MMG(01208)

Search documents

港股传来利好,外资最新发声

Zheng Quan Shi Bao· 2025-10-29 01:47

Group 1 - Foreign capital continues to be optimistic about Hong Kong stocks, with Morgan Stanley predicting that the upward trend will extend into next year due to attractive valuations and multiple favorable factors [2][3] - The Hang Seng Index and Hang Seng Tech Index have seen significant gains of 31.34% and 36.38% respectively this year, with sectors like metals and semiconductors showing nearly 150% growth [2] - Morgan Stanley maintains a target of 13,000 points for the MSCI Hong Kong Index by year-end and a bullish target of 14,000 points, expecting further increases by 2026 [2] Group 2 - The rebound in Hong Kong's financial markets is attributed to factors such as capital inflows, stabilization in the real estate market, and robust retail sales [3] - The current easing cycle by the Federal Reserve is seen as more favorable for Hong Kong compared to previous cycles, as corporate profits are still rising amid global economic stability [3] Group 3 - Foreign investors are particularly optimistic about Chinese technology companies, noting that China is still in the early stages of AI development, providing ample room for growth compared to global peers [4][5] - The liquidity in the Chinese market remains abundant, with low interest rates driving retail investors towards equities for higher returns [5] Group 4 - Emerging markets, including China, are expected to benefit significantly from structural changes in the global economy, with a focus on technology hardware, infrastructure, and local consumer brands [6] - UBS reports a growing interest among international investors in Chinese stocks, driven by favorable valuations and expectations of further capital inflows [7]

港股铜业股跌幅居前 江西铜业股份(00358.HK)跌超6%

Mei Ri Jing Ji Xin Wen· 2025-10-28 07:31

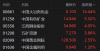

Group 1 - Copper industry stocks experienced significant declines, with Jiangxi Copper Co., Ltd. (00358.HK) falling by 6.33% to HKD 32.84 [1] - Minmetals Resources (01208.HK) decreased by 4.99%, trading at HKD 6.85 [1] - China Nonferrous Mining (01258.HK) saw a drop of 3.93%, with shares priced at HKD 13.95 [1] - Luoyang Molybdenum Co., Ltd. (03993.HK) declined by 2.41%, reaching HKD 16.63 [1]

港股异动 | 铜业股跌幅居前 江西铜业股份(00358)跌超6% 五矿资源(01208)跌近5%

智通财经网· 2025-10-28 07:21

Group 1 - Copper stocks have experienced significant declines, with Jiangxi Copper Co. down 6.33% to HKD 32.84, Minmetals Resources down 4.99% to HKD 6.85, China Nonferrous Mining down 3.93% to HKD 13.95, and Luoyang Molybdenum down 2.41% to HKD 16.63 [1] - As of October 28, LME copper prices have dropped by 1%, currently at USD 10,918.5 per ton [1] - Everbright Futures suggests that geopolitical easing between Russia and Ukraine, progress in China-US trade negotiations, and the introduction of domestic 14th Five-Year Plan proposals indicate a positive start for the global economy next year [1] Group 2 - The International Copper Study Group (ICSG) predicts a potential shortage of refined copper by 2026 due to ongoing impacts from the Indonesian mining incident, despite a tight balance in copper supply and demand [1] - There is a divergence in market expectations, as domestic copper demand growth in the first three quarters has been substantial, leading to potential pressure on demand in the fourth quarter, which may not be as significant as anticipated [1] - Jiangxi Copper Co. is set to hold a board meeting today to consider and approve the announcement regarding its third-quarter performance for the nine months ending September 30, 2025 [1]

港股概念追踪|金属价格持续走高 机构预计3年来铜将再次转为供应短缺(附概念股)

智通财经网· 2025-10-28 00:32

Group 1: Copper Market Overview - Shanghai copper futures have surpassed 88,300 CNY/ton, while LME copper prices have exceeded 11,000 USD/ton, indicating a bullish market sentiment [1] - International forecasts predict a return to copper supply shortages over the next three years, contributing to rising prices and increased capital inflow into the copper market [1] - As of October 27, the net inflow of funds into copper futures reached 48.58 billion CNY, making it the second-largest commodity futures category after gold [1] Group 2: Codelco's Copper Premium - Codelco plans to raise its copper premium for the European market to 345 USD/ton by 2026, marking a historical high and reflecting concerns over tight copper supply next year [2] Group 3: Company-Specific Insights - Luoyang Molybdenum (03993) has increased its copper production forecast for 2028-2030 by 30% to 1 million tons, expecting a compound annual growth rate of 38% in regular profits from 2025 to 2026 due to rising copper and cobalt prices [3] - Zijin Mining (02899) reported a copper production of 830,000 tons in the first three quarters, a 5.1% year-on-year increase, with future production expected to rise significantly from the completion of the Giant Dragon copper mine project [3] - Minmetals Resources (01208) has seen significant increases in copper production from its three major mines, with Las Bambas, Khoemacau, and Kinsevere showing year-on-year growth rates of 67%, 120%, and 19% respectively [3] - Jiangxi Copper (00358) holds a significant stake in First Quantum, which has proven copper resources of 35.5 million tons and is expected to resume production at the Panama copper mine in the second half of 2026, potentially enhancing Jiangxi Copper's profits [4]

