10-31 05:47

Core Viewpoint - Baosteel Steel Pipe (Maanshan) Technology Co., Ltd. has been established with a registered capital of 1 billion RMB, focusing on steel and iron smelting, steel rolling processing, and import-export activities [1] Company Information - The legal representative of the new company is Xue Jianguo [1] - The company is wholly owned by Baosteel Pipe Industry Technology Co., Ltd., which is a subsidiary of Baosteel Co., Ltd. [1] - The registered capital is 1 billion RMB (100 million) [2] - The company is located in Maanshan City, Anhui Province, China [2] - The business scope includes steel and iron smelting, steel rolling processing, and import-export activities [2] Registration Details - The company was established on October 28, 2025, and has no fixed business duration [2] - The organization code is MAG2EF5K-0, and the taxpayer identification number is 91340503MAG2EF5K0H [2] - The company is classified under the black metal smelting and rolling processing industry (C31) [2]

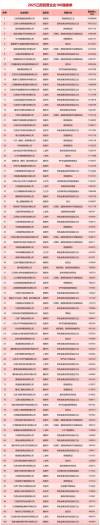

2025江西民营企业100强榜单出炉 入围门槛48.18亿元

Sou Hu Cai Jing· 2025-10-29 03:55

Core Insights - The 2025 Jiangxi Top 100 Private Enterprises list was released, highlighting significant growth in revenue thresholds for inclusion, with the manufacturing sector seeing a notable increase in the number of companies exceeding 10 billion yuan in revenue [7][8]. Group 1: Overall Rankings - The top three companies in the 2025 Jiangxi Private Enterprises 100 list are Jiangxi Shuangbantian Holdings Co., Ltd. with 103.87 billion yuan, Jiangxi Fangda Steel Group Co., Ltd. with 100.73 billion yuan, and JinkoSolar Co., Ltd. with 92.47 billion yuan in revenue [8]. - A total of 38 companies reported revenues exceeding 10 billion yuan, an increase of 2 companies from the previous year [8]. Group 2: Manufacturing Sector - The 2025 Jiangxi Top 100 Private Manufacturing Enterprises list also reflects strong performance, with Jiangxi Shuangbantian Holdings Co., Ltd. leading at 103.87 billion yuan, followed by Jiangxi Fangda Steel Group Co., Ltd. at 100.73 billion yuan, and JinkoSolar Co., Ltd. at 92.47 billion yuan [4][8]. - The revenue threshold for inclusion in the manufacturing sector reached 3.78 billion yuan, an increase of 376 million yuan from the previous year [7]. Group 3: Service Sector - The 2025 Jiangxi Top 20 Private Service Enterprises list shows a revenue threshold of 3.05 billion yuan, which is an increase of 697 million yuan from the previous year [7]. - The leading company in the service sector is Yingtan Copper Industry Development Investment Co., Ltd. with a revenue of 2.73 billion yuan [7].

2025江西民营企业100强榜单揭晓!

Sou Hu Cai Jing· 2025-10-28 11:41

Core Insights - The 2025 Jiangxi Top 100 Private Enterprises and Social Responsibility Report was released, highlighting the growth and characteristics of private enterprises in Jiangxi province [1][14]. Group 1: Rankings and Financial Performance - The threshold for entering the 2025 Jiangxi Top 100 Private Enterprises reached 4.818 billion yuan, an increase of 501 million yuan from the previous year [14]. - The total revenue of the top 100 private enterprises exceeded 100 billion yuan for 38 companies, with Jiangxi Shuangbaotai Holdings Co., Ltd. leading at 103.86846 billion yuan [14]. - The total assets of the top 100 private enterprises amounted to 890.862 billion yuan, reflecting a growth of 3.31% compared to the previous year [14]. Group 2: Industry Structure - Manufacturing remains the dominant sector among the top 100 private enterprises, with 73 companies contributing 78.49% of total revenue and employing 81.45% of the workforce [15]. - There are 38 enterprises engaged in non-ferrous metal smelting and rolling, indicating a strong presence in this industry [15]. Group 3: Innovation and R&D - 29 enterprises among the top 100 have R&D expenditure intensity exceeding 3%, with notable investments from companies like JinkoSolar and Jiangxi Fangda Steel Group [16]. - The integration of technology and innovation is emphasized, with many enterprises enhancing their R&D capabilities and collaborating with academic institutions [16]. Group 4: Social Responsibility - The 2025 Jiangxi Private Enterprise Social Responsibility Report outlines significant contributions to the economy, with the non-public economy generating a value-added of 2.14 trillion yuan, accounting for 62.4% of the province's GDP [16]. - Employment initiatives have been robust, with 440 enterprises participating in job creation efforts, providing over 24,500 job opportunities [17]. - The report highlights the active involvement of private enterprises in rural revitalization, with 3,522 enterprises participating in related projects, benefiting 3,246 villages [18].

