国产电子工程EDA(原理图和PCB)设计软件

Search documents

国内高校“芯”实力爆发 4只低估值潜力芯片股获融资客重点埋伏

Zheng Quan Shi Bao· 2025-10-19 23:48

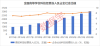

Core Insights - Chinese universities have recently made significant breakthroughs in the chip field, showcasing their growing strength in "hard technology" [1][2][4] Group 1: Research Achievements - Tsinghua University developed the world's first sub-angstrom snapshot spectral imaging chip, "Yuheng," marking a major advancement in intelligent photonics technology [2] - Peking University created a high-precision, scalable analog matrix computing chip based on resistive random-access memory, achieving analog computing precision comparable to digital systems [2] - Shanghai Jiao Tong University and the National Center for Nanoscience and Technology successfully demonstrated efficient excitation and path separation of nano-optical signals on a chip, laying the groundwork for next-generation photonic chips [2] - Fudan University introduced the world's first two-dimensional silicon-based hybrid architecture flash memory chip, addressing storage speed challenges [3] Group 2: Funding and Investment - China's higher education institutions have seen a steady increase in technology funding, with investments rising from under 100 billion yuan in 2015 to 306.55 billion yuan in 2024, representing a historical high of 8.44% of total social technology funding [4] - The surge in research output reflects both the commitment of universities to independent R&D and international recognition of China's research capabilities [4] Group 3: Market Trends - The semiconductor sector in China is experiencing a significant influx of investment, with 112 chip stocks in the A-share market seeing an average increase of over 35% in share price this year [9] - Notable companies like XChip Technology and Hezhong Technology have seen their stock prices double, while others like Zhaori Technology have faced declines [9] - The financing balance for these 112 stocks reached 181.88 billion yuan as of October 16, 2023, marking a nearly 54% increase from the end of the previous year [9] Group 4: Company Performance - Companies such as Aobi Zhongguang and Ruixin Microelectronics reported significant profit increases, with Aobi Zhongguang expected to turn a profit of 108 million yuan in the first three quarters of the year [10] - Ruixin Microelectronics anticipates a profit of up to 800 million yuan, reflecting a year-on-year growth of 127% due to the ongoing evolution of AI technology [10] - Several companies, including Haiguang Information and Zhongke Shuguang, reported profit growth exceeding 20% in the same period [11]

从湾芯展看“中国芯”,日行跬步终至千里

Mei Ri Jing Ji Xin Wen· 2025-10-16 03:50

Core Viewpoint - The 2025 Bay Area Semiconductor Industry Ecosystem Expo (Bay Chip Expo) held in Shenzhen showcased significant advancements in China's semiconductor industry, highlighting breakthroughs in high-end electronic measurement instruments and EDA software, which are crucial for the development of advanced chips and autonomous capabilities in the sector [1][2][4]. Group 1: Event Highlights - The Bay Chip Expo attracted over 600 companies and thousands of visitors, emphasizing the growing interest and investment in China's semiconductor market [1][4]. - New Kai Lai's subsidiary, Wanliyan Technology, unveiled a 90GHz ultra-high-speed real-time oscilloscope, marking a 500% performance improvement over previous domestic models and positioning it as the second globally [1][2]. - Another subsidiary, Qiyunfang, launched two EDA design software products with complete independent intellectual property rights, filling a critical gap in the market [2]. Group 2: Market Dynamics - China is the world's largest semiconductor consumer, with an integrated circuit import scale of approximately 2.8 trillion yuan in 2024, and the Bay Area is the largest semiconductor growth market in China [4]. - The expo facilitated connections between major semiconductor projects and industry funds, with Shenzhen establishing a 5 billion yuan industry investment fund to support the sector [4][5]. - The number of mergers and acquisitions in China's chip industry reached 93 by the end of Q3 2025, a 33% increase year-on-year, with a total transaction value of 54.9 billion yuan, reflecting a nearly 50% growth [5]. Group 3: International Collaboration - The expo featured numerous foreign companies, including ASML, Applied Materials, and Nikon, indicating a growing international interest in China's semiconductor market [5][6]. - Foreign chip companies are increasing investments in China, with NXP establishing a new business line and Micron expanding its operations in Xi'an, showcasing the global supply chain's responsiveness to China's semiconductor growth [6]. - The event represents a shift towards a more collaborative and innovative approach in the semiconductor industry, with a focus on system coordination and overcoming existing technological gaps [6].

