诺诚健华

Search documents

“宜起新生”淋巴瘤患者影像展在北京举行

Bei Jing Shang Bao· 2025-10-19 04:04

此外,"精准调色盘——淋巴瘤多学科助力患者新生沙龙"和"泼墨调色师——社会多方助力患者新生沙 龙"两场专家沙龙分别聚焦淋巴瘤多学科治疗策略优化,以及医疗、企业、媒体等多方如何构建患者支 持网络,为淋巴瘤患者康复提供更多思路。 活动现场,多位专家分享观点。哈尔滨血液病肿瘤研究所所长马军教授表示:"淋巴瘤治疗已经进入了 一个新时代,特别是靶向治疗、免疫治疗和细胞治疗。"北京大学肿瘤医院朱军教授则强调,"淋巴瘤治 疗已迈入全新时代,我们的目标不仅是延长生命,更是要提升患者的生活质量。"诺诚健华联合创始 人、董事长兼首席执行官崔霁松博士在开场致辞中介绍,诺诚健华研发的奥布替尼等药物,可为患者提 供治疗支持。 10月18日,"宜起新生:艺术与科学的对话——淋巴瘤患者影像展"在北京禄米仓启幕。本次活动由广州 市红棉肿瘤和罕见病公益基金会、淋巴瘤之家联合发起,设置患者影像作品展、患者故事分享及专家沙 龙等多元形式。活动现场与会嘉宾还共同启动了"宜起新生"患者关爱项目暨第二届淋巴瘤患者短视频大 赛。 影像展中,淋巴瘤患者创作的摄影作品与短视频,记录下他们战胜病魔后的生活片段。患者代表也分享 了抗病历程,慢性淋巴细胞白血病患者 ...

创新药板块有望持续迎来重磅催化,关注科创创新药ETF国泰(589720)

Sou Hu Cai Jing· 2025-10-17 01:41

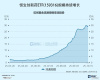

Group 1 - The core viewpoint is that the innovative drug sector remains a strong investment theme despite a recent 15% pullback, with a year-to-date performance still among the best in the market [2] - From January to September, the total contract value for Chinese innovative drugs going overseas exceeded $100 billion, marking a 170% year-on-year increase, indicating a robust long-term outlook for the innovative industry chain [2] - The trend of innovative drugs going global is expected to continue, with more business development (BD) deals anticipated by year-end, reinforcing confidence in the innovative sector [2] Group 2 - The innovative drug sector is expected to receive significant catalysts in the fourth quarter, with 23 Chinese studies selected for presentation at the upcoming ESMO conference, a substantial increase from 7 studies in 2024 [3] - Macroeconomic conditions are favorable for the innovative drug sector, as recent comments from Powell suggest potential interest rate cuts, which are beneficial for rate-sensitive innovative drugs [3] - The innovative drug sector is seen as a good investment choice amid market resistance and a rotation in tech growth, with BD deals expected to drive recovery in the sector [3] Group 3 - The fourth quarter typically sees BD transactions account for about 40% of annual totals, with large products also expected to contribute positively [3] - Recent adjustments in the market provide a favorable entry point for long-term investors in the innovative drug sector [3] - Investors are encouraged to consider ETFs focused on innovative drugs, particularly those targeting the STAR Market and smaller-cap stocks, which may show stronger resilience [3]

ETF日报:煤炭板块具备周期与红利的双重属性,当前煤炭持仓低位,基本面已到拐点右侧,可关注煤炭ETF

Xin Lang Ji Jin· 2025-10-16 15:33

Market Overview - The A-share market showed mixed results with the Shanghai Composite Index rising by 0.10% to close at 3916.23 points, while the Shenzhen Component Index fell by 0.25% to 13086.41 points, and the ChiNext Index increased by 0.38% to 3037.44 points [1] - The trading volume in the Shanghai and Shenzhen markets dropped below 2 trillion, with a total of 193.11 billion, a decrease of 141.7 billion from the previous day [1] Sector Performance - The insurance, coal, shipping, and banking sectors saw the highest gains, while small metals, precious metals, wind power equipment, steel, mining, and fertilizer sectors experienced the largest declines [1] - The coal ETF (515220) rose by 2.97%, with a five-day change of 7.28% [2][3] Seasonal Trends and Demand - There is an increasing expectation of a cold winter, which is anticipated to boost winter demand for coal [4] - The China Electricity Council predicts that electricity consumption growth in the second half of the year will exceed that of the first half, with a projected year-on-year increase of 5% to 6% for 2025 [4] Policy and Market Dynamics - The National Development and Reform Commission and the State Administration for Market Regulation have announced measures to regulate price competition and maintain market order [4] - Analysts from Guosheng Securities expect coal prices to rebound in the second half of 2025, improving coal company profits [4] Investment Opportunities - The coal sector is viewed as having dual attributes of cyclical and dividend investments, making it an attractive area for investment [5] - The innovative pharmaceutical sector remains a key focus, with significant growth in overseas contracts, totaling over 100 billion USD in the first nine months of the year, a 170% increase year-on-year [7] - Upcoming international conferences are expected to provide catalysts for the innovative drug sector, with a notable increase in research presentations from China at the ESMO conference [8]

重磅会议召开!新一轮催化即将展开?

