Shen Zhen Shang Bao

Search documents

沪指收复3900点 创业板大涨3%

Shen Zhen Shang Bao· 2025-10-21 23:01

Group 1 - A-shares continued to rebound, with the Shanghai Composite Index recovering above 3900 points, closing up 1.36% at 3916.33 points, and the ChiNext Index rising 3.02% [1] - The overall market showed a broad-based increase, with over 4600 stocks rising, accounting for more than 80% of the total [1] - Key sectors leading the market included telecommunications, electronic components, shipbuilding, and semiconductors, while coal and daily chemicals declined [1] Group 2 - The stability of the stock market is crucial for injecting capital into the real economy and enhancing consumer confidence through wealth, psychological, and expectation effects [2] - The Nasdaq Golden Dragon China Index rose by 2.39%, indicating increasing foreign investment interest in Chinese stocks [2] - Short-term market fluctuations are expected due to profit-taking and market sentiment, but favorable policies and potential interest rate cuts from the Federal Reserve and the People's Bank of China may support the market [2]

泡泡玛特股价大跌8%

Shen Zhen Shang Bao· 2025-10-21 22:57

Core Insights - Pop Mart announced a projected revenue growth of 245%-250% for Q3 2025 compared to Q3 2024, with Chinese revenue expected to grow by 185%-190% and overseas revenue by 365%-370% [1] Revenue Performance - Offline channels in China experienced a revenue increase of 130%-135% year-on-year [1] - Online channels saw a significant revenue growth of 300%-305% year-on-year [1] Stock Performance - Pop Mart's stock price surged from HKD 18.74 per share on January 2 last year to HKD 339.80 per share on August 26 this year, marking a cumulative increase of 1713.24% [1] - As of October 21, the stock was priced at HKD 250.40 per share, down 8.08%, with a trading volume of HKD 98.3 billion and a total market capitalization of approximately HKD 336.3 billion [1] - The stock has increased by 182.10% year-to-date [1]

“国民好车”一周预约近万人

Shen Zhen Shang Bao· 2025-10-21 22:32

Core Insights - CATL's "Chocolate" battery swap stations have surpassed 700 locations across 39 cities in China, with plans to establish over 2,500 stations in more than 120 cities by 2026 [2] - The "Chocolate" battery swap stations, launched by CATL's subsidiary, focus on urban core business districts and transportation hubs, reducing battery swap time to just a few minutes [2] - The battery swap network aims to achieve a target of 1,000 stations by the end of 2025, significantly faster than the industry average of over four years for similar milestones [3] Company Developments - A new vehicle, termed the "National Good Car," was announced in collaboration with JD Auto and GAC, set to launch during JD's "Double 11" shopping festival, with 9,449 reservations made within a week [3][4] - JD Auto will serve as the sales channel, GAC will handle production, and CATL's subsidiary will provide new energy operation services, enhancing the integration of battery swap services with vehicle sales [4] Market Trends - The battery swap market for new energy vehicles is projected to grow from 12.433 billion RMB in 2023 to 174.917 billion RMB by 2025, with an expected compound annual growth rate of 190% [4] - The total number of battery swap stations is anticipated to exceed 30,000 by 2025, indicating a rapidly expanding market [4] - The competitive landscape is evolving, with traditional automakers and energy groups forming the first two tiers, while third-party operators are emerging as a significant force in the market [4]

比亚迪“出海舰队”年运力超百万辆

Shen Zhen Shang Bao· 2025-10-21 22:32

Core Insights - On October 19, 1380 BYD electric vehicles were loaded onto the "Changzhou" roll-on/roll-off ship at Xiaomo International Logistics Port, marking a significant step in BYD's expansion into the Brazilian market [2] - Xiaomo Port is becoming a crucial gateway for BYD's global strategy, with plans to export over 14,000 vehicles in October, setting a new monthly record for the port [2] - BYD's global sales reached 3.26 million units from January to September, a year-on-year increase of 18.64%, with overseas markets driving growth [3] Company Developments - BYD has established 11 international roll-on/roll-off shipping routes from Xiaomo Port, covering key regions including Southeast Asia, the Middle East, Europe, and South America [2] - The company has a fleet of ships, including the "Pioneer 1," "Shenzhen," and "Zhengzhou," with a total investment of 5 billion yuan, capable of transporting over 1 million vehicles annually [2] - BYD's overseas sales for the first nine months of the year reached 701,500 units, surpassing the total for the entire year of 2024 [3] Industry Trends - The Shenzhen transportation department is enhancing services at Xiaomo Port to support the growing demand for electric vehicle exports, ensuring efficient operations and zero delays in vehicle loading [4] - Xiaomo Port is undergoing expansion to accommodate increased shipping capacity, with new multi-purpose berths and adjustments to existing facilities to handle two large roll-on/roll-off ships simultaneously [4] - The port's annual capacity is expected to reach 1 million vehicles once the expansion is completed, positioning it as a key player in the automotive export market [4]

