EVE(300014)

Search documents

储能推动电池新一轮周期,电池材料景气度上行

Xinda Securities· 2025-11-02 12:03

Investment Rating - The industry investment rating is "Positive" [2] Core Viewpoints - The new lithium battery cycle is driven by energy storage, with significant demand expected from 2025 to 2027, particularly a 50% growth in energy storage demand in 2026 [3] - The core material segments lack supply elasticity, with slow capacity expansion due to environmental regulations and high energy consumption [3] - Battery materials are beginning to show price elasticity, with expectations of a price uptrend in segments like lithium hexafluorophosphate and iron lithium [3] Summary by Sections Demand - The new lithium battery cycle is driven by energy storage, with historical cycles previously driven by policy and electric vehicle pricing [3] - The expected demand growth for energy storage is significant, with a forecasted 50% increase in 2026 [3] Supply Elasticity - Key materials such as lithium hexafluorophosphate, iron lithium, and anode materials face slow capacity expansion due to environmental concerns and high energy requirements [3] Pricing - Battery materials are entering a price uptrend, with expected utilization rates for various segments in 2026 indicating a tight balance in the industry [3] Investment Recommendations - The report suggests focusing on companies such as CATL, Yiwei Lithium Energy, Tianci Materials, and others that are well-positioned to benefit from the energy storage demand cycle [4]

2025进博会 | 虹桥论坛储能分论坛特邀报告嘉宾:亿纬储能总裁陈翔

中关村储能产业技术联盟· 2025-11-02 05:43

Core Viewpoint - The upcoming 8th Hongqiao International Economic Forum will focus on "Promoting High-Quality Development of New Energy Storage to Facilitate Global Energy Transition" and will feature a significant guest, Chen Xiang, Senior Vice President of EVE Energy Co., Ltd., who will present a report on the synergy between lithium battery technology and global carbon neutrality [2][6]. Forum Information - The forum is organized by the National Energy Administration and the Ministry of Commerce, and it will take place on November 5, 2025, at the National Exhibition and Convention Center in Shanghai [6][7]. - The forum aims to create a high-end storage "ecosystem" by inviting global experts from government, industry, academia, and finance to discuss breakthroughs in storage technology, business model exploration, policy incentives, and international cooperation [7]. Guest Profile - Chen Xiang holds a master's degree from Huazhong University of Science and Technology and has over 20 years of experience in the network energy and storage sectors. He specializes in the design of storage systems based on lithium battery technology and has a deep understanding of the storage industry [5]. Agenda Highlights - The forum will feature a keynote speech by Song Hongkun, Deputy Director of the National Energy Administration, focusing on the development of new energy storage and its role in building a new power system [9].

固态电池“水火相融”:尾部拱火与头部降温、资本炒作与瓶颈待破

Jing Ji Guan Cha Bao· 2025-11-01 05:01

Core Viewpoint - Solid-state batteries are gaining significant attention in the market, with many companies announcing advancements and plans for mass production, but industry experts caution that true commercialization will take time and patience [2][3][7]. Industry Developments - Numerous automotive and battery companies, including Chery Automobile and Guoxuan High-Tech, have recently announced new solid-state battery developments or plans for pilot production lines [2][4]. - The solid-state battery sector has seen a surge in activity, with companies like Aoxin Technology and Huizhou Huasheng announcing plans for production lines and capacity expansion [4][6]. Technological Advancements - Tsinghua University and the Chinese Academy of Sciences have made breakthroughs in solid-state battery materials, enhancing safety, energy density, and lifespan [3]. - Companies like XINWANDA and Guoxuan High-Tech have reported high energy densities for their solid-state batteries, with XINWANDA achieving 400Wh/kg and Guoxuan High-Tech reaching 600Wh/kg [4][9]. Market Trends - The solid-state battery sector has experienced a dramatic increase in stock prices, with the sector index rising from 1200 points in April to 2426 points by October, indicating strong investor interest [6]. - Many lesser-known companies are entering the solid-state battery market, with significant investments being made in production facilities [6]. Expert Opinions - Industry experts express skepticism about the rapid commercialization of solid-state batteries, emphasizing that many claims are misleading and that the technology remains largely in the experimental phase [3][7]. - Leading battery manufacturers like CATL and BYD maintain a cautious stance, predicting that mass production of solid-state batteries may not occur until 2027 or later [7][8]. Challenges and Limitations - Solid-state batteries face significant technical challenges, including slow charge/discharge rates and high production costs, which hinder their commercialization [10][12]. - The current production yield for solid-state batteries is low, with laboratory yields at 60%-70% and pilot line yields dropping to 40%-50% [13]. Financial Performance - Companies involved in solid-state battery development, such as Guoxuan High-Tech and Aoxin Technology, have reported mixed financial results, with some experiencing significant losses despite high revenue growth [16][17]. - The financial health of these companies raises questions about their ability to sustain solid-state battery development without substantial external funding [16][17].

