CHINFMINING(01258)

Search documents

中国有色矿业(01258.HK):经营业绩保持平稳 多个扩产项目同步推进

Ge Long Hui· 2025-10-28 03:49

Core Viewpoint - The company reported a net profit of approximately 356 million yuan for the first three quarters, representing a year-on-year increase of 13.38%, with a notable decline in Q3 profit compared to Q2 [1] Group 1: Financial Performance - The company achieved a net profit of approximately 123 million, 140 million, and 93 million USD for Q1, Q2, and Q3 respectively, with Q3 showing a quarter-on-quarter decrease of 33.57% [1] - The total copper production from the company's own mines for the first three quarters was approximately 118,100 tons, a year-on-year decrease of 3% [1] Group 2: Mining Operations - The company’s own mines produced approximately 54,200 tons of crude copper and anode copper, a year-on-year decrease of about 6%, while cathode copper production remained stable at approximately 63,900 tons [1] - The production of anode copper from the company's African mines decreased by about 2% to 49,864 tons, primarily due to temporary shutdowns at the Qianbixi Southeast mine [1] Group 3: Future Production Capacity - The company has five mining projects under construction or planning, which are expected to gradually increase annual copper production capacity to approximately 300,000 tons by 2030 [2] - The projects include the Qianbixi wet method Samba copper mine, the new Luansha mine project, and the Gangbof Menza Sa mine project, among others, which collectively have the potential to add 150,000 tons of copper production capacity once fully operational [2] Group 4: Mergers and Acquisitions - The company announced the acquisition of 10.5% of SM Minerals' issued share capital, which will primarily fund technical exploration and development of the Bonkara mining project, containing approximately 1.5 million tons of copper resources [2]

国信证券:维持中国有色矿业(01258)“优于大市”评级 经营业绩保持平稳

智通财经网· 2025-10-27 07:08

Group 1 - The core viewpoint of the report is that Guosen Securities maintains an "outperform" rating for China Nonferrous Mining (01258), projecting revenue growth for 2025-2027 with expected revenues of $3.632 billion, $4.730 billion, and $4.950 billion, reflecting year-on-year growth rates of -4.8%, 30.2%, and 4.7% respectively [1] - The projected net profit attributable to shareholders for the same period is $480 million, $518 million, and $631 million, with year-on-year growth rates of 20.5%, 7.7%, and 21.9% respectively [1] - The diluted EPS is expected to be $0.12, $0.13, and $0.16, with current price-to-earnings ratios of 14.7, 13.7, and 11.2 times [1] Group 2 - In the third quarter, the company reported a net profit attributable to shareholders of approximately $35.6 million, representing a year-on-year increase of 13.38%, with quarterly profits of approximately $12.3 million, $14.0 million, and $9.3 million for Q1, Q2, and Q3 respectively, showing a quarter-on-quarter decrease of 33.57% in Q3 [2] - The company produced approximately 54,200 tons of crude copper and anode copper from its own mines, a year-on-year decrease of about 6%, while the production of cathode copper remained stable at approximately 63,900 tons [2] - The total copper production from the company's own mines for the first three quarters was approximately 118,100 tons, reflecting a year-on-year decrease of about 3% [2] - The company announced in June that it would acquire 10.5% of the issued share capital of SM Minerals through a share subscription, with the funds primarily allocated for technical exploration and development of the Bonkara mining project [2] - The Bonkara North mining rights hold approximately 1.5 million tons of copper metal, providing sufficient resources for large-scale mining operations [2]

国信证券:维持中国有色矿业“优于大市”评级 经营业绩保持平稳

Zhi Tong Cai Jing· 2025-10-27 07:08

Group 1 - The core viewpoint of the report is that Guosen Securities maintains an "outperform" rating for China Nonferrous Mining (01258), projecting revenue growth from 2025 to 2027 with expected revenues of $36.32 billion, $47.30 billion, and $49.50 billion, reflecting year-on-year growth rates of -4.8%, 30.2%, and 4.7% respectively [1] - The projected net profit attributable to shareholders for the same period is $4.80 billion, $5.18 billion, and $6.31 billion, with year-on-year growth rates of 20.5%, 7.7%, and 21.9% respectively [1] - The diluted EPS is expected to be $0.12, $0.13, and $0.16, with current stock prices corresponding to PE ratios of 14.7, 13.7, and 11.2 times [1] Group 2 - The company reported a net profit attributable to shareholders of approximately $3.56 billion for the first three quarters, representing a year-on-year increase of 13.38%, with quarterly profits of approximately $1.23 billion, $1.40 billion, and $0.93 billion for Q1, Q2, and Q3 respectively, showing a quarter-on-quarter decrease of 33.57% in Q3 [2] - The production of copper from the company's own mines was approximately 54,200 tons for crude copper and anode copper, a year-on-year decrease of about 6%, while the production of cathode copper was approximately 63,900 tons, remaining stable year-on-year [2] - The total copper production from the company's own mines for the first three quarters was approximately 118,100 tons, reflecting a year-on-year decrease of about 3% [2] - The company announced in June that it would acquire 10.5% of the issued share capital of SMMinerals through a share subscription, with the subscription price mainly allocated for technical exploration and development of the Bonkara mining project [2] - The Bonkara North mining rights owned by SMMinerals have an estimated copper metal reserve of approximately 1.5 million tons, providing sufficient resources for large-scale mining operations [2]

