PING AN OF CHINA(02318)

Search documents

中国平安旗下深圳北医康复医院开业,汇聚领军专家、打造六大康复专科 “保险+康复+养老”深度协同

Quan Jing Wang· 2025-11-01 08:50

Core Viewpoint - The opening of Shenzhen Beida Rehabilitation Hospital marks a significant step for Ping An in enhancing healthcare services in the Greater Bay Area, aligning with the national strategy of building a healthy China and advancing the company's medical and elderly care strategy [4][19]. Group 1: Hospital Overview - Shenzhen Beida Rehabilitation Hospital, operated by Beida Medical Group under Ping An, officially opened in Bao'an District, Shenzhen, with a total construction area of nearly 30,000 square meters and 301 approved beds [1]. - The hospital is expected to handle an annual patient volume of up to 100,000, providing comprehensive rehabilitation services from acute to chronic care [1]. Group 2: Service Features - The hospital aims to provide high-quality rehabilitation services by leveraging a "family-style service + AI empowerment" model, ensuring a full-cycle service from pre-hospital to post-hospital care [4][8]. - It will feature a multi-specialty rehabilitation treatment matrix, including six major rehabilitation specialties, and plans to establish expert studios in collaboration with top hospitals for remote diagnosis [13]. Group 3: Technological Integration - The hospital will incorporate advanced technologies into its operations, including exoskeleton robots and 3D posture analysis systems, to enhance rehabilitation services [13]. - A focus on smart rehabilitation will drive the hospital's development, integrating cutting-edge technology into diagnosis, service, and management processes [6]. Group 4: Strategic Collaboration - Shenzhen Beida Rehabilitation Hospital will collaborate with Ping An's insurance, medical, and elderly care services to create an innovative "insurance + rehabilitation + elderly care" model [14]. - The hospital is set to integrate with Ping An Health Insurance's high-end medical direct payment system, facilitating a seamless payment experience for patients [17]. Group 5: Market Positioning - The hospital is positioned as a benchmark for professional rehabilitation medical services in the Greater Bay Area, aiming to meet the increasing demand for high-quality rehabilitation resources [10][8]. - As part of Ping An's broader healthcare ecosystem, the hospital will contribute to the integration of healthcare and elderly care services, enhancing the overall quality of care in the region [19].

中国平安的前世今生:营收8329.4亿行业居首,净利润1550.67亿仅次于国寿

Xin Lang Zheng Quan· 2025-10-31 14:28

Core Viewpoint - China Ping An is a leading comprehensive financial group in China, primarily focused on insurance, and has shown strong performance in revenue and net profit in the industry [1][2]. Business Performance - In Q3 2025, China Ping An achieved an operating revenue of 832.94 billion yuan, ranking first in the industry, significantly higher than the industry average of 474.8 billion yuan and the median of 520.99 billion yuan [2]. - The net profit for the same period was 155.07 billion yuan, ranking second in the industry, above the industry average of 93.65 billion yuan and the median of 63.40 billion yuan [2]. Financial Ratios - As of Q3 2025, China Ping An's debt-to-asset ratio was 89.94%, slightly up from 89.79% year-on-year and above the industry average of 88.71% [3]. - The gross profit margin was 21.84%, an increase from 20.52% year-on-year but still below the industry average of 23.85% [3]. Executive Compensation - Chairman Ma Mingzhe's compensation for 2024 was 6.0997 million yuan, a slight decrease from 6.0998 million yuan in 2023 [4]. - General Manager Xie Yonglin's compensation for 2024 was 6.7116 million yuan, an increase from 6.7066 million yuan in 2023 [4]. Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 12.89% to 692,100, while the average number of circulating A-shares held per shareholder increased by 13.70% to 15,400 [5]. - The top ten circulating shareholders included Hong Kong Central Clearing Limited and Huaxia SSE 50 ETF, with notable decreases in their holdings [5]. Business Highlights - The new business value (NBV) for life and health insurance grew by 46.2% year-on-year to 35.724 billion yuan in the first three quarters of 2025, with a quarterly increase of 58.3% [5][6]. - Property insurance premium income increased by 7.1% year-on-year to 256.247 billion yuan [5][6]. - The non-annualized comprehensive investment return rate improved to 5.4%, up by 1.0 percentage point year-on-year [5][6].

