信贷风险

Search documents

美国区域银行陷危机?千亿市值一日蒸发,黄金暴涨破纪录发出警报

Sou Hu Cai Jing· 2025-10-21 19:58

Core Viewpoint - The current financial landscape in the U.S. is marked by heightened uncertainty, driven by multiple risks including a government shutdown, concerns over AI-related valuation bubbles, and emerging credit risks within regional banks [3][5][13]. Group 1: Market Signals and Reactions - Gold prices have reached a historic high of $4,322 per ounce, while the yield on the 10-year U.S. Treasury has fallen below 4%, indicating potential underlying issues within the financial system [1]. - The recent credit issues faced by two lesser-known regional banks have led to a significant market reaction, with over $100 billion in market value evaporating from bank stocks in a single day [7][10]. Group 2: Government Shutdown and Economic Impact - The ongoing government shutdown has lasted for two weeks with no resolution in sight, risking becoming the second-longest in U.S. history, which adds to market liquidity management challenges and uncertainty in fiscal policy [3]. - This situation is likely to suppress corporate investment and consumer confidence, further complicating the financial landscape [3]. Group 3: Credit Market Concerns - The U.S. is nearing the end of a historically aggressive interest rate hike cycle, leading to a tightening credit environment and increasing debt repayment pressures for companies [5][16]. - Recent bankruptcies in the automotive parts sector, with debts ranging from $10 billion to $50 billion, highlight vulnerabilities in the credit market [5]. Group 4: Regional Bank Crisis - The credit issues at Zion Bank and Western Alliance Bank have triggered widespread panic, causing significant stock price declines and a broader sell-off in the banking sector [7][9]. - Zion Bank reported a $50 million impairment on over $60 million in revolving credit, while Western Alliance initiated legal action to recover approximately $100 million, leading to respective stock drops of 15% and 13% [8][10]. Group 5: Risk Management Failures - The crisis reflects systemic failures in risk management within regional banks, with specific instances of inadequate oversight on large loans and post-loan asset management [13][16]. - The low-interest rate environment prior to the current high-rate cycle has contributed to a lack of preparedness for rising credit risks, exposing vulnerabilities in the banking sector [16]. Group 6: Market Differentiation and Future Outlook - The financial market is showing signs of differentiation, with larger banks reporting strong earnings while still facing pressure from regional bank risks [20][21]. - The upcoming earnings reports from regional banks will be critical in determining the nature of the crisis and the market's direction, with a focus on potential disclosures related to non-deposit financial institution (NDFI) loan exposures [18][23].

海外札记:外部风险继续上行但幅度可控

Orient Securities· 2025-10-21 10:34

Group 1: Economic Risks - The U.S. economy is facing deterioration, with the manufacturing PMI recorded at 49.1, remaining below the 50 mark for seven consecutive months[12] - The small business optimism index fell to 98.8 in September, below the expected value of 100.8, indicating a cooling trend in sales and credit expectations[12] - The consumer confidence index for October is at 55, down from 55.1, reflecting weak consumer sentiment towards the economic outlook[12] Group 2: Financial Risks - U.S. financial market liquidity is currently tight, with significant concerns following the credit failures of two small banks, leading to a 6.2% drop in the regional bank stock index[17] - The overall corporate debt level in the U.S. is manageable, with the non-financial corporate sector's leverage ratio at 73.7%, and corporate debt growth at approximately 1.7%, below historical averages[22] - The bad debt ratio for various loans has stabilized or declined, indicating a potential improvement in asset quality[22] Group 3: Policy Responses - The Federal Reserve is expected to initiate a new round of interest rate cuts in response to ongoing economic pressures, aligning with a global trend of fiscal and monetary easing[20] - The Fed's liquidity support tools are well-established, allowing for timely interventions to prevent systemic risks, even in the event of localized liquidity crises[20] - The recent tightening of liquidity is anticipated to ease, as the most significant pressures have passed, leading to a gradual stabilization of the financial system[20] Group 4: Market Trends - Risk assets have shown increased volatility, but significant downturns are unlikely, while safe-haven assets like gold are expected to continue their upward trend[11] - Gold prices have surged by 6.69% recently, reflecting heightened demand for safe-haven investments amid market uncertainties[35] - The U.S. dollar is losing its safe-haven status, with expectations of continued appreciation of non-U.S. currencies and gold against the dollar[29]