Ge Long Hui A P P· 2025-10-16 11:20

Core Viewpoint - The innovative drug sector is experiencing a counter-trend rise despite a pullback in AI technology, with significant interest in upcoming events like the ESMO conference, which is expected to showcase breakthroughs from Chinese pharmaceutical companies [1][2]. Group 1: Market Performance - The Hang Seng Innovative Drug ETF (159316) increased by 2.81%, while the low-fee Hong Kong Stock Connect Medical ETF (513200) rose by 1.32% [1]. - The upcoming ESMO conference from October 17 to 21, 2025, in Berlin is anticipated to be a crucial platform for domestic pharmaceutical companies to present their achievements and secure new business development (BD) partnerships [1][2]. Group 2: International Expansion - The outbound licensing transactions of Chinese biopharmaceutical companies exceeded $50 billion in the first half of the year, surpassing the total for 2024, and reached $87.4 billion by August 2025 [3]. - The quality of outbound transactions has significantly improved, with upfront payments reaching $4.16 billion by August 2025, nearing the total of $4.91 billion for 2024 [4]. - There were 21 major transactions exceeding $1 billion in total value in the first eight months of 2025, almost matching the 23 transactions for the entire year of 2024 [4]. Group 3: Technological Advancements - ADC drugs remain the primary focus for outbound transactions, with 14 ADC-related deals completed in the first eight months of 2025, including a record $13 billion collaboration between Qihuang Dejian and Biohaven [5]. - The metabolic field, particularly GLP-1 products, has emerged as a new hotspot for outbound transactions, with companies like Hansoh Pharmaceutical and Lianbang Pharmaceutical achieving over $2 billion in overseas licensing [6]. Group 4: Future Drivers - The next 5-10 years are expected to present historic development opportunities for the Chinese innovative drug industry [12]. - Chinese companies have demonstrated international competitiveness in ADC research, with significant collaborations indicating global trust in their capabilities [13]. - The dual-track payment system of medical insurance and commercial insurance is facilitating rapid market entry for innovative drugs, despite some price pressures from insurance [15]. Group 5: Investment Opportunities - The innovative drug sector is categorized into three main areas: platform giants, explosive biotech firms, and international pioneers, each representing different investment opportunities [16]. - The Hang Seng Innovative Drug ETF (159316) has seen a net inflow of 849 million yuan over the past 20 days, with a total fund size of 2.961 billion yuan [16].

宣布20亿美元对外授权合作 诺诚健华股价为何大跌?

BambooWorks· 2025-10-16 09:10

Core Viewpoint - The article discusses the recent licensing agreement between Innovent Biologics and Zenas, highlighting market concerns regarding the low upfront payment and the financial stability of Zenas, a relatively new player in the biopharmaceutical industry [1][2]. Group 1: Transaction Overview - Innovent Biologics announced a licensing agreement with Zenas for the global exclusive rights to the BTK inhibitor, Oubatinib, with a potential total transaction value exceeding $2 billion [1]. - The upfront payment from Zenas consists of $35 million in cash, $65 million in milestone payments, and approximately $146 million worth of Zenas stock, with the remaining over $1.7 billion contingent on future milestones [2]. Group 2: Market Reaction - The market reacted negatively to the transaction, with Innovent's stock price dropping approximately 21.8% over two trading days following the announcement, primarily due to the low upfront payment, which constitutes only 1.75% of the total deal value [1][2]. - Concerns about Zenas's ability to fulfill its commitments arise from its status as a clinical-stage company with only $10 million in revenue and a net loss of approximately $8.58 million in the first half of 2025 [2]. Group 3: Product Background - Oubatinib is a key product for Innovent, being the first and only approved BTK inhibitor for the treatment of relapsed or refractory marginal zone lymphoma in China, with significant sales growth reported [3]. - The product has been previously licensed to Biogen, which later terminated the agreement, raising questions about the product's market viability and the reliability of future revenue from Zenas [3]. Group 4: Strategic Implications - Innovent's management emphasized the importance of business development (BD) as a priority for the next three years, indicating a strategic focus on international expansion [5]. - The company retains core rights to Oubatinib in oncology while licensing non-core rights, reflecting a strategy to balance risk and reward in its international ventures [5].