中国平安(601318):2025年三季报点评:Q3单季寿险NBV和净利润均增长强劲

HUAXI Securities· 2025-10-31 13:12

Investment Rating - The investment rating for the company is "Buy" [1] Core Insights - The company reported strong growth in both new business value (NBV) and net profit for Q3 2025, with NBV increasing by 46.2% year-on-year to 35.724 billion yuan and net profit rising by 45.4% year-on-year [2][3] - The overall business performance is stable, with core operations showing high-quality development, particularly in the life insurance sector [6] Summary by Sections Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 832.94 billion yuan, a year-on-year increase of 7.4%, and a net profit attributable to shareholders of 132.856 billion yuan, up 11.5% year-on-year [2] - The operating profit for the same period was 116.264 billion yuan, reflecting a 7.2% year-on-year growth [2] - The company's net assets at the end of the period were 986.406 billion yuan, an increase of 6.2% from the beginning of the year [2] Life and Health Insurance - The NBV for life and health insurance business grew significantly, with a year-on-year increase of 46.2% to 35.724 billion yuan, and a quarterly increase of 58.3% [3] - The first-year premium income for the first three quarters increased by 2.3% year-on-year, while Q3 saw a 21.1% increase [3] - The agent channel contributed significantly to NBV, with a year-on-year increase of 23.3% [3] Property and Casualty Insurance - The company’s property and casualty insurance premium income rose by 7.1% year-on-year to 256.247 billion yuan [4] - The combined ratio improved by 0.8 percentage points year-on-year to 97.0%, although it increased from 95.2% in the first half of the year [4] Investment Performance - The company’s investment portfolio achieved a non-annualized net investment return of 2.8%, a decrease of 0.3 percentage points year-on-year, while the overall investment return increased by 1.0 percentage points to 5.4% [5] - As of September 30, 2025, the investment portfolio size exceeded 6.41 trillion yuan, an increase of 11.9% from the beginning of the year [5] Earnings Forecast and Valuation - The revenue forecast for 2025 has been adjusted to 1,054.039 billion yuan, up from a previous estimate of 1,035.9 billion yuan [6] - The net profit forecast for 2025 has been raised to 138.458 billion yuan, compared to the previous estimate of 127.3 billion yuan [6] - The estimated earnings per share (EPS) for 2025 is now projected at 7.60 yuan, an increase from the previous estimate of 6.99 yuan [6]

中国平安三季度业绩飙涨,战略升级重构金融生态

Di Yi Cai Jing· 2025-10-31 11:30

Core Insights - China Ping An reported strong Q3 results with a 15.2% increase in operating profit and a 45.4% increase in net profit attributable to shareholders [1][2] - The company's stock price rose by 2.06% on October 29, reflecting market satisfaction with its performance, with a year-to-date increase of 17.1% [1][2] Financial Performance - For the first three quarters of the year, China Ping An achieved revenue of 901.67 billion yuan, a year-on-year increase of 4.6% [2] - Operating profit attributable to shareholders reached 116.26 billion yuan, up 7.2%, while net profit attributable to shareholders was 132.86 billion yuan, growing by 11.5% [2] - The Q3 operating profit saw a significant increase of 15.2%, and net profit surged by 45.4% compared to the same period last year [2] New Business Value (NBV) Growth - The NBV for Ping An's life insurance business grew by 46.2% year-on-year in the first three quarters of 2025 [2] - The growth was primarily driven by a substantial increase in multi-channel distribution, with the bancassurance channel's NBV rising by 170.9% [2] - The number of agents decreased by 2.5% to 354,000, but productivity improved, with per capita NBV increasing by 29.9% [2] Investment Performance - The investment portfolio of Ping An achieved a non-annualized comprehensive investment return of 5.4%, an increase of 1.0 percentage points year-on-year [3] - The company capitalized on rising equity markets to enhance its equity allocation, ensuring stable long-term investment returns [3] Healthcare and Elderly Care Strategy - The healthcare and elderly care services were emphasized in the report, with the term "service" mentioned 86 times, highlighting its importance [4] - As of September 30, 2025, Ping An had over 87,000 paying clients in its healthcare and elderly care sectors [5] - The company has established a comprehensive service network, including partnerships with over 50,000 doctors and more than 37,000 hospitals in China [5] Unique Business Model - Ping An's approach combines elements of e-commerce and standardized service delivery, creating a unique business model in the insurance sector [4][6] - The company has expanded its elderly care services to cover 85 cities, with nearly 240,000 clients receiving home care services [6] - The integration of financial, technological, and healthcare services positions Ping An as an ecosystem service provider rather than a traditional financial institution [7]

