DeepSeek

Search documents

收盘丨A股三大指数全天震荡调整,市场超3100只个股下跌

Di Yi Cai Jing Zi Xun· 2025-11-07 07:13

Market Overview - The A-share market experienced a day of fluctuation and adjustment, with the Shanghai Composite Index down by 0.25%, the Shenzhen Component Index down by 0.36%, and the ChiNext Index down by 0.51% [5] - The total trading volume in the Shanghai and Shenzhen markets reached 2 trillion yuan, a decrease of 56.2 billion yuan compared to the previous trading day, with over 3,100 stocks declining across the market [2] Sector Performance - The computing hardware and software sector led the declines, with significant drops in server, DeepSeek, and fintech indices; meanwhile, chemical stocks surged, particularly in fluorine and phosphorus chemical sectors, and solid-state battery themes strengthened [1] - Main capital inflows were observed in basic chemicals, photovoltaic equipment, and energy metals, while there were outflows from computing, electronics, and power grid equipment sectors [4] Individual Stock Movements - Notable net inflows were recorded for Tianfu Communication (22.32 million yuan), Tianci Materials (9.66 million yuan), and Duofu Du (8.65 million yuan) [4] - Conversely, significant net outflows were seen in Industrial Fulian (21.42 million yuan), Sanhua Intelligent Control (15.36 million yuan), and Silis (8.87 million yuan) [4] Institutional Insights - According to Changcheng Securities, the market is entering a quiet period in November, lacking major policy or event-driven catalysts, which may lead to a reliance on technical and fundamental support for market movements [4] - Huaxi Securities noted that following the release of Q3 reports, the A-share market is entering a performance vacuum period of approximately three months, shifting focus towards next year's performance expectations and industry trends, with trading likely returning to active themes [6]

紧扣两翼协同 充分释放面向创新发展的科普动能

Ren Min Ri Bao· 2025-11-04 22:52

Core Viewpoint - The emphasis on the dual role of scientific popularization and technological innovation as essential components for achieving innovative development, with a call for equal importance to be placed on both aspects in society [1][2] Group 1: Policy and Strategic Framework - The new revision of the "Science and Technology Popularization Law" will legally establish the equal importance of scientific popularization and technological innovation [1] - A series of policies have been introduced to strengthen the institutional framework for the collaboration between scientific popularization and technological innovation, including the "National Science and Technology Popularization Development Plan" [3] - The top-level design for the collaboration has evolved from integrating research and popularization to a more comprehensive approach that includes various elements such as facilities, talent, and outcomes [3] Group 2: Collaborative Ecosystem - The collaboration between scientific popularization and technological innovation has expanded to include a diverse range of stakeholders, including technology enterprises, media, and the public [4] - The role of technology enterprises has become crucial in bridging the gap between science and the public through immersive educational experiences and open research facilities [4] - The content of scientific popularization has evolved to include cutting-edge topics such as the metaverse, chip technology, and AI advancements, reflecting public interest and enhancing the interaction between popularization and innovation [4] Group 3: Challenges and Recommendations - There are existing weaknesses in the collaboration, such as insufficient integration of popularization into evaluation systems for projects and talent, and a lag in the supply of cutting-edge popularization content [5] - The urgency of building a strong technological nation has been highlighted, with a strategic goal set for 2035, necessitating improvements in the effectiveness of the collaboration [5] - Recommendations include strengthening institutional collaboration, innovating content production mechanisms, and enhancing talent development in the field of scientific popularization [6][7]

充分释放面向创新发展的科普动能

Ren Min Ri Bao· 2025-11-04 22:12

Core Viewpoint - The emphasis on the dual role of scientific popularization and technological innovation as essential components for achieving innovative development is highlighted, establishing the strategic importance of scientific popularization in the context of innovation [1][2]. Group 1: Policy and Framework - The new revision of the "Science and Technology Popularization Law" will incorporate the equal importance of scientific popularization and technological innovation into legal provisions, reflecting a commitment to integrate these two aspects [1]. - A series of policies, including the "National Science and Technology Popularization Development Plan" and the "14th Five-Year Plan," have been introduced to systematically strengthen the institutional framework for the collaboration between scientific popularization and technological innovation [3]. - The top-level design for the collaboration has evolved from the initial proposal of combining research and popularization to establishing a legal framework that ensures their close cooperation [3]. Group 2: Stakeholder Involvement - The collaboration has expanded to include a diverse range of stakeholders beyond traditional entities like research institutions and universities, now encompassing technology companies, media, and the general public [4]. - Technology companies are playing a crucial role in bridging the gap between science and the public by creating immersive educational environments and opening research facilities [4]. - New media platforms have emerged as significant channels for disseminating cutting-edge scientific knowledge, enhancing the reach and impact of scientific popularization [4]. Group 3: Content and Quality - The content of scientific popularization is evolving, with innovative and disruptive technological advancements providing fresh material and perspectives for public engagement [4]. - The popularity of topics such as the metaverse, chip technology, and AI tools like ChatGPT reflects the public's keen interest in technological progress and the interactive relationship between scientific popularization and innovation [4]. - There is a recognized need to improve the quality and timeliness of scientific popularization content to keep pace with rapid technological advancements [5]. Group 4: Challenges and Recommendations - Existing challenges include inadequate integration of popularization efforts into the evaluation systems for scientific projects and talent, as well as a shortage of professionals capable of effectively communicating complex scientific concepts [5]. - To enhance the effectiveness of the collaboration, it is recommended to strengthen institutional frameworks, improve incentive mechanisms for scientific popularization, and develop a comprehensive talent training system [5][6][7]. - The establishment of a collaborative model involving government, society, and market forces is essential for creating a robust ecosystem for scientific popularization [6].

