NAURA(002371)

Search documents

北方华创:第三季度净利润19.2亿元,同比增长14.60%

Hua Er Jie Jian Wen· 2025-10-31 01:37

Core Viewpoint - Northern Huachuang reported a third-quarter revenue of 11.16 billion yuan, representing a year-on-year increase of 38.31%, and a net profit of 1.922 billion yuan, reflecting a year-on-year growth of 14.60% [1] Financial Performance - Third-quarter revenue reached 11.16 billion yuan, up 38.31% compared to the same period last year [1] - Net profit for the third quarter was 1.922 billion yuan, showing a year-on-year increase of 14.60% [1]

北方华创(002371.SZ)发布前三季度业绩,归母净利润51.3亿元,同比增长14.83%

智通财经网· 2025-10-30 17:05

智通财经APP讯,北方华创(002371.SZ)发布2025年三季度报告,前三季度,公司实现营业收入273.01亿 元,同比增长32.97%。归属于上市公司股东的净利润51.3亿元,同比增长14.83%。归属于上市公司股东 的扣除非经常性损益的净利润51.02亿元,同比增长19.47%。 ...

北方华创的前世今生:营收273.01亿元高于行业均值,净利润49.8亿元远超同行

Xin Lang Cai Jing· 2025-10-30 17:03

Core Viewpoint - North Huachuang is a leading enterprise in China's high-end integrated circuit equipment sector, with strong performance in semiconductor equipment and a diverse product matrix [1][6]. Group 1: Business Performance - In Q3 2025, North Huachuang achieved a revenue of 27.301 billion yuan, ranking first in the industry, significantly higher than the industry average of 3.195 billion yuan and the median of 1.152 billion yuan [2]. - The company's net profit for the same period was 4.98 billion yuan, also ranking first in the industry, exceeding the industry average of 0.515 billion yuan and the median of 0.127 billion yuan [2]. - The main business composition includes electronic process equipment at 15.258 billion yuan (94.53%) and electronic components at 0.868 billion yuan (5.37%) [2]. Group 2: Financial Ratios - As of Q3 2025, North Huachuang's debt-to-asset ratio was 50.90%, a decrease from 52.89% year-on-year but still above the industry average of 35.23% [3]. - The gross profit margin for Q3 2025 was 41.41%, down from 44.22% year-on-year but higher than the industry average of 38.42% [3]. Group 3: Shareholder Information - As of September 30, 2025, the number of A-share shareholders increased by 11.57% to 85,100, while the average number of circulating A-shares held per household decreased by 10.33% to 8,506.57 [5]. - Major shareholders include Hong Kong Central Clearing Limited and various ETFs, with notable increases in holdings [5]. Group 4: Future Outlook - North Huachuang is expected to expand its market presence in ion implantation equipment and has completed the acquisition of ChipSource to enhance its product line [6][7]. - Revenue for the first half of 2025 was 16.142 billion yuan, a year-on-year increase of 29.51%, with a net profit of 3.208 billion yuan, up 14.97% [6]. - Projections for 2025-2027 indicate revenues of 39.283 billion, 49.665 billion, and 61.156 billion yuan, with net profits of 7.530 billion, 9.676 billion, and 11.863 billion yuan respectively [6][7].

北方华创的前世今生:2025年Q3营收273.01亿行业第一,净利润49.8亿远超同业平均

Xin Lang Cai Jing· 2025-10-30 15:02

Core Viewpoint - North Huachuang is a leading enterprise in China's high-end integrated circuit equipment sector, demonstrating strong revenue and profit growth in the semiconductor industry [2][6][7]. Group 1: Business Performance - In Q3 2025, North Huachuang achieved a revenue of 27.301 billion yuan, ranking first among 22 companies in the industry, significantly higher than the industry average of 3.195 billion yuan and the median of 1.152 billion yuan [2]. - The company's net profit for the same period was 4.98 billion yuan, also leading the industry, with the average being 0.515 billion yuan and the median at 0.127 billion yuan [2]. - The main business revenue composition includes electronic process equipment at 15.258 billion yuan (94.53%) and electronic components at 0.868 billion yuan (5.37%) [2]. Group 2: Financial Ratios - As of Q3 2025, North Huachuang's debt-to-asset ratio was 50.90%, down from 52.89% year-on-year, which is higher than the industry average of 35.23% [3]. - The gross profit margin for the same period was 41.41%, slightly down from 44.22% year-on-year, but still above the industry average of 38.42% [3]. Group 3: Shareholder Information - As of September 30, 2025, the number of A-share shareholders increased by 11.57% to 85,100, while the average number of circulating A-shares held per shareholder decreased by 10.37% to 8,503.17 [5]. - Major shareholders include Hong Kong Central Clearing Limited and various ETFs, with notable increases in holdings [5]. Group 4: Strategic Developments - North Huachuang is expanding its product matrix and entering new markets, including the ion implantation equipment market and acquiring ChipSource to enhance its product line [6]. - The company reported a revenue growth of 29.51% year-on-year in the first half of 2025, with a net profit increase of 14.97% [6]. - The semiconductor equipment business is expected to contribute significantly to revenue, projected to reach 26.578 billion yuan in 2024, accounting for about 90% of total revenue [6]. Group 5: Management Compensation - The chairman, Zhao Jinrong, received a salary of 3.95 million yuan in 2024, a decrease of 321,300 yuan from 2023 [4]. - The general manager, Tao Haihong, earned 3.02 million yuan in 2024, down by 183,800 yuan from the previous year [4].

