AI产业链

Search documents

A股三大指数集体拉升,煤炭板块跳水

Zheng Quan Shi Bao· 2025-10-24 10:07

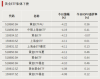

Market Performance - A-shares saw a collective rise in major indices, with the Shanghai Composite Index reaching a 10-year high, closing at 3950.31 points, up 0.71% [1] - The ChiNext Index surged over 3%, while the STAR 50 Index increased by more than 4% [1] - The total trading volume in the Shanghai and Shenzhen markets reached 199.18 billion yuan, an increase of over 33 billion yuan from the previous day [1] Sector Highlights - The semiconductor and chip sectors experienced significant gains, with stocks like Purun and Xiangnong Chip reaching their daily limit of 20% [1][4] - AI-related stocks, including CPO concept stocks, also saw substantial increases, with companies like Kexiang and Shengyi Electronics hitting their daily limit [9] - The satellite navigation sector rose sharply, with companies like China Satellite and Guanghe Technology reaching their daily limit [1] Coal Sector Decline - The coal sector faced a sharp decline, with companies like Antai Group and Yunmei Energy hitting their daily limit down [12][13] - Daya Energy saw a drop of over 6%, following a significant rise of nearly 150% in the previous 10 trading days [13][15] - Antai Group reported a cumulative increase of about 30% over the past six trading days, but warned of potential operational risks due to market volatility [15] Trading Volume Insights - Ten stocks in the A-share market had trading volumes exceeding 10 billion yuan, with Hanwujing and Zhongji Xuchuang leading at 23.4 billion yuan and 23.03 billion yuan respectively [2] - CITIC Securities recorded a trading volume of 8.89 billion yuan, with significant sell orders observed during the closing auction [2] Policy and Innovation Focus - The recent Central Committee meeting emphasized accelerating high-level technological self-reliance and innovation, aiming to enhance the national innovation system [6][7] - Key areas of focus include integrated circuits, advanced materials, and core technologies, which are expected to receive policy support during the 14th Five-Year Plan [7] CPO Technology Development - CPO (Co-Packaged Optics) technology is gaining traction, with expectations for commercial use between 2024 and 2025, and projected market revenue reaching $2.6 billion by 2033 [11] - Domestic companies like Zhongji Xuchuang and Xinyi Sheng are actively advancing CPO technology, alongside international players like Intel and Broadcom [11]

港股Q4风格切换?恒生科技或为主线!一手抓“科技+红利”的520560成资金布局窗口

Xin Lang Ji Jin· 2025-10-24 09:13

Core Viewpoint - The Hong Kong stock market showed signs of recovery on October 24, driven primarily by the strong performance of the information technology sector, while the new energy vehicle sector lagged behind [1]. Group 1: Market Performance - The Hong Kong 30 ETF (520560) demonstrated stable performance, closing up 0.51% and successfully surpassing the five-day moving average, indicating strong buying power in the market [1]. - Semiconductor Manufacturing International Corporation (SMIC) surged by 8%, leading the gains among constituent stocks, followed by Lenovo Group, Alibaba-W, and Kuaishou-W, each rising over 2% [2]. Group 2: Fund Flows - The Hong Kong 30 ETF has attracted significant capital attention, with an average daily trading volume exceeding 31 million yuan since its listing on October 13, and a net inflow of nearly 30 million yuan over the past ten trading days [2]. Group 3: Future Outlook - Guotai Junan Securities anticipates a potential major style shift in the Hong Kong stock market in the fourth quarter, with low-position growth sectors like Hang Seng Technology likely to outperform [4]. - CITIC Securities believes that the resumption of the Federal Reserve's interest rate cut cycle will benefit the Hong Kong stock market, particularly the technology sector, which is expected to see valuation expansion due to the ongoing growth in the global AI computing power industry [4]. Group 4: ETF Characteristics - The Hong Kong 30 ETF closely tracks the Hang Seng China (Hong Kong-listed) 30 Index, featuring a "barbell strategy" that combines high-growth technology and high-dividend stocks, focusing on leading companies across various sectors [5]. - The ETF's top ten holdings account for over 73% of its weight, indicating a high concentration and strong capacity for accommodating large trades with lower impact costs [5].

