CHINA TAIPING(00966)

Search documents

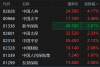

港股内险股集体拉升上涨,中国人寿涨超4%

Mei Ri Jing Ji Xin Wen· 2025-10-21 01:56

Core Viewpoint - The Hong Kong insurance stocks experienced a collective surge, with notable increases in share prices for major companies in the sector [1] Group 1: Stock Performance - China Life Insurance led the gains with an increase of over 4% [1] - China Pacific Insurance rose by 3.5% [1] - New China Life Insurance saw a rise of 2.6% [1] - Other companies such as New China Life, Ping An Insurance, China Pacific Insurance, and AIA Group all recorded increases of over 2% [1]

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]

2024年寿险产品盘点:增额终身寿依然是市场第一名,已经连续三年夺冠,有一款单品超过500亿!

13个精算师· 2025-10-17 11:04

Core Insights - The core viewpoint of the article emphasizes the dominance of whole life insurance products in the market, highlighting their sustained growth in sales and premium income over recent years [2][20][26]. Group 1: Market Trends - In 2024, whole life insurance remains the top-selling product, continuing its three-year streak as the market leader, with one product exceeding 50 billion in premium income [2][20]. - The total premium income for the top five insurance products in the life insurance industry reached 1.22 trillion yuan, accounting for 38.4% of the total original insurance premium income [26][29]. - The concentration of premium income among the top five products has decreased from 48.4% in 2017 to 38.4% in 2024, indicating a trend towards diversification in product offerings [29]. Group 2: Product Performance - The number of whole life insurance products in the top five has increased significantly, with 188 products generating a total premium income of approximately 72.23 billion yuan in 2024 [22]. - The average premium income for whole life insurance products is 38.4 million yuan per product, which is the highest among all product categories [22]. - In 2024, 42 companies reported that their top premium-generating product was whole life insurance, although this number decreased by two companies compared to the previous year [20][24]. Group 3: Cash Flow Metrics - The cash flow payout to income ratio for the top five products in 2024 was 2.3%, a decrease of 0.4 percentage points year-on-year [10][39]. - The average cash flow payout to income ratio for the top seven companies was 2.1%, while smaller companies had an average of 2.4% [10][39]. - Among 323 products with payout amounts, the simple average cash flow payout to income ratio was 3.6%, with a weighted average of 2.3% [41][42].

“旅居养老”催生万亿元级市场,保险机构纷纷布局

Mei Ri Jing Ji Xin Wen· 2025-10-16 23:36

Core Viewpoint - The trend of "travel nursing" is gaining popularity among the elderly in China, reflecting a shift in their lifestyle preferences towards a more engaging and quality life rather than merely "spending their later years" [1][3]. Group 1: Market Trends - The number of healthy elderly individuals in China is expected to exceed 100 million by the end of the 14th Five-Year Plan, making them a significant consumer group in the tourism market [2]. - The travel nursing market is projected to transition from a niche to a mainstream market, entering a rapid development phase due to the increasing elderly population and their evolving needs [2][3]. - By 2035, the market size of China's travel nursing industry could reach 5 trillion yuan, indicating a clear direction towards high growth [3]. Group 2: Policy Support - The Chinese government has issued policies to support the development of the silver economy and travel nursing, including the cultivation of travel nursing destinations and promotional activities [2]. - Local governments are actively promoting the travel nursing industry, with various regions developing new business models such as health and wellness communities [2][3]. Group 3: Insurance Industry Involvement - Several insurance companies, including China Pacific Insurance and Taikang Insurance, have launched travel nursing product lines, often combining insurance products with travel nursing services [4]. - Large and medium-sized insurance companies are leveraging their existing retirement communities to facilitate travel nursing, while smaller companies are utilizing external resources to provide related services [4][5]. Group 4: Advantages and Challenges - Insurance institutions possess a large customer base, strong financial capabilities, and rich risk management experience, making them well-suited for the travel nursing sector [5]. - However, challenges exist, such as the need for standardized services and policy coordination across regions, which may affect operational efficiency [6]. Group 5: Recommendations for Small and Medium-sized Insurers - Small and medium-sized insurers are advised to adopt a cautious and flexible approach, starting with light asset collaborations and focusing on niche markets [7]. - Emphasizing customer experience and building a strong reputation are crucial for success in the travel nursing sector [7].

