INNOVENT BIO(01801)

Search documents

港股通(深)净卖出13.53亿港元

Zheng Quan Shi Bao Wang· 2025-10-21 13:39

Core Points - The Hang Seng Index rose by 0.65% to close at 26,027.55 points on October 21, with a net inflow of HKD 1.171 billion from southbound funds through the Stock Connect [1] - The total trading volume for the Stock Connect on the same day was HKD 126.489 billion, with a net buy of HKD 1.171 billion [1] - In the Shanghai Stock Connect, the trading volume was HKD 80.647 billion with a net buy of HKD 2.524 billion, while the Shenzhen Stock Connect had a trading volume of HKD 45.843 billion with a net sell of HKD 1.353 billion [1] Trading Activity - The most actively traded stock in the Shanghai Stock Connect was Alibaba-W, with a trading volume of HKD 6.587 billion, followed by SMIC and Pop Mart, with trading volumes of HKD 4.678 billion and HKD 4.097 billion, respectively [1] - In terms of net buying, Pop Mart led with a net inflow of HKD 0.683 billion, despite its stock price dropping by 8.08% [1] - Alibaba-W had the highest net sell amount of HKD 0.133 billion, while its stock price increased by 1.98% [1] Shenzhen Stock Connect Activity - In the Shenzhen Stock Connect, Alibaba-W also topped the trading volume with HKD 3.743 billion, followed by SMIC and Pop Mart with HKD 3.127 billion and HKD 1.800 billion, respectively [2] - Pop Mart again had the highest net buy amount of HKD 0.438 billion, despite a closing price drop of 8.08% [2] - The stock with the largest net sell was the Tracker Fund of Hong Kong, with a net sell of HKD 1.102 billion, while its stock price rose by 0.68% [2]

智通港股通活跃成交|10月21日

智通财经网· 2025-10-21 11:03

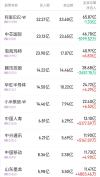

Group 1 - On October 21, 2025, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) ranked as the top three companies by trading volume in the Southbound Stock Connect, with transaction amounts of 6.587 billion, 4.678 billion, and 4.097 billion respectively [1] - In the Southbound Stock Connect for the Shenzhen-Hong Kong Stock Connect, Alibaba-W (09988), SMIC (00981), and Pop Mart (09992) also held the top three positions, with transaction amounts of 3.743 billion, 3.127 billion, and 1.800 billion respectively [1] Group 2 - In the Southbound Stock Connect, the top active trading companies included Alibaba-W (09988) with a transaction amount of 6.587 billion and a net buy of -0.133 billion, SMIC (00981) with 4.678 billion and a net buy of -51.9952 million, and Pop Mart (09992) with 4.097 billion and a net buy of +683 million [2] - For the Shenzhen-Hong Kong Stock Connect, the top active trading companies were Alibaba-W (09988) with a transaction amount of 3.743 billion and a net buy of -0.296 billion, SMIC (00981) with 3.127 billion and a net buy of +180 million, and Pop Mart (09992) with 1.800 billion and a net buy of +438 million [2]

南向资金重现净买入!机构称短期调整不改牛市格局

Xin Lang Cai Jing· 2025-10-21 10:22

Market Overview - The Hong Kong stock market continues its upward trend, with the Hang Seng Index rising by 0.65%, the Hang Seng Tech Index increasing by 1.26%, and the Hang Seng China Enterprises Index up by 0.76%, indicating a broad market rally with 1,315 stocks rising and 883 falling [1] - Southbound funds recorded a net purchase of HKD 1.171 billion on a single day, signaling renewed buying interest after a brief outflow [4] Stock Performance - The most favored stocks included Pop Mart, Xiaomi Group-W, and Hua Hong Semiconductor, which saw net purchases of HKD 1.121 billion, HKD 0.481 billion, and HKD 0.441 billion, respectively [4] - Conversely, the iShares Asia 50 ETF, Alibaba-W, and Innovent Biologics experienced varying degrees of net selling, with net sales of HKD 1.102 billion, HKD 4.3 billion, and HKD 0.78 billion, respectively [5] Future Outlook - According to Guotai Junan, historical data suggests that minor pullbacks in the Hong Kong market often occur after profit-taking following market rallies, with the Hang Seng Index typically declining by an average of 7% over 11 trading days [6] - The report emphasizes that short-term fluctuations do not alter the medium-term positive trend, with the technology sector remaining the main investment focus amid an upward industrial cycle and increased capital inflow [6] - Guoyuan International highlights that the primary external uncertainty remains the US-China rivalry, which could impact investor sentiment and lead to short-term market volatility, but there is a significant likelihood that the Hang Seng Index will return to an upward trajectory [6]