港股异动丨铜业股大涨 中国大冶有色金属涨超14% 中国有色矿业涨5.3%

Ge Long Hui· 2025-10-27 02:17

Group 1 - The core viewpoint of the article highlights a significant rise in Hong Kong copper stocks, driven by a surge in copper prices, which reached a historical high of $11,035 per ton on the London Metal Exchange (LME) [1] - Copper prices have increased by approximately 25% this year, recovering from a sharp sell-off triggered by the escalation of the trade war in April [1] - Supply challenges have become a focal point for investors, particularly due to the suspension of operations at Freeport-McMoRan's Grasberg mine in Indonesia following a landslide [1] Group 2 - Citigroup's recent research report indicates that global manufacturing sentiment remains mixed, and cyclical demand growth continues to face pressure [1] - Data from Citigroup shows that copper consumption growth in August was weak, rising only 1.3% year-on-year, which is below the strong performance driven by the solar industry in the first half of the year [1] - The bank anticipates that copper consumption growth will remain moderate for the remainder of the year, but maintains a positive outlook for copper prices, predicting they will rise to $12,000 per ton by the second quarter of next year [1] Group 3 - Notable stock performances include China Daye Non-Ferrous Metals rising over 14%, China Nonferrous Mining up 5.3%, Jiangxi Copper and Minmetals Resources increasing by 4%, China Gold International rising by 2.5%, and China Metal Resources up by 1.2% [1]

黄金是波动而非转折,碳酸锂将迎拐点之年

Changjiang Securities· 2025-10-26 13:43

Investment Rating - The report maintains a "Positive" investment rating for the industry [7] Core Views - The lithium industry has passed its darkest moment, with a clear trend of improvement in supply and demand fundamentals. Domestic demand for power steadily increases, coupled with strong energy storage demand, leading to a significant upward revision of terminal growth rates for 2026. The industrialization process of solid-state batteries further strengthens the medium to long-term industry outlook [5][3] - In the precious metals sector, gold prices have experienced significant fluctuations due to various factors, including easing silver market pressures and expectations of a de-escalation in the Russia-Ukraine conflict. However, this does not change the trend of increasing allocation to gold stocks. The current price movements are seen as fluctuations rather than a trend reversal [3][4] - Industrial metals, particularly copper and aluminum, are viewed positively as supply bottlenecks are gradually alleviated. The report highlights the impact of improved trade relations between China and the US, as well as the ongoing geopolitical tensions affecting commodity prices [4][5] Summary by Sections Lithium Industry - The darkest period for the lithium sector is over, with improving supply-demand fundamentals. Domestic power demand is growing steadily, and energy storage demand remains strong. The terminal growth rate for 2026 has been significantly revised upward, and the industrialization of solid-state batteries is accelerating, enhancing long-term industry expectations. Supply-side uncertainties in overseas resource development and weak profitability due to low lithium prices have peaked capital expenditures in the industry by 2024-2025. Although there will still be some capacity release in 2026, supply growth is expected to decline from 2026 to 2028 [5][3] Precious Metals - The report notes that gold prices have seen significant fluctuations recently, driven by easing pressures in the silver market and expectations of a de-escalation in the Russia-Ukraine conflict. Despite these fluctuations, the trend of increasing allocation to gold stocks remains intact. The report emphasizes that the current price movements are more about valuation adjustments rather than a definitive trend reversal [3][4] Industrial Metals - The report indicates that industrial metals, particularly copper and aluminum, are expected to perform well as supply bottlenecks are gradually resolved. The easing of trade tensions between China and the US, along with geopolitical developments, has contributed to a positive outlook for these metals. The report highlights that copper and aluminum inventories have improved, and the overall macroeconomic environment is becoming more favorable for industrial metals [4][5]

