铜价上涨

Search documents

大行评级丨高盛:大幅上调洛阳钼业目标价至19港元 料受惠于铜价及产量上升

Ge Long Hui· 2025-10-27 05:09

Core Viewpoint - Goldman Sachs reports that Luoyang Molybdenum (3993.HK) achieved a 96% year-on-year increase in net profit for Q3, reaching 5.61 billion RMB, with recurring net profit for the first three quarters at 14.1 billion RMB, exceeding expectations [1] Financial Performance - The recurring net profit for the first three quarters is approximately 75% of Goldman Sachs' full-year forecast and about 82% of market expectations [1] - The company’s Q3 net profit growth is attributed to rising copper prices and a recovery in cobalt prices [1] Earnings Forecast - Goldman Sachs has raised its recurring profit forecast for Luoyang Molybdenum for 2025 to 2027 by 8% to 32% [1] - The copper production forecast for 2028 to 2030 has been increased by 30% to 1 million tons [1] Growth Drivers - The expected average compound annual growth rate (CAGR) for recurring profits from 2025 to 2026 is projected to be 38% due to rising copper prices and cobalt price recovery [1] - The anticipated production of 1 million tons of copper in 2028 and the launch of the Cangrejos gold-copper project are expected to drive profit growth from 2028 to 2029 [1] Investment Rating - Goldman Sachs maintains a "Buy" rating for Luoyang Molybdenum, raising the target price from 10.8 HKD to 19 HKD [1]

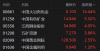

港股异动丨铜业股大涨 中国大冶有色金属涨超14% 中国有色矿业涨5.3%

Ge Long Hui· 2025-10-27 02:17

Group 1 - The core viewpoint of the article highlights a significant rise in Hong Kong copper stocks, driven by a surge in copper prices, which reached a historical high of $11,035 per ton on the London Metal Exchange (LME) [1] - Copper prices have increased by approximately 25% this year, recovering from a sharp sell-off triggered by the escalation of the trade war in April [1] - Supply challenges have become a focal point for investors, particularly due to the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia following a landslide [1] Group 2 - Citigroup's recent research report indicates that global manufacturing sentiment remains mixed, and cyclical demand growth continues to face pressure [1] - Data from Citigroup shows that copper consumption growth in August was weak, rising only 1.3% year-on-year, which is below the strong performance driven by the solar industry in the first half of the year [1] - The bank anticipates that copper consumption growth will remain moderate for the remainder of the year, but maintains a positive outlook for copper prices, predicting they will rise to $12,000 per ton by the second quarter of next year [1] Group 3 - Notable stock performances include China Daye Non-Ferrous Metals rising over 14%, China Nonferrous Mining up 5.3%, Jiangxi Copper and Minmetals Resources increasing by 4%, China Gold International rising by 2.5%, and China Metal Resources up by 1.2% [1]

