汽车制造业

Search documents

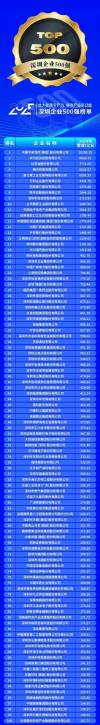

2025深圳企业500强榜单发布:平安、华为、比亚迪位列前三

Sou Hu Cai Jing· 2025-10-28 17:42

Core Insights - The "2025 Shenzhen Top 500 Enterprises List" was officially released, with Ping An Insurance, Huawei Investment, and BYD ranking as the top three, maintaining their leading positions [1][16] - The list is based on the companies' revenue for the fiscal year 2024, and the accompanying report analyzes various dimensions of enterprise development, including scale, operational efficiency, innovation capability, social contribution, and internationalization [1][16] Group 1: Key Characteristics of the Top 500 Enterprises - Overall revenue growth is observed, with 18 companies exceeding 100 billion yuan in revenue, but the average sales profit margin has decreased to 4.86%, down from 5.10% in 2023 [1][2] - The number of companies in the 1-10 billion yuan revenue range has increased to 331, a year-on-year growth of 5.41%, with total revenue in this segment rising by 9.76% [1][2] Group 2: Competitive Landscape - The competition among top enterprises is intensifying, with 97 new entrants making up 19% of the list, and only 22 companies maintaining their previous rankings [2] - The revenue threshold for entering the list has been consistently rising over the past five years, indicating a rapidly evolving competitive landscape [2] Group 3: Private Sector Dynamics - Private enterprises account for 70% of the list, contributing over 45% of total revenue, particularly excelling in high-end medical devices and robotics sectors [2] - The manufacturing sector remains robust, with 207 manufacturing companies on the list showing a revenue growth of 13.82%, although traditional manufacturing faces transformation pressures [2] Group 4: Regional Development - The regional development is categorized into three tiers: Nanshan and Futian as the "core leading tier," Longgang and four other districts as the "growth and challenge tier," and Luohu and three other districts as the "transformation and adjustment tier," highlighting distinct industrial characteristics and collaboration opportunities [2] Group 5: Future Directions - Shenzhen's top 500 enterprises need to focus on enhancing value addition, optimizing innovation workforce allocation, balancing industrial development, and improving overseas business layouts to drive sustainable growth and support the city's economic high-quality development [16]

汉马科技:10月28日召开董事会会议

Mei Ri Jing Ji Xin Wen· 2025-10-28 12:59

Group 1 - Hanma Technology (SH 600375) announced on October 28 that its 17th meeting of the 9th board of directors was held, discussing the proposal for the 2025 first extraordinary general meeting of shareholders [1] - For the first half of 2025, Hanma Technology's revenue composition was as follows: automotive manufacturing accounted for 95.1%, other businesses 4.59%, and financial leasing 0.31% [1] - As of the report date, Hanma Technology's market capitalization was 11.8 billion yuan [1] Group 2 - The A-share market has surpassed 4000 points, marking a significant resurgence after ten years of stagnation, with technology leading the market and a new "slow bull" pattern emerging [1]