陈得信出席ESG中国·创新年会并作主题演讲

Sou Hu Cai Jing· 2025-10-24 12:42

Core Points - The ESG China Innovation Annual Conference (2025) and the first ESG International Expo opened in Beijing, attended by notable government officials and industry leaders [1][3] - Chen Dexin, Chairman of China Minmetals, emphasized the importance of implementing the new development concept and accelerating the green transformation of the economy and society [3] - China Minmetals aims to become a world-class metal mineral enterprise group, leveraging its comprehensive industry chain advantages developed over 75 years [3] - The company is focused on enhancing the high-end, intelligent, and green levels of its industry to support economic growth and social development [3] - Looking ahead to the 14th Five-Year Plan, China Minmetals plans to build an international ESG support system and contribute to global sustainable development [3] - The company was recognized for its excellence in ESG practices and included in the "Supply Chain ESG Pioneer 50" list [5] Group 1 - The ESG China Innovation Annual Conference (2025) and the first ESG International Expo opened in Beijing [1] - Chen Dexin highlighted the strategic importance of the new development concept and green transformation [3] - China Minmetals has established a comprehensive industry chain over 75 years [3] Group 2 - The company aims to enhance high-end, intelligent, and green industry levels [3] - Plans to build an international ESG support system for sustainable development [3] - Recognized for excellence in ESG practices and included in the "Supply Chain ESG Pioneer 50" list [5]

港股异动 | 五矿资源(01208)尾盘涨超7% Las Bambas矿区运营稳定 机构上调全...

Xin Lang Cai Jing· 2025-10-24 08:01

Core Viewpoint - Minmetals Resources (01208) experienced a significant stock price increase, rising over 7% and reaching HKD 7.01, with a trading volume of HKD 4.52 billion, following the announcement of strong production figures for copper and zinc in Q3 2025 [1] Production Performance - The total copper production for Q3 2025 is projected to be 127,030 tons, representing an 11% year-on-year increase [1] - Zinc production is expected to reach 58,747 tons, marking a 26% year-on-year growth [1] - The Las Bambas mine has achieved a production ranking as the fifth largest copper mine globally in the first half of the year [1] Quarterly Production Insights - In Q3, the Las Bambas mine produced 102,875 tons of copper concentrate, which is a 14% increase compared to the same period in 2024, continuing the strong production momentum from Q2 [1] - The strong performance is attributed to the Las Bambas, Kinsevere, and Dugald River mining areas [1] Production Guidance - Due to the stable operations at the Las Bambas mine, the company has raised its annual copper production guidance for this mine to 400,000 tons [1] - The production level is expected to be sustainable over the next two years [1]

五矿资源尾盘涨超7% Las Bambas矿区运营稳定 机构上调全年铜产量指引

Zhi Tong Cai Jing· 2025-10-24 07:53

Group 1 - The core viewpoint of the article highlights a significant increase in the stock price of Minmetals Resources, which rose over 7% and is currently trading at 7.01 HKD with a transaction volume of 4.52 billion HKD [1] - Minmetals Resources reported a total copper production of 127,030 tons for Q3 2025, representing an 11% year-on-year increase, and zinc production of 58,747 tons, which is a 26% increase compared to the previous year [1] - The Las Bambas mine has achieved a production ranking as the fifth largest copper mine globally in the first half of the year, with a production of 102,875 tons of copper concentrate in Q3, marking a 14% increase from the same period in 2024 [1] Group 2 - CCB International published a report indicating that the strong performance of the Las Bambas, Kinsevere, and Dugald River mines contributed to the increases in copper and zinc production for Minmetals Resources [1] - Due to the stable operations at the Las Bambas mine this year, the company has raised its full-year copper production guidance for this mine to 400,000 tons [1] - The report suggests that this production level can be maintained over the next two years [1]

港股异动 | 五矿资源(01208)尾盘涨超7% Las Bambas矿区运营稳定 机构上调全年铜产量指引

智通财经网· 2025-10-24 07:49

Core Viewpoint - Minmetals Resources (01208) experienced a significant stock price increase, rising over 7% and reaching HKD 7.01, with a trading volume of HKD 4.52 billion, following the announcement of strong production figures for copper and zinc in Q3 2025 [1] Production Performance - In Q3 2025, the total copper production reached 127,030 tons, marking an 11% year-on-year increase [1] - Zinc production for the same period was 58,747 tons, reflecting a 26% year-on-year growth [1] - The Las Bambas mine's production in the first half of the year positioned it as the fifth largest copper mine globally [1] Quarterly Production Insights - In Q3, the Las Bambas mine produced 102,875 tons of copper concentrate, which is a 14% increase compared to the same period in 2024, continuing the strong production momentum from Q2 [1] - The strong performance in production is attributed to the Las Bambas, Kinsevere, and Dugald River mining areas [1] Production Guidance - Due to the stable operations at the Las Bambas mine, the company has raised its annual copper production guidance for this mine to 400,000 tons [1] - The outlook suggests that this production level can be maintained over the next two years [1]