北水动向|北水成交净买入11.71亿 泡泡玛特盘后发布盈喜 北水全天抢筹超11亿港元

Zhi Tong Cai Jing· 2025-10-21 10:02

Core Insights - The Hong Kong stock market saw a net inflow of 11.71 billion HKD from northbound trading on October 21, with a net buy of 25.24 billion HKD from the Shanghai Stock Connect and a net sell of 13.53 billion HKD from the Shenzhen Stock Connect [1] Group 1: Stock Performance - The most bought stocks included Pop Mart (09992), Xiaomi Group-W (01810), and Hua Hong Semiconductor (01347) [1] - The most sold stocks included the Tracker Fund of Hong Kong (02800), Alibaba Group-W (09988), and Innovent Biologics (01801) [1] Group 2: Individual Stock Details - Pop Mart (09992) received a net buy of 11.2 billion HKD, with projected revenue growth of 245%-250% year-on-year for Q3 2025 [4] - Xiaomi Group-W (01810) had a net buy of 4.81 billion HKD, with the company repurchasing 10.7 million shares at prices between 45.9 and 46.76 HKD [5] - Hua Hong Semiconductor (01347) saw a net buy of 4.29 billion HKD, supported by positive sentiment around the semiconductor sector driven by AI [5] - China Mobile (00941) received a net buy of 1.77 billion HKD, reporting Q3 service revenue of 216.2 billion HKD, a 0.8% year-on-year increase [5] - China Life (02628) had a net buy of 517.7 million HKD, with expected net profit growth of 50% to 70% year-on-year for the first three quarters [6] Group 3: Market Sentiment - The Tracker Fund of Hong Kong (02800) experienced a net sell of 11.02 billion HKD, attributed to increased market volatility and high valuations of global risk assets [6] - Tencent (00700), Innovent Biologics (01801), and Alibaba Group-W (09988) faced net sells of 318.7 million, 776.4 million, and 4.29 billion HKD respectively [7]

南向资金 | 泡泡玛特获净买入11.21亿港元

Di Yi Cai Jing· 2025-10-21 10:00

(本文来自第一财经) 南向资金今日净买入11.71亿港元。其中泡泡玛特、小米集团-W、华虹半导体净买入额位列前三,分别 获净买入11.21亿港元、4.81亿港元、4.41亿港元。净卖出方面,盈富基金、阿里巴巴-W、信达生物分别 遭净卖出11.02亿港元、4.3亿港元、0.78亿港元。 ...

中国人寿近一个月首次上榜港股通成交活跃榜

Zheng Quan Shi Bao Wang· 2025-10-20 14:41

Core Viewpoint - On October 20, China Life made its first appearance on the Hong Kong Stock Connect active trading list in nearly a month, with a trading volume of 10.41 billion HKD and a net buying amount of 1.37 billion HKD, closing up 2.44% [1] Trading Activity Summary - The total trading volume of active stocks on the Hong Kong Stock Connect on October 20 was 369.37 billion HKD, accounting for 33.62% of the day's total trading amount, with a net selling amount of 21.97 billion HKD [1] - Alibaba-W led the trading volume with 96.98 billion HKD, followed by SMIC and Tencent Holdings with trading amounts of 53.97 billion HKD and 44.91 billion HKD, respectively [1] Frequent Trading Stocks - The stocks that appeared most frequently on the active trading list over the past month were Alibaba-W and Huahong Semiconductor, each appearing 15 times, indicating strong interest from Hong Kong Stock Connect funds [1] - China Life's recent appearance marks its first in nearly a month, highlighting a potential shift in investor interest [1] Individual Stock Performance - Tencent Holdings had a trading amount of 44.91 billion HKD with a net buying amount of 0.97 billion HKD, closing up 3.21% [1] - SMIC recorded a trading amount of 53.97 billion HKD with a net selling amount of 3.25 billion HKD, closing up 3.91% [1] - Alibaba-W had a significant trading amount of 96.98 billion HKD but faced a net selling amount of 17.54 billion HKD, closing up 4.86% [1] - China Life's trading amount was 10.41 billion HKD with a net buying amount of 1.37 billion HKD, closing at 23.520 HKD, up 2.44% [1]

