CNRE(600111)

Search documents

有色金属行业今日净流出资金81.46亿元,北方稀土等23股净流出资金超亿元

Zheng Quan Shi Bao Wang· 2025-10-31 10:00

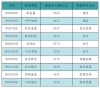

Market Overview - The Shanghai Composite Index fell by 0.81% on October 31, with 16 industries experiencing gains, led by the pharmaceutical and media sectors, which rose by 2.42% and 2.39% respectively [2] - The telecommunications and electronics sectors saw the largest declines, with drops of 4.07% and 3.06% respectively [2] - Overall, there was a net outflow of 62.903 billion yuan in the main funds across the two markets, with 13 industries seeing net inflows [2] Industry Performance Pharmaceutical and Media Sectors - The pharmaceutical sector had the highest net inflow of funds, totaling 4.494 billion yuan, contributing to its 2.42% increase [2] - The media sector followed closely with a net inflow of 4.029 billion yuan and a daily increase of 2.39% [2] Electronics and Telecommunications Sectors - The electronics sector experienced the largest net outflow of funds, amounting to 28.762 billion yuan, while the telecommunications sector saw a net outflow of 11.113 billion yuan [2] Nonferrous Metals Industry - The nonferrous metals sector declined by 2.03%, with a total net outflow of 8.146 billion yuan [3] - Out of 137 stocks in this sector, 40 stocks rose, including one that hit the daily limit, while 95 stocks fell, with two hitting the daily limit down [3] - The top three stocks with the highest net inflow were Hunan Gold (500 million yuan), Ding Sheng New Materials (215 million yuan), and Xingye Silver Tin (129 million yuan) [3] Top Gainers in Nonferrous Metals - Hunan Gold: +7.09%, turnover rate 10.90%, net inflow 499.67 million yuan [4] - Ding Sheng New Materials: +9.97%, turnover rate 9.75%, net inflow 215.48 million yuan [4] - Xingye Silver Tin: +0.07%, turnover rate 3.49%, net inflow 128.84 million yuan [4] Top Losers in Nonferrous Metals - Northern Rare Earth: -4.13%, net outflow 1.283 billion yuan [5] - Tianqi Lithium: -4.09%, net outflow 802.29 million yuan [5] - Ganfeng Lithium: -4.63%, net outflow 732.31 million yuan [5]

有色金属行业双周报(2025、10、17-2025、10、30):能源金属持续回暖,贵金属板块高位震荡-20251031

Dongguan Securities· 2025-10-31 09:37

Investment Rating - The report maintains a standard rating for the non-ferrous metals industry, indicating a positive outlook for investment opportunities in this sector [2][17]. Core Insights - The non-ferrous metals industry has shown a significant increase, with a 3.70% rise over the past two weeks, outperforming the CSI 300 index by 1.72 percentage points, ranking 4th among 31 industries [3][13]. - The energy metals sector has experienced a notable increase of 8.72%, while precious metals have seen a decline of 9.37% [19][22]. - The report highlights the impact of macroeconomic factors, such as the Federal Reserve's interest rate cuts, which have contributed to the upward trend in metal prices [51][67]. Market Review - As of October 30, 2025, the non-ferrous metals industry has risen by 79.55% year-to-date, leading the market performance among all sectors [13][19]. - The industrial metals segment is benefiting from a global easing cycle, with copper and aluminum prices gradually recovering [68]. - Precious metals, particularly gold and silver, have shown volatility, influenced by changes in investor sentiment and central bank purchasing trends [37][67]. Price Analysis - Key prices as of October 30, 2025: - LME Copper: $10,930/ton - LME Aluminum: $2,870/ton - LME Lead: $2,022/ton - LME Zinc: $3,044.50/ton - LME Nickel: $15,250/ton - LME Tin: $35,720/ton [26][68]. - For precious metals: - COMEX Gold: $4,038.30/oz (up $145.7 since early October) - COMEX Silver: $48.73/oz (up $1.31 since early October) [37][67]. Sector Performance - The report suggests focusing on specific companies within the industry: - Western Mining (601168) and Luoyang Molybdenum (603993) in the industrial metals sector [70]. - Xiamen Tungsten (600549) in the small metals sector [68][70]. - The energy metals sector, particularly lithium carbonate, is highlighted for its potential growth due to advancements in energy storage and solid-state battery technologies [69].

