POP MART(09992)

Search documents

景区 LABUBU带火泡泡玛特乐园

Bei Jing Shang Bao· 2025-10-30 14:17

Core Insights - The influx of international tourists to Beijing's attractions has increased, with cultural heritage sites like the Forbidden City and the Great Wall remaining top destinations [1][3][4] - The Beijing Universal Resort has gained popularity among foreign visitors, showcasing a blend of international and local appeal [6][7] - The rise of the Pop Mart City Park, featuring popular IPs like LABUBU, has emerged as a significant attraction for young international tourists [12][13] Group 1: Tourist Preferences and Trends - International tourists are increasingly interested in deep cultural experiences rather than just sightseeing, seeking to understand the historical significance of sites like the Great Wall [4] - The popularity of night tours and unique cultural activities, such as intangible cultural heritage performances, is growing among inbound tourists [1][4] - The Forbidden City and the Great Wall continue to hold a central position in attracting global visitors, despite the emergence of new attractions [4] Group 2: Popular Attractions - The Forbidden City, Mutianyu Great Wall, and Badaling Great Wall are consistently ranked among the top attractions for inbound tourists [3] - The Beijing Universal Resort has been recognized as a top destination, appealing to both Western and Southeast Asian tourists [6][7] - Pop Mart City Park has rapidly climbed the ranks to become the sixth most popular attraction for inbound tourists, reflecting a shift towards modern and trendy experiences [12][13]

泡泡玛特全球首家24小时营业门店落地卡塔尔

Bei Jing Shang Bao· 2025-10-30 12:17

Core Insights - Pop Mart has officially opened its first store in the Middle East at Hamad International Airport in Doha, Qatar, marking its first 24/7 operational store globally [2] - The store features a design that incorporates Middle Eastern architectural elements and covers an area of approximately 100 square meters [2] - A travel-exclusive product line called "Starry People Wonderful Journey Series" has been launched, including items like card holders, U-shaped plush toys, and portable storage bags, along with a limited-edition blanket as a gift [2] - The COO of Pop Mart International Group highlighted the cultural richness and youthful consumer power of the Middle East, positioning the store as a space for cultural exchange and emotional connection [2] - As of now, Pop Mart has opened over 570 physical stores worldwide, with its IP products becoming increasingly popular as travel souvenirs among global tourists [2]

泡泡玛特全球首家24小时门店落地卡塔尔多哈机场

Bei Jing Shang Bao· 2025-10-30 12:15

Core Insights - Pop Mart has opened its first 24-hour store in the Middle East at Hamad International Airport in Doha, Qatar, marking its first global store operating 24/7 [1] - The store features a design that incorporates Middle Eastern architectural elements and covers an area of approximately 100 square meters [1] - A travel-exclusive product line called "Starry People Wonderful Journey Series" has been launched, including items like card holders, U-shaped travel pillows, and portable storage bags, along with a limited-edition blanket as a gift [1] - The COO of Pop Mart International Group emphasized the cultural richness and youthful consumer base in the Middle East, positioning the store as a space for cultural exchange and emotional connection [1] - Pop Mart has over 570 physical stores globally, with its IP products becoming popular as travel souvenirs among tourists [1]

大摩:泡泡玛特(09992)策略聚焦增长可持续性 明年销售增长转向更为正面

Zhi Tong Cai Jing· 2025-10-30 09:44

Core Viewpoint - Morgan Stanley has a positive outlook on Pop Mart's sales growth until 2026, indicating that the company has not fully unleashed its growth potential by 2025 [1] Group 1: Sales Growth and Strategy - The company is focusing on business quality and sustainable growth through tactical adjustments [1] - The pre-order drive for Labubu has led to better-than-expected performance in Q3 2025 [1] - The company has resumed its spot sales model to better manage product life cycles and promote repeat customer growth [1] Group 2: Future Expectations - Management anticipates strong sales performance in Q4 due to more festive occasions and a robust product reserve [1] - Offline sales in the U.S. continue to grow, supported by a diversified IP portfolio and high store efficiency [1] - The company plans to open more high-traffic flagship stores between 2026 and 2027 [1] Group 3: Online Sales and Product Launches - U.S. online sales may experience temporary impacts due to reduced pre-sale activities [1] - The introduction of new products from top IPs is expected to accelerate growth quickly [1]