铜行业系列 - 关注二线铜矿标的铜陵有色、西部矿业

2025-10-27 00:31

Summary of Conference Call on Copper Industry Industry Overview - **Copper Supply Constraints**: Multiple factors are limiting copper supply growth, including Teck Resources lowering production guidance, Andeavor Logistics having conservative production expectations, and uncertainties surrounding the KK mine's output from the joint venture between Ivanhoe and Zijin Mining. Additionally, the recovery of the KOVEA mine by First Quantum is uncertain, and Chilean copper production may be affected by accidents [1][2][8]. Key Points and Arguments - **Electricity Demand Support**: The State Grid's investment is expected to increase in Q4, leading to a recovery in the operating rates of wire and cable companies. China's wire and cable exports are maintaining high growth, offsetting trade war impacts and supporting domestic copper demand, with no significant inventory accumulation observed [1][4]. - **Home Appliance Demand Improvement**: The home appliance sector is showing a slight improvement in Q4 compared to Q3, although it remains down year-on-year. Long-term growth for air conditioning is expected to stabilize at around 2% annually [1][5]. - **Transportation Sector Demand**: The demand for copper in the transportation sector, particularly from electric vehicles, is expected to maintain high growth rates, with an overall increase of over ten percentage points anticipated for the transportation segment [1][6]. - **Changes in Smelting Landscape**: By the end of next year, processing fees may drop to zero, putting significant cost pressure on overseas smelting companies, some of which have already closed or reduced capacity. This situation will highlight the cost advantages of Chinese smelting companies and may reshape the global smelting landscape [1][12]. Future Market Outlook - **Copper Price Predictions**: Copper prices are expected to exceed market expectations in Q4 and the first half of next year, potentially reaching between 100,000 to 120,000 yuan per ton, although the duration at these high levels may be limited [3][9][15]. - **Supply Outlook for 2026**: The copper supply is not expected to see significant growth next year. The KK mine's production guidance remains unclear, and the KOVEA mine's recovery is uncertain. Chilean copper production is projected to increase by about 50,000 tons, but past production guidance has often not been met [8][9]. Investment Recommendations - **Companies to Watch**: - **Zijin Mining**: Valuation is low with an increasing share of gold business, expected profits around 52.3 billion yuan this year, and 65 to 70 billion next year, corresponding to a valuation of about 11 to 12 times [3][10]. - **Luoyang Molybdenum**: Performance has exceeded expectations, particularly in Q3 [10]. - **Copper Industry Second-Tier Stocks**: Focus on Tongling Nonferrous Metals (high growth and dividend yield) and Western Mining (acquisition of copper-gold polymetallic mine to enhance resource reserves) [3][10][11][13]. Additional Insights - **Western Mining's Recent Developments**: The company reported Q3 results in line with expectations and acquired a copper-gold polymetallic mine for 8.6 billion yuan, which has significant copper and gold resources. This acquisition is seen as reasonable given the resource value [13][14]. - **Copper Supply from Tongling Nonferrous Metals**: Expected production of about 190,000 tons this year, with significant contributions from both domestic and overseas operations. The company is committed to a dividend payout of over 50%, resulting in a high dividend yield [11]. - **Challenges for Smelting Companies**: The potential for zero processing fees by the end of next year poses significant challenges for overseas smelting companies, which may struggle to maintain production levels [12]. This summary encapsulates the key insights and projections regarding the copper industry, highlighting supply constraints, demand dynamics, price forecasts, and investment opportunities.

洛阳钼业前三季度净利润超去年全年

Zheng Quan Ri Bao· 2025-10-24 17:48

Core Viewpoint - Luoyang Molybdenum Co., Ltd. reported significant growth in revenue and net profit for the first three quarters of 2025, driven by increased copper production and sales, alongside rising copper prices [1][2]. Financial Performance - The company achieved a revenue of 145.485 billion yuan and a net profit of 14.28 billion yuan, marking a year-on-year increase of 72.61%, setting a historical record for the same period [1]. - In Q3 alone, the net profit attributable to shareholders reached 5.608 billion yuan, reflecting a 96.4% year-on-year growth [1]. Production and Sales - Copper production reached 543,400 tons, a 14.14% increase year-on-year, with a completion rate of 86.25% against production guidance [1]. - Copper sales amounted to 520,300 tons, up 10.56% year-on-year [1]. Market Conditions - The average domestic copper price in the first three quarters was 78,266 yuan per ton, an increase of 4.22% year-on-year, indicating a general upward trend in prices [2]. - Global copper supply remains tight, with several mining supply issues reported, while refined copper smelting capacity is expected to expand rapidly from 2023 to 2026 [2]. Strategic Developments - The company plans to invest 1.084 billion USD in the second phase of the Jinshan Mining project, expected to produce an additional 100,000 tons of copper annually upon completion in 2027 [2]. - Luoyang Molybdenum is focusing on establishing lean operational production methods and building a global platform organization to drive future growth [3]. Personnel Changes - Recent organizational upgrades include the appointment of Peng Xuhui as President and CEO, and Branko Buhavac as Vice President and Chief Commercial Officer [2].