10月28日晚间公告 | 富临精工投资40亿磷酸铁锂项目;兆易创新第三季度净利润增长超6成

Xuan Gu Bao· 2025-10-28 12:24

Suspension and Resumption of Trading - Shiwai New Materials: The offer period for Zhi Yuan Heng Yue's acquisition has ended, and the stock is suspended for one day [1] - Zhongyuan Co., Ltd.: The actual controller is planning a change in company control, with a suspension period not exceeding three trading days [1] - Delong Huineng: The actual controller has changed to Ms. Sun Weijia, and the stock has resumed trading [1] Share Buyback - Haida Group: Plans to repurchase shares worth between 1 billion to 1.6 billion yuan, with a maximum repurchase price of 62.00 yuan per share [2] Investment Cooperation and Operational Status - Yunnan Energy Investment: Huaping Yuneng New Energy Co., Ltd. is investing in the Huaping West Wind Power Project with a capacity of 150 MW and a total investment of 780 million yuan; Honghe Yuneng Investment New Energy Development Co., Ltd. is investing in the Yongning Wind Power Project (Phase IV) with a capacity of 87.1 MW and a total investment of 453 million yuan; Yongsheng Yuneng New Energy Co., Ltd. is investing in the Aguzi Wind Power Project with a capacity of 100 MW and a total investment of 619 million yuan [3] - Xiasha Precision: Plans to raise no more than 800 million yuan through a private placement for the industrialization of core components of intelligent transmission systems, equipment development, technology research, and working capital [3] - Suzhou Tianmai: Plans to invest no more than 600 million yuan in the construction of an intelligent manufacturing base for thermal conductive products, which will add an annual production capacity of 18 million high-end uniform temperature plates [3] - Fulian Precision: Jiangxi Shenghua plans to invest in a new high-density lithium iron phosphate project with an annual production capacity of 350,000 tons in the Deyang-Abazhou Ecological Economic Industrial Park, with an estimated total investment of 4 billion yuan [3] - Renxin New Materials: Plans to invest in an integrated project for polystyrene new materials with a total investment of 3.8 billion yuan in cooperation with the Huizhou Daya Bay Economic and Technological Development Zone [3] - New World: Signed a cooperation agreement for GLP-1 class long-acting peptide innovative drugs [4] Performance Changes - Keli Yuan: Third-quarter net profit of 80.43 million yuan, a year-on-year increase of 2,836.88% [5] - Hailian Jinhui: Third-quarter net profit of 76.87 million yuan, a year-on-year increase of 1,000.56% [5] - Tianqiao Hoisting: Third-quarter net profit of 41.29 million yuan, a year-on-year increase of 618.70% [5] - Shengyi Electronics: Third-quarter net profit of 584 million yuan, a year-on-year increase of 545.95% [5] - Huasheng Tiancai: Third-quarter net profit of 219 million yuan, a year-on-year increase of 563.58% [5] - Boliang Optoelectronics: Third-quarter net profit of 11.53 million yuan, a year-on-year increase of 470.61% [5] - Geling Deep Vision: Third-quarter revenue of 51.76 million yuan, a year-on-year increase of 453.28% [5] - Jibite: Third-quarter net profit of 570 million yuan, a year-on-year increase of 307.70% [5] - Mingzhi Electric: Third-quarter net profit of 22.88 million yuan, a year-on-year increase of 215.97% [6] - Shengyi Technology: Third-quarter net profit of 1.017 billion yuan, a year-on-year increase of 131.18% [6] - Jingce Electronics: Third-quarter net profit of 72.42 million yuan, a year-on-year increase of 123.44% [6] - Feirongda: Third-quarter net profit of 120 million yuan, a year-on-year increase of 120.52% [6] - Xingqi Eye Medicine: Third-quarter net profit of 264 million yuan, a year-on-year increase of 117.45% [6] - State Grid Yingda: Third-quarter net profit of 1.086 billion yuan, a year-on-year increase of 102.49% [6] - Guanghong Technology: Third-quarter net profit of 99.61 million yuan, a year-on-year increase of 99.68% [6] - China Shipbuilding: Third-quarter net profit of 2.074 billion yuan, a year-on-year increase of 97.56% [6] - Huasheng Securities: Third-quarter net profit of 848 million yuan, a year-on-year increase of 97.61% [6] - Aofei Data: Third-quarter net profit of 57.55 million yuan, a year-on-year increase of 90.36% [6] - Giant Network: Third-quarter net profit of 640 million yuan, a year-on-year increase of 81.19% [6] - Tianneng Co., Ltd.: Third-quarter net profit of 491 million yuan, a year-on-year increase of 81.92% [6] - Yutong Bus: Third-quarter net profit of 1.357 billion yuan, a year-on-year increase of 78.98% [6] - Aerospace Intelligent Manufacturing: Third-quarter net profit of 259 million yuan, a year-on-year increase of 73.98% [6] - Jucheng Co., Ltd.: Third-quarter net profit of 115 million yuan, a year-on-year increase of 67.69% [6] - Longqi Technology: Third-quarter net profit of 152 million yuan, a year-on-year increase of 64.46% [6] - Zhaoyi Innovation: Third-quarter net profit of 508 million yuan, a year-on-year increase of 61.13% [6] - Sunshine Power: Third-quarter net profit of 4.147 billion yuan, a year-on-year increase of 57.04% [6] - Hudian Co., Ltd.: Third-quarter net profit of 1.035 billion yuan, a year-on-year increase of 46.25% [6] - South Grid Energy Storage: Third-quarter net profit of 601 million yuan, a year-on-year increase of 43.41% [6] - Jiangxi Copper: Third-quarter net profit of 1.849 billion yuan, a year-on-year increase of 35.20% [6] - Haowei Group: Third-quarter net profit of 1.182 billion yuan, a year-on-year increase of 17.26% [6]