卖得更多,赚得更少!江铃汽车三季度净利暴跌

Shen Zhen Shang Bao· 2025-10-21 15:29

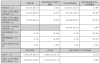

Core Insights - Jiangling Motors reported a decline in revenue and profit for Q3 2025, with operating income of 9.196 billion yuan, down 6.26% year-on-year, and a net profit attributable to shareholders of 16.41 million yuan, down 93.94% [1][2] - The company's net profit excluding non-recurring items showed a loss of 72.93 million yuan, a decrease of 126.67% compared to the previous year, indicating that the core business is in a loss position [1][2] - For the first three quarters of 2025, total revenue was 27.289 billion yuan, a decrease of 1.59%, and net profit attributable to shareholders was 749.13 million yuan, down 35.76% [1][2] Financial Performance - The cash flow from operating activities for the first three quarters decreased by 88.30%, amounting to a net cash flow of 201.90 million yuan, primarily due to a reduction in cash received from sales [2][3] - The basic and diluted earnings per share for Q3 were both 0.02 yuan, reflecting a decline of 93.55% year-on-year [2] - The weighted average return on equity was 0.16%, down 2.49% from the previous year [2] Sales and Market Position - In the first three quarters of 2025, Jiangling Motors sold a total of 260,957 vehicles, an increase of 7.73% year-on-year, including 70,773 light passenger vehicles, 52,726 trucks, 45,404 pickups, and 92,054 SUVs [3] - Despite the increase in sales volume, revenue decreased by 1.59%, indicating that higher sales did not translate into higher income [3] - Accounts receivable increased by 15.36 billion yuan, a rise of 36.75%, primarily due to growth in vehicle export business, which poses a risk of bad debts and consumes significant working capital [3]

汇才代理被吊销业务许可证

Shen Zhen Shang Bao· 2025-10-21 15:16

Core Points - Huicai Insurance Agency (Shenzhen) Co., Ltd. has had its insurance intermediary license revoked by the Shenzhen Financial Regulatory Bureau due to violations of regulatory laws [1][3] - The revocation was based on the agency's refusal to cooperate with regulatory inspections, leading to administrative penalties against both the agency and its responsible personnel [2][3] - The agency was previously under investigation for failing to pay regulatory fees and not providing required insurance documentation, which further contributed to the revocation of its license [5] Summary by Sections License Revocation - The Shenzhen Financial Regulatory Bureau officially revoked the insurance intermediary license of Huicai Insurance Agency on October 16, 2025, citing violations of the Administrative Licensing Law and Insurance Agent Supervision Regulations [1] Administrative Penalties - The agency and its responsible personnel faced administrative penalties for obstructing legal supervision and inspection, resulting in the revocation of the business license and a one-year ban for an individual from entering the insurance industry [3][4] Previous Investigations - Earlier in the year, on March 4, the agency was notified of an investigation for failing to pay the 2023 regulatory fees and not reporting required insurance guarantees, with a deadline set for April 10, 2025, to provide necessary documentation [5]

周大生涉2.11亿元合同纠纷案,最新进展!

Shen Zhen Shang Bao· 2025-10-21 12:22

Core Viewpoint - The court upheld the original ruling in a contract dispute involving Zhou Dasheng, resulting in a compensation of 2.78 million yuan, significantly lower than the plaintiff's claim of 211 million yuan, while the company's financial performance showed a substantial decline in revenue but stable net profit due to improved gross margin [1][2]. Financial Performance - In the first half of 2025, Zhou Dasheng reported a revenue of 4.597 billion yuan, a year-on-year decrease of 43.92% [2]. - The net profit attributable to shareholders was 594 million yuan, reflecting a slight decline of 1.27% year-on-year [2]. - The gross margin increased to 30.34%, up by 11.96 percentage points compared to the same period last year, indicating product structure optimization and pricing benefits from rising gold prices [2]. Revenue Trends - Zhou Dasheng's revenue has experienced a continuous decline for five consecutive quarters from Q2 2024 to Q2 2025, with year-on-year decreases of 20.89%, 40.91%, 18.79%, 47.28%, and 38.47% respectively [2]. Store Operations - As of June 30, 2025, Zhou Dasheng had a total of 4,718 brand terminal stores, including 4,311 franchise stores and 407 self-operated stores [3]. - In the first half of 2025, the company reduced its total number of stores by 494, comprising 32 self-operated stores and 462 franchise stores [3].

“卤味第一股”商誉飙升!“买来的”净利润高增长能否持续?