新易盛获融资资金买入近54亿元丨资金流向日报

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-31 04:08

Market Overview - The Shanghai Composite Index fell by 0.73% to close at 3986.9 points, with a daily high of 4025.7 points [1] - The Shenzhen Component Index decreased by 1.16% to 13532.13 points, reaching a maximum of 13700.25 points [1] - The ChiNext Index dropped by 1.84% to 3263.02 points, with a peak of 3331.86 points [1] Margin Trading and Securities Lending - The total margin trading and securities lending balance in the Shanghai and Shenzhen markets was 24911.76 billion yuan, with a financing balance of 24732.7 billion yuan and a securities lending balance of 179.06 billion yuan, reflecting a decrease of 75.56 billion yuan from the previous trading day [2] - The Shanghai market's margin trading balance was 12657.39 billion yuan, down by 39.35 billion yuan, while the Shenzhen market's balance was 12254.37 billion yuan, decreasing by 36.21 billion yuan [2] - A total of 3456 stocks had financing funds for purchase, with the top three being Xinyi Technology (53.65 billion yuan), Zhongji Xuchuang (46.23 billion yuan), and Sunshine Power (36.47 billion yuan) [2] Fund Issuance - Four new funds were issued yesterday, including two mixed funds and two stock funds, all launched on October 30, 2025 [3][4] Top Trading Activities - The top ten net buying amounts on the Dragon and Tiger List included Jiangte Electric (27681.86 million yuan), Tianji Shares (20137.13 million yuan), and Guodun Quantum (16408.1 million yuan) [5] - The highest price increase was seen in Jiangte Electric with a rise of 9.98%, followed by Tianji Shares with a 10.0% increase [5]

稀土板块盘初调整,中国稀土跌超4%

Mei Ri Jing Ji Xin Wen· 2025-10-31 01:53

Core Viewpoint - The rare earth index experienced a significant adjustment on October 31, with notable declines in several component stocks [1] Company Performance - China Rare Earth saw a decline of 4.57% [1] - Guangsheng Nonferrous dropped by 4.37% [1] - Northern Rare Earth decreased by 4.13% [1] - Huahong Technology fell by 3.88% [1] - Shenghe Resources declined by 3.20% [1]