“三省”为“道”,AI为“术”:“AI in All”背后,中国平安重新定义服务边际 沈安蓓

Di Yi Cai Jing· 2025-10-31 11:30

Core Insights - China Ping An's Q3 report highlights strong growth momentum, exceptional new business value, and significant investment performance, attracting industry attention [1] - The construction of an AI moat is also a key highlight, as the financial industry undergoes transformative changes in the AI era, enhancing service efficiency and customer experience [1] Group 1: Service Transformation - The insurance industry has faced challenges in maintaining frequent interactions with customers, leading to a shift from a low-frequency model to embedding services within the protection chain, creating new competitive barriers [2] - China Ping An has prioritized service alongside product innovation since its inception, upgrading its "Three Savings" concept to a top priority for the entire group, integrating it with a dual strategy of comprehensive finance and healthcare [2] Group 2: AI Integration - AI is becoming the core technology driving the "Three Savings" service philosophy, with a goal of transforming the entire value chain in finance and healthcare by 2025 [3] - The implementation of AI has led to significant operational efficiencies, such as achieving 94% instant underwriting for life insurance policies and handling over 12.92 billion AI service interactions [3][4] Group 3: Data Advantage - China Ping An possesses a vast database of 30 trillion bytes, covering nearly 250 million individual customers, which serves as a critical foundation for AI value creation [4] - The company has accumulated over 3.2 trillion high-quality text data, 310,000 hours of annotated voice data, and over 7.5 billion image data, enhancing its AI model training capabilities [4] Group 4: Service Scenarios - AI is integrated into various service scenarios, such as the "111 Rapid Compensation" service for life insurance, which allows for quick claims processing with minimal human intervention [7] - In property insurance, AI streamlines the claims process for minor accidents, significantly improving customer experience and reducing operational costs [7] Group 5: Predictive Service - The goal of AI is to transition from reactive to proactive service, anticipating customer needs before they arise, exemplified by the "Eagle Eye System" for disaster risk management [9] - This proactive approach not only enhances customer experience but also transforms service from a cost center to a value creation center, benefiting both customers and the company [10]

合赚4260亿,五大上市险企三季报详细解读

Xin Lang Cai Jing· 2025-10-31 10:49

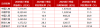

Core Insights - The five major listed insurance companies in China reported a total operating income of 23,739.81 billion RMB for the first three quarters of 2025, representing a 13.6% increase compared to the same period in 2024. The net profit reached 4,260.39 billion RMB, a year-on-year growth of 33.54% [1][3] Group 1: Company Performance - China Life Insurance maintained its leading position in the life insurance sector with a premium growth of 25.9%, achieving a net profit of 1,678.04 billion RMB, up 60.5% [3][4] - Ping An Insurance reported an operating income of 8,329.40 billion RMB, with a net profit of 1,328.56 billion RMB, reflecting an 11.5% increase [3][4] - China Pacific Insurance achieved a net profit of 457 billion RMB, a growth of 19.3%, with an operating income of 3,449.04 billion RMB [3][4] - New China Life Insurance saw a significant net profit increase of 58.0%, totaling 328.57 billion RMB, with a premium growth of 28.3% [3][4] - China Property & Casualty Insurance reported a net profit of 468.22 billion RMB, up 28.9%, with an operating income of 5,209.90 billion RMB [3][4] Group 2: Premium Growth and Channels - The life insurance sector is experiencing a recovery, with total premiums and new business premiums showing double-digit growth across multiple companies [4][6] - China Life achieved total premiums of 6,696.45 billion RMB, a 10.1% increase, with renewal premiums growing by 10.0% [4][6] - New China Life reported a 59.8% increase in first-year premiums for long-term insurance [4][6] - The bancassurance channel has become a significant growth driver, with China Pacific Insurance's bancassurance premiums reaching 583.10 billion RMB, up 63.3% [6][7] Group 3: Investment Performance - All five companies highlighted significant increases in investment income as a key driver of profit growth, benefiting from a recovering capital market [10][11] - China Life's total investment income reached 3,685.51 billion RMB, a 41.0% increase, with an investment return rate of 6.42% [10][11] - Ping An's investment portfolio exceeded 6.41 trillion RMB, with a non-annualized comprehensive investment return rate of 5.4% [10][11] - China Property & Casualty Insurance reported total investment income of 862.50 billion RMB, a 35.3% increase [10][11] Group 4: Asset Growth - The total assets of the five major insurance companies reached 27.82 trillion RMB, an 8.3% increase from the end of 2024 [12][13] - Ping An's total assets amounted to 13.65 trillion RMB, a 5.3% increase, while China Life's total assets reached 7.42 trillion RMB, growing by 9.6% [12][13]