全球化布局再落“关键一子” 吉利出海提速锚定欧洲主流汽车品牌

Zhong Guo Jing Ying Bao· 2025-10-28 10:44

Core Insights - Geely Auto has officially entered the UK market with its pure electric model, Geely International EX5, and plans to launch 15 new models in Europe over the next five years, aiming to establish a network of over 1,000 dealerships and service centers [1][3][4] Group 1: Market Expansion - The UK is identified as a strategic high ground for Geely's expansion into Europe, as it has become the largest market for new energy vehicles in Europe, with a growth rate of 34.6% for pure electric vehicles in the first half of 2025 [3][4] - Geely has established 25 sales outlets in the UK and plans to increase this number to 40 by the end of 2025 and 100 by the end of 2026, aiming for full coverage across the UK [3][4] Group 2: Sales Performance - In the first nine months of this year, Geely's total sales reached 2.17 million units, a year-on-year increase of 46%, with new energy vehicle sales reaching 1.168 million units, a significant increase of 114% [5][6] - Geely's sales in September alone surpassed Tesla, positioning the company as the second-largest globally with 165,000 units sold [5][6] Group 3: Global Strategy - Geely's CEO has indicated that the company expects to exceed 3 million units in total sales for 2025, with a domestic market share increase from 6.3% in 2021 to 10.4% currently [6][7] - The company aims to focus on overseas expansion as a key development strategy, with a target of 423,000 units in overseas sales for the year, having already achieved 71% of this goal by the end of the third quarter [6][7] Group 4: Technological Development - Geely is committed to a long-term strategy that emphasizes not just short-term sales but a comprehensive global layout, including five design centers, five engineering research centers, and five testing areas [7][8] - The company has invested over 250 billion RMB in R&D over the past 11 years, achieving industry-leading results in core technology areas and continuously exploring advancements in AI and smart technology [7][8] Group 5: Sustainability Goals - Geely has set a carbon neutrality target for 2045 and has achieved a 23.5% reduction in carbon emissions per vehicle by the first half of 2025, with a total reduction of 9.7 tons per vehicle [8]

吉利登陆英国市场,2030年要实现10万台汽车销量

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-28 10:28

Core Insights - Geely has officially launched its electric vehicle model, Geely International EX5, in the UK market, with prices set at £31,990, £33,990, and £36,990 for different variants, making it competitive against local offerings like BYD ATTO3 and Tesla Model 3 [1][5] - The company aims to achieve annual sales of 100,000 units in the UK by 2030, which requires a compound annual growth rate significantly higher than the local market average [5][6] - Geely plans to introduce 15 new models in Europe over the next five years and establish over 1,000 sales outlets, focusing on the UK as a strategic entry point into the European market [2][5] Market Strategy - Geely has established 25 sales service outlets in the UK, with plans to double this number by the end of the year and reach 100 by 2026 [5][6] - The UK market is seen as a core part of Geely's European strategy due to its lack of dominant domestic brands and a consumer base open to new entrants [6][7] - The company is adopting a dual approach of promoting both electric and fuel vehicles, aiming to compete with established brands like Toyota in the fuel segment while targeting higher growth rates in the electric vehicle market [7][9] Performance and Growth - Geely's overall sales have been growing, with 1.1678 million new energy vehicles sold in the first three quarters of the year, achieving a penetration rate of 53.8% [9][10] - The company has seen a 61.8% increase in sales in the European market during the first nine months of the year, with a significant rise in new energy vehicle exports [10] - Geely's strategy includes leveraging established brands like Volvo to enhance brand recognition in the competitive European market [10]

沪光股份:全资子公司拟参与赛力斯香港首次公开发行

Xin Lang Cai Jing· 2025-10-28 08:33

Core Viewpoint - The company plans to invest up to 20 million USD in the initial public offering of Cyric Group Co., Ltd. to strengthen strategic cooperation and enhance its market influence [1] Group 1 - The investment will be made by the company's wholly-owned subsidiary, Hu Guang (Hong Kong) International Co., Ltd. [1] - The purpose of the investment is to enhance collaboration within the industry chain and solidify the strategic partnership with Cyric [1] - This move aims to improve the company's risk resistance, core competitiveness, and influence in the capital market [1]

影响市场重大事件:证监会发布中小投资者保护“23条” ;潘功胜:央行探索在特定情景下向非银机构提供流动性的机制安排

Mei Ri Jing Ji Xin Wen· 2025-10-28 08:28

Group 1: Central Bank and Regulatory Developments - The People's Bank of China is exploring mechanisms to provide liquidity to non-bank institutions under specific circumstances to maintain financial market stability and prevent moral hazards [1] - The China Securities Regulatory Commission (CSRC) has released 23 practical measures to enhance the protection of small and medium investors in the capital market, focusing on improving the fairness of trading environments and enhancing customer service levels [2] - The CSRC aims to strengthen the legal foundation for investor protection by supporting the formulation of financial laws and revising existing regulations, including those related to market manipulation and insider trading [3][4] Group 2: Foreign Investment and Trade Policies - The State Administration of Foreign Exchange plans to introduce nine new policies to facilitate trade innovation and expand the scope of cross-border trade pilot programs, including the implementation of integrated currency pools for multinational corporations [5] - The CSRC has issued a work plan to optimize the Qualified Foreign Institutional Investor (QFII) system, aiming to attract long-term foreign investment by simplifying the approval process for sovereign funds and other institutional investors [6] Group 3: Credit and Digital Currency Initiatives - The People's Bank of China is researching policies to support individuals in repairing their credit records, particularly for those who have settled debts affected by the pandemic [7][8] - The central bank is also working to optimize the management system for digital currency, enhancing its positioning and supporting more commercial banks in operating digital currency services [9] Group 4: Automotive Industry Innovations - Changan Automobile is collaborating with JD.com to develop smart logistics vehicles and explore the design and production of new energy autonomous vehicles [10] - BYD has launched a new energy storage product, "Haohan," featuring the world's largest 2710Ah blade battery, which significantly enhances energy capacity and system reliability [11]