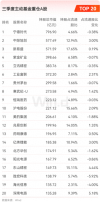

公募三季报持仓洗牌:科技股“七雄”霸榜,茅台失宠,ST华通成黑马

Hua Xia Shi Bao· 2025-10-30 13:16

Core Viewpoint - The report highlights significant shifts in the holdings of actively managed equity funds in the third quarter of 2025, with a notable rise in technology stocks and a decline in traditional consumer stocks like Kweichow Moutai [3][4][6]. Group 1: Fund Holdings Overview - As of September 2025, the total assets under management in the public fund industry reached 35.85 trillion yuan, a quarter-on-quarter increase of 6.30% [3]. - The top three holdings of actively managed equity funds are dominated by technology companies, with CATL reclaiming the top position, surpassing Tencent Holdings [3][4]. - Kweichow Moutai's total market value held by active equity funds decreased to 29.958 billion yuan, down from 30.616 billion yuan in the previous quarter, dropping from third to seventh place among top holdings [3][6]. Group 2: Technology Sector Performance - The technology sector emerged as the primary focus for public fund investments, with seven out of the top ten holdings being technology-related companies [4]. - Notable performers include Xinyi Technology and Zhongji Xuchuang, both of which ranked among the top three heavyweights [4]. - The current market trend indicates a strong and sustained interest in technology stocks, driven by China's economic transformation towards a hard-tech model [4][5]. Group 3: Challenges in Traditional Consumer Sector - The traditional consumer sector, particularly the liquor industry, is facing significant challenges, with 59.7% of liquor companies reporting a decrease in operating profits [6][7]. - The white liquor market is undergoing a deep adjustment phase due to policy changes, consumption structure transformation, and intense competition [6][7]. - The overall sales volume in the liquor industry is expected to decline by over 20% year-on-year, reflecting macroeconomic fluctuations and slow recovery in consumer spending [7][8]. Group 4: Fund Manager Strategies - The top five stocks with increased holdings include Zhongji Xuchuang, Industrial Fulian, ST Huatuo, Dongshan Precision, and Hanwha Technology, all of which are technology companies [9][10]. - Conversely, the top stocks with reduced holdings include Shenghong Technology and Haiguang Information, with significant sell-offs attributed to internal management's actions [11]. - Despite CATL being the top holding, it also appears on the list of reduced holdings, indicating a complex strategy among institutional investors [11].

国内市场持续增长,北方华创Q3净利润19.2亿元,同比增长14.60%

Hua Er Jie Jian Wen· 2025-10-30 13:00

Core Insights - The company, North Huachuang, reported significant revenue and profit growth in Q3, but faced a drastic decline in cash flow due to increased orders and R&D investments [1][3]. Financial Performance - Q3 revenue reached 11.16 billion yuan, a year-on-year increase of 38.31% - Net profit for Q3 was 1.92 billion yuan, up 14.60% year-on-year - For the first three quarters, total revenue was 27.30 billion yuan, reflecting a 32.97% increase - Net profit for the first three quarters amounted to 5.13 billion yuan, a 14.83% increase [1][3][4]. Cash Flow and Debt - The net cash flow from operating activities was -2.57 billion yuan, a staggering decline of 713% year-on-year - Long-term borrowings surged from 3.95 billion yuan at the beginning of the year to 13.22 billion yuan, marking a 235% increase - Total interest-bearing debt reached 13.5 billion yuan, with financial expenses for the first three quarters hitting 150 million yuan, a 116% increase [1][3][4]. R&D Investment - R&D expenses for the first three quarters totaled 3.29 billion yuan, a 48% increase year-on-year, accounting for 12% of revenue - Capitalized R&D expenditures rose to 7.47 billion yuan, up 25% from the beginning of the year [4]. Market Performance - The company's stock price increased nearly 50% year-to-date, closing at 415.5 yuan per share, up from 277.18 yuan at the start of the year [4].