信贷稳+贸易和+停摆困 黄金期货高位拉锯

Jin Tou Wang· 2025-10-21 02:10

Group 1 - The core viewpoint of the articles highlights the interplay between financial stability, international trade negotiations, and the ongoing U.S. government shutdown, which are key factors influencing market sentiment and investment opportunities [2][3]. Group 2 - Recent financial reports from regional banks have alleviated concerns regarding credit quality, injecting confidence into the stability of the financial system [2]. - Upcoming U.S.-China trade talks in Malaysia, led by U.S. Treasury Secretary and Chinese Vice Premier, aim to reduce trade tensions, with both sides signaling a willingness to negotiate [2]. - The U.S. government shutdown has reached a critical point, being one of the longest in modern history, which poses significant challenges for fiscal policy and market stability [3]. Group 3 - In the gold futures market, the December contract has shown bullish momentum, with a recent price increase of $135, reaching $4348.3, although there are indications of a potential market top [1][4]. - Technical analysis suggests that the next resistance level for gold futures is at $4392.00, while a significant support level is identified at $4000.00 [4].

关键一周开启!日经225指数升至历史新高,黄金一度跌至4220美元下方

Sou Hu Cai Jing· 2025-10-20 01:16

Market Performance - The Nikkei 225 index in Japan reached a historical high, increasing by approximately 2.2% [3] - The South Korean Composite Index rose by 0.36%, marking its third consecutive day of setting historical highs [1] - U.S. stock futures showed minor fluctuations, with the Nasdaq 100 futures slightly up by 0.03% [1] Economic Indicators - The U.S. stock market indices all closed higher last Friday, providing a positive lead for the Asia-Pacific markets [1] - Investors are focusing on trade tensions while attempting to recover from significant sell-offs caused by credit concerns in regional banks [1] - Upcoming economic data, including the U.S. CPI, is expected to attract global market attention [2] Gold Market - Gold prices experienced a mild decline, having previously recorded the largest single-day drop since May of the previous year [1] - Gold has seen a continuous increase for nine weeks, with a year-to-date rise of over 60% as of 2025, supported by central bank purchases and inflows into exchange-traded funds [2] - Technical indicators suggest that the strong upward trend in gold prices since August of the previous year may be overheating, facing potential correction pressure [1][2]

周一早盘:美股期货开盘上涨 市场聚焦公司财报和通胀数据

Xin Lang Cai Jing· 2025-10-19 22:29

Market Overview - US stock index futures opened higher, with the Dow Jones up 105 points (approximately 0.2%), S&P 500 futures up 0.3%, and Nasdaq 100 futures also up 0.3% [2] - Spot gold rose nearly $20, reaching $4274 per ounce, while WTI and Brent crude oil opened slightly higher at $57.19 and $61.24 per barrel, respectively [2] Trade Relations - Reports indicate that President Trump has granted exemptions on tariffs for dozens of products and proposed further exemptions for hundreds more, reflecting a growing sentiment among officials to lower tariffs on goods that cannot be produced domestically [2] - US Treasury Secretary Mnuchin stated that trade relations have shown signs of easing, suggesting that previous trade threats may not be implemented [3] Market Sentiment - Despite a volatile week marked by trade tensions and regional bank losses, US stocks ended higher, buoyed by a strong start to the Q3 earnings season and expectations of a 25 basis point rate cut by the Federal Reserve at the end of October [2] - The Chicago Board Options Exchange (Cboe) S&P 500 Volatility Index spiked above 28 but fell back below 21 as the stock market rebounded [3] Economic Indicators - Major companies, including Netflix, Coca-Cola, Tesla, and Intel, are set to release quarterly earnings this week, with particular attention on the September Consumer Price Index (CPI) report expected to show high inflation [4] - The ongoing government shutdown, now in its fourth week, is causing concerns about potential impacts on quarterly GDP growth, although many believe it will lead to a temporary slowdown followed by a recovery [4]

美国- 地区性银行坏账风波、政府关门与数据“真空”