10月20日南向资金净卖出26.70亿港元

Zheng Quan Shi Bao Wang· 2025-10-20 14:32

Group 1 - The Hang Seng Index rose by 2.42% to close at 25,858.83 points on October 20, with a total net sell of 2.67 billion HKD through the southbound trading channel [1] - The total trading volume for the southbound trading on October 20 was 109.87 billion HKD, with a net sell of 2.67 billion HKD [1] - The Shanghai Stock Exchange's southbound trading had a total trading volume of 66.81 billion HKD, resulting in a net sell of 2.29 billion HKD, while the Shenzhen Stock Exchange's southbound trading had a volume of 43.05 billion HKD with a net sell of 0.38 billion HKD [1] Group 2 - In the top ten active stocks for the Shanghai Stock Exchange's southbound trading, Alibaba-W had the highest trading volume at 5.79 billion HKD, followed by SMIC and Tencent Holdings with trading volumes of 3.23 billion HKD and 2.93 billion HKD respectively [2] - In terms of net buying, China National Offshore Oil Corporation had the highest net buy amount of 0.146 billion HKD, with its stock price increasing by 2.31% [2] - Alibaba-W recorded the highest net sell amount of 1.205 billion HKD, while its stock price still rose by 4.86% [2]

港股创新药ETF(159567)跌0.46%,成交额9.07亿元

Xin Lang Cai Jing· 2025-10-20 10:03

Core Insights - The Hong Kong Innovative Drug ETF (159567) closed down 0.46% on October 20, with a trading volume of 907 million yuan [1] - The fund was established on January 3, 2024, with an annual management fee of 0.50% and a custody fee of 0.10% [1] - As of October 17, 2024, the fund's shares totaled 8.134 billion, with a total size of 6.968 billion yuan, reflecting a significant increase in both shares and size compared to the previous year [1] Fund Performance - The fund has seen a remarkable increase of 1957.27% in shares and 1744.35% in size since December 31, 2023 [1] - The fund's cumulative trading amount over the last 20 trading days reached 27.487 billion yuan, with an average daily trading amount of 1.374 billion yuan [1] - Year-to-date, the cumulative trading amount is 224.063 billion yuan, averaging 1.173 billion yuan per day over 191 trading days [1] Fund Management - The current fund manager is Ma Jun, who has managed the fund since its inception, achieving a return of 71.34% during the management period [2] - The fund's top holdings include companies such as Innovent Biologics, WuXi Biologics, BeiGene, and others, with significant percentages of the portfolio allocated to these stocks [2]