中国有色矿业(01258.HK)预估前三季度公司拥有人分占利润约3.56亿美元 同比增长约13%

Ge Long Hui· 2025-10-24 13:51

Core Viewpoint - China Nonferrous Mining (01258.HK) reported a significant increase in production and profits for the first three quarters of 2025, driven by rising international copper prices and increased sales of cathode copper [1] Production and Operational Performance - The company produced approximately 107,663 tons of cathode copper, a year-on-year increase of 12%, achieving about 77% of its annual production target [1] - The production of crude copper and anode copper reached approximately 307,573 tons, reflecting a 7% year-on-year growth [1] - The subsidiary Zhongse Huaxin Maben achieved a 74% increase in cathode copper production to 24,222 tons, attributed to the utilization of generators and photovoltaic systems [1] - Luala Copper Smelting saw a 28% increase in crude copper production to 112,994 tons, as production systems operated at full capacity [1] Profitability - The company estimates a profit attributable to owners of approximately $356 million, representing a 13% year-on-year increase, primarily due to the rise in international copper prices and increased sales volume of cathode copper [1] Challenges - The Qianbixi hydrometallurgy operation temporarily ceased production due to a tailings pond incident, resulting in an 82% year-on-year decrease in cathode copper production to 755 tons [1] - Ganfeng Mining faced a 39% year-on-year reduction in cobalt hydroxide production to 390 tons, impacted by export restrictions on cobalt products from the Democratic Republic of the Congo [1]

今日铜价如同坐上火箭,创下阶段性新高。

Sou Hu Cai Jing· 2025-10-24 13:01

Core Viewpoint - The domestic copper market is experiencing a significant surge, with both futures and spot prices reaching new highs, driven by strong performance in the futures market [1] Group 1: Futures Market Performance - The main contract for copper on the Shanghai Futures Exchange has surpassed a critical resistance level, breaking through the 86,000 yuan per ton mark [1] - During intraday trading, the price peaked at 86,720 yuan per ton, reflecting an increase of over 1,100 yuan per ton compared to the previous trading day's closing price [1] - The notable single-day price increase has made the futures market a focal point for investors [1] Group 2: Spot Market Reaction - Following the strong performance in the futures market, spot copper prices have also risen, with the current mainstream quotation for domestic spot copper reaching 78,000 yuan per ton [1] - The correlation between futures and spot prices is evident, highlighting a synchronized upward movement in the copper market [1] - The trading activity in the copper market has significantly increased, with prevailing optimistic sentiment regarding future price trends [1]

市场氛围向暖 沪铜偏强运行【盘中快讯】

Wen Hua Cai Jing· 2025-10-24 09:53

Core Viewpoint - International copper and domestic copper prices are experiencing a strong upward trend, with both increasing by over 2% due to ongoing tightness in the copper mining sector and improved risk appetite in the market [1] Group 1 - The tightness in the copper mining sector continues to provide support for copper prices [1] - Recent improvements in market risk appetite are contributing to the bullish trend in copper prices [1] - Domestic policy expectations are becoming more favorable, further reinforcing the strength of copper prices [1]

