PICC P&C(02328)

Search documents

人保财险宁波市分公司被罚款78万元 因财务业务数据不真实等6项违规

Feng Huang Wang Cai Jing· 2025-10-21 03:20

Core Viewpoint - The Ningbo branch of China People's Property Insurance Company was penalized for six violations, including false financial data and fictitious insurance activities, resulting in a total fine of 780,000 yuan [1][2]. Summary by Categories Violations - The company faced issues such as untrue financial data, fabrication of insurance intermediary business, exaggeration of insurance claims, unauthorized cross-regional insurance operations, imprudent insurance claims handling, and deficiencies in internal controls [1][2]. Penalties - The total fine imposed on the Ningbo branch was 780,000 yuan. Additionally, responsible individuals received warnings and fines totaling 280,000 yuan. Specific individuals were banned from the insurance industry for varying periods: Li Hongjie and Liang Zhibo for three years, and Chen Zhiyuan for one year [1][2].

港股内险股全线走高 中国人寿涨5.44%

Mei Ri Jing Ji Xin Wen· 2025-10-21 02:43

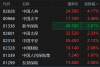

Group 1 - Hong Kong insurance stocks experienced a significant increase on October 21, with China Life (02628.HK) rising by 5.44% to HKD 24.8 [1] - New China Life (01336.HK) saw a gain of 3.68%, reaching HKD 50.1 [1] - Ping An Insurance (02318.HK) increased by 2.67%, trading at HKD 55.75 [1] - China Pacific Insurance (02328.HK) rose by 2.35%, with a price of HKD 19.19 [1]

内险股全线走高 受益于权益投资收益增长 多家险企业绩盈喜大超预期

Zhi Tong Cai Jing· 2025-10-21 02:31

光大证券发布研报称,受益于权益投资收益增长,业绩大超预期。该行认为2025年前三季度三家上市险 企在去年同期"924行情"带来的较高基数下进一步实现利润高增的共同原因为股票市场回稳向好推动权 益投资收益同比大幅增长,其中第三季度沪深300指数累计上涨17.9%,涨幅较去年同期扩大1.8pct。该 行指出,股票仓位明显提升,险企资产端弹性加大。 内险股全线走高,截至发稿,中国人寿(02628)涨5.44%,报24.8港元;新华保险(601336)(01336)涨 3.68%,报50.1港元;中国平安(02318)涨2.67%,报55.75港元;中国财险(02328)涨2.35%,报19.19港 元。 消息面上,近期多家险企发布2025年前三季度业绩预增公告。中国人寿预计前三季净利润1568-1777亿 元,同比增长50%-70%;新华保险预计前三季净利润299.9-341.2亿元,同比增长45%-65%;中国财险预 计前三季净利润375-428亿元,同比增长40%-60%。 ...

港股异动 | 内险股全线走高 受益于权益投资收益增长 多家险企业绩盈喜大超预期

智通财经网· 2025-10-21 02:27

智通财经APP获悉,内险股全线走高,截至发稿,中国人寿(02628)涨5.44%,报24.8港元;新华保险 (01336)涨3.68%,报50.1港元;中国平安(02318)涨2.67%,报55.75港元;中国财险(02328)涨2.35%,报 19.19港元。 光大证券发布研报称,受益于权益投资收益增长,业绩大超预期。该行认为2025年前三季度三家上市险 企在去年同期"924行情"带来的较高基数下进一步实现利润高增的共同原因为股票市场回稳向好推动权 益投资收益同比大幅增长,其中第三季度沪深300指数累计上涨17.9%,涨幅较去年同期扩大1.8pct。该 行指出,股票仓位明显提升,险企资产端弹性加大。 消息面上,近期多家险企发布2025年前三季度业绩预增公告。中国人寿预计前三季净利润1568-1777亿 元,同比增长50%-70%;新华保险预计前三季净利润299.9-341.2亿元,同比增长45%-65%;中国财险预 计前三季净利润375-428亿元,同比增长40%-60%。 ...

港股异动丨内险股集体上涨 中国人寿涨超4% 中国平安涨超2%

Ge Long Hui· 2025-10-21 01:52

Group 1 - The core viewpoint of the article highlights a collective rise in Hong Kong insurance stocks, with China Life leading the gains at over 4% [1] - Major insurance companies such as China Life, New China Life, and PICC have announced significant profit increases, with net profit growth exceeding 40% year-on-year, and China Life leading with a projected increase of 50% to 70% [1] - The strong performance in equity investments is identified as a key driver behind the net profit growth of these companies [1] Group 2 - Several brokerage firms maintain an optimistic outlook on the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [1] - Continuous policy support from multiple departments encourages insurance capital to enter the market as long-term funds, promoting the establishment of a long-term assessment mechanism [1]