固态电池“水火相融”:尾部拱火与头部降温、资本炒作与瓶颈待破

经济观察报· 2025-11-01 05:00

Core Viewpoint - Solid-state batteries, regarded as the "holy grail" of lithium batteries, are gaining significant attention in the market, with many companies announcing breakthroughs and plans for mass production. However, industry experts caution that true commercialization will require time and patience [1][2][3]. Group 1: Industry Developments - Numerous automotive and battery companies, including Chery Automobile and Guoxuan High-Tech, have recently announced advancements in solid-state battery technology, signaling a potential shift from laboratory to mass production [2][5]. - Significant technical breakthroughs have been reported, such as Tsinghua University and the Chinese Academy of Sciences developing new materials that enhance safety, energy density, and lifespan of solid-state batteries [5]. - Companies like Xinwanda and Chery have announced impressive energy densities for their solid-state batteries, with Chery's reaching 600Wh/kg and Xinwanda's at 400Wh/kg, indicating a competitive landscape [5][10]. Group 2: Market Sentiment and Investment - The solid-state battery sector has seen a surge in capital market interest, with the A-share index for solid-state batteries nearly doubling from 1200 points in April to 2426 points in October [7]. - Many lesser-known companies are entering the solid-state battery market, with significant investments announced for production facilities, indicating a rush to capitalize on the emerging technology [7][8]. - Despite the hype, industry insiders express skepticism about the sustainability of this trend, noting that many companies promoting solid-state batteries are struggling in the traditional lithium-ion battery market [16][18]. Group 3: Challenges and Realities - Experts highlight that solid-state batteries remain largely in the experimental phase, with true mass production still several years away. The consensus among leading battery manufacturers is that 2027 may be the earliest for small-scale production [9][10]. - Technical challenges, such as slow charge-discharge rates and high production costs, continue to hinder the commercialization of solid-state batteries. Current production yields are significantly lower than those of traditional lithium-ion batteries [14][18]. - The cost of materials for solid-state batteries is substantially higher than for conventional batteries, with estimates suggesting that the cost could be five to ten times greater, complicating the path to mass adoption [14][18]. Group 4: Application Scenarios - Initial applications for solid-state batteries may not be in the automotive sector but rather in energy storage and low-altitude drones, where high energy density and safety are prioritized over cost [18]. - Companies are exploring various applications for solid-state batteries, with some focusing on sectors like robotics and aviation, which can validate technology without the immediate pressure of cost constraints [18].