万里眼超高速实时示波器全球首发,科创AIETF(588790)红盘震荡,机构仍看好科技主线

Sou Hu Cai Jing· 2025-10-16 02:34

Core Insights - The Shanghai Stock Exchange's Sci-Tech Innovation Board Artificial Intelligence Index has shown a slight increase of 0.04% as of October 16, 2025, with notable gains from key stocks such as Cambricon (up 3.72%) and DaoTong Technology (up 2.80%) [3] - The Sci-Tech AI ETF (588790) has experienced a cumulative increase of 0.87% for the month up to October 15, 2025, indicating a stable performance amidst market fluctuations [3] - The ETF has seen a trading volume of 72.98 million yuan with a turnover rate of 1.09%, reflecting strong liquidity in the market [3] Market Trends - Recent adjustments in technology heavyweight stocks are indicative of a market consolidation phase, with expectations that small and mid-cap stocks may stabilize first as the market enters the latter part of this phase [6] - The overseas computing power industry remains robust, unaffected by recent trade tensions, suggesting a strong fundamental resonance within the related industry chain [6] - The domestic AI industry is expected to maintain high growth, driven by advancements in models and multi-modal technologies [6] Investment Opportunities - The Sci-Tech AI ETF is positioned as the largest product tracking the Sci-Tech Innovation Board Artificial Intelligence Index, with significant weight in stocks like Cambricon and Haiguang Information, which holds a 70% market share in domestic GPUs [7] - The ETF has seen a substantial growth of 1.98 billion yuan in scale over the past three months, ranking first among comparable funds [7] - The ETF's share count has increased by 3.783 billion shares in the last six months, indicating strong investor interest [7] Industry Developments - Oracle plans to deploy 50,000 AMD MI450 AI chips starting in the second half of 2026 to enhance its AI computing capabilities [8] - Walmart has partnered with OpenAI to introduce shopping features on ChatGPT, showcasing the integration of AI in retail [8] - The domestic usage of computing power chips is expected to surpass that of overseas chips soon, indicating a shift in the market landscape [8]

每经热评|湾芯展现场的掌声 也是“中国芯”前行的铿锵足音

Mei Ri Jing Ji Xin Wen· 2025-10-16 01:28

Core Insights - The 2025 Bay Area Semiconductor Industry Ecosystem Expo (Bay Chip Expo) held in Shenzhen showcased significant advancements in China's semiconductor industry, particularly highlighting the achievements of Shenzhen's Xin Kailai and its subsidiaries [1][2][3] Group 1: Key Developments - Xin Kailai's subsidiary, Wanlian Technology, launched a 90GHz ultra-high-speed real-time oscilloscope, marking a critical breakthrough in high-end electronic measurement instruments and enhancing domestic oscilloscope performance by 500% [1][2] - Another subsidiary, Qiyunfang, introduced two EDA software products with complete independent intellectual property rights, addressing a market gap and overcoming U.S. export restrictions [2][3] Group 2: Market Context - China is the world's largest chip consumer, with an estimated integrated circuit import scale of approximately 2.8 trillion yuan in 2024, and the Bay Area represents the largest semiconductor growth market in China [2][3] - The expo featured over 600 companies and attracted thousands of visitors, indicating strong interest and investment potential in the semiconductor sector [1][4] Group 3: Investment and Collaboration - The expo facilitated connections between major semiconductor projects and industry funds, with Shenzhen planning to establish a 5 billion yuan industry investment fund [3][4] - There has been a notable increase in mergers and acquisitions in the Chinese chip industry, with 93 transactions reported in Q3 2025, reflecting a 33% year-on-year growth and a total transaction value of 54.9 billion yuan, up nearly 50% [4][5] Group 4: Global Engagement - The expo attracted numerous international companies, including ASML, Applied Materials, and Nikon, showcasing China's openness to global collaboration in the semiconductor industry [4][5] - Foreign chip companies are increasing their investments in China, with notable expansions and commitments from firms like NXP and Micron, indicating a positive outlook for the global chip supply chain [5]