【光大研究每日速递】20251022

光大证券研究· 2025-10-21 23:07

Macro Insights - The recent surge in gold prices is attributed to multiple factors including renewed US-China trade tensions, Powell's indication of ending balance sheet reduction, and regional bank failures in the US. This has led to increased capital inflow into the gold market. Although short-term bullish factors are fully priced in, the long-term bull market for gold is far from over. [5] - Following the rapid increase in gold prices, copper is expected to experience a rebound. The copper-to-gold ratio is at historically low levels, and the strategic importance of copper is rising due to global energy transition and the AI revolution, indicating a structural shortage cycle ahead. [5] Company Performance Summaries 奥来德 (688378.SH) - For the first three quarters of 2025, the company expects revenue between 370 to 400 million yuan, a year-on-year decrease of 13.75% to 20.22%. - The anticipated net profit attributable to shareholders is between 29 to 34 million yuan, reflecting a year-on-year decline of 66.42% to 71.36%. - The non-recurring net profit is expected to be between -6.7 to -5.6 million yuan, a significant decrease of 108.47% to 110.13%. [5] 利安隆 (300596.SZ) - The company achieved revenue of 4.509 billion yuan in the first three quarters of 2025, a year-on-year increase of 5.72%. - The net profit attributable to shareholders reached 392 million yuan, marking a year-on-year growth of 24.92%. - The continuous improvement in capacity utilization from new projects has led to enhanced scale effects and a corresponding increase in overall gross margin. [6] 煌上煌 (002695.SZ) - The company reported revenue of 1.379 billion yuan for the first three quarters of 2025, a year-on-year decline of 5.08%. - The net profit attributable to shareholders was 101 million yuan, showing a year-on-year increase of 28.59%. - The non-recurring net profit reached 88 million yuan, reflecting a year-on-year growth of 38.87%. [7] 燕京啤酒 (000729.SZ) - For the first three quarters of 2025, the company achieved revenue of 13.43 billion yuan, a year-on-year increase of 4.6%. - The net profit attributable to shareholders was 1.77 billion yuan, representing a year-on-year growth of 37.4%. - Structural upgrades and cost optimization have significantly improved profit margins. [8] 九洲药业 (603456.SH) - The company reported revenue of 4.16 billion yuan for the first three quarters of 2025, a year-on-year increase of 4.92%. - The net profit attributable to shareholders was 748 million yuan, reflecting a year-on-year growth of 18.51%. - The non-recurring net profit was 746 million yuan, marking a year-on-year increase of 20.67%. [9]

浙商证券沈皓俊:供给紧张格局将支撑铜价中枢进一步抬升

Zhong Zheng Wang· 2025-10-16 14:17

中证报中证网讯(记者马爽)10月16日晚,浙商证券(601878)金属行业负责人沈皓俊在中国证券报"ETF 点金汇"直播间表示,从铜行业基本面来看,供给端出现扰动因素,而基本面数据表现强劲,铜价中枢 有望延续趋势性上行。不过需要关注的是,国际贸易局势可能存在反复,美联储的调息政策也存在不确 定性,这些因素或对铜价造成一定扰动。从全年来看,铜市场的供给紧张格局基本确定,这将支撑铜价 中枢进一步抬升,看好年度维度上铜价的上涨趋势。 ...

瑞银:将2026至28年铜价预测分别上调8%、19%及11%,至每吨11464美元、13095美元及12809美元,供应收紧将支持铜价持续上行

Ge Long Hui· 2025-10-15 06:51

(责任编辑:宋政 HN002) 格隆汇10月15日|瑞银发表报告,将2026至28年各年铜价预测分别上调8%、19%及11%,至每吨11464 美元、13095美元及12809美元,以反映行业基本面收紧,主要因印尼Grasberg矿场下调产量指引,以及 刚果(金)Kamoa Kakula和智利El Teniente发生事故,加上今年秘鲁发生抗议,可能加剧矿场供应的短期 风险。该行预计2026年精炼铜需求将增长3%,而相应供应仅增长不足1%,将推动市场转入短缺状态, 并导致库存下降,从而支持铜价持续上行。 【免责声明】本文仅代表作者本人观点,与和讯网无关。和讯网站对文中陈述、观点判断保持中立,不对所包含内容 的准确性、可靠性或完整性提供任何明示或暗示的保证。请读者仅作参考,并请自行承担全部责任。邮箱: news_center@staff.hexun.com ...