中国有色矿业现涨逾3% 预估前三季度公司拥有人分占利润同比增长约13%

Xin Lang Cai Jing· 2025-10-27 03:08

Core Viewpoint - China Nonferrous Mining (01258) has seen a stock price increase of 2.91%, reaching HKD 14.50, with a trading volume of HKD 143 million, following the announcement of a projected profit increase for the upcoming financial period [1] Financial Performance - For the nine months ending September 30, 2025, the company estimates a profit attributable to shareholders of approximately USD 356 million, representing a year-on-year growth of about 13% [1] - The primary drivers for this growth are attributed to the rise in international copper prices and an increase in the production and sales volume of cathode copper compared to the previous year [1]

中国有色矿业(01258.HK)涨超3%

Mei Ri Jing Ji Xin Wen· 2025-10-27 03:08

Core Viewpoint - China Nonferrous Mining (01258.HK) has seen a stock price increase of over 3%, currently trading at 14.53 HKD with a transaction volume of 136 million HKD [1] Group 1 - The stock price of China Nonferrous Mining rose by 3.12% [1] - The current trading price is 14.53 HKD [1] - The total transaction volume reached 136 million HKD [1]

港股异动 | 中国有色矿业(01258)涨超3% 预估前三季度公司拥有人分占利润同比增长约13%

智通财经网· 2025-10-27 02:56

Core Viewpoint - China Nonferrous Mining (01258) shares rose over 3%, reaching HKD 14.53 with a trading volume of HKD 136 million, following the announcement of a projected profit increase for the nine months ending September 30, 2025 [1] Financial Performance - The company estimates a profit attributable to shareholders of approximately USD 356 million, representing a year-on-year growth of about 13% [1] - The increase in economic indicators is primarily driven by the rise in international copper prices and an increase in cathode copper production and sales [1] Production Metrics - For the nine months ending September 30, 2025, the company produced approximately 107,700 tons of cathode copper (including copper product processing services), a year-on-year increase of about 12%, achieving 77% of the annual production target [1] - The production of cathode copper from its own mines was approximately 63,900 tons, remaining stable compared to the same period last year [1] - The total production of crude copper and anode copper (including copper product processing services) was approximately 307,600 tons, a year-on-year increase of about 7%, also achieving 77% of the annual production target [1] - The production of crude copper and anode copper from its own mines was approximately 54,200 tons, a year-on-year decrease of about 6% [1] - The company produced approximately 788,300 tons of sulfuric acid, a year-on-year increase of about 2%, completing 79% of the annual production target [1] - The production of cobalt hydroxide (containing cobalt) was approximately 676 tons, a year-on-year decrease of about 12%, achieving 75% of the annual production target [1] - The production of liquid sulfur dioxide was approximately 1,442 tons, a significant year-on-year decrease of about 90%, completing only 14% of the annual production target [1]

港股异动丨铜业股大涨 中国大冶有色金属涨超14% 中国有色矿业涨5.3%

Ge Long Hui· 2025-10-27 02:17

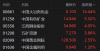

Group 1 - The core viewpoint of the article highlights a significant rise in Hong Kong copper stocks, driven by a surge in copper prices, which reached a historical high of $11,035 per ton on the London Metal Exchange (LME) [1] - Copper prices have increased by approximately 25% this year, recovering from a sharp sell-off triggered by the escalation of the trade war in April [1] - Supply challenges have become a focal point for investors, particularly due to the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia following a landslide [1] Group 2 - Citigroup's recent research report indicates that global manufacturing sentiment remains mixed, and cyclical demand growth continues to face pressure [1] - Data from Citigroup shows that copper consumption growth in August was weak, rising only 1.3% year-on-year, which is below the strong performance driven by the solar industry in the first half of the year [1] - The bank anticipates that copper consumption growth will remain moderate for the remainder of the year, but maintains a positive outlook for copper prices, predicting they will rise to $12,000 per ton by the second quarter of next year [1] Group 3 - Notable stock performances include China Daye Non-Ferrous Metals rising over 14%, China Nonferrous Mining up 5.3%, Jiangxi Copper and Minmetals Resources increasing by 4%, China Gold International rising by 2.5%, and China Metal Resources up by 1.2% [1]