泡泡玛特中东首店落地多哈!旅游场景门店成出海布局核心方向

Nan Fang Du Shi Bao· 2025-10-30 08:52

Core Insights - Pop Mart has officially entered the Middle East market with its first store opening at Hamad International Airport in Doha, Qatar, which is also its first 24/7 operational store globally targeting international travelers [2] - The company aims to accelerate its globalization strategy, focusing on travel retail as a core direction for expansion, with plans to open more stores in tourist cities and airports worldwide [2] - Pop Mart has opened over 570 physical stores globally, including locations in Bali, Vietnam, France, and Singapore, positioning its IP products as popular travel souvenirs [2] Financial Performance - In the first half of the year, Pop Mart's overseas revenue reached 5.59 billion yuan, marking a year-on-year increase of 437.5%, significantly outpacing the 135.2% growth in its Chinese business [2] - Overseas business now accounts for 40.3% of total revenue, narrowing the gap with the Chinese business, which holds a 59.7% share [2] - For the third quarter, overseas revenue is projected to grow by 365%-370%, compared to a 185%-190% increase in the Chinese market [3] - The Americas region showed the highest growth rate, with revenue increasing by 1265%-1270%, followed by Europe and other regions at 735%-740%, and the Asia-Pacific region at 170%-175% [3]

泡泡玛特中东首店盛大开业!全球首家24小时营业门店提供更多陪伴

Zheng Quan Shi Bao Wang· 2025-10-30 06:20

Core Insights - The opening of the first store in the Middle East at Hamad International Airport in Doha marks a significant milestone for Pop Mart, being the first 24/7 operational store globally, aimed at providing warmth and companionship to travelers from around the world [1][2] Group 1: Store Features and Offerings - The Doha store is strategically located in the airport's security area near gate C18, covering approximately 100 square meters, and incorporates Middle Eastern architectural elements in its design [2] - A travel-exclusive product line, "Starry People’s Wonderful Journey Series," was launched at the Doha store, featuring items like card holders, U-shaped plush toys, portable storage bags, and crossbody bags, designed to enhance the travel experience [2] - A Qatar-exclusive blanket, featuring traditional patterns and colors, is offered as a gift with purchase, merging local culture with practicality [2] Group 2: Market Strategy and Expansion - The opening of the Middle East store is part of Pop Mart's broader strategy to explore new travel consumption scenarios and deepen its global market presence, particularly in travel retail [3] - The Middle East market is identified as having significant growth potential due to its unique regional position and hub advantages, with plans for further expansion into major tourist cities and airports worldwide [3] - As of now, Pop Mart has over 570 physical stores globally, with recent openings in Bali, Vietnam, France, and Singapore, which have become popular tourist destinations [3] Group 3: Brand Vision - Pop Mart is committed to enhancing the shopping experience by focusing on joy and beauty, with plans to continue expanding into iconic global landmarks and tourist attractions [4]

【前瞻分析】2025年中国潮玩盲盒行业需求驱动因素及消费者心理分析

Sou Hu Cai Jing· 2025-10-30 03:22

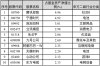

Core Insights - The rise of the Z generation is driving demand for trendy blind boxes, as they seek products that align with their values and provide emotional connections [2][4] - The Chinese government is implementing a regulatory framework for the trendy blind box industry, focusing on consumer protection and promoting cultural integration [7][9] Group 1: Industry Overview - Major listed companies in the trendy blind box sector include Pop Mart (09992.HK), Miniso (09896.HK), Aofei Entertainment (002292.SZ), Gaole Shares (002348.SZ), and Yuanlong Yatu (002878.SZ) [1] - The trendy blind box market is characterized by a blend of emotional companionship, nostalgia, and investment value, appealing to consumers' desire for unique designs and surprise elements [4] Group 2: Consumer Behavior - The Z generation, as internet natives, values individual expression, social recognition, and emotional connections, making trendy toys a significant part of their social currency [2] - The psychological aspects of trendy blind box consumption include emotional attachment, collection desire, and the thrill of surprise, which enhance the overall consumer experience [4] Group 3: Government Policies - The 2023 "Guidelines for Blind Box Business Conduct (Trial)" establishes a comprehensive regulatory framework for the industry, emphasizing the prohibition of illegal sales and the protection of minors [7] - The government is encouraging the integration of trendy toys with intangible cultural heritage and tourism, with initiatives like a 1 billion yuan IP overseas expansion fund aimed at increasing international revenue [7][9] Group 4: Regional Development - Various provinces and cities in China are adopting measures to promote the trendy blind box industry, including market regulation, cultural empowerment, and consumer rights protection [12]