信达生物与中国创新药的十年突围

新财富· 2025-10-20 08:46

Core Viewpoint - The article discusses the journey of Innovent Biologics, highlighting its transformation from a startup in a borrowed lab to a significant player in the Chinese biopharmaceutical industry, emphasizing the importance of innovation and accessibility in drug development [6][11]. Group 1: Company Background and Mission - In 2011, Dr. Yu Dechao founded Innovent Biologics with the mission to develop high-quality biopharmaceuticals that are affordable for the public [7][8]. - The company emerged during a time when China's innovative drug development was in its infancy, with most companies focusing on generic drugs [10][11]. Group 2: Early Challenges and Strategic Direction - Innovent faced significant challenges in its early days, operating without its own facilities and relying on borrowed resources, yet managed to complete preclinical research for its first drug, IBI301, in just 12 months [13][15]. - A strategic meeting in 2012 established two key goals: to develop a product line of innovative biopharmaceuticals meeting international standards and to build a compliant production base [15][16]. Group 3: Collaboration with Eli Lilly - Innovent sought partnerships with international pharmaceutical companies, notably Eli Lilly, to validate its systems and processes [18][19]. - After receiving critical feedback from Eli Lilly regarding its production standards, Innovent undertook a rigorous 18-month overhaul of its quality management system, successfully meeting international standards [23][25]. Group 4: Financing and IPO Journey - Innovent's early financing was challenging due to skepticism about the viability of innovative drugs in China, but it secured significant investments from forward-thinking institutions [27][28]. - A pivotal moment came in 2015 when Innovent signed a strategic cooperation agreement with Eli Lilly, which included a $33 billion collaboration, significantly enhancing its credibility in the international market [28][29]. Group 5: Product Launch and Market Impact - In December 2018, Innovent's PD-1 inhibitor, IBI301 (brand name: Tyvyt), was approved, marking a significant milestone as one of the first domestically developed PD-1 inhibitors in China [38][39]. - The pricing strategy for Tyvyt aimed to make it accessible, with annual treatment costs reduced to under 100,000 yuan, allowing for broader patient access [40][41]. Group 6: International Expansion and Challenges - Following domestic success, Innovent began international expansion efforts, including a partnership with Eli Lilly to promote Tyvyt outside China [46][47]. - Despite facing setbacks, such as the FDA's rejection of Tyvyt's application due to insufficient international clinical data, Innovent continues to pursue global market opportunities [49][50]. Group 7: Ongoing Commitment to Innovation - Innovent's journey reflects a broader commitment to making innovative drugs accessible, with ongoing efforts to expand into chronic disease areas and maintain a focus on original innovation [56][57]. - The establishment of the "Guoqing Institute" symbolizes Innovent's dedication to advancing from following innovation to leading it, aiming to create groundbreaking therapies [57][58].

智通港股通持股解析|10月20日

智通财经网· 2025-10-20 00:32

Core Insights - The top three companies by Hong Kong Stock Connect holding ratios are China Telecom (70.56%), COSCO Shipping Energy (69.91%), and GCL-Poly Energy (69.65%) [1][2] - Xiaomi Group-W, Meituan-W, and Pop Mart have seen the largest increases in holding amounts over the last five trading days, with increases of +1.967 billion, +1.692 billion, and +1.514 billion respectively [1][2] - The companies with the largest decreases in holding amounts over the same period include Innovent Biologics (-2.053 billion), SMIC (-1.978 billion), and Alibaba-W (-1.651 billion) [1][2] Hong Kong Stock Connect Latest Holding Ratios - China Telecom (00728): 9.793 billion shares, 70.56% holding ratio [1] - COSCO Shipping Energy (01138): 906 million shares, 69.91% holding ratio [1] - GCL-Poly Energy (01330): 282 million shares, 69.65% holding ratio [1] - China Shenhua (01088): 2.284 billion shares, 67.62% holding ratio [1] - Kaisa Group (01108): 168 million shares, 67.37% holding ratio [1] Recent Increases in Holdings (Last 5 Trading Days) - Xiaomi Group-W (01810): +1.967 billion, +42.788 million shares [1] - Meituan-W (03690): +1.692 billion, +17.904 million shares [1] - Pop Mart (09992): +1.514 billion, +5.498 million shares [1] - China Mobile (00941): +1.438 billion, +16.863 million shares [1] - Huahong Semiconductor (01347): +1.434 billion, +18.918 million shares [1] Recent Decreases in Holdings (Last 5 Trading Days) - Innovent Biologics (01801): -2.053 billion, -23.641 million shares [2] - SMIC (00981): -1.978 billion, -28.625 million shares [2] - Alibaba-W (09988): -1.651 billion, -10.691 million shares [2] - Tencent Holdings (00700): -1.475 billion, -2.426 million shares [2] - Yingfu Fund (02800): -1.259 billion, -48.701 million shares [2]