@保险,重要改革!238家机构,监管大调整

Zheng Quan Shi Bao Wang· 2025-10-16 08:59

Core Viewpoint - The recent adjustment in the regulatory responsibilities of insurance institutions in China indicates a shift towards localized supervision, with a significant increase in the number of insurance entities under local regulatory bodies, while the Financial Regulatory Authority focuses primarily on insurance groups and their subsidiaries [1][2][3]. Group 1: Regulatory Changes - As of June 30, 2025, the number of insurance entities regulated by the Financial Regulatory Authority decreased from 116 to 65, primarily focusing on insurance groups and their subsidiaries [2]. - The adjustment reflects a broader trend of localizing regulatory responsibilities, with local regulatory bodies now overseeing a larger number of insurance institutions [4][5]. - The Financial Regulatory Authority convened a special meeting with local regulatory agencies to discuss these changes [1]. Group 2: Impact on Local Regulatory Bodies - Local regulatory bodies, particularly in major cities like Beijing and Shanghai, have seen a significant increase in the number of insurance entities they oversee, with Beijing's count rising from 24 to 39 and Shanghai's from 24 to 36 [4][5]. - The increase in regulatory responsibilities has led to heightened pressure on local regulatory bodies, necessitating stronger management accountability from insurance company executives [5]. Group 3: Specific Changes in Insurance Institutions - The total number of insurance institutions listed as of June 30, 2025, is 238, a decrease of one from the end of 2024, with notable changes including the removal of Tianan Insurance and the addition of Suzhou Dongwu Insurance [6]. - Several types of insurance institutions, such as insurance asset management companies and health insurance companies, have shifted from being regulated by the Financial Regulatory Authority to local regulatory bodies [6][7]. - A total of 21 out of 35 insurance asset management companies have transitioned to local regulatory oversight, while 14 remain under the Financial Regulatory Authority [7].

申万宏源:投资端亮眼表现有望带动险企25Q3利润超预期

Zhi Tong Cai Jing· 2025-10-16 06:04

Core Viewpoint - The insurance sector in A-shares is expected to see a significant increase in net profit for Q3 2025, driven by strong performance in the equity market, with a projected year-on-year growth of 26.7% to 186.49 billion yuan [1] Group 1: Profit Forecasts - For the first three quarters of 2025, the total net profit of A-share listed insurance companies is expected to grow by 14.3% year-on-year to 364.68 billion yuan, with Q3 alone showing a remarkable growth of 26.7% [1] - New China Life Insurance is projected to have a net profit growth of 54.2% year-on-year, while China Life and China Pacific Insurance are expected to grow by 18.1% and 14.1%, respectively [1] Group 2: New Business Value (NBV) Insights - The expected decline in preset interest rates is anticipated to boost the NBV of listed insurance companies, with New China Life projected to grow by 49.7% year-on-year [2] - The preset interest rate for ordinary life insurance products has been lowered, which is expected to lead to a surge in product demand and support NBV growth [2] Group 3: Property and Casualty Insurance Performance - The property and casualty insurance sector is expected to show continued improvement in the combined ratio (COR) due to a low base effect, with a projected COR of 96.4% for China Property Insurance [3] - The total premium income for property and casualty insurance companies reached 1.22 trillion yuan, reflecting a year-on-year growth of 4.7% [3] Group 4: Investment Environment - The equity market has shown strong performance, with the CSI 300 index increasing by 17.9% in Q3 2025, which is expected to benefit insurance companies that are well-positioned to capitalize on growth opportunities [4] - The long-term interest rates have seen a slight increase, which may exert pressure on certain bond classifications but is overall favorable for the insurance service sector [4] Group 5: Investment Recommendations - The insurance sector is viewed positively, particularly for undervalued companies with strong Q3 performance catalysts, including China Life, New China Life, and China Pacific Insurance [5] - The recommendation emphasizes focusing on low-valuation and high-elasticity stocks within the insurance sector [5]

保险业季度观察报(2025年第1期)

Lian He Zi Xin· 2025-10-13 11:39

Investment Rating - The report indicates a stable investment outlook for the insurance industry, with expectations for continued growth driven by policy support and market demand [5][34]. Core Insights - The insurance industry in China is experiencing stable competition, with significant head effects among leading companies. Premium income from life insurance is the main growth driver, while property insurance is also seeing growth due to rising car insurance revenue and rapid health insurance growth [4][34]. - Investment returns have decreased compared to the previous year due to fluctuations in bond rates and underperformance in equity markets, despite an increase in the scale of funds utilized by insurance companies [4][5]. - The overall solvency of the industry has improved, with a decrease in the number of companies failing to meet solvency standards, although market volatility poses challenges to solvency levels [4][22]. Summary by Sections 1. Industry Overview - In the first half of 2025, the insurance industry maintained a stable competitive landscape, with premium income from life insurance companies growing by 5.38% year-on-year, driven primarily by life insurance business [15][34]. - Property insurance companies also saw a 5.10% increase in premium income, with car insurance revenue rebounding and health insurance growing rapidly [16][34]. 2. Regulatory Environment - The regulatory framework for the insurance industry has tightened, with an increase in the frequency of policy releases aimed at enhancing risk management and promoting high-quality development [8][34]. 3. Financial Performance - As of June 2025, the total assets of the reinsurance industry reached 0.86 trillion yuan, a 3.96% increase from the previous year, although some companies experienced a decline in premium income [18][34]. - The solvency ratios for insurance companies improved, with the comprehensive solvency ratio at 204.5% and core solvency ratio at 147.8% as of June 2025 [22][34]. 4. Investment and Returns - The total investment balance of the insurance industry reached 36.23 trillion yuan, a year-on-year increase of 17.39%, with fixed-income instruments remaining the primary investment category [19][34]. - Investment returns have been affected by market volatility, with a general decline in investment yield compared to the previous year [28][34]. 5. Future Outlook - The insurance industry is expected to continue its stable growth trajectory, supported by favorable policies and increasing market demand, although attention must be paid to potential market fluctuations and regulatory changes [5][34].