成长风格今日再度爆发,成长ETF(159259)标的指数涨超3%

Mei Ri Jing Ji Xin Wen· 2025-10-24 07:50

Core Viewpoint - The growth style in the market has seen a resurgence, with the Guozheng Growth 100 Index rising by 3.8% at the close, indicating strong investor interest in growth-oriented stocks [1] Group 1: Index Performance - The Guozheng Growth 100 Index focuses on A-share stocks with prominent growth characteristics, featuring leading companies in new productivity sectors such as AI and high-end manufacturing [1] - The index's constituent stocks are expected to achieve a more than 100% growth in net profit attributable to shareholders by 2025, according to consensus forecasts [1] - Year-to-date, the index has delivered a return of over 48%, and approximately 105% since the beginning of 2024, outperforming similar style indices [1] Group 2: Investment Products - The Growth ETF (159259) is the only ETF product tracking the Guozheng Growth 100 Index, providing a convenient option for investors favoring growth stocks to gain exposure to high-quality growth companies [1]

阿里巴巴开盘涨超2%,开启夸克AI眼镜预售,机构称明年有望迎来端侧AI大年

Mei Ri Jing Ji Xin Wen· 2025-10-24 02:11

Group 1 - The Hong Kong stock market opened positively on October 24, with the Hang Seng Index rising by 0.81% to 26,177.11 points, the Hang Seng Tech Index increasing by 1.36%, and the National Enterprises Index up by 0.86% [1] - Technology stocks, gold stocks, and Chinese brokerage stocks showed strong performance, with Alibaba's stock rising over 2% [1] - Alibaba launched its first self-developed AI glasses, Quark AI glasses, available for pre-sale at a price of 3,699 yuan for 88VIP members and 3,999 yuan for regular consumers, along with additional promotional benefits [1] Group 2 - The Hang Seng Tech Index ETF (513180) includes 30 leading technology stocks in Hong Kong, focusing on the AI industry chain across upstream, midstream, and downstream sectors, with companies like Alibaba, Tencent, Xiaomi, Meituan, and SMIC identified as potential "seven giants" of Chinese technology stocks [2] - Investors without a Hong Kong Stock Connect account can access Chinese AI core assets through the Hang Seng Tech Index ETF (513180) [2]

V型拉升!重点把握结构性机会

Sou Hu Cai Jing· 2025-10-23 11:34

Market Overview - A-shares showed a rebound after a period of fluctuation, with the Shanghai Composite Index closing at 3922.41 points, up 0.22% [2] - The Shenzhen Component Index and the ChiNext Index also saw slight increases, while the STAR 50 Index declined by 0.30%, indicating ongoing internal differentiation within growth sectors [2] - The total market turnover was 1.66 trillion yuan, a decrease of 29.5 billion yuan from the previous trading day, with major funds rapidly reallocating among sectors [2] Industry Highlights and Driving Logic - Structural opportunities in the A-share market are highlighted by policy drivers and industrial breakthroughs, particularly in Shenzhen stocks benefiting from a new action plan aimed at high-quality mergers and acquisitions [3] - The coal sector continued to perform strongly, supported by government policies promoting energy efficiency and rising winter heating demand [3] - Significant differentiation was observed within the technology growth sector, with the quantum technology segment experiencing a surge due to breakthroughs in quantum computing [3] Hong Kong Market Dynamics - The Hong Kong market displayed clear sector rotation, with consumer discretionary and financial stocks leading the rebound, while large tech stocks turned positive in the afternoon [4] - The banking sector saw widespread gains, attracting foreign investment due to low valuations and high dividend yields [4] - The energy sector showed a positive correlation with A-shares, benefiting from stable international oil prices and domestic energy supply policies [4] Investment Strategy Recommendations - The current market phase is characterized by "policy catalysis and structural rotation," suggesting a focus on specific sub-sectors within three main lines: technology growth, resource cycles, and consumer sectors [5] - In the technology growth sector, attention should be paid to quantum technology and storage chips, with a focus on companies that can benefit from domestic substitution trends [5] - The resource sector, particularly lithium mining, is recommended for low-cost entry as demand for new energy recovers [6] Overall Market Sentiment - The market's volume supports a structural trend, but caution is advised regarding rapid sector rotation that may lead to chasing high prices [7] - Long-term strategies should focus on undervalued quality stocks that resonate with industrial prosperity and policy support, particularly in technology growth and cyclical resource sectors [7]

资金逆势加码这一方向,什么信号?