北方稀土_2025 年第三季度因产品结构调整导致毛利率不及预期,维持买入评级

2025-10-31 00:59

Summary of China Northern Rare Earth High-Tech (600111.SS) 3Q25 Earnings Call Company Overview - **Company**: China Northern Rare Earth High-Tech (NRE) - **Ticker**: 600111.SS - **Industry**: Rare Earth Materials Key Financial Highlights - **Net Profit**: 9M25 net profit reached Rmb1,541 million, up 280% YoY, representing 69% of Street consensus and 71% of the full-year estimation [1][5] - **3Q25 Net Profit**: Implied net profit was Rmb610 million, up 22% QoQ and 69% YoY [1] - **Excluding One-offs**: Net profit excluding one-offs for 9M25 was Rmb1,362 million, up 412% YoY; 3Q25 net profit was Rmb467 million, up 86% YoY and 1% QoQ [1] - **Gross Profit (GP)**: 3Q25 GP was Rmb1,130 million, up 28% YoY but down 9% QoQ [1] Sales and Production Data - **Sales Volume**: 3Q25 rare earth raw materials sales volume increased by 38% YoY [2] - **Production Figures**: - Rare earth oxides: 6,939 tons, up 63% YoY - Rare earth salts: 38,635 tons, up 14% YoY - Rare earth metals: 12,197 tons, up 24% YoY [2] Margin Analysis - **GP Margin**: 3Q25 GP margin was 10%, down 0.4 percentage points YoY and down 3 percentage points QoQ, attributed to product-mix adjustments with increased share of lanthanum and cerium products [3] Inventory and Cash Flow - **Inventory Levels**: Inventory decreased by 12% QoQ to Rmb14 billion, accounting for 29% of total assets, down from 34% at the end of 1H25 [4] - **Free Cash Flow (FCF)**: 9M25 FCF was Rmb1,750 million, with 3Q FCF at Rmb1,472 million, up 45% YoY and 372% QoQ [5] Valuation Metrics - **Current Trading Multiples**: NRE is trading at 52.9x 2026E P/E and 6.8x 2026E P/B [5] - **Target Price**: Target price set at Rmb72, implying a 35.1% expected share price return [8][11] Risks and Considerations - **Demand Growth**: Risks include slower or faster-than-expected demand growth in downstream applications such as NEVs and wind power [12] - **Supply Chain Dynamics**: Potential impacts from global supply-chain diversification efforts and changes in mining or processing capacity outside of China [12] - **Policy Changes**: Risks from tariffs, trade barriers, and policy adjustments in China affecting supply and profitability [12] - **Technological Substitutes**: Emergence of alternative materials or technologies that could replace rare earth elements [12] Conclusion - The company has shown significant growth in net profit and sales volume, although margins have been impacted by product mix changes. The inventory management strategy appears effective, and the company maintains a positive cash flow. However, various risks related to demand, supply chain, and policy changes could affect future performance. The current valuation suggests a favorable outlook, supported by strong fundamentals and market conditions.

上游利润丰沛、中游韧性但有隐忧 稀土产业链三季报“答卷”冷暖有别

Shang Hai Zheng Quan Bao· 2025-10-30 23:19

Core Viewpoint - The rare earth permanent magnet industry has shown varied performance in Q3, with upstream companies benefiting from strong price increases, while midstream magnet manufacturers face challenges despite demonstrating resilience in growth [1] Group 1: Upstream Performance - Rare earth product prices have significantly increased, with the average price of praseodymium and neodymium oxide reaching 561.5 yuan per kilogram by September 30, marking a 41% increase since the beginning of the year [2] - Major rare earth resource companies reported substantial profit growth in Q3, with Guangxi Chuangsheng Nonferrous Metals, Shenghe Resources, and Northern Rare Earth seeing net profit increases of 240.56%, 166.31%, and 85.91% respectively [2] - Cash flow analysis indicates that upstream companies have stronger bargaining power and cash flow compared to downstream magnet manufacturers, reflecting higher profit quality [2] Group 2: Midstream Magnet Manufacturers - Despite facing policy uncertainties and market volatility, leading domestic magnet companies exhibited strong profit resilience in Q3, with significant growth in non-recurring net profits [4] - Companies like Ningbo Yunsheng, Jinli Permanent Magnet, and Zhenghai Magnetic Materials reported impressive non-recurring net profit growth rates of 621.23%, 254.98%, and 165.39% respectively [4] - The performance improvement in magnet companies is attributed to the release of new production capacity and the exploration of emerging markets [4][5] Group 3: Operational Challenges - Many companies experienced longer inventory turnover days compared to previous years, indicating potential operational challenges [6] - Some companies reported cash flow pressures, with net cash ratios falling below 1 or even negative, highlighting financial strain despite positive profit levels [6] - The overall performance of magnet companies in Q3 serves as evidence of their ability to grow amidst a complex environment [6]