实探|新凯来“C位出道”,子公司重大突破!国产半导体设备集体突围

Zheng Quan Shi Bao· 2025-10-15 14:26

Core Viewpoint - New Kylin's recent exhibition at the 2025 Bay Area Semiconductor Industry Ecological Expo showcased its subsidiaries' innovations, particularly in high-speed oscilloscopes and domestic EDA software, rather than new lithography machines [1][2][4]. Group 1: Product Launches and Innovations - New Kylin's subsidiary Wanlianyan introduced a new generation of high-speed real-time oscilloscopes with a bandwidth exceeding 90GHz, marking a significant breakthrough in the industry [4]. - The oscilloscopes are positioned for applications in semiconductor, 6G communication, optical communication, and intelligent driving sectors, with the product being the first in China and second globally [4]. - Another subsidiary, Qiyunfang, launched two domestically developed EDA design software products, filling a gap in high-end electronic design software technology in China [6]. Group 2: Market Dynamics and Trends - The Chinese semiconductor equipment market is experiencing a "group-style breakthrough," with companies adopting multi-product line strategies to enhance market share and accelerate domestic equipment replacement [1][8]. - The domestic oscilloscope market has been dominated by international brands, with imports accounting for over 85% from 2020 to 2024, but this is expected to decline as domestic production increases [4]. - The EDA market in China has been historically dominated by foreign giants, with a current domestic market penetration of 17.61%, projected to rise to 18.52% in 2024 [6]. Group 3: Industry Ecosystem and Collaboration - New Kylin is building a semiconductor ecosystem that integrates software and hardware across research, production, and testing through its subsidiaries [8]. - Other companies, such as North Huachuang, are also adopting a similar multi-product line approach to enhance their competitiveness in the semiconductor equipment sector [8][9]. - Cities like Shenzhen are investing heavily in semiconductor manufacturing projects, with significant developments like the 12-inch integrated circuit production line by Runpeng Semiconductor, which aims to strengthen local manufacturing capabilities [10].

实探|新凯来“C位出道”,子公司重大突破!国产半导体设备集体突围

证券时报· 2025-10-15 14:06

Core Viewpoint - The article highlights the advancements in China's semiconductor industry, particularly focusing on the new products launched by subsidiaries of Xinkailai, including a high-speed oscilloscope and domestic EDA software, which signify a shift towards domestic alternatives in semiconductor equipment [1][6][10]. Group 1: Product Launches - Xinkailai showcased 16 equipment products at the 2025 Bay Area Semiconductor Industry Expo, including thin film deposition and etching equipment, but did not present any new products [1][5]. - The subsidiary Wanlianyan introduced a new generation of high-speed real-time oscilloscopes with a bandwidth exceeding 90GHz, marking a significant breakthrough in the industry [6][7]. - The subsidiary Qiyunfang launched two domestic EDA design software products, filling a gap in high-end electronic design software technology in China [8][10]. Group 2: Market Dynamics - The Chinese semiconductor equipment market is experiencing a "group-style breakthrough," with many companies adopting multi-product line strategies to enhance market share and accelerate domestic substitution of equipment [1][9]. - The oscilloscope market in China has been dominated by international brands, with imports accounting for over 85% from 2020 to 2024, but this is expected to decrease as domestic production increases [7][8]. - The domestic EDA market has been historically dominated by foreign companies, with a current domestic market share of 17.61%, projected to rise to 18.52% in 2024 [8]. Group 3: Industry Trends - The semiconductor industry in China is rapidly developing, driven by government support and increasing demand for domestic equipment, leading to significant market opportunities for local manufacturers [13]. - The establishment of multiple semiconductor manufacturing projects in cities like Shenzhen is expected to strengthen the local manufacturing capabilities and attract design companies back to the region [12]. - The "systemic monopoly" of foreign equipment in the semiconductor production line is being challenged by the coordinated efforts of domestic companies to develop compatible equipment [11].