非银金融行业周报:继续看好低估值的非银板块-20251012

Shenwan Hongyuan Securities· 2025-10-12 06:12

Investment Rating - The report maintains a "Positive" outlook on the non-bank financial sector [1] Core Views - The report highlights a continuation of strong growth in the brokerage sector, with a significant increase in net profits expected for the first nine months of 2025. Key metrics include a 61% year-on-year increase in new A-share accounts and a 203% increase in average daily stock trading volume in September 2025 [2][5] - The brokerage sector is currently undervalued, with a price-to-book (PB) ratio of 1.48, placing it in the 47.8th percentile over the past decade [2] - The report notes a favorable market environment supporting continued high growth in brokerage performance, with specific recommendations for leading firms and those with strong international business capabilities [2][7] Summary by Sections Market Review - The Shanghai Composite Index rose by 1.47% during the period from September 29 to October 10, 2025, while the non-bank index increased by 3.18%. The brokerage, insurance, and diversified financial sectors reported gains of 4.42%, 0.89%, and 0.52%, respectively [5][6] Non-Bank Sector Insights - The report indicates that the insurance sector is benefiting from the implementation of a "de-involution" policy framework for non-auto insurance, which is expected to improve underwriting profitability for leading firms [2][16] - Specific investment recommendations include firms that are expected to benefit from improved competitive dynamics and those with strong earnings elasticity [2][7] Key Data Tracking - As of October 10, 2025, the average daily trading volume in the stock market was 26,034.09 billion yuan, reflecting an 18.99% increase from the previous period [14][32] - The report also tracks significant metrics such as the balance of margin financing and securities lending, which stood at 24,455.47 billion yuan as of October 9, 2025, marking a 31.2% increase from the end of 2024 [14][39]

大行评级丨高盛:内险股风险回报正在改善 第三季盈利或好过预期

Ge Long Hui· 2025-10-10 05:20

Core Viewpoint - Goldman Sachs reports that domestic insurance stocks have underperformed since the end of July, with average declines of 2% in H-shares and 6% in A-shares, while the Hang Seng Index and CSI 300 Index rose by 8% and 14% respectively. This underperformance is attributed to high valuation levels following a rebound in early April and a weak profit growth outlook due to high base effects in the second half of 2024 [1] Group 1: Performance Analysis - Domestic insurance stocks have seen a decline in stock prices, with H-shares down 2% and A-shares down 6% since late July [1] - The Hang Seng Index and CSI 300 Index have increased by 8% and 14% respectively during the same period [1] - The decline in domestic insurance stocks is linked to high valuation levels and a weak profit growth outlook due to high base effects expected in 2024 [1] Group 2: Earnings Outlook - Goldman Sachs anticipates that the risk-reward profile for domestic insurance stocks is improving, with expectations that third-quarter earnings may exceed forecasts due to stock investment returns [1] - The new business value for next year is expected to achieve double-digit growth, and the profit margin for contract services is projected to reach a growth inflection point [1] Group 3: Company-Specific Projections - Among domestic insurance stocks, China Life is expected to benefit the most from market and yield changes in the third quarter, followed by China Pacific Insurance [1] - New China Life is projected to show the strongest earnings growth, although its book value and solvency ratio may lag behind peers [1] - Goldman Sachs has raised its 2025 earnings forecast for domestic insurance stocks by 2% to 20%, with China Life and New China Life seeing the largest increases of 20% and 19% respectively [1] Group 4: Rating Changes - The rating for China Pacific Insurance has been upgraded from "Neutral" to "Buy" [1] - The rating for China Taiping has been upgraded from "Sell" to "Neutral" [1]

曾长期任职最高检,那艳芳履新中国太平

Xin Jing Bao· 2025-10-04 14:54

Group 1 - China Pacific Insurance Holdings Co., Ltd. announced the appointment of Na Yanfang as an executive director and member of the nomination and remuneration committee, risk management committee, and strategic and investment committee [1] - Na Yanfang currently serves as an executive director of China Pacific Insurance Group Co., Ltd. and China Pacific Insurance Group (Hong Kong) Co., Ltd. [1] Group 2 - Na Yanfang, born in June 1973, is a member of the Communist Party of China with a doctoral degree [3] - She has a long tenure at the Supreme People's Procuratorate, having held positions such as deputy secretary of the party committee, director of the Ninth Procuratorial Division, and director of the Tenth Procuratorial Division [3] - China Pacific Insurance Group Co., Ltd. was founded in 1929 in Shanghai and is recognized as the longest-operating national insurance brand in China [3] - China Pacific Insurance Holdings Co., Ltd. was registered in February 2000 under Hong Kong company regulations and is headquartered in Hong Kong as a financial holding company [3]