容知日新的前世今生:2025年三季度营收3.9亿行业29/61,净利润2689.49万行业37/61

Xin Lang Cai Jing· 2025-10-31 16:09

Core Viewpoint - Rongzhi Rixin is a leading provider of intelligent operation and maintenance solutions for industrial equipment in China, focusing on technology and data barriers in its products [1] Group 1: Company Overview - Rongzhi Rixin was established on August 7, 2007, and listed on the Shanghai Stock Exchange on July 26, 2021, with its registered and operational base in Hefei, Anhui Province [1] - The company operates in the mechanical equipment sector, specifically in general equipment and instrumentation, and is involved in multiple concept sectors including artificial intelligence and DeepSeek [1] - Its main products include industrial equipment condition monitoring and fault diagnosis systems, widely used in industries such as wind power, petrochemicals, and metallurgy [1] Group 2: Financial Performance - For Q3 2025, Rongzhi Rixin reported revenue of 390 million yuan, ranking 29th out of 61 in its industry, with the top competitor, Chuan Yi Co., achieving 4.89 billion yuan [2] - The net profit for the same period was approximately 26.89 million yuan, placing the company 37th in its industry, with the leading competitor, Chuan Yi Co., reporting a net profit of 469 million yuan [2] Group 3: Financial Ratios - As of Q3 2025, Rongzhi Rixin's debt-to-asset ratio was 21.75%, lower than the previous year's 22.77% and below the industry average of 27.43% [3] - The company's gross profit margin was 63.96%, an increase from 61.87% year-on-year, and significantly higher than the industry average of 43.50% [3] Group 4: Shareholder Information - As of September 30, 2025, the number of A-share shareholders increased by 37.54% to 5,371, while the average number of circulating A-shares held per shareholder decreased by 26.82% to 16,200 [5] - The ninth largest circulating shareholder is Hua'an Small and Medium Cap Growth Mixed Fund, holding 1.6621 million shares, a decrease of 44,500 shares from the previous period [5] Group 5: Future Outlook - Guosheng Securities maintains a "Buy" rating, projecting revenues of 710 million, 934 million, and 1.233 billion yuan for 2025 to 2027, with net profits of 129 million, 176 million, and 245 million yuan respectively, driven by high R&D investment [5] - Dongfang Securities also maintains a "Buy" rating, forecasting net profits of 147 million, 194 million, and 254 million yuan for 2025 to 2027, with a target price of 61.79 yuan based on a 37x P/E ratio for 2025 [5]

安联基金沈良: 立高远之志 行务实之事

Zhong Guo Zheng Quan Bao· 2025-10-26 22:55

Core Insights - Allianz Fund aims to integrate international vision with local practices in China's asset management market, emphasizing a long-term, stable investment experience for investors [1][3] - The company is positioned to leverage its strong data advantages, extensive market investment experience, and deep risk management culture to meet the evolving needs of Chinese investors in the "Wealth Management 2.0" era [1][3][4] Group 1: Company Vision and Strategy - Allianz Fund is committed to providing customized asset allocation solutions and one-stop services, reflecting its ambition in the "Wealth Management 2.0" era [2][4] - The firm emphasizes a pragmatic approach, focusing on professional research, product development, and service quality to build trust with investors [1][5] Group 2: Team and Research Capabilities - The investment research team at Allianz Fund comprises a significant portion of its workforce, indicating a strong focus on research-driven asset management [5][6] - The team utilizes grassroots research methods to gain insights into market opportunities, enhancing its competitive edge in the foreign asset management sector [6][5] Group 3: Product Development and Market Positioning - Allianz Fund launched its first product, the Allianz China Select Mixed Fund, in a challenging market environment, demonstrating confidence in the Chinese asset market [7][8] - The company plans to expand its product offerings, including fixed-income products and potentially cross-border investment products, to cater to diverse investor needs [8][7] Group 4: Market Outlook and Investment Opportunities - Allianz Fund identifies significant value re-evaluation potential in the Chinese stock market, supported by structural economic transformations and advancements in technology [10][11] - The firm highlights the importance of high-quality alpha opportunities in China, emphasizing the need to focus on sustainable development and long-term investment quality [12][11]

机器人何时能迎来自己的“DeepSeek时刻”?