泡泡玛特中东首店开业,首次推行24小时营业模式

Xin Lang Ke Ji· 2025-10-30 03:18

Core Insights - The opening of the first store in the Middle East at Hamad International Airport in Doha marks a significant milestone for Pop Mart, being the first 24/7 operational store globally [1][3] - The store aims to serve as a cultural exchange and joyful sharing hub for travelers, reflecting the company's confidence in the Middle Eastern market [3] Company Expansion - Pop Mart's strategy includes expanding into travel retail as a core direction for global growth, with plans to enter more tourist cities and airports worldwide [3] - The company has opened over 570 physical stores globally to date, indicating a robust expansion strategy [3]

智通ADR统计 | 10月30日

智通财经网· 2025-10-29 22:26

Market Overview - The Hang Seng Index (HSI) closed at 26,606.21, up by 260.07 points or 0.99% on October 29, 2023 [1] - The index reached a high of 26,714.82 and a low of 26,434.77 during the trading session, with a trading volume of 42.127 million [1] Major Blue-Chip Stocks Performance - HSBC Holdings closed at HKD 109.551, an increase of 2.87% compared to the previous close [2] - Tencent Holdings closed at HKD 655.070, up by 1.56% from the previous close [2] ADR Performance - Tencent Holdings (ADR) traded at USD 655.070, reflecting an increase of 1.56% compared to its Hong Kong stock price [3] - Alibaba Group (ADR) showed a price of USD 174.812, up by 2.23% compared to its Hong Kong stock price [3] - HSBC (ADR) was priced at USD 109.551, which is 2.87% higher than its Hong Kong counterpart [3]

泉果基金孙伟:消费复苏需观察政策实施力度,三季度增配新消费与锂电

Sou Hu Cai Jing· 2025-10-29 09:20

Core Insights - The report from the "泉果消费机遇" fund indicates a significant growth in fund size, reaching 695 million yuan by the end of Q3 2025, up from 61.93 million yuan in Q2 2025, reflecting increasing recognition from investors, including institutions [1][2] - The fund's net value performance shows a 33.00% increase over the past year, outperforming the benchmark of 3.69% [1] Fund Performance and Market Context - The fund has gained favor among institutional investors, with 2.856 million shares held, accounting for 4.96% of total shares [2] - In Q3 2025, major stock indices performed well, with the Shanghai Composite Index rising by 12.73%, Shenzhen Component Index by 29.25%, CSI 300 by 17.90%, and Hang Seng Index by 11.56% [2] - Economic indicators showed steady growth, with industrial added value increasing by 5.7% and 5.2% in July and August respectively, and retail sales growing by 3.7% and 3.4% in the same months [2] Portfolio Adjustments - The fund manager, Sun Wei, indicated a slight increase in equity positions and adjustments in the portfolio structure, focusing on new consumption and lithium battery sectors [3] - The fund increased allocations in personal care, trendy toys, and gaming industries while reducing exposure in closely related sectors [3] - The top ten holdings account for 30.12% of the fund's net asset value, with Tencent Holdings, CATL, and Pop Mart among the largest positions [5] Investment Strategy - As of Q3 2025, the fund's stock position constituted 79.01% of its net assets, with a 24.77% allocation to Hong Kong stocks, showing stability compared to the previous quarter [4][3] - New entries in the top ten holdings include Pop Mart, Alibaba-W, and Tianqi Lithium, while previous holdings like Yanjing Beer and Li Auto have exited the list [3][5]