智通港股解盘 | 形势有利汇率走强助推 市场全面开花医药值得潜伏

Zhi Tong Cai Jing· 2025-10-15 12:28

Market Overview - The stock market is experiencing a phase of alternating trends, with US stocks showing signs of weakness while domestic markets are strengthening, as evidenced by the Hong Kong stock market rising by 1.84% [1] - The Federal Reserve is likely nearing the end of its quantitative tightening policy, with indications that interest rate cuts may occur at upcoming meetings based on current conditions [1] - The focus of tensions has shifted to sanctions and counter-sanctions, particularly regarding rare earth materials, with the EU also seeking to address these issues [1] Sector Performance - Insurance stocks have become market leaders, driven by strong earnings, with companies like Xinhua Insurance and China Taiping seeing gains of over 8% [2] - The Chinese yuan has strengthened, with the central parity rate rising to 7.10, benefiting the aviation sector, as airlines like China Eastern and China Southern saw increases of over 7% [2] - The international oil price has dropped significantly, with WTI crude futures falling over 19% from September, further supporting airline stocks [2] Technology and Innovation - New Kai's subsidiary launched two domestically developed EDA software products, which are crucial for semiconductor design, leading to stock increases for companies like Huahong Semiconductor and SMIC [3] - Strategic collaborations are emerging in the tech sector, such as the partnership between SenseTime and Cambricon to enhance cloud computing capabilities, resulting in stock gains for both companies [3] Automotive Industry - JD.com, GAC Group, and CATL have launched a new electric vehicle model, targeting the mainstream market with a price range of 150,000 to 250,000 yuan, leading to an 11% increase in GAC Group's stock [4] - Tesla's reported order for linear actuators from a Chinese supplier has resulted in significant stock price increases for the supplier, Sanhua Intelligent Controls [4] Construction and Materials - The issuance of 1.3 trillion yuan in special government bonds for infrastructure has boosted market expectations for demand in construction materials, with companies like China National Building Material and Anhui Conch Cement seeing stock increases of over 7% [5] - Steel stocks are also performing well due to favorable conditions in iron ore purchasing, with companies like Ansteel and Maanshan Iron & Steel rising over 7% [5] Healthcare Sector - The upcoming ESMO conference is expected to showcase significant clinical research results, with several domestic innovative drug companies set to present key findings [6] - Companies like Kelun-Biotech and Innovent Biologics have important studies included in the conference, which could attract investor interest [6] Automotive Sales - Geely Automobile reported record sales of 2,953,452 vehicles in the first three quarters of 2025, a 29% year-on-year increase, with electric vehicle sales growing by 68% [7] - The company has raised its annual sales target from 2.71 million to 3 million vehicles, reflecting strong growth momentum [8]

新凯来展出16款半导体设备

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-15 10:41

Core Insights - SiCarrier Technologies showcased 16 semiconductor equipment products at the Bay Chip Expo, highlighting advancements in optical detection, measurement, etching, diffusion, and thin film technologies [1] - The company’s subsidiaries, Wuhan Qiyunfang Technology and Shenzhen Wanliyan Technology, introduced significant technological breakthroughs in electronic design automation (EDA) software and a 90GHz ultra-high-speed oscilloscope, respectively [1][2] Group 1: EDA Software Developments - Qiyunfang launched two EDA software products with fully independent intellectual property rights, filling a gap in high-end electronic design software in China [2] - The EDA software reportedly improves performance by 30% compared to industry benchmarks, reduces hardware development cycles by 40%, and enhances design success rates by 30% [2][3] - Over 20,000 hardware personnel are currently using Qiyunfang's EDA software, which is compatible with various domestic operating systems and platforms [3] Group 2: Ultra-High-Speed Oscilloscope - Wanliyan developed China's first 90GHz ultra-high-speed oscilloscope, crucial for testing high-speed interfaces in advanced AI chips and supporting the development of 6G technology [3] - The oscilloscope meets the requirements for signal integrity and low noise, providing essential support for breakthroughs in 6G communications and smart driving technologies [3] Group 3: Company Overview and Market Impact - SiCarrier Technologies is a strategic emerging enterprise fully controlled by Shenzhen Major Industry Investment Group, with a registered capital of 1.5 billion yuan [4] - The company has multiple subsidiaries focused on achieving technological breakthroughs in semiconductor manufacturing and has plans for global expansion, including establishing service centers in Germany and Singapore by 2026 [4] - The recent performance of SiCarrier has positively impacted the A-share market, with related companies experiencing significant stock price increases due to the "semiconductor self-sufficiency" concept [4]