虎嗅APP· 2025-10-24 09:53

Core Viewpoint - The article discusses the evolution of AI from "cognition" to "action," emphasizing the importance of experience-driven control in achieving practical applications in autonomous driving and robotics [5][6]. Group 1: Experience-Driven Control - The transition from traditional mathematical modeling to experience-driven control is highlighted as essential for real-world applications in complex environments [9][10]. - Experience-driven control allows AI systems to learn from historical data, enabling effective decision-making without precise mathematical models [10][11]. Group 2: Embodied Intelligence - The complexity of embodied intelligence is noted, with a focus on its higher dimensionality compared to autonomous driving, requiring advanced understanding and generalization capabilities [12][14]. - The current state of embodied intelligence is compared to the "DeepSeek moment," indicating that while significant progress has been made, a breakthrough akin to ChatGPT has not yet occurred [15][16]. Group 3: World Models - World models are identified as crucial for enabling robots to understand and interact with the physical world, serving as a foundational element for embodied intelligence [21][25]. - The article outlines three primary uses of world models: facilitating a feedback loop with the robot's brain, generating trajectory data, and integrating physical understanding into robot operations [25][26]. Group 4: Future Directions - The need for world models in the industry is emphasized, particularly for enhancing the generalization capabilities of robots in complex environments [28][31]. - The article suggests that the evolution of world models is still in its early stages, with ongoing developments aimed at improving their application in robotic training and task execution [29][30].

独家|对话北京人形机器人创新中心CTO唐剑:世界模型有望带来具身智能的“DeepSeek时刻”

Hu Xiu· 2025-10-23 07:06

Core Insights - The article discusses the evolution of AI from "cognition" to "action," highlighting the transition of Tang Jian from academia to industry, particularly in the fields of autonomous driving and embodied intelligence [1][2] - Tang Jian emphasizes the importance of experience-driven control methods over traditional mathematical modeling in complex environments, suggesting that AI systems can learn from historical data to make effective decisions [4][5] - The concept of a "world model" is introduced as essential for embodied intelligence, enabling robots to understand and predict their environment, thus enhancing their operational capabilities [13][14] Summary by Sections Transition from Academia to Industry - Tang Jian, a former tenured professor, shifted focus to practical applications of AI in industry, particularly in autonomous driving and robotics [1][3] - His experience in various companies, including Didi and Midea, has informed his approach to AI-driven system control [3][6] Experience-Driven Control - The article outlines the difference between traditional control methods and experience-driven approaches, with the latter relying on data and historical experiences rather than precise mathematical models [4][5] - This experience-driven philosophy is evident in autonomous driving applications, where end-to-end control merges perception, planning, and control into a single learning process [6][7] Embodied Intelligence and World Models - Tang Jian argues that embodied intelligence presents a higher complexity than autonomous driving, requiring robots to manage multiple joints and navigate dynamic environments [7][8] - The world model is described as a critical component for robots to understand and interact with the physical world, enabling them to perform tasks that require nuanced understanding and adaptability [14][15] - The article highlights the need for a world model to facilitate the development of robots that can generalize across various tasks and environments, which is crucial for their deployment in real-world scenarios [21][22] Future Directions and Challenges - The discussion includes the potential for world models to achieve a "DeepSeek moment" in embodied intelligence, drawing parallels to breakthroughs in AI performance under limited resources [9][10] - Tang Jian acknowledges the current limitations in data and model architecture, indicating that further iterations and improvements are necessary for the field to progress [2][13] - The article concludes with the assertion that the world model is not just a technical choice but a fundamental requirement for the advancement of embodied intelligence [13][22]

