量子技术

Search documents

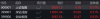

国盾量子成交额创上市以来新高

Zheng Quan Shi Bao Wang· 2025-10-30 03:44

Core Insights - GuoDun Quantum's trading volume reached a record high since its listing, amounting to 4.448 billion RMB, with a stock price increase of 17.75% and a turnover rate of 10.01% [1][1][1] - The previous trading day's total trading volume was 4.366 billion RMB [1] Company Overview - GuoDun Quantum Technology Co., Ltd. was established on May 27, 2009, with a registered capital of 1.02861 billion RMB [1]

聚焦“十五五”规划建议丨下好产业布局“先手棋” 打造经济新增长点

Yang Shi Wang· 2025-10-29 07:34

Group 1 - The core viewpoint emphasizes the acceleration of energy transition in China, with a focus on building a new energy system and promoting emerging technologies as new economic growth points [1][3][10] - In the electricity consumption of the whole society, one-third is green electricity, and the proportion of non-fossil energy in national energy consumption increases by 1 percentage point annually, while coal's share decreases by 1 percentage point each year [3] - China is leading the world in renewable energy and new energy vehicles, enhancing the "green content" of industries while balancing economic growth and environmental protection [3][12] Group 2 - The rapid development of the digital economy in China is highlighted, with new e-commerce becoming a vibrant component, and over half of live-streaming e-commerce actively using generative AI to optimize operations [7][8] - Emerging industries such as quantum technology, biomanufacturing, hydrogen energy, and brain-machine interfaces are being prioritized in China's strategic layout to seize global technological competition [10][12] - The "14th Five-Year Plan" targets future industries that represent revolutionary technological breakthroughs, indicating a significant potential for productivity leaps and industrial empowerment [12]

量子技术指数盘中强势拉升,科大国创涨停

Mei Ri Jing Ji Xin Wen· 2025-10-29 02:05

Group 1 - The quantum technology index experienced a strong surge, with notable stocks such as Keda Guokong and Shenzhou Information hitting the daily limit up [1] - GuoDun Quantum saw an increase of 17%, while Geer Software and Tianrongxin also experienced gains [1]

杨德龙:新质生产力全面纳入“十五五”规划 本轮科技牛行情有望延续

Xin Lang Zheng Quan· 2025-10-25 12:59

Core Viewpoint - The 20th Central Committee's Fourth Plenary Session approved the guidelines for the 15th Five-Year Plan, emphasizing high-quality development, technological self-reliance, and significant improvements in social civilization and living standards, with a nominal GDP growth rate of approximately 5.4% over the next decade [1][2]. Economic Development Goals - The main objectives for the 15th Five-Year Plan include achieving significant results in high-quality development, enhancing technological independence, deepening reforms, improving social civilization, and advancing the construction of a beautiful China [1][2]. - By 2035, the goal is to elevate China's economic, technological, and national strength significantly, with per capita GDP reaching the level of moderately developed countries [1]. Capital Market Implications - The 15th Five-Year Plan signals positive developments for the capital market, reinforcing investor confidence in China's long-term economic growth and potentially extending the current bull market [2]. - The plan outlines a clear economic development path for the next five years, which is expected to attract more capital into the technology sector, further driving the ongoing technology bull market [2]. Focus on Innovation Industries - The plan highlights the importance of nurturing emerging industries, with a target for the "three new" economy's contribution to GDP exceeding 18% by 2024 [3]. - Key strategic emerging industries include new energy, new materials, aerospace, and low-altitude economy, with the potential to create several trillion-yuan markets [3]. - Future industries such as quantum technology, biomanufacturing, hydrogen energy, and 6G are identified as new growth points for the economy [3]. Market Dynamics and Investment Opportunities - The current market is experiencing significant differentiation, with technology innovation sectors seeing substantial gains while traditional sectors lag behind [4]. - The ongoing economic transition is expected to reduce opportunities in traditional industries, which may face overcapacity and operational difficulties [4]. - The rapid growth of household deposits, exceeding 160 trillion yuan, and declining interest rates on bank deposits are likely to drive investors towards the capital market in search of higher returns [5]. Conclusion - The 15th Five-Year Plan is set to inject new momentum into economic development, with a focus on innovation and technology, while traditional sectors may face challenges [4][5].

学习贯彻党的二十届四中全会精神 | 勠力进取,确保基本实现社会主义现代化取得决定性进展——与会同志谈贯彻落实党的二十届四中全会精神

Xin Hua She· 2025-10-24 14:41

Core Points - The 20th Central Committee's Fourth Plenary Session has significant implications for China's modernization and economic development over the next five years [1][2] - The session emphasizes the integration of theoretical and practical innovations, aligning top-level design with grassroots exploration [1][2] - The focus on high-quality development and the deep integration of technological and industrial innovation is crucial for achieving new productive forces [3][4] Economic and Social Development - The "14th Five-Year Plan" aims to enhance high-quality development, with a strong emphasis on technological innovation and industrial integration [3] - The session outlines the need for a robust fiscal system to support modernization, with increased fiscal strength and improved public services [2] - The importance of reform and innovation as fundamental drivers for high-quality development is highlighted, particularly in state-owned enterprises [4][5] Technological Innovation - The integration of scientific research and production is essential for advancing technology, particularly in cutting-edge fields like quantum technology [3] - The session calls for a focus on original innovation and overcoming key technological challenges to enhance national defense capabilities [5] People's Well-Being - The session prioritizes improving the quality of life for citizens, with policies aimed at enhancing accessibility and equity in public services [6] - The commitment to a people-centered development approach is reiterated, emphasizing the importance of addressing public concerns and enhancing overall well-being [6][7] Regional Development - The session encourages regions like Gansu and Jilin to develop unique modernization strategies that leverage local strengths and resources [2][7] - There is a call for expanding effective demand and transforming natural resources into economic benefits, particularly in agriculture and environmental sustainability [7]