Shen Zhen Shang Bao· 2025-10-21 07:54

Core Viewpoint - The financial report of Huangshanghuang (002695) for Q3 2025 shows a mixed performance with a slight revenue increase but significant profit growth, largely driven by non-recurring gains from acquisitions and government subsidies [1][3]. Financial Performance Summary - Q3 revenue reached 394.41 million yuan, a year-on-year increase of 0.62% [2] - Net profit attributable to shareholders was 24.11 million yuan, up 34.31% year-on-year [2] - For the first three quarters, revenue totaled 1.38 billion yuan, a decline of 5.08% compared to the previous year [2] - Net profit for the first three quarters was 101.03 million yuan, an increase of 28.59% year-on-year [2] - The company received government subsidies amounting to 14.21 million yuan in Q3, contributing over 14% to net profit [3] Acquisition Impact - In August 2025, the company acquired 51% of Fujian Lixing Food Co., Ltd. for 495 million yuan, which was included in the consolidated financial statements in September [3] - This acquisition significantly contributed to the net profit growth, with a substantial portion of the increase being "bought" through this transaction [3] - Accounts receivable surged by 603.71% to 128 million yuan due to the consolidation of the new subsidiary [3] Financial Position Changes - Prepayments increased by 64.43%, and short-term borrowings rose from 0 to 91.79 million yuan, attributed to the new acquisition [4] - Goodwill skyrocketed from 22.42 million yuan to 335 million yuan, indicating potential future impairment risks [5] - Other payables increased by 154.27% to 320 million yuan, primarily due to installment payments for the equity acquisition [5] Business Growth Challenges - The company has faced ongoing challenges with sluggish growth in its core business, with revenue declining for several consecutive years [7] - Historical revenue figures from 2021 to 2024 show a consistent downward trend, with 2025 Q3 continuing this pattern [8][10] - Despite attempts to expand through acquisitions, the core processed food business remains slow-growing [10]

深深房A控股股东拟减持,或套现3亿元

Shen Zhen Shang Bao· 2025-10-21 07:50

Core Viewpoint - Shenzhen Investment Holdings Co., Ltd., the controlling shareholder of Shenzhen Housing A, plans to reduce its stake by up to 10.12 million shares, representing no more than 1% of the company's total share capital, due to operational needs [1][2]. Group 1: Shareholder Actions - The proposed reduction will occur within three months from November 11, 2025, to February 10, 2026, through centralized bidding [1]. - The total market value of the shares involved in the reduction is approximately 300 million yuan, based on the closing price of 29.53 yuan per share on October 20 [2]. Group 2: Company Financial Performance - For the year 2024, the company reported an operating income of 407 million yuan, a year-on-year decrease of 23.3% [2]. - The net profit attributable to shareholders improved from a loss of 251 million yuan in the previous year to a loss of 177 million yuan, indicating a reduction in losses [2]. - The net profit excluding non-recurring gains and losses also showed improvement, with a loss of 198 million yuan compared to a loss of 268 million yuan in the previous year [2]. - The net operating cash flow was -127 million yuan, a significant decline of 112.2% year-on-year [2]. - In the first half of 2025, the company achieved an operating income of 637 million yuan, a substantial increase of 374.85% [2]. - The net profit attributable to shareholders for the same period was 103 million yuan, reflecting a remarkable growth of 1732.32% [2]. - The net profit excluding non-recurring gains and losses reached 94.35 million yuan, a year-on-year increase of 1915.47% [2].

增值率191%,GQY视讯1750万收购泰亨光电70%股份

Shen Zhen Shang Bao· 2025-10-21 04:28

Core Viewpoint - GQY Vision has acquired a 70% stake in Shenzhen Taiheng Optoelectronics for 17.5 million yuan to enhance its strategic positioning in the large-screen display sector and improve operational efficiency [1][4]. Group 1: Transaction Details - The acquisition involves purchasing shares from shareholders Cha Changchun, Cha Xiaogang, and Gu Yongqiang, with the transaction completed on October 10, 2025 [1]. - The total consideration for the acquisition is 17.5 million yuan, corresponding to 3.5 million shares of Taiheng Optoelectronics [1]. - The transaction was funded using the company's own funds and is not expected to adversely affect its financial status [4]. Group 2: Company Overview - Taiheng Optoelectronics, established in 2014, specializes in the R&D, production, and sales of LED display products, with a registered capital of 5 million yuan [2]. - The company offers a diverse range of LED display products applicable in various sectors, including advertising, stage performances, and education [2]. Group 3: Financial Performance - In 2024, Taiheng Optoelectronics reported audited revenues of 67.93 million yuan and a net profit of 3.23 million yuan [3]. - For the first half of 2025, the company achieved revenues of 34.12 million yuan and a net profit of 4.15 million yuan, surpassing the total revenue of the previous year [2][3]. - As of June 30, 2025, Taiheng Optoelectronics had total assets of 72.54 million yuan, total liabilities of 62.96 million yuan, and a debt-to-asset ratio of 86.8% [2][3]. Group 4: Performance Commitments - The original shareholders have committed to performance targets, ensuring that Taiheng Optoelectronics achieves a minimum revenue of 65 million yuan in 2025 and progressively increasing targets through 2028 [4]. - If the cumulative net profit over three years does not reach 9 million yuan, the sellers must compensate the difference in cash [4].