Zhong Guo Zheng Quan Bao· 2025-10-22 12:53

Group 1: Gold ETF Performance - On October 22, gold ETFs collectively declined due to falling international gold prices, with the top ten decliners all being gold ETFs [4][5] - Despite the significant drop in gold ETFs this week, there is a trend of "buying on dips," with multiple gold ETFs receiving increased capital inflows [2][6] - The specific declines in gold ETFs include: - Gold ETF AU (518860.SH): -4.22% - Bank of China Shanghai Gold ETF (518890.SH): -4.19% - Gold ETF (159934.SZ): -4.13% [5] Group 2: Bond ETF Activity - Several bond ETFs are actively traded, with the Short-term Bond ETF (511360) achieving a transaction volume of 38.747 billion yuan, the highest in the market [10][11] - The turnover rates for the Sci-Tech Bond ETFs from Huatai and Guotai both exceeded 100% [10] Group 3: Market Outlook - Companies are optimistic about the market direction over the next 6 to 12 months, driven by the expansion of profit effects since last year's "9.24" event and the acceleration of medium to long-term capital inflows [12] - Key investment opportunities include the AI industry chain, resilient external demand, and financial sectors amid active capital markets [12][9]

沪指收复3900点 创业板大涨3%

Shen Zhen Shang Bao· 2025-10-21 23:01

Group 1 - A-shares continued to rebound, with the Shanghai Composite Index recovering above 3900 points, closing up 1.36% at 3916.33 points, and the ChiNext Index rising 3.02% [1] - The overall market showed a broad-based increase, with over 4600 stocks rising, accounting for more than 80% of the total [1] - Key sectors leading the market included telecommunications, electronic components, shipbuilding, and semiconductors, while coal and daily chemicals declined [1] Group 2 - The stability of the stock market is crucial for injecting capital into the real economy and enhancing consumer confidence through wealth, psychological, and expectation effects [2] - The Nasdaq Golden Dragon China Index rose by 2.39%, indicating increasing foreign investment interest in Chinese stocks [2] - Short-term market fluctuations are expected due to profit-taking and market sentiment, but favorable policies and potential interest rate cuts from the Federal Reserve and the People's Bank of China may support the market [2]

利安隆(300596):2025Q3归母净利润同比+61%,看好抗老化助剂企稳及润滑油添加剂放量:——利安隆(300596):2025年三季报点评

Guohai Securities· 2025-10-21 10:44

Investment Rating - The report maintains a "Buy" rating for the company [1][12][13] Core Insights - The company achieved a year-on-year increase of 61% in net profit attributable to shareholders for Q3 2025, driven by stable demand for anti-aging additives and increased volume in lubricant additives [2][6][7] - The company’s revenue for the first three quarters of 2025 reached 4.509 billion yuan, a year-on-year increase of 5.72%, while the net profit attributable to shareholders was 392 million yuan, up 24.92% year-on-year [5][6] - The report highlights strong performance in Q3 2025, with a single-quarter revenue of 1.514 billion yuan, a 4.77% increase year-on-year, and a net profit of 151 million yuan, reflecting a 60.83% year-on-year growth [6][7] Summary by Sections Financial Performance - For Q3 2025, the company reported a gross profit margin of 21.97%, an increase of 1.37 percentage points year-on-year, and a net profit margin of 9.77%, up 3.43 percentage points year-on-year [6][7] - The company’s operating cash flow for the first three quarters was 282 million yuan, a decrease of 1.84% year-on-year [5] Market Expansion and New Projects - The company has initiated an overseas capacity expansion plan, establishing a wholly-owned subsidiary in Singapore and planning to invest up to 300 million USD in Malaysia for the development of high-performance anti-aging additives and lubricant additives [8][10] - The lubricant additives segment has seen improved capacity utilization and cost reduction efforts, contributing to the overall profitability [7][8] Future Outlook - The company is projected to achieve revenues of 6.454 billion yuan in 2025, 7.557 billion yuan in 2026, and 8.101 billion yuan in 2027, with corresponding net profits of 550 million yuan, 671 million yuan, and 821 million yuan respectively [11][12] - The report emphasizes the potential growth driven by the AI industry, which is expected to boost demand for anti-aging and lubricant additives [10][12]