新凯来亮相湾芯展,子公司展示“惊喜”

Guan Cha Zhe Wang· 2025-10-15 07:08

Core Insights - The article highlights the presence of the domestic semiconductor equipment company, Xinkailai, and its subsidiaries at the 2025 Bay Area Semiconductor Industry Ecosystem Expo, showcasing advancements in semiconductor technology [1][12]. Company Developments - Xinkailai's subsidiary, Wanliyan, introduced a new generation of ultra-high-speed real-time oscilloscopes, featuring 90GHz bandwidth signal acquisition and a sampling rate of 200GSa/s per channel, significantly enhancing performance compared to previous domestic offerings [3][5]. - Another subsidiary, Qiyunfang, launched two EDA (Electronic Design Automation) software products with a 30% performance improvement over industry benchmarks and a 40% reduction in hardware development cycles, addressing gaps in high-end electronic design software in China [7][9]. Market Context - The high-end oscilloscope market in China has been dominated by foreign companies, with domestic products previously lagging in performance, having bandwidths between 8GHz and 18GHz, while leading international products exceed 60GHz [5][9]. - The advancements in Wanliyan's oscilloscope technology are expected to support the development of advanced semiconductor processes, including 3nm and 5nm technologies, which are critical for the future of the semiconductor industry [5][9]. Company Structure - Xinkailai was established in June 2022, with a registered capital of 1.5 billion RMB, and is fully owned by Shenzhen Deep Chip Heng Technology Investment Co., Ltd., which is controlled by the Shenzhen State-owned Assets Supervision and Administration Commission [9][12]. - The company has multiple subsidiaries, including Wanliyan and Qiyunfang, which are focused on different aspects of semiconductor technology and design [12].

新凯来亮相,子公司展示“惊喜”

Guan Cha Zhe Wang· 2025-10-15 06:59

Core Insights - The article highlights the presence of the domestic semiconductor equipment company, Xinkailai, and its subsidiaries at the 2025 Bay Area Semiconductor Industry Ecosystem Expo, showcasing advancements in semiconductor technology [1][8]. Company Developments - Xinkailai's subsidiary, Wanliyan, introduced a new generation of ultra-high-speed real-time oscilloscopes, featuring 90GHz bandwidth signal acquisition and a sampling rate of 200GSa/s per channel, significantly enhancing performance by 500% compared to previous domestic products [3][5]. - Another subsidiary, Qiyunfang, launched two EDA (Electronic Design Automation) software products with a 30% performance improvement over industry benchmarks, reducing hardware development cycles by 40% and increasing design success rates by 30% [8][10]. Market Context - The high-end oscilloscope market in China has been dominated by foreign companies, with domestic products lagging in performance. The new products from Wanliyan aim to bridge this gap and support advancements in semiconductor technology, including 3nm and 5nm chip development [5][10]. - The article notes that the rapid iteration of next-generation optical communication technologies necessitates that domestic high-end oscilloscopes advance by one to two generations to support China's technological breakthroughs and industrial upgrades [5][10]. Company Structure - Xinkailai was established in June 2022, with a registered capital of 1.5 billion RMB, and is fully owned by Shenzhen Shenchip Heng Technology Investment Co., Ltd., which is ultimately controlled by the Shenzhen State-owned Assets Supervision and Administration Commission [10][13]. - The company has multiple subsidiaries, including Wanliyan and Qiyunfang, which are focused on developing advanced semiconductor equipment and software solutions [13].