多重催化来袭!100%创新药研发标的“520880”强势收复5日线,放量成交4亿元,已超上一日全天

Xin Lang Ji Jin· 2025-10-16 03:19

Core Viewpoint - The Hong Kong Stock Connect innovative drug sector is showing strong performance, with the Hong Kong Stock Connect Innovative Drug ETF (520880) experiencing significant trading activity and price increases, indicating a bullish sentiment in the market [1][4]. Group 1: Market Performance - The Hong Kong Stock Connect Innovative Drug ETF (520880) surged by nearly 4% in early trading, surpassing its 5-day moving average, with trading volume exceeding 400 million yuan, surpassing the previous day's total [1]. - The ETF covers 37 innovative drug research companies, with 36 stocks showing gains, including notable increases from companies like BeiGene and China Biologic Products [4]. - The index tracked by the ETF has shown a year-to-date increase of 108.14%, outperforming other innovative drug indices [8]. Group 2: Key Companies and Their Performance - Major companies within the ETF include: - BeiGene (6160) with a weight of 10.46%, current price at 191.60, and a 2.13% increase [2]. - China Biologic Products (1177) with a weight of 10.01%, current price at 7.66, and a 2.00% increase [2]. - Innovent Biologics (1801) with a weight of 9.20%, current price at 88.35, and a 3.21% increase [2]. - Other notable performers include CanSino Biologics and 3SBio, with increases of over 6% and 7% respectively [4]. Group 3: Upcoming Events and Opportunities - The European Society for Medical Oncology (ESMO) annual meeting is scheduled from October 17 to 21 in Berlin, which is expected to be a significant platform for domestic pharmaceutical companies to showcase their achievements and explore new business development opportunities [2]. - Recent business development transactions, such as the $100 million upfront payment by Innovent Biologics, indicate a robust pipeline for potential deals in the coming months, particularly in the traditional peak season for such transactions [3]. Group 4: Policy and Economic Environment - Domestic policy adjustments in the medical insurance directory are expected to support genuine innovation, providing a stable outlook for commercialization [3]. - The resumption of the Federal Reserve's interest rate cut cycle is anticipated to benefit the Hong Kong Stock Connect innovative drug sector through improved valuation and financing conditions [3].

港股创新药板块再度走强,恒生创新药ETF(159316)标的指数涨超3%

Sou Hu Cai Jing· 2025-10-16 02:52

Core Viewpoint - The Hong Kong innovative drug sector continues to rise, with the Hang Seng Innovative Drug Index increasing by 3.2% shortly after market opening, driven by significant gains in constituent stocks such as InnoCare Pharma and 3SBio [1] Group 1: Market Performance - The Hang Seng Innovative Drug Index rose by 3.2% within the first half hour of trading [1] - InnoCare Pharma-B surged over 10%, while 3SBio increased by over 6%, and both CanSino Biologics and BGI Genomics rose by over 5% [1] Group 2: Upcoming Events - The 2025 European Society for Medical Oncology (ESMO) annual meeting is scheduled from October 17 to October 21 in Berlin, Germany, expected to be a significant platform for domestic pharmaceutical companies to showcase their achievements and facilitate new business development (BD) agreements [1] Group 3: Market Trends and Policies - October to November is traditionally a peak season for BD transactions, with notable deals already initiated by companies like Innovent Biologics, indicating potential for continued activity in the sector [1] - The adjustment window for the medical insurance catalog has opened, with clear policy support for genuine innovation, providing stable expectations for commercialization [1] - The Federal Reserve's potential interest rate cuts may benefit the innovative drug sector through improved valuation and financing conditions [1] Group 4: Index Composition and Investment Products - The Hang Seng Innovative Drug Index is the first "pure" innovative drug index with 100% purity, excluding CXO companies, allowing for an accurate reflection of the overall performance of China's innovative drug firms [1] - The Hang Seng Innovative Drug ETF (159316) is currently the only product tracking this index, having attracted over 500 million yuan in the last 10 trading days, facilitating investor access to leading innovative drug companies [1]