黑色金属冶炼和压延加工业1-9月份利润总额973.4亿元

Guo Jia Tong Ji Ju· 2025-10-28 08:38

Core Insights - In the first nine months of 2025, the total profit of large-scale industrial enterprises in China reached 53,732 billion yuan, reflecting a year-on-year growth of 3.2% [1][4][10] Profit by Ownership Type - State-owned enterprises reported a total profit of 17,021.8 billion yuan, a slight decline of 0.3% year-on-year [1][10] - Joint-stock enterprises achieved a profit of 39,923.5 billion yuan, marking a growth of 2.8% [1][10] - Foreign and Hong Kong, Macao, and Taiwan-invested enterprises saw profits of 13,509.7 billion yuan, up by 4.9% [1][10] - Private enterprises reported a profit of 15,131.7 billion yuan, with a growth of 5.1% [1][10] Profit by Industry - The mining industry experienced a significant profit decline of 29.3%, totaling 6,369.2 billion yuan [1][4][10] - The manufacturing sector saw a profit increase of 9.9%, amounting to 40,671.8 billion yuan [1][4][10] - The electricity, heat, gas, and water production and supply industry reported a profit of 6,691.0 billion yuan, reflecting a growth of 10.3% [1][4][10] Major Industry Performance - Key industries with notable profit growth include: - Electricity and heat production and supply: +14.4% [2] - Non-ferrous metal smelting and rolling: +14.0% [2] - Agricultural and sideline food processing: +12.5% [2] - Computer, communication, and other electronic equipment manufacturing: +12.0% [2] - Industries facing profit declines include: - Coal mining and washing: -51.1% [2] - Oil and gas extraction: -13.3% [2] - Chemical raw materials and products manufacturing: -4.4% [2] - Textile industry: -5.9% [2] Financial Metrics - Total operating revenue for large-scale industrial enterprises reached 1,020,846.7 billion yuan, with a year-on-year growth of 2.4% [4][10] - Operating costs amounted to 873,426.0 billion yuan, increasing by 2.6% [4][10] - The operating profit margin was 5.26%, up by 0.04 percentage points year-on-year [4][10] Balance Sheet Overview - As of the end of September, total assets of large-scale industrial enterprises were 186.27 trillion yuan, a year-on-year increase of 5.0% [5] - Total liabilities reached 107.96 trillion yuan, growing by 5.2% [5] - Owner's equity totaled 78.31 trillion yuan, reflecting a growth of 4.7% [5] - The asset-liability ratio stood at 58.0%, up by 0.1 percentage points year-on-year [5]

成材:基本面短期转暖,钢价小幅反弹

Hua Bao Qi Huo· 2025-10-28 02:50

Group 1: Report Industry Investment Rating - Not provided Group 2: Core View of the Report - The industry is operating at a low level with a short - term rebound potential [3] Group 3: Summary of Relevant Information Macro - economic Data - From January to September 2025, the total profit of industrial enterprises above designated size in China was 5373.2 billion yuan, a year - on - year increase of 3.2%. The ferrous metal smelting and rolling processing industry turned from loss to profit, with a profit of 973.4 billion yuan [2] Downstream Construction Projects - A survey of 36 downstream construction units showed that only 38.89% of enterprises have new projects in Q4 2025, and new projects will be concentrated in Q1 2026. Most enterprises' existing project scales are stable, but they face significant financial pressure and are cautious in procurement, keeping raw material inventory low [2] Market Performance -成材 rebounded yesterday, with a morning decline and an afternoon rally. After Sino - US consultations, a preliminary consensus was reached, improving the macro - level and boosting risk sentiment. Since Monday, some areas in Hebei have implemented a weather level - II emergency response, supporting the price of 成材 [2] Later Concerns - Macro policies and downstream demand conditions should be focused on [3]