2025-10-19 15:58

Summary of Key Points from the Conference Call Industry Overview - The discussion primarily revolves around the **U.S. banking sector**, particularly focusing on **regional banks** and the implications of the ongoing **government shutdown** on the economy and financial markets [1][2][7]. Core Insights and Arguments - **Regional Bank Bad Debt Crisis**: The bad debt issues stem from credit fraud involving ZionsBankCorp and West Alliance, which provided loans to an investment fund that mismanaged collateral, leading to market sell-offs. This situation has raised concerns about credit risk despite the amounts involved being relatively small [2][3]. - **Impact of Government Shutdown**: The U.S. government has been shut down for three weeks, creating a data vacuum that increases uncertainty in key economic indicators such as employment and inflation, further exacerbating market volatility [7][11]. - **Large Banks' Financial Health**: Recent financial reports from large banks indicate a healthy status with no signs of systemic risk, contrasting with the issues faced by smaller regional banks [5]. - **Non-Bank Credit Risks**: There is a growing concern regarding non-bank institutions, particularly private credit and Business Development Companies (BDCs), which have seen rapid growth in loan balances from $900 billion in 2023 to $1.7 trillion in 2025. However, the stock prices of firms like Blackstone have dropped nearly 20%, indicating market caution [6]. - **Economic Losses from Shutdown**: The government shutdown is projected to result in a weekly loss of $15 billion, totaling $60 billion if it lasts a month, which could equate to a 0.2% decline in GDP [12]. Additional Important Points - **Market Sentiment and Bond Yields**: The market is increasingly worried about the lack of key economic data, leading to a drop in two-year and ten-year Treasury yields below critical levels. There is speculation that the Federal Reserve may need to implement significant rate cuts due to anticipated poor economic data [3][15]. - **Political Dynamics**: The ongoing political standoff over healthcare funding is a significant factor in the government shutdown, with both parties using the situation to gain political leverage ahead of upcoming elections [8][9]. - **Long-term Economic Implications**: While government shutdowns typically result in short-term impacts, potential layoffs could lead to longer-lasting negative effects on the economy if they occur [13][14]. This summary encapsulates the critical aspects of the conference call, highlighting the current challenges faced by the U.S. banking sector and the broader economic implications of the government shutdown.

美国区域银行再现信贷危机,一天蒸发上千亿美元市值

Sou Hu Cai Jing· 2025-10-18 12:17

Core Viewpoint - Recent disclosures of loan issues and fraud allegations by two regional banks in the U.S. have raised investor concerns, leading to significant declines in bank stocks and overall market performance [1][4][5]. Group 1: Market Reaction - On October 16, U.S. bank stocks experienced a sharp decline, with the regional bank index falling by 6.3%, marking the worst single-day performance since April [7]. - The market capitalization of 74 major U.S. banks dropped by over $100 billion in a single day, equivalent to approximately 712.4 billion yuan [8]. - The VIX index, a measure of market volatility, surged over 22% to close at 25.31 on the same day, indicating heightened investor fear [8]. Group 2: Specific Bank Issues - Zion Bank Group reported discovering two commercial loans with "obvious false statements and defaults," leading to a provision of $60 million [5]. - Western Alliance Bank filed a fraud lawsuit against a borrower for failing to provide collateral, with estimates suggesting the bank is seeking to recover around $100 million [5]. Group 3: Investor Sentiment and Future Outlook - Following the initial panic, market tensions eased on October 17, with the VIX index dropping to 21.5 [8]. - Investors are closely monitoring upcoming earnings reports to assess whether the loan issues are isolated incidents or indicative of broader systemic risks [10]. - Goldman Sachs noted that the market's reaction to a single borrower's disclosure seems excessive, especially given that three unrelated fraud cases have emerged within a short period [9].