A股三季报勾勒产业新图景 电子、有色、储能行业业绩亮眼

Zhong Guo Zheng Quan Bao· 2025-10-30 22:10

Core Insights - The A-share market's Q3 2025 reports reveal significant growth across multiple industries, with notable reversals in performance for some sectors, particularly electronics, non-ferrous metals, and energy storage [1] Electronics Industry - The electronics sector, led by major player Industrial Fulian, reported a revenue of 603.93 billion yuan for the first three quarters, marking a 38.4% year-on-year increase, and a net profit of 22.49 billion yuan, up 48.52% [2] - AI-driven demand has significantly boosted growth in various electronic applications, including servers and communication devices, with companies like Zhongji Xuchuang and Xinyi achieving revenue increases of 44.43% and 221.7% respectively [2] - PCB companies also showed strong performance, with Shengyi Electronics reporting a staggering 497.61% increase in net profit [2] Non-Ferrous Metals Industry - The non-ferrous metals sector experienced substantial growth due to rising product prices and increased downstream demand, with several rare earth companies reporting over 100% growth in net profit [4] - For instance, Shenghe Resources achieved a net profit growth rate of 748.07%, driven by favorable market conditions and effective management strategies [4] - Other companies like Zijin Mining and Baiyin Nonferrous Metals also reported significant revenue increases, with Zijin Mining's revenue reaching approximately 254.2 billion yuan, up 10.33% [4] Energy Storage Industry - The energy storage sector is witnessing robust demand, with global lithium battery storage installations exceeding 170 GWh, reflecting a 68% year-on-year growth [5] - Companies like Sungrow Power reported a revenue of 66.40 billion yuan, up 32.95%, with a notable 70% increase in energy storage shipments [6] - Kelu Electronics also experienced growth, with a revenue increase of 23.42% and a net profit surge of 251.1%, highlighting the expanding applications and technological advancements in the energy storage market [6]

电子、有色、储能行业业绩亮眼

Zhong Guo Zheng Quan Bao· 2025-10-30 21:11

Core Insights - The A-share market's Q3 2025 reports reveal significant growth across multiple industries, particularly in electronics, non-ferrous metals, and energy storage, driven by strong downstream demand [1] Electronics Industry - The electronics sector, led by major player Industrial Fulian, reported a revenue of 603.93 billion yuan for the first three quarters, marking a 38.4% year-on-year increase, with net profit rising by 48.52% to 22.49 billion yuan [1] - The growth in cloud computing is attributed to the large-scale delivery of AI cabinet products and sustained demand for AI computing power, positively impacting various electronic applications [1] - In the optical module sector, companies like Zhongji Xuchuang and Xinyi Sheng reported substantial revenue increases of 44.43% and 221.7%, respectively, with net profits soaring by 90.05% and 284.37% [2] - PCB companies, including Shenghong Technology and Shunyi Electronics, also experienced significant profit growth, with Shengyi Electronics' net profit increasing by 497.61% [2] - Dongwei Technology, specializing in PCB plating equipment, reported a net profit of 85.37 million yuan, up 24.8%, with Q3 net profit surging by 236.93% [2] Non-Ferrous Metals Industry - The non-ferrous metals sector saw substantial profit growth, with companies like Northern Rare Earth and China Rare Earth reporting over 100% year-on-year increases in net profit, and Shenghe Resources achieving a remarkable 748.07% growth [3] - Silver Industry's Q3 revenue reached 72.64 billion yuan, a 5.21% increase, with Q3 alone showing a 70.72% rise [3] - Zijin Mining reported approximately 254.2 billion yuan in revenue, up 10.33%, and a net profit of 37.86 billion yuan, reflecting a 55.45% increase [3] Energy Storage Industry - The global lithium battery energy storage installations exceeded 170 GWh in the first three quarters of 2025, representing a 68% year-on-year growth, indicating a robust market expansion [4] - Sunshine Power achieved a revenue of 66.40 billion yuan, a 32.95% increase, with net profit rising by 56.34% to 11.88 billion yuan, driven by strong performance in photovoltaic inverters and energy storage [4] - Kelu Electronics reported a revenue of 3.59 billion yuan, up 23.42%, with net profit soaring by 251.1% to 23.2 million yuan, benefiting from the growing share of renewable energy in the new power system [4] - Hunan Yuren, a supplier of lithium-ion battery cathode materials, reported revenue and net profit growth rates of 46.27% and 31.51%, respectively, due to increased demand in the energy storage sector [5]