【非银】权益投资收益大幅增长,保险股配置机会再现——上市险企2025年前三季度业绩预增公告点评(王一峰/黄怡婷)

光大证券研究· 2025-10-20 23:07

Core Viewpoint - The three listed insurance companies in China have announced significant profit growth forecasts for the first three quarters of 2025, driven by improved equity investment returns and favorable market conditions [5][6]. Group 1: Earnings Forecasts - China Life Insurance expects a net profit attributable to shareholders of 156.8-177.7 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 50%-70%. The estimated net profit for Q3 2025 is projected to be 115.9-136.8 billion yuan, with a growth of 75%-106% [5]. - New China Life Insurance anticipates a net profit attributable to shareholders of 29.99-34.12 billion yuan for the first three quarters of 2025, reflecting a year-on-year increase of 45%-65%. The Q3 2025 net profit is expected to be 15.2-19.3 billion yuan, with a growth of 58%-101% [5]. - China Pacific Insurance forecasts a net profit of 37.5-42.8 billion yuan for the first three quarters of 2025, indicating a year-on-year growth of 40%-60%. The estimated Q3 2025 net profit is projected to be 13-18.3 billion yuan, with a growth of 57%-122% [5]. Group 2: Performance Drivers - The strong earnings growth is attributed to a recovery in the stock market, which has significantly boosted equity investment returns. The CSI 300 Index rose by 17.9% in Q3, an increase of 1.8 percentage points compared to the same period last year [6]. - As of the end of September, the yield on 10-year government bonds increased by 21 basis points compared to the end of June, which is expected to positively impact China Life's service fees in Q3 [6]. - New China Life's acquisition of a stake in Hangzhou Bank is anticipated to contribute positively to its financial results due to a change in accounting treatment for the investment [6]. - China Pacific Insurance benefits from a reduction in the impact of major disasters and improvements in its non-auto insurance segment, leading to enhanced underwriting profits [6]. Group 3: Asset Allocation Trends - As of the end of H1 2025, the total stock investment of five major listed insurance companies reached 1.8 trillion yuan, a growth of 28.9% from the beginning of the year, with stock investments now accounting for 9.3% of total investment assets, an increase of 1.5 percentage points [7]. - The proportion of total invested assets in TPL stocks for these companies is 5.6%, up by 0.3 percentage points from the start of the year, indicating a significant increase in asset flexibility [7]. - New China Life's stock investment proportion is 8.9%, while China Life's is 6.7%, both showing increases from the beginning of the year, suggesting a trend towards higher equity exposure among insurance firms [7].

人保财险:预计2025年前三季度净利润同比增加约40%到60%

Zhong Guo Jing Ying Bao· 2025-10-20 11:43

Core Viewpoint - China People's Property Insurance Company (PICC) expects a net profit increase of approximately 40% to 60% in the first three quarters of 2025 compared to the same period in 2024 [1] Group 1: Financial Performance - PICC attributes the expected profit increase to a stable and improving overall economic environment in China [1] - The company emphasizes its commitment to advancing the "Five Major Articles" of finance and deepening the structural reform of the insurance supply side [1] - The underwriting profit is expected to see a significant year-on-year increase due to enhanced operational management and risk control capabilities [1] Group 2: Strategic Focus - The company is focused on optimizing its management model and reinforcing strategic layouts in key areas to improve business quality and efficiency [1] - PICC is optimistic about the development prospects of the Chinese economy and capital market, planning to moderately increase allocations to high-quality equity assets with long-term value [1] - The optimization of asset allocation has amplified the positive effects of the capital market's rise, leading to a substantial year-on-year increase in total investment income [1]