超3700股上涨,锂电概念爆发,中际旭创、天孚通信跌超8%

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 07:49

Market Overview - On October 31, the A-share market experienced fluctuations, with the Shanghai Composite Index falling by 0.81%, the Shenzhen Component Index by 1.14%, and the ChiNext Index by 2.31% [1][2] - The total market turnover reached 2.35 trillion yuan, with over 3,700 stocks rising [1] Sector Performance - The pharmaceutical sector saw collective gains, with stocks like Lianhuan Pharmaceutical and Sanofi China hitting the daily limit [3] - The liquor concept stocks surged in the afternoon, with Zhongrui Co. achieving two consecutive limit-ups [3] - The film and television sector was active, with Bona Film Group hitting the daily limit [3] - The AI application concept stocks also rose against the trend, with Rongxin Culture and Fushik Holdings both hitting the daily limit [3] Battery Sector Highlights - The battery sector showed strong performance on October 31, with Haike New Energy hitting the daily limit and Lijia Technology rising over 13% [5] - Several lithium battery companies reported impressive Q3 earnings, with Penghui Energy achieving a revenue of 3.28 billion yuan, up 74.96% year-on-year, and a net profit of 203 million yuan, up 977.24% [5] - Ganfeng Lithium reported a revenue of 6.249 billion yuan, up 44.10%, and a net profit of 557 million yuan, up 364.02% [5] - Tianqi Lithium's net profit reached 95.49 million yuan, up 119.26% year-on-year [5] Stock Price Analysis - As of October 30, stocks like Xianhui Technology, Zhenyu Technology, and Huabao New Energy showed the largest potential upside to their target prices, while popular stocks like CATL and Yiwei Lithium Energy still had over 10% upside potential [5] Optical Module Sector - The optical module sector faced a significant pullback, with major players like NewEase, Zhongji Xuchuang, and Tianfu Communication experiencing declines of 7.94% to 8.14% [14] - Despite strong demand in the optical module market, these companies reported a decline in Q3 revenue compared to Q2, attributed to changes in customer order patterns and procurement pressures [14][15] - Analysts remain optimistic about the long-term prospects of the optical communication industry, predicting a shift from "order acquisition" to "delivery capability" as the key competitive factor by 2026 [15]

亿纬锂能股价涨5.17%,浙商证券资管旗下1只基金重仓,持有2.27万股浮盈赚取9.83万元

Xin Lang Cai Jing· 2025-10-31 03:03

Core Viewpoint - EVE Energy Co., Ltd. has seen a significant stock price increase, with a 5.17% rise on October 31, reaching 88.13 CNY per share, and a total market capitalization of 180.29 billion CNY, reflecting a cumulative increase of 8.99% over three days [1] Company Overview - EVE Energy, established on December 24, 2001, and listed on October 30, 2009, is located in Huizhou, Guangdong Province. The company specializes in the research, production, and sales of consumer batteries (including lithium primary batteries, small lithium-ion batteries, and ternary cylindrical batteries) and power batteries (including electric vehicle batteries and energy storage batteries) [1] - The revenue composition of EVE Energy is as follows: power batteries account for 45.26%, energy storage batteries 36.56%, consumer batteries 18.03%, and others 0.16% [1] Fund Holdings - According to data, a fund under Zheshang Securities Asset Management holds a significant position in EVE Energy. The Zheshang Huijin Transformation Growth Fund (000935) held 22,700 shares in the third quarter, representing 3.99% of the fund's net value, making it the fifth-largest holding. The fund has realized a floating profit of approximately 98,300 CNY today and 156,900 CNY during the three-day increase [2] - The Zheshang Huijin Transformation Growth Fund was established on December 30, 2014, with a current size of 51.79 million CNY. Year-to-date returns stand at 44.4%, ranking 1559 out of 8154 in its category, while the one-year return is 37.82%, ranking 1979 out of 8046 [2]