北方华创(002371.SZ):前三季净利润51.3亿元 同比增长14.83%

Ge Long Hui A P P· 2025-10-30 12:41

Core Viewpoint - Northern Huachuang (002371.SZ) reported strong financial performance in Q3, with significant year-on-year growth in both revenue and net profit [1] Financial Performance - The company's revenue for the first three quarters reached 27.301 billion yuan, representing a year-on-year increase of 32.97% [1] - The net profit attributable to shareholders for the same period was 5.13 billion yuan, showing a year-on-year growth of 14.83% [1] - The net profit attributable to shareholders after deducting non-recurring gains and losses was 5.102 billion yuan, reflecting a year-on-year increase of 19.47% [1]

北方华创(002371) - 关于全资子公司使用部分闲置募集资金暂时补充流动资金的公告

2025-10-30 11:29

证券代码:002371 证券简称:北方华创 公告编号:2025-063 北方华创科技集团股份有限公司 关于全资子公司使用部分闲置募集资金暂时补充流动资金 的公告 本公司及董事会全体成员保证信息披露的内容真实、准确、完整,没有虚 假记载、误导性陈述或者重大遗漏。 北方华创科技集团股份有限公司(以下简称"公司")于 2025 年 10 月 30 日召开第八届董事会第二十八次会议及第八届监事会第十七次会议,审议通过了 《关于全资子公司使用部分闲置募集资金暂时补充流动资金的议案》,同意公司 全资子公司北京北方华创微电子装备有限公司(以下简称"北方华创微电子") 使用闲置募集资金不超过 125,000 万元暂时补充流动资金,使用期限为自董事会 审议通过之日起不超过 12 个月。为规范公司募集资金的使用和管理,开立闲置 募集资金暂时补充流动资金专用账户,并与保荐机构、专用账户开户银行签订监 管协议。现将相关情况公告如下: 一、募集资金基本情况 经中国证券监督管理委员会出具的《关于核准北方华创科技集团股份有限公 司非公开发行股票的批复》(证监许可[2021]2710 号)核准,公司非公开发行人 民币普通股(A 股)27,9 ...

北方华创(002371) - 公司章程修订对照表(2025年10月)

2025-10-30 11:29

北方华创科技集团股份有限公司 公司章程修订对照表 (2025 年 10 月 30 日,经第八届董事会第二十八次会议审议通过) 公司对《公司章程》中部分条款进行修改,主要修订内容如下: | 序号 | 原条款 | 拟修订条款 | | --- | --- | --- | | 1 | 第一章 总则 | 第一章 总则 | | | 第一条 为维护北方华创科技集团股份有限公司(以下简称"公 | 第一条 为维护北方华创科技集团股份有限公司(以下简称"公司")、股 | | | 司")、股东和债权人的合法权益,规范公司的组织和行为,根据 | 东、职工和债权人的合法权益,规范公司的组织和行为,根据《中华人民 | | 2 | 《中华人民共和国公司法》(以下简称《公司法》)、《中华人 | 共和国公司法》(以下简称《公司法》)、《中华人民共和国证券法》(以 | | | 民共和国证券法》(以下简称《证券法》)《上市公司章程指引》 | 下简称《证券法》)《上市公司章程指引》和其他有关规定,制订制定本 | | | 和其他有关规定,制订本章程。 | 章程。 | | 3 | 第六条 公司注册资本为人民币 元。 533,608,487.00 | 第 ...

北方华创(002371) - 2025-2027年员工持股计划(草案)

2025-10-30 11:29

股票简称:北方华创 股票代码:002371 上市地点:深圳证券交易所 北方华创科技集团股份有限公司 2025-2027年员工持股计划 (草案) 二〇二五年十月 北方华创科技集团股份有限公司 2025-2027年员工持股计划(草案) 声明 本公司及董事会全体成员保证本员工持股计划不存在虚假记载、误导性陈述或 重大遗漏,并对其真实性、准确性、完整性承担法律责任。 1 北方华创科技集团股份有限公司 2025-2027年员工持股计划(草案) 风险提示 一、北方华创科技集团股份有限公司(以下简称"北方华创"或"公司")2025- 2027年员工持股计划草案须经公司股东大会批准后方可实施,本次员工持股计划能否 获得公司股东大会批准,存在不确定性。 二、各期员工持股计划资金主要来源为公司根据参与对象业绩达成情况提取的业 绩奖金,以及用于特殊人才和新引进人才的奖励金。若未达到计提奖励金条件时,则 当年员工持股计划存在不能成立的风险。 三、股票价格受公司经营业绩、宏观经济周期、国际/国内政治经济形势及投资 者心理等多种复杂因素影响。因此,股票交易是有一定风险的投资活动,投资者对 此应有充分准备。 四、公司将根据相关规定披露本员 ...