黑色金属冶炼和压延加工业前三季度盈利近千亿元

Zhong Guo Jing Ying Bao· 2025-10-27 13:57

Core Viewpoint - The black metal smelting and rolling industry in China has shown signs of recovery in profitability despite a decline in revenue, with a total profit of 97.34 billion yuan in the first nine months of 2025, marking a turnaround from losses in the previous year [1][2]. Group 1: Revenue and Profit Trends - In the first nine months of 2025, the industry achieved operating revenue of 575.99 billion yuan, a year-on-year decrease of 3.8% [1]. - The cumulative profit for the same period reached 97.34 billion yuan, indicating a successful transition from losses to profits [1]. - The operating costs for the industry were 544.57 billion yuan, reflecting a year-on-year decline of 6.1%, which was significantly higher than the revenue decline, thus creating conditions for profit recovery [1]. Group 2: Quarterly Profit Recovery - The profitability recovery has accelerated throughout the year, with profits of 7.51 billion yuan in Q1, 38.77 billion yuan in Q2 (an increase of 17.72 billion yuan year-on-year), and 51.06 billion yuan in Q3, also showing a turnaround from losses [2]. - Monthly profit data shows a consistent increase since March, with profits reaching 90.6 billion yuan in March, peaking at 193.4 billion yuan in August, before a decline to 136.4 billion yuan in September [2]. Group 3: Market Conditions and Demand - The steel market has transitioned from peak season to traditional off-season, with actual demand not meeting market expectations despite increased funding for major projects [3]. - The construction steel demand recovery is slow due to the ongoing impact of the real estate sector, while stable demand from the manufacturing sector provides some support to the market [3].

刚刚通报,黄石民企“家底”……

Sou Hu Cai Jing· 2025-10-27 09:07

Core Viewpoint - The Yellow Stone City government has released the "2025 Yellow Stone City Top 100 Private Enterprises" list, highlighting the growth and contributions of private enterprises in the region, in line with national policies to promote the development of the private economy [4][5]. Group 1: Overview of the Top 100 Private Enterprises - A total of 140 private enterprises with revenues exceeding 100 million yuan participated in the survey, with the top 100 selected based on revenue [4]. - The total revenue of the top 100 private enterprises reached 125.6 billion yuan, with 57 enterprises showing positive growth, and 22 of them achieving growth rates exceeding 10% [5]. - The total assets of these enterprises amounted to 216.5 billion yuan, with 64 enterprises reporting asset growth, and 35 of them exceeding 10% growth [5]. - The net profit of the top 100 enterprises totaled 8.9 billion yuan, reflecting a year-on-year increase of 26%, with 64 enterprises achieving positive profit growth [5]. Group 2: Industry and Regional Distribution - Among the top 100 enterprises, 68 belong to the secondary industry, generating 105.6 billion yuan, accounting for 84.1% of total revenue, while 32 are in the tertiary industry, contributing 19.9 billion yuan, or 15.9% [6]. - The top five industries represented include black metal smelting, general equipment manufacturing, non-metallic mineral products, and pharmaceutical manufacturing, with 40 enterprises generating 74.6 billion yuan, or 59.4% of total revenue [6]. - The distribution of enterprises by region shows that Daye City has 40 enterprises, followed by Kaite District with 20, and Yangxin County with 16 [6]. Group 3: Technological Innovation and Development - A total of 47 enterprises are recognized as national high-tech enterprises, with 12 classified as "little giant" enterprises, and 46 as provincial specialized and innovative enterprises [6]. - Research and development (R&D) expenditures for the top 100 enterprises reached 2.5 billion yuan, an increase of 300 million yuan from the previous year, with 44 enterprises reporting growth in R&D spending [6]. - The number of R&D personnel in these enterprises totals 6,398, accounting for 8.7% of the total workforce, with 56 enterprises having over 10% of their workforce in R&D [6]. Group 4: Social Responsibility - Among the top 100 enterprises, 82 have an A-level tax rating, and 16 have a B-level rating [7]. - These enterprises provided 74,000 jobs, with 11 enterprises employing over 1,000 people, totaling 48,000 [7]. - A total of 48 enterprises participated in social welfare activities, contributing 570 million yuan in donations [7]. Group 5: Business Environment and Support Measures - The Yellow Stone City government has implemented the "Yellow Stone City Continuous Improvement of Business Environment Action Plan," which includes 31 specific measures to enhance the business environment [8]. - The number of key reform pilot projects increased from 21 in 2022 to 66 in 2025, with significant improvements in service efficiency and satisfaction among businesses [8][9]. - Tax reductions and refunds reached 429 million yuan by the end of September, with various financial support measures leading to a 19.9% increase in private investment [9][10]. Group 6: Employment and Recruitment Initiatives - The city has utilized online and offline recruitment methods, successfully assisting 52,200 job seekers and attracting 21,500 new graduates to work in the area [14][15]. - Employment service stations and flexible job opportunities have been established, providing over 68,300 flexible job positions [16]. - Collaborative efforts with vocational schools and enterprises have been initiated to ensure a stable supply of skilled labor for key industries [17].