国信证券晨会纪要-20251027

Guoxin Securities· 2025-10-27 01:41

Group 1: Company Analysis - The report highlights the strong performance of Dongfang Caifu (300059.SZ), with a revenue of 11.589 billion yuan for the first three quarters of 2025, representing a year-on-year increase of 58.7%, and a net profit attributable to shareholders of 9.097 billion yuan, up 50.6% year-on-year [9][10] - The company's return on equity (ROE) stands at 10.74%, an increase of 2.60 percentage points compared to the previous year [9] - The significant growth in the company's securities business, particularly in brokerage and margin financing, is attributed to the active trading environment in the capital market since Q4 2024 [9][10] Group 2: Industry Insights - The report discusses the recovery of the fund distribution business, noting that Dongfang Caifu's fund distribution scale is leading in the industry, with a total of 1.0572 trillion yuan in fund sales for the first half of 2025 [11] - The report emphasizes the resilience of the export market, with a surprising export growth rate of 6.6% in Q3 2025, indicating a robust recovery despite expectations of a decline [15] - The media industry is identified as having a favorable seasonal effect, particularly in November, suggesting a good opportunity for investment in this sector [33]

中国有色矿业(01258):经营业绩保持平稳,多个扩产项目同步推进

Guoxin Securities· 2025-10-26 09:10

Investment Rating - The report maintains an "Outperform" rating for the company [4][6][25]. Core Views - The company has shown stable operational performance with a year-on-year increase in net profit of approximately 13.38% for the first three quarters, amounting to about 356 million USD [1][9]. - The company is actively pursuing expansion projects, with five mining projects under construction or planning, which are expected to gradually increase annual copper production capacity to approximately 300,000 tons by 2030 [2][22][23]. - The company is also engaged in external acquisitions, including a recent purchase of 10.5% of SM Minerals to support the development of the Bonkara mining project, which has significant copper reserves [2][24]. Summary by Sections Financial Performance - For the first three quarters, the company produced approximately 118,100 tons of copper, a decrease of about 3% year-on-year, with specific production figures for different types of copper [1][12]. - The projected revenues for 2025-2027 are 3.632 billion, 4.730 billion, and 4.950 billion USD, with year-on-year growth rates of -4.8%, 30.2%, and 4.7% respectively [4][25]. - The expected net profits for the same period are 480 million, 518 million, and 631 million USD, with growth rates of 20.5%, 7.7%, and 21.9% respectively [4][25]. Production Capacity and Projects - The company has five key mining projects that are expected to enhance copper production capacity significantly, including the Chambishi Wet Method Samba Copper Mine and the new Luanshya Mine project [2][23]. - The company aims to achieve an annual copper production of 300,000 tons by 2030, with a compound annual growth rate of approximately 10% [2][23]. Market Position and Strategy - The company is recognized as a leading copper producer with a strong focus on resource development in Zambia and the Democratic Republic of Congo [22]. - The company’s self-owned mines have a stable production cost structure, allowing it to benefit from rising copper prices [23].

中国有色矿业(01258.HK):10月24日南向资金增持331.5万股

Sou Hu Cai Jing· 2025-10-24 22:53

Core Insights - Southbound funds increased their holdings in China Nonferrous Mining (01258.HK) by 3.315 million shares on October 24, 2025, marking a 0.56% increase in total holdings [1][2] - Over the past 5 trading days, there were 3 days of net reductions totaling 11.876 million shares, while in the last 20 trading days, there were 10 days of net increases totaling 1.0858 million shares [1][2] - As of now, southbound funds hold 594 million shares of China Nonferrous Mining, representing 15.2% of the company's total issued ordinary shares [1] Summary by Category Shareholding Changes - On October 24, 2025, total shares held reached 594 million, with an increase of 3.315 million shares [2] - On October 23, 2025, total shares held were 590 million, with an increase of 3.711 million shares [2] - On October 22, 2025, total shares held were 587 million, with a decrease of 7.842 million shares [2] - On October 21, 2025, total shares held were 594 million, with a decrease of 6.303 million shares [2] - On October 20, 2025, total shares held were 601 million, with a decrease of 4.757 million shares [2] Company Overview - China Nonferrous Mining Co., Ltd. primarily engages in the exploration, mining, and processing of copper and cobalt metals [2] - The company operates two segments: the hydrometallurgy segment, which produces and sells cathode copper and cobalt hydroxide, and the smelting segment, which produces and sells crude copper and anode copper [2]