IDC:上半年中国AI IaaS市场规模达198.7亿元 整体市场同比增长122.4%

智通财经网· 2025-10-21 03:56

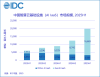

Core Insights - The overall AI IaaS market in China is expected to grow by 122.4% year-on-year, reaching a market size of 19.87 billion RMB by the first half of 2025 [1] - The GenAI IaaS market is projected to grow by 219.3%, with a market size of 16.68 billion RMB, while the Other AI IaaS market is expected to decline by 14.1%, reaching 3.19 billion RMB [1] Market Overview - The AI IaaS market is experiencing explosive growth, driven by strong demand across various sectors including internet, automotive, mobile manufacturing, finance, and government [5] - Cloud service providers have significantly increased capital investment in AI infrastructure, leading to stable resource supply and pricing in the computing market [5] - The demand for intelligent computing and AI applications is rising, particularly in the automotive sector, where competition for autonomous driving solutions is intensifying [5] GenAI IaaS Market Dynamics - The focus in the GenAI IaaS market is shifting from large-scale model training to inference, with inference scenarios accounting for 42% of the market share in the first half of the year [6] - The DeepSeek event has positively impacted the market, with significant deployments in state-owned enterprises and government sectors nearing completion [6] - Major enterprises are beginning to test generative AI applications within their business systems, indicating a shift towards more diverse AI applications [6] Supply Landscape - The supply landscape is evolving towards a diversified ecosystem, with cloud vendors and leading computing clients focusing on optimizing inference service cost structures [7] - Domestic and international cloud computing companies are increasingly investing in self-developed chips, signaling a new growth phase for domestic computing resources [7] Competitive Landscape - The GenAI IaaS market share has risen to 84%, while the Other AI IaaS market share has dropped to 16%, indicating a concentration of market power [9] - Alibaba Cloud maintains the largest market share by increasing capital expenditure on AI infrastructure and offering diverse AI IaaS services [9] - Other players like ByteDance's Volcano Engine and Baidu are also expanding their market presence through competitive pricing and technological advantages [9] Operator Developments - Major telecom operators are rapidly deploying intelligent computing resources, with significant growth in AI-related business [10] - China Telecom is building a distributed intelligent computing network, while China Mobile and China Unicom are enhancing their AI capabilities and service offerings [10] Future Projections - The AI IaaS market in China is expected to continue its rapid growth, potentially reaching nearly 150 billion RMB by 2029, with inference computing accounting for nearly 80% of the market [12] - Technological advancements in multi-modal models and video generation models are anticipated to drive new AI applications and further increase demand for AI computing resources [12]

A股的泼天富贵,溢到了北交所

36氪· 2025-10-10 00:01

Group 1 - The core viewpoint of the article is that the A-share market is currently in a bull market driven by abundant liquidity, referred to as the "water buffalo" phenomenon, with the Shanghai Composite Index rising by 25% over six months [4][5] - The North Exchange (北交所) has also shown impressive performance this year, with the North 50 Index increasing by 47% year-to-date as of September 30 [5][12] - B-shares, previously quiet, have experienced several waves of trading activity, with the National B Index seeing a maximum increase of over 10% since mid-June [7][22] Group 2 - The trading activity in the North Exchange has significantly improved due to liquidity, with daily trading volumes often exceeding 20 billion, peaking at 52.8 billion, and an average turnover rate of 9.9% [10][13] - The North Exchange's liquidity issues have been alleviated, benefiting from the spillover effects of liquidity improvements in the main A-share markets [12][22] - The North Exchange's focus on small-cap stocks, which have higher price elasticity, and a more flexible trading system with a 30% price limit (excluding new stocks) have contributed to increased trading activity [12][19] Group 3 - The investment direction in the North Exchange has shown a clear trend of short-term theme-driven trading, with significant activity in AI-related and humanoid robot stocks [17][18] - Solid fundamentals in certain sectors, such as the automotive industry and new consumption, have attracted investor attention, with notable stock performances like a 300% increase for Yizhi Mogu and a 280% increase for Kaitex [19][21] - The North 50 Index's PE-TTM has recently exceeded 70 times, indicating a high valuation level that poses potential risks despite positive expectations for future performance [19][21] Group 4 - B-shares have benefited from the overall liquidity in the market, with recent trading activity driven by net inflows of funds [22] - Future opportunities for B-shares include improved transfer mechanisms and simplified account opening procedures, which may enhance market participation [22]

节后A股有望迎“开门红” 结构性机会或进一步增多

Zhong Guo Zheng Quan Bao· 2025-10-08 23:00

Group 1 - The global stock markets remained stable during the National Day holiday, providing a solid external foundation for the A-share market's opening in the fourth quarter [2][3] - The U.S. stock market saw slight increases, with the Dow Jones, Nasdaq, and S&P 500 indices rising by 0.44%, 0.57%, and 0.39% respectively from October 1 to October 7 [2] - The semiconductor sector was a focal point for investors, with the Hong Kong semiconductor index rising by 10.34% during the holiday period, and several stocks reaching historical highs [4][5] Group 2 - Analysts expect a resurgence of active funds in the A-share market post-holiday, with increased local bullish momentum and more structural opportunities [3][7] - The Chinese technology sector is identified as a core investment theme, with expectations of upward breakthroughs and the emergence of "DeepSeek" moments in various fields [8] - Investment strategies should focus on three main lines: technology industry, "anti-involution" themes, and sectors benefiting from stock market rises, such as brokerage and financial technology [8]