江西铜业

Search documents

刚刚,再次见证历史!

中国基金报· 2025-10-29 12:48

Core Viewpoint - The article highlights the significant rise in copper prices, with LME copper reaching a historical high of $11,146 per ton, driven by strong demand from sectors like electric vehicles and AI infrastructure [2][4][6]. Supply and Demand Dynamics - The global copper supply has shifted from a "tight balance" to a "shortage," with major mining companies reducing their copper production forecasts [8][9]. - Glencore reported a 17% decrease in copper production for the first three quarters of the year, adjusting its annual target to 850,000 - 875,000 tons from a previous range of 850,000 - 890,000 tons [9][10]. - Significant production disruptions have occurred, including a 120,000-ton reduction from Freeport's Grasberg mine and a 50,000-ton impact from social unrest at the Constancia mine in Peru [10]. - Chile's Codelco reported a 25% drop in production at its El Teniente mine, reaching a 20-year low, while other Chilean mines also lowered their production forecasts [10][11]. Market Outlook - The International Copper Study Group (ICSG) revised the global mine production growth rate down to 1.4% for 2025, predicting a supply shortfall of 150,000 tons in 2026, contrary to earlier forecasts of a surplus [11]. - LME copper inventories fell below 140,000 tons, increasing the risk of short squeezes for bearish positions [12]. - Analysts suggest that while short-term demand may be subdued, the overall trend for copper prices remains bullish due to supply constraints and improving macroeconomic conditions [14][15][16]. - The expected trading range for copper prices in November is projected to be between 85,000 - 92,000 yuan per ton, with a cautious approach recommended for trading strategies [16].

4000点拉锯战 | 谈股论金

水皮More· 2025-10-29 10:06

Core Viewpoint - The A-share market has shown a significant upward trend, with major indices collectively rising and the Shanghai Composite Index surpassing the symbolic 4000-point mark, indicating a battleground for bulls and bears [2][3]. Market Performance - The Shanghai Composite Index closed at 4016.33 points, up 0.70%, while the Shenzhen Component Index rose by 1.95% to 13691.38 points, and the ChiNext Index increased by 2.93% to 3324.27 points. The total trading volume in the Shanghai and Shenzhen markets approached 2.3 trillion yuan, an increase of over 100 billion yuan compared to the previous day [2][4]. Key Drivers - The core driving force behind the index's rise was the securities sector, particularly CITIC Securities, which saw a gain of over 1%. Additionally, Industrial Fulian, a key stock in the Shanghai market, surged approximately 8%, benefiting from Nvidia's strong performance in the U.S. market [4][5]. - The new energy sector, led by CATL, also played a crucial role in boosting the Shenzhen market, with significant contributions from the photovoltaic, lithium battery, and copper sectors [5][6]. Sector Analysis - The performance of the A50 index, closely related to the Shanghai Composite, weakened, primarily due to a nearly 2% decline in bank stocks, which had previously supported market rebounds. The current market focus has shifted towards new energy stocks, which are experiencing a resurgence after a period of underperformance [6][7]. - The recent increase in raw material prices for the new energy industry raises questions about whether this is a trend reversal or a temporary rebound, which will impact the future performance of related stocks [7][8]. Market Dynamics - Despite the overall positive index performance, a significant number of stocks (approximately 2600) declined, indicating that the index's rise did not benefit the majority of stocks. The median change in stock prices was negative, reflecting a market skewed towards large-cap technology stocks [8][9]. - The Northbound trading was absent due to the Hong Kong market's closure, yet the overall trading volume remained high, suggesting strong market activity independent of external influences [9].

黄金概念涨2.69% 主力资金净流入这些股

Zheng Quan Shi Bao Wang· 2025-10-29 09:35

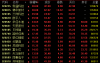

Core Insights - The gold concept sector saw an increase of 2.69%, ranking 9th among concept sectors, with 59 stocks rising, including Jiangxi Copper, Tebian Electric Apparatus, and Huayu Mining, which rose by 9.57%, 8.91%, and 8.09% respectively [1] - The sector experienced a net inflow of 4.995 billion yuan, with 45 stocks receiving net inflows, and 12 stocks exceeding 100 million yuan in net inflows, led by Tebian Electric Apparatus with 1.22 billion yuan [2][3] Sector Performance - The top-performing concept sectors included Hainan Free Trade Zone (+4.35%), BC Battery (+3.89%), and Metal Zinc (+3.60%), while the worst performers included DRG/DIP (-1.31%) and Military Equipment Restructuring Concept (-1.14%) [2] - The gold concept sector's performance was bolstered by significant inflows, with major contributors being Tebian Electric Apparatus, Zijin Mining, Jiangxi Copper, and Luoyang Molybdenum, which saw net inflows of 1.22 billion yuan, 878 million yuan, 583 million yuan, and 445 million yuan respectively [2] Stock-Specific Insights - The stocks with the highest net inflow ratios included Hangmin Co., Jiangxi Copper, and Zijin Mining, with net inflow ratios of 16.50%, 13.64%, and 13.58% respectively [3] - Notable stock performances included Tebian Electric Apparatus (+8.91%), Zijin Mining (+3.75%), and Jiangxi Copper (+9.57%), with respective turnover rates of 8.83%, 1.03%, and 4.96% [3][4]

帮主郑重收评:北证50飙8%!沪指站4000点,明天这么干

Sou Hu Cai Jing· 2025-10-29 09:10

Market Overview - The market experienced a significant rally with all three major indices rising, particularly the North Stock Exchange 50, which surged by 8.41% [3] - The Shanghai Composite Index increased by 0.7%, while the ChiNext Index rose nearly 3% [3] - The total trading volume reached over 2.2 trillion yuan, an increase of more than 120 billion yuan compared to the previous day, indicating strong market liquidity [3] Sector Performance - The photovoltaic and energy storage sectors saw substantial gains, with leading companies like LONGi Green Energy and Canadian Solar hitting their daily price limits [3] - The non-ferrous metals sector also performed well, with copper and zinc leading the charge; major players like