开盘:上证指数涨0.17% 存储芯片概念再度起势

Di Yi Cai Jing· 2025-10-24 02:10

Core Points - The three major stock indices opened higher, with the Shanghai Composite Index starting at 3929.12 points, up 0.17%, the Shenzhen Component Index at 13091.34 points, up 0.51%, and the ChiNext Index at 3087.63 points, up 0.83% [1] Industry Summary - Samsung and SK Hynix both raised prices by 30%, leading to a resurgence in the memory chip sector [1] - The commercial aerospace, quantum technology, and GPU sectors saw significant gains [1] - The short video, lab-grown diamond, and coal sectors experienced slight declines [1]

滚动更新丨A股三大指数集体高开,量子科技概念延续强势

Di Yi Cai Jing· 2025-10-24 01:36

Group 1 - The storage chip concept is gaining momentum again, with Samsung and SK Hynix both raising prices by 30%, leading to a resurgence in related stocks [3][1] - The commercial aerospace, quantum technology, and GPU concepts are among the top gainers in the market [1] - The Hong Kong stock market saw a significant rise, with Kanda Foods surging 163.16% after a major acquisition [4] Group 2 - The A-share market opened with all three major indices rising: the Shanghai Composite Index up 0.17%, the Shenzhen Component Index up 0.51%, and the ChiNext Index up 0.83% [2][3] - The Hang Seng Index opened up 0.81%, with the Hang Seng Tech Index increasing by 1.36%, indicating a continued rebound in tech stocks [4][5] - The central bank conducted a 168 billion yuan reverse repurchase operation with a rate of 1.40%, indicating ongoing liquidity management [5]

A股盘前播报 | 美欧开启新一轮对俄制裁!国际油价大涨 中国资产深夜爆发

智通财经网· 2025-10-24 00:29

Group 1: Macroeconomic Insights - The Fourth Plenary Session of the 20th Central Committee emphasizes accelerating high-level technological self-reliance, building a strong domestic market, and expanding high-level opening-up [1] - The U.S. and EU have initiated new sanctions against Russia, particularly targeting its oil sector, leading to a significant rise in international oil prices [2][4] - The EU's sanctions include Chinese companies, which has raised concerns from China's Ministry of Commerce regarding the impact on Sino-European economic cooperation [4] Group 2: Market Reactions - Major foreign investment firms, including Goldman Sachs and Morgan Stanley, express optimism about the Chinese market, predicting a 30% increase in major stock indices by the end of 2027 [3] - The Nasdaq Golden Dragon China Index rose by 1.66%, with Alibaba's stock increasing by over 3% [3] Group 3: Sector-Specific Developments - The semiconductor industry is experiencing a "super cycle," with NAND and DRAM prices rising by 30% due to tight supply [10] - Alibaba's self-developed AI glasses are set for pre-sale, with expectations of a significant market opportunity, projecting a 188% increase in sales by 2025 [11] - Breakthroughs in quantum communication are anticipated to accelerate the industrialization of quantum technologies, with potential recognition in the 2025 Nobel Prize in Physics [12]

A股重返3900点!不出意外、明天迎来新一轮行情了

Sou Hu Cai Jing· 2025-10-23 23:45

Market Overview - The A-share market has shown a strong performance, with major indices rising, including the Shanghai Composite Index surpassing 3900 points and the ChiNext Index increasing by 2.92% [3] - Despite the index gains, trading volume has significantly decreased by 19.5%, indicating a "shrinking rally" pattern [4] Capital Flow Dynamics - There is a disconnect between rising indices and the reluctance of new capital to enter the market, suggesting a cautious approach from investors [5] - Recent developments, such as the resumption of Sino-U.S. trade talks and the approval of the "14th Five-Year Plan," have positively influenced market sentiment [6] Policy and Investment Focus - The "14th Five-Year Plan" emphasizes investment in technology, particularly in artificial intelligence and critical areas like quantum technology and solid-state batteries [7] - The policy direction aims to enhance technological independence and resource security, which could lead to significant investment opportunities in these sectors [7] Stock Performance and Investor Sentiment - The market is experiencing a stark divergence in stock performance, with certain sectors like telecommunications and non-ferrous metals seeing gains over 25%, while financials and real estate lag behind [9] - The volatility in technology stocks indicates a short-term speculative environment, with significant capital inflows and outflows observed [9] Investment Strategies - With over 5000 stocks available, identifying reliable investment opportunities is challenging, leading to a preference for index funds [10] - As of the end of Q1 2025, the scale of passive index funds has surpassed 3.26 trillion yuan, accounting for 51.11% of A-share market capitalization [10] Foreign Investment Trends - Foreign capital inflows into the Chinese stock market have rebounded, with a net inflow of 4.6 billion USD in September 2025, marking the highest monthly figure since November 2024 [12] - Projections indicate a potential 30% upside for A-shares by the end of 2027, driven by earnings growth and valuation re-rating [12]

开盘:沪指跌0.25% 超硬材料板块普遍回调

Di Yi Cai Jing· 2025-10-23 02:11

Core Points - The three major stock indices opened lower, with the Shanghai Composite Index down 0.25%, the Shenzhen Component Index down 0.29%, and the ChiNext Index down 0.28% [1] - Sectors such as nuclear fusion, ultra-high voltage, and storage chips experienced significant declines, while CPO, wind power, and superhard materials also saw widespread pullbacks [1] - Google announced a major breakthrough with its quantum chip "Willow," leading to a general rise in quantum technology concepts [1] - Real estate and oil & gas stocks remained active [1]