创新药重磅会议临近,恒生医药ETF涨近2%

Mei Ri Jing Ji Xin Wen· 2025-10-16 02:05

Core Viewpoint - The Hong Kong stock market is experiencing slight fluctuations, with the pharmaceutical sector leading gains, particularly driven by the upcoming ESMO annual meeting in Berlin, which is expected to provide a platform for domestic pharmaceutical companies to showcase their achievements and facilitate new licensing deals [1] Group 1: Market Performance - The Hang Seng Biotechnology Index has risen over 2%, with the Hang Seng Pharmaceutical ETF (159892) following suit [1] - Leading companies in the sector include Ming En Bio, Kangfang Bio, Nuocheng Jianhua, and WuXi Biologics [1] Group 2: Upcoming Events - The 2025 European Society for Medical Oncology (ESMO) annual meeting is scheduled from October 17 to 21 in Berlin, Germany [1] - This meeting is anticipated to be a significant opportunity for domestic pharmaceutical companies to present their results and explore new business development (BD) licensing opportunities [1] Group 3: Valuation Insights - According to Guotai Junan Futures, the price-to-sales (PS) valuation of innovative drug companies represented by Hong Kong stocks is not considered expensive following significant gains this year [1] - The improvement in cash flow expectations is attributed to breakthroughs in the commercialization capabilities of innovative drug companies and the early monetization of core products through licensing agreements [1]

回血!A股最大医疗ETF收复失地,港股通创新药ETF(520880)反弹超2%!资金高歌猛进,做多时刻到了?

Xin Lang Ji Jin· 2025-10-15 11:48

Group 1 - A-shares and Hong Kong stocks in the innovative pharmaceutical sector have rebounded, with significant gains in related stocks and ETFs [1][3][5] - The largest medical ETF in A-shares (512170) saw a trading volume of 589 million yuan, recovering 1.34% on the day [1] - The innovative drug sector is experiencing a collective rise, with notable stocks like Huahai Pharmaceutical increasing by 7.59% [3] Group 2 - The Hong Kong innovative drug ETF (520880) rose by 2.12%, with 35 out of 37 constituent stocks gaining, led by Green Leaf Pharmaceutical with an 8.31% increase [5][7] - Recent funding trends indicate a significant inflow into the innovative drug sector, with over 1.29 billion yuan added in the last three days [7] - Upcoming catalysts include the European Society for Medical Oncology (ESMO) annual meeting, which may showcase significant research results from Chinese innovative drugs [7] Group 3 - Investment strategies suggest focusing on innovative drugs, with specific ETFs like the Hong Kong innovative drug ETF (520880) and the A-share drug ETF (562050) highlighted for their potential [8] - The medical ETF (512170) is noted for its inclusion of CXO companies, which account for 26.77% of its weight [8] - The medical ETF is the largest in the market, with a scale of 26.4 billion yuan, while the drug ETF is the only one tracking the China Pharmaceutical Index [9]

万亿产业南北联动 透视北京医药健康产业创新密码

Xin Jing Bao· 2025-10-15 11:39

Core Insights - The article highlights the role of the Xinchao Innovation Center in fostering innovation within the biopharmaceutical sector in Beijing, emphasizing its commitment to supporting original innovation and the exploration of the unknown [1][3][4]. Group 1: Company Overview - Xinchao Innovation Center has incubated 102 companies since its establishment in 2019, including projects from prestigious institutions like Tsinghua University and Harvard University [3]. - The center has facilitated the clinical trial phase for six globally innovative drugs and nurtured two unicorns and 25 national high-tech enterprises, with total financing exceeding 6.5 billion yuan [3]. - The center provides comprehensive support throughout the lifecycle of biopharmaceutical companies, aiming to lower barriers for scientists entering entrepreneurship [3][4]. Group 2: Industry Development - Beijing's biopharmaceutical industry is projected to exceed 1 trillion yuan in scale by 2024, with a reported value of 1.06 trillion yuan [6][5]. - The city has seen significant growth in its pharmaceutical sector, with 436 large-scale pharmaceutical enterprises generating approximately 185 billion yuan in output value [6]. - The "South-North Linkage" strategy is being implemented to enhance industrial upgrades, with the southern region focusing on the International Pharmaceutical Innovation Park and the northern region centered around the Zhongguancun Life Science Park [6][5]. Group 3: Policy and Support - Beijing has introduced a series of measures to promote high-quality development in the innovative pharmaceutical sector, including a reduction in clinical trial approval times from 60 days to 30 days [7][8]. - The new "32 measures" aim to support the pharmaceutical industry through various initiatives, such as expanding the training of project leaders and simplifying drug approval processes [8]. - A 10 billion yuan pharmaceutical merger fund has been established to further support the industry, alongside initiatives for talent acquisition and intellectual property protection [8].