上游利润丰沛 中游韧性但有隐忧 稀土产业链三季报“答卷”冷暖有别

Shang Hai Zheng Quan Bao· 2025-10-30 18:29

Core Viewpoint - The rare earth permanent magnet industry has shown varied performance in Q3, with upstream companies benefiting from strong product price increases, while midstream magnet manufacturers face challenges but demonstrate resilience through diverse strategies [1][2]. Group 1: Upstream Performance - Rare earth product prices have significantly increased, with the average price of praseodymium and neodymium oxide reaching 561.5 RMB/kg, a 41% rise since the beginning of the year [2]. - Major upstream companies like Guangsheng Nonferrous, Shenghe Resources, and Northern Rare Earth reported substantial increases in net profit, with year-on-year growth rates of 240.56%, 166.31%, and 85.91% respectively [2][4]. - Northern Rare Earth achieved historical highs in production and sales across its three main product categories [4]. Group 2: Midstream Magnet Manufacturers - Leading magnet companies such as Ningbo Yunsheng, Jinli Permanent Magnet, and Zhenghai Magnetic Materials reported impressive net profit growth rates of 621.23%, 254.98%, and 165.39% respectively in Q3 [1][5]. - Jinli Permanent Magnet attributed its growth to the steady release of new production capacity and strong performance in the electric vehicle and energy-saving sectors, with sales revenue reaching 2.615 billion RMB and 1.446 billion RMB respectively [5][6]. - Ningbo Yunsheng's profit growth was linked to improved gross margins and a strong market position in the domestic new energy vehicle sector, holding a 23% market share [6]. Group 3: Challenges and Concerns - Despite strong performance, many companies face challenges such as increased inventory turnover days and cash flow pressures, with some companies reporting net cash ratios below 1 or even negative [7]. - The uncertainty in policies and market conditions has led to longer inventory turnover days for several companies, indicating potential operational challenges ahead [7]. - The overall positive net profit levels in Q3 provide evidence of the magnet industry's ability to grow despite a complex environment [7].

锂矿概念狂飙!涨幅前7个股携手新高,有色龙头ETF(159876)逆市上探2.3%!机构:有色配置价值或十分坚固

Xin Lang Ji Jin· 2025-10-30 11:30

Group 1 - The lithium mining sector experienced a significant increase, with companies like Yongxing Materials hitting the daily limit, Tianqi Lithium rising by 9.67%, and Tibet Mining increasing by over 7% [1] - The non-ferrous metal sector ETF (159876) saw a price surge of 4.58% yesterday and a further increase of 1.09% today, with a total trading volume of 68.73 million yuan [1] - The Federal Reserve's recent interest rate cut of 25 basis points is expected to lead to a weaker dollar, making dollar-denominated metals cheaper and boosting global demand [2][3] Group 2 - The non-ferrous metal sector has shown significant earnings growth, with 49 out of 53 companies reporting profits and 39 showing year-on-year net profit growth [3] - Notable companies like Chuanjiang New Materials reported a 20-fold increase in net profit, while eight other companies achieved triple-digit growth [3] - The non-ferrous metal sector is anticipated to enter a new super cycle due to the Fed's rate cuts and increasing demand for industrial metals like copper and aluminum [3] Group 3 - The non-ferrous metal sector attracted a net inflow of 11.317 billion yuan, leading among 31 first-level industries [4] - Major stocks such as Tianqi Lithium and Northern Rare Earth attracted 3.075 billion yuan and 2.022 billion yuan respectively, ranking first and second in A-share capital inflow [4] Group 4 - The non-ferrous sector ETF (159876) has a current scale of 537 million yuan, making it the largest among its peers [7] - The ETF tracks the Zhongzheng Non-Ferrous Metal Index, which includes a diversified portfolio of metals such as copper, gold, aluminum, rare earths, and lithium, providing a risk diversification strategy [5]