煤炭和汽车双轮驱动,陕西前三季度GDP增长5.3%

Di Yi Cai Jing· 2025-10-28 07:31

Core Insights - Shaanxi's industrial value added above designated size grew by 8.5% year-on-year, surpassing the national average by 2.3 percentage points, ranking fifth among all provinces in China [1][2] - The province's GDP reached 25,771.37 billion yuan, with a year-on-year growth of 5.3%, supported by robust performance in key industries such as coal and automotive [1] Industrial Performance - The coal mining and washing industry saw a value added increase of 11.5%, while the equipment manufacturing sector grew by 11.0%, with electrical machinery and equipment manufacturing rising by 35.4% and automotive manufacturing by 24.8% [2] - Over 80% of industries in Shaanxi reported positive growth, indicating strong resilience in production operations [1][2] Emerging Industries - Strategic emerging industries in Shaanxi grew by 5.9% year-on-year, outpacing the GDP growth rate, with high-end equipment manufacturing increasing by 6.1% and digital creative industries by 8.7% [3] - The solar photovoltaic industry chain experienced a remarkable growth of 36.9%, while the drone industry chain grew by 12.4%, highlighting a trend towards high-end, intelligent, and green development [3] Trade Dynamics - Shaanxi's total import and export value reached 3,780.78 billion yuan, marking a year-on-year increase of 12.0%, with exports growing by 14.8% and imports by 6.2% [4] - The trade structure improved, with general trade imports and exports rising by 14.0%, and the share of mechanical and electrical products in exports reaching 85.7% [4] - Notably, exports of "new three types" products surged by 32.6%, with lithium-ion batteries increasing by 120% and electric vehicles by 79.7% [4]

涛涛车业(301345):业绩高速增长,持续关注机器人等新赛道进展

NORTHEAST SECURITIES· 2025-10-28 06:49

Investment Rating - The report maintains a "Buy" rating for the company, with a target price of 328.68 yuan for the next six months [5]. Core Insights - The company has demonstrated impressive performance in its Q3 2025 results, with a revenue of 2.77 billion yuan, a year-on-year increase of 24.9%, and a net profit of 610 million yuan, reflecting a 101.3% increase [1][2]. - The company is expanding its product lines and sales channels, particularly in the smart electric low-speed vehicle segment, and has successfully launched a new brand, TEKO, targeting the North American market [2][3]. - The company is actively pursuing advancements in emerging technologies such as humanoid robots and autonomous driving, establishing strategic partnerships to enhance its capabilities in these areas [2][3]. Financial Summary - For the first three quarters of 2025, the gross margin was approximately 42.31%, an increase of about 5.99 percentage points year-on-year, while the net profit margin was around 21.87%, up by 8.3 percentage points [1]. - The company forecasts revenues of 3.785 billion yuan, 4.995 billion yuan, and 6.595 billion yuan for 2025, 2026, and 2027 respectively, with net profits projected at 787 million yuan, 1.195 billion yuan, and 1.620 billion yuan for the same years [3][4]. - The report indicates a significant improvement in operational efficiency, with a decrease in expense ratios and an increase in profitability metrics [1][3].

江淮汽车申请车载卫星通信设备固定装置专利,方便车载卫星通信设备安装和拆卸

Jin Rong Jie· 2025-10-28 06:16

Core Insights - Anhui Jianghuai Automobile Group Co., Ltd. has applied for a patent for a "Vehicle Satellite Communication Device Fixed Installation" with publication number CN120840518A, filed on September 2025 [1] - The patent describes a fixed installation device for satellite communication equipment in vehicles, featuring an installation box with specific slots for device and drive components, indicating innovation in automotive technology [1] Company Overview - Anhui Jianghuai Automobile Group Co., Ltd. was established in 1999 and is located in Hefei City, primarily engaged in the automotive manufacturing industry [1] - The company has a registered capital of 21,840.09791 million RMB and has invested in 47 enterprises, participated in 5,000 bidding projects, and holds 946 trademark records and 5,000 patent records [1] - Additionally, the company possesses 672 administrative licenses, showcasing its extensive operational footprint in the automotive sector [1]