德银:“4月以来最动荡一周”结束了,美股依旧上涨,但不再平静

美股IPO· 2025-10-18 08:40

Group 1 - The article highlights a significant market turmoil in the U.S. stock market, driven by renewed trade conflicts, emerging credit risks in regional banks, and concerns over inflated valuations of AI stocks, marking the most severe market fluctuations since April [1][2][5] - The S&P 500 index experienced a notable intraday increase, surpassing 2% for the first time since April, indicating a shift in market dynamics [2][3] - Despite a rebound in major U.S. stock indices, there was a substantial outflow of funds from high-yield bond funds, reflecting a growing preference for safe-haven assets like government bonds and gold [4][20] Group 2 - The VIX index surged to 28.99, the highest intraday level since late April, signaling a return of market volatility and underlying instability despite seemingly strong stock indices [18][24] - Recent failures of companies like First Brands Group and Tricolor Holdings have reignited concerns over credit losses, leading to significant declines in regional bank stocks and a broader reevaluation of credit risks [11][13][14] - Investment strategies are shifting towards credit risk defense, with fund managers reducing risk exposure and employing hedging strategies in response to perceived market vulnerabilities [26][28] Group 3 - There is a divergence in market sentiment, with some analysts suggesting that the recent volatility is an overreaction to isolated events rather than indicative of systemic issues, maintaining that the fundamentals of the credit market remain strong [29][30]

“4月以来最动荡一周”结束了,美股依旧上涨,但不再平静

Hua Er Jie Jian Wen· 2025-10-18 02:10

Core Insights - The market has experienced its most turbulent week since April, driven by renewed trade conflicts, emerging credit risks in U.S. regional banks, and concerns over inflated valuations of AI stocks [2][4]. Market Performance - The S&P 500 index saw its first intraday gain exceeding 2% since April, despite a volatile week [2][3]. - Major U.S. stock indices opened lower but rebounded, with a weekly increase of at least 1% [4][5]. Investor Behavior - Investors are shifting towards safe-haven assets like government bonds and gold, leading to significant outflows from high-yield bond funds [4][13]. - The VIX index, a measure of market volatility, surged to 28.99, indicating increased market anxiety [10][11]. Credit Risk Concerns - The collapse of companies like First Brands Group and Tricolor Holdings has reignited fears of credit losses, impacting regional bank stocks significantly [7][18]. - Reports of substantial impairment losses related to fraud at Zions Bancorp and Western Alliance erased over $100 billion in market value from U.S. bank stocks [7]. Asset Allocation Trends - As of the end of August, the allocation to risk assets in tracked portfolios reached 67%, nearing peak levels [9]. - There has been a notable outflow of over $3 billion from high-yield bond funds, reflecting a shift in risk appetite [16]. Fund Manager Strategies - Fund managers are adjusting their strategies to reduce risk exposure, with some moving to short stocks due to perceived disconnection between market positions and fundamentals [17]. - Legal & General's multi-asset fund manager has lowered risk exposure and is viewing recent bankruptcies as potential warning signs of broader credit stress [17]. Diverging Opinions - Not all analysts believe the market is at a decisive turning point, with some viewing recent volatility as an overreaction to isolated events rather than systemic issues [18].

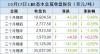

金属普涨,期铜盘中触及一周低点,受美国信贷担忧拖累【10月17日LME收盘】

Wen Hua Cai Jing· 2025-10-18 00:55

Core Viewpoint - The London Metal Exchange (LME) saw most base metals decline, with copper hitting a one-week low, influenced by concerns over credit pressures in U.S. regional banks, leading to a negative sentiment in the market [1][4]. Group 1: Market Performance - On October 17, LME three-month copper fell by $42.5, or 0.4%, closing at $10,604.5 per ton, with an intraday low of $10,430, marking a 2% drop and the lowest since October 10 [1][2]. - Other base metals also experienced declines, with three-month aluminum down by $11.00 (0.39%), zinc down by $39.50 (1.33%), and tin down by $735.00 (2.05%) [2]. Group 2: Economic Indicators - Copper is viewed as a barometer for the global economy, with recent supply concerns pushing prices to a 16-month high of $11,000 per ton last week [1]. - Recent reports indicate a temporary easing of supply concerns, as copper inventories at the Shanghai Futures Exchange increased by 550 tons, reaching the highest level since April [4]. Group 3: Market Sentiment - The environment is characterized by a general risk aversion, with high-risk assets under pressure due to concerns over the U.S. economic situation [4]. - The spread between spot copper contracts and three-month forward contracts widened, indicating a decrease in immediate demand for copper [4].