平安固收:2025年10月托管月报:预计11-12月供给平稳,保险配置维持强劲-20251031

Ping An Securities· 2025-10-31 09:32

1. Report Industry Investment Rating - Not provided in the content 2. Core Viewpoints of the Report - In September 2025, the new bond custody scale was 1.1 trillion yuan, the lowest level of the year, with the year - on - year growth rate of bond custody balance at 14.2%, down 0.75 percentage points from August. Government bonds and credit bonds were the main supply forces, while inter - bank certificates of deposit were weak. Banks and insurance institutions increased their bond holdings, while non - legal person products decreased theirs. It is expected that from November to December, the net financing scale of national debt and special bonds will be 1.0 trillion yuan and 930 billion yuan respectively, with a relatively stable supply. Banks are expected to maintain a neutral to slightly strong bond - allocation level, insurance institutions are expected to maintain a strong bond - allocation level, and the buying power of asset management accounts is expected to increase [3][4]. 3. Summary According to Relevant Catalogs 3.1 Bond Custody Scale in September 2025 - The year - on - year growth rate of bond custody balance was 14.2%, down 0.75 percentage points from August. The new custody scale in September was 1.1 trillion yuan, the lowest of the year, and about 0.9 trillion yuan less than the same period last year [3][4]. 3.2 Bond Supply by Type - Government bonds, credit bonds were the main supply forces, while inter - bank certificates of deposit were weak. National debt, local government bonds, and corporate credit bonds increased by 13.72 billion yuan, 3.08 billion yuan, and 30.23 billion yuan more than the seasonal level respectively. Policy - financial bonds and inter - bank certificates of deposit had net financing significantly lower than the seasonal level. Policy - financial bonds increased 13.43 billion yuan less than the seasonal level, possibly due to the concentrated financing of 500 billion yuan in new policy - financial instruments in August. Inter - bank certificates of deposit increased 74.79 billion yuan less than the seasonal level, continuing the weak trend [3][7]. - The new supply of national debt in September was 761.2 billion yuan, and that of local bonds was 455.1 billion yuan, both decreasing month - on - month. The total of the two was 1.2 trillion yuan, a year - on - year decrease of 351.9 billion yuan [11]. - In September, the net supply of inter - bank certificates of deposit was - 40.75 billion yuan, and that of financial bonds was 1.71 billion yuan, both further declining from August. The net supply of corporate credit bonds was 26.93 billion yuan, an increase of 11.58 billion yuan month - on - month, mainly supported by central enterprise credit bonds [17]. 3.3 Bond - Buying Behavior by Institution - Banks and insurance institutions increased their bond holdings, while non - legal person products and foreign investors decreased theirs. In September, banks increased their bond holdings by 981.2 billion yuan (considering repurchase), and the proportion of the increase in bank bond - holding scale to the new government bond custody scale was 68%, at a historically low level. Insurance institutions increased their bond holdings by 252.8 billion yuan, 124.2 billion yuan more than the seasonal level, mainly increasing their holdings of local government bonds and credit bonds. Asset management accounts decreased their bond holdings by 236.6 billion yuan, 331.3 billion yuan less than the seasonal level, mainly reducing their holdings of credit bonds, inter - bank certificates of deposit, and financial bonds. Foreign investors decreased their bond holdings by 44.9 billion yuan, 15.2 billion yuan less than the seasonal level, mainly reducing their holdings of inter - bank certificates of deposit. Securities firms increased their bond holdings by 22.7 billion yuan, 35.8 billion yuan less than the seasonal level, mainly increasing their holdings of local government bonds [3][20][34]. 3.4 Outlook for Bond Supply and Institutional Behavior - Bond supply: It is expected that from November to December, the net financing scale of national debt and special bonds will be 1.0 trillion yuan and 930 billion yuan, with a relatively stable supply [3][40]. - Banks: Considering the restart of the central bank's bond - buying and the still - low loan growth rate, it is expected that banks will maintain a neutral to slightly strong bond - allocation level [3][42]. - Insurance institutions: With sufficient premiums and the return of yields to an attractive level for allocation, it is expected that insurance institutions will maintain a strong bond - allocation level [3][44]. - Asset management accounts: With the return of the liability side and the warming of the bond market, the buying power is expected to increase. However, the liability side of funds may still be affected by the potential negative impact of the new public fund fee regulations, and the fund redemption situation needs to be observed [3][47].