A股强势上扬,AI产业链股爆发,海洋经济概念崛起

Zheng Quan Shi Bao· 2025-10-21 09:13

Market Overview - A-shares surged on October 21, with the Shanghai Composite Index returning above 3900 points, and the ChiNext Index rising over 3% [1] - The Shanghai Composite Index closed up 1.36% at 3916.33 points, the Shenzhen Component Index rose 2.06% to 13077.32 points, and the ChiNext Index increased by 3.02% to 3083.72 points [1] - Total trading volume in the Shanghai and Shenzhen markets reached 1.8929 trillion yuan, an increase of over 140 billion yuan compared to the previous day [1] AI Industry Chain - Stocks in the AI industry chain experienced significant gains, with Yuanjie Technology hitting the daily limit and approaching 500 yuan, marking a historical high [1][3] - Other notable performers included New Yisheng, which rose over 10%, and Zhongji Xuchuang, which increased by over 9% [3] - Demand for 1.6T optical modules is expected to rise, with total industry demand projected to increase from 10 million units to 20 million units due to accelerated deployment of GB300 and Rubin platforms [4] Ocean Economy - The ocean economy concept saw strong performance, with stocks like Deshi Co., CITIC Heavy Industries, and Shenkai Co. hitting the daily limit [7] - The Ministry of Natural Resources announced plans to strengthen standards for resource protection and utilization during the 14th Five-Year Plan, focusing on emerging fields such as marine carbon sinks and smart cities [9] Consumer Electronics - The consumer electronics sector was active, with stocks like Yunzhu Technology and Yachuang Electronics seeing significant gains, including a 20% increase for Yunzhu Technology [11] - Apple's stock rose nearly 4%, driven by strong demand for the new iPhone series, which saw early sales outperforming the iPhone 16 series by 14% [13] - The global smart glasses market is projected to see a shipment volume of 4.065 million units in the first half of 2025, representing a year-on-year growth of 64.2% [13]

科技核心资产月报:回调蓄势不改科技趋势机会-20251021

Bank of China Securities· 2025-10-21 08:59

Group 1: AI Industry Chain - The AI industry chain has experienced a short-term adjustment, but the medium-term outlook remains positive, driven by significant model updates from major players like OpenAI and DeepSeek, which are expected to catalyze new applications and edge opportunities [9][10][15] - OpenAI's recent DevDay introduced tools such as Apps SDK and AgentKit, which enhance the integration of third-party services and lower the technical barriers for developing AI agents, indicating a shift towards a more comprehensive application platform [12][11] - The demand for high-bandwidth memory (HBM) is increasing due to the rapid development and application of AI technologies, leading to a notable price increase in storage chips, with DRAM and NAND prices rising by 227.6% and 42.7% respectively since the beginning of 2025 [19][13] Group 2: High-end Manufacturing - The high-end manufacturing sector is poised for a new wave of opportunities, particularly in the robotics segment, with significant catalysts expected from Tesla's upcoming Q3 earnings call and shareholder meeting, which may provide insights into the progress of their humanoid robot, Optimus [33][34] - The robotics industry is seeing increased investment and collaboration, such as the $1 billion strategic partnership between UBTECH and Infini Capital, aimed at expanding the humanoid robot ecosystem [31][32] - The military industry has seen a pause in its upward trend, but upcoming disclosures related to the "14th Five-Year Plan" and quarterly reports are expected to provide better investment opportunities [22][27]