瞄准“十五五”碳达峰目标!六氟磷酸锂价格翻倍+储能需求爆发,绿色能源ETF盘中涨逾1.4%,刷新阶段高点

Xin Lang Ji Jin· 2025-10-31 02:53

Group 1 - Over 12.3 billion in main funds flowed into the power equipment sector, making it the top sector among 31 Shenwan primary industries [1] - The only ETF tracking the green energy index saw a peak increase of over 1.4% before dropping 0.38%, reaching a high not seen since February 2023 [1] - Key stocks such as Enjie, Yongxing Materials, and New Zoubang saw significant gains, with New Zoubang rising over 11% and Beiterui increasing by more than 9% [1] Group 2 - The "14th Five-Year Plan" emphasizes accelerating the construction of a new energy system and achieving carbon peak by 2030, with leading companies like CATL and Sungrow expected to benefit [3] - The photovoltaic industry is entering a critical bottom phase, with expectations for a new era led by major players, focusing on supply control and enhancing global competitiveness [3] - Lithium hexafluorophosphate prices have doubled from under 50,000 yuan/ton in August to 105,000 yuan/ton by October 30, impacting pricing strategies for electrolyte products [3] Group 3 - Dongwu Securities highlights a strong demand for lithium batteries, with production and sales expected to rise significantly, particularly in Europe and global energy storage [4] - The battery sector is projected to exceed market expectations by 2026, with first-tier profitability improving and second-tier profitability reaching a turning point [4] - The solid-state battery sector is anticipated to see increased demand due to advancements in AI, with multiple catalysts expected to emerge in Q4 [4] Group 4 - The green energy ETF (562010) passively tracks the green energy index, with top ten weighted stocks including CATL, BYD, and Longi Green Energy [4]

锂电需求强劲+龙头产能饱满!电池ETF(561910)大涨近4%,盘中价格创年内新高

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 02:40

Group 1 - The core viewpoint of the articles highlights the strong performance of the energy storage sector, particularly in the battery ETF market, which has seen significant gains this year [1][2] - The battery ETF (561910) opened with a nearly 4% increase, reaching a new annual high of 0.909, with major stocks like Enjie and Hunan Youneng experiencing substantial gains [1] - The performance of leading companies in the battery sector is impressive, with CATL reporting a net profit of 49 billion yuan for the first three quarters, and Gotion High-Tech showing a staggering 514% year-on-year growth in net profit [1] Group 2 - According to CITIC Securities, the domestic energy storage market is experiencing a significant economic turning point, with robust investment and increasing demand driven by data centers [2] - Lithium battery demand is expected to grow over 30% next year, creating investment opportunities across materials, batteries, and integration sectors [2] - Dongwu Securities notes that leading lithium material companies are at full capacity, indicating a price turning point is approaching, with expectations for price increases in lithium hexafluorophosphate and iron lithium [2]

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

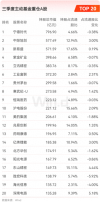

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

9家锂电池上市公司今年前三季度净利润同比增长超100%

Zheng Quan Ri Bao Wang· 2025-10-30 12:14

Core Insights - The lithium battery sector in A-shares shows strong performance, with 65.52% of the 29 listed companies reporting year-on-year profit growth in their Q3 2025 reports [1] - The domestic production and sales of power and other batteries reached 1121.9 GWh and 1067.2 GWh respectively from January to September this year, marking increases of 51.4% and 55.8% year-on-year [1] - The industry is transitioning from scale expansion to quality improvement, driven by diverse technological advancements in solid-state batteries and traditional lithium batteries [1] Company Performance - Keli Yuan achieved a revenue of 3.086 billion yuan, a year-on-year increase of 25.25%, with net profit soaring by 539.97% to 132 million yuan [2] - Guoxuan High-Tech reported a revenue of 29.508 billion yuan, up 17.21%, and a net profit of 2.533 billion yuan, reflecting a 514.35% increase [2] - Guoxuan's Q3 net profit reached 2.167 billion yuan, a staggering increase of 1434.42% year-on-year [2] Technological Diversification - The battery industry is witnessing a shift towards a multi-technology approach, which is reshaping the value growth logic [2] - CATL's revenue reached 283.072 billion yuan, with a net profit of 49.034 billion yuan, reflecting a year-on-year growth of 9.28% and 36.2% respectively [3] - CATL's strategy includes a comprehensive technology coverage, enhancing high-end product ratios and addressing fast-charging challenges [3] Market Adaptation - The introduction of new technologies, such as sodium-ion batteries, is paving the way for broader applications in the market [3] - The stable prices of upstream lithium resources have reduced the basic costs for battery companies, while technological upgrades have improved profitability [4] - The diverse technological paths are not only boosting company performance but also catering to the differentiated market demands [4]