中国平安跌1.40%,成交额33.31亿元,近3日主力净流入-1.47亿

Xin Lang Cai Jing· 2025-10-31 07:25

Core Viewpoint - China Ping An's stock price decreased by 1.40% on October 31, with a trading volume of 3.33 billion yuan and a market capitalization of 1,047.17 billion yuan [1] Group 1: Dividend and Shareholder Information - The dividend yields for China Ping An over the past three years were 5.15%, 6.03%, and 4.84% [2] - As of September 30, 2025, China Ping An has distributed a total of 391.90 billion yuan in dividends since its A-share listing, with 134.54 billion yuan distributed in the last three years [7] - The top ten circulating shareholders include Central Huijin Asset Management and China Securities Finance Corporation [2] Group 2: Business Overview - China Ping An, established on March 21, 1988, and listed on March 1, 2007, is headquartered in Shenzhen, Guangdong Province, and offers diversified financial services including insurance, banking, securities, and trust [6] - The revenue composition of China Ping An is as follows: life and health insurance 45.76%, property insurance 34.46%, banking 13.87%, asset management 5.27%, and financial empowerment 3.85% [6] Group 3: Financial Performance - For the period from January to September 2025, China Ping An reported a net profit attributable to shareholders of 132.86 billion yuan, representing a year-on-year growth of 11.47% [6] - The average trading cost of shares is 51.63 yuan, with the stock price currently near a support level of 57.74 yuan [5] Group 4: Market Activity - The net inflow of funds today was 59.65 million yuan, accounting for 0.02% of the total, with no significant trend in the main capital flow [3] - Over the past 20 days, the main capital inflow has been 415.69 million yuan, indicating a lack of control by major shareholders and a dispersed distribution of shares [4]

平安产险董事长龙泉: 人工智能重塑保险价值链 |金融街论坛聚焦

Sou Hu Cai Jing· 2025-10-31 05:43

Core Viewpoint - The current advancements in artificial intelligence (AI) are significantly reshaping the global technological landscape and fundamentally altering the value creation logic within the financial and insurance sectors [1][3]. Group 1: AI Application and Development - The company has entered the 3.0 phase of large-scale AI application, achieving 100% coverage of core scenarios in five key areas: marketing, service, operations, management, and business [3]. - The digital transformation strategy of the company consists of three stages: online, data-driven, and intelligent, with the company entering the intelligent phase in 2021 [3]. - The company has implemented over 1,000 sub-business scenarios and has a team of more than 350 algorithm engineers, supported by a scalable AI architecture that allows for rapid integration of new large models within a week [3]. Group 2: AI Safety Governance - The company emphasizes AI safety governance, establishing a comprehensive system that includes application safety, data security, model algorithm safety, and compliance operations to ensure AI applications are "safe, reliable, and controllable" [3]. Group 3: AI Empowering Financial Productivity - In the smart service domain, the company developed the "Eagle Eye" system, which integrates over 100 risk models to enhance digital risk reduction capabilities, providing services for various projects along the Belt and Road Initiative [4]. - During the "14th Five-Year Plan" period, the Eagle Eye system issued 162,000 intelligent disaster warnings and sent out 47 billion warning messages, covering 130 million customers [4]. Group 4: Operational Efficiency and Fraud Prevention - The company has automated 90% of new car insurance policy operations using AI, reducing the average processing time from 6 minutes to 1.2 minutes, significantly decreasing customer wait times [6]. - In the area of fraud prevention, the company has established a digital risk control system that enhances the accuracy and efficiency of fraud detection, with a cumulative interception amount of 11.9 billion yuan in 2024 [6].

朝阳监管分局同意中国平安朝阳中心支公司建平营销服务部变更营业场所

Jin Tou Wang· 2025-10-31 03:33

Core Viewpoint - The National Financial Supervision Administration's Chaoyang Regulatory Branch has approved the relocation of China Ping An Life Insurance Co., Ltd.'s Chaoyang Center Branch's Jianping Marketing Service Department to a new address [1] Group 1 - The new business location for the Jianping Marketing Service Department is specified as: No. 01018 and No. 01028, Building D1, Xingu Community, Yebaishou Street Office, Jianping County, Chaoyang City [1] - China Ping An Life Insurance Co., Ltd. is required to handle the change and obtain the necessary permits in accordance with relevant regulations [1]