“炒股”赚翻了,新华保险、人保财险、中国人寿三季报业绩大幅预喜

Xin Lang Cai Jing· 2025-10-20 11:00

Core Viewpoint - The insurance industry is experiencing significant growth in both premium income and profitability, with major companies reporting substantial increases in net profit for the first three quarters of 2025, driven by strong investment returns and improved product structures [1][2]. Premium Income and Structure Improvement - The overall insurance industry has maintained a growth trend in premium income, with China Pacific Insurance's life insurance premiums reaching 232.436 billion yuan, a year-on-year increase of 10.9%, and New China Life Insurance reporting 172.705 billion yuan, with a growth rate of 19% [4]. - New China Life Insurance achieved a premium income of 158 billion yuan from January to August 2025, reflecting a year-on-year growth of 21%, partly due to the "炒停售" effect before the adjustment of the predetermined interest rate [4]. Profit Growth Driven by Investment Returns - China Life Insurance expects a net profit attributable to shareholders of approximately 156.785 billion to 177.689 billion yuan for the first three quarters of 2025, representing a year-on-year increase of about 50% to 70% [2]. - New China Life Insurance anticipates a net profit of 29.986 billion to 34.122 billion yuan, with a year-on-year growth of 45% to 65% [2]. - The increase in profits is largely attributed to strong investment performance, with companies optimizing their asset allocation in response to a recovering capital market [3]. Investment Strategy and Asset Allocation - Insurance companies are increasing their allocation to high-quality equity assets while maintaining liquidity safety margins, benefiting from the overall recovery of the A-share market [3]. - By the end of the second quarter of 2025, the total investment in stocks by life and property insurance companies exceeded 3 trillion yuan, an increase of nearly 1 trillion yuan compared to the same period in 2024 [3]. - New China Life Insurance's investment assets included 11.6% in stocks and 18.6% in funds, significantly higher than industry peers [3]. Product Structure Transformation - In response to the adjustment of predetermined interest rates, listed insurance companies are accelerating product structure transformation, focusing on participating insurance and other floating income products [5]. - By the first half of 2025, participating insurance accounted for over 50% of the first-year premium income in individual insurance channels for China Life Insurance, while China Pacific Insurance's new policy premium income from participating insurance rose to 42.5% [5]. Market Outlook - The insurance sector is expected to continue its strong performance, with a projected premium growth rate of around 10% as the market prepares for the "开门红" period [5]. - Despite potential slowdowns in growth due to interest rate adjustments, the overall structure of the business is expected to improve, with optimistic expectations for investment returns in the fourth quarter [5].

【Fintech 周报】多地预警黄金投资骗局;今年超300家中小银行合并、解散;农行股价“12连阳”

Sou Hu Cai Jing· 2025-10-20 10:34

Regulatory Dynamics - The Financial Regulatory Bureau has published a list of 238 insurance institutions with designated regulatory responsibilities, effective until June 30, 2025, indicating a shift of regulatory authority to local agencies for most property, reinsurance, and life insurance institutions [1] - Multiple local governments have issued warnings about scams related to gold custody, rental returns, and virtual investments, urging the public to be cautious of high-yield investment traps [1] Industry Dynamics - Over 300 small and medium-sized banks have merged, dissolved, or exited the market in 2025, indicating a significant acceleration in industry consolidation, particularly among local rural commercial banks and village banks [2] - Agricultural Bank of China has integrated over 190 rural commercial bank branches in Jilin, reflecting a systematic approach to reform and restructuring in the rural banking sector [3] - Several payment institutions have undergone capital adjustments and personnel changes, with La Ka La reducing its registered capital from approximately 788 million to 777 million yuan [4] Corporate Dynamics - China Pacific Insurance expects a net profit increase of 40% to 60% for the first three quarters of 2025, driven by stable economic performance and strategic business improvements [7] - New China Life Insurance reported a 19% year-on-year increase in premium income, totaling 172.7 billion yuan for the first nine months of 2025 [7] - Yuexiu Group has completed an 18 billion HKD acquisition of Hong Kong Life, enhancing its financial services portfolio [7] - Ant Group's acquisition of Yao Cai Securities has received approval from the Hong Kong Securities and Futures Commission, pending further regulatory approvals [8] - Agricultural Bank of China's A-share stock has experienced a "12 consecutive days" rise, with its price-to-book ratio surpassing 1 for the first time in years [8]

险企三季报集体“预喜”,投资收益成业绩增长最强引擎

Huan Qiu Wang· 2025-10-20 06:44

Core Viewpoint - The performance of listed insurance companies is showing a positive trend, with major players like China Life, New China Life, and PICC Property & Casualty reporting significant profit increases, driven primarily by strong equity investments [1][3]. Group 1: Performance Highlights - China Life leads the market with a projected net profit increase of 50% to 70%, while other major insurers also report over 40% growth in net profit [1]. - The recovery of the A-share market since 2025 has provided substantial returns for insurance investment portfolios, significantly boosting investment income [1]. - Insurers are actively increasing their equity investments and strategically positioning themselves in new productivity sectors, contributing to notable growth in investment returns [1]. Group 2: Operational Strengths - The insurance sector is experiencing robust performance on the liability side, with steady operational management and structural optimization supporting profit growth [1]. - Despite a lack of widespread monthly premium data, available figures indicate overall growth in premium scale, with a shift towards dividend insurance and floating income products in response to reduced preset interest rates [1]. - The property insurance sector is also seeing significant improvements in underwriting profits through quality enhancement and efficiency measures [1]. Group 3: Future Outlook - Multiple brokerage firms maintain an optimistic outlook for the insurance sector, anticipating a "double hit" in valuation and performance due to "asset-liability resonance" [3]. - Continued policy support, including encouragement for insurance capital to enter the market and the establishment of long-term assessment mechanisms, is expected to bolster industry development [3]. - As of the second quarter of 2025, the total investment in stocks by life and property insurance companies has exceeded 3 trillion yuan, marking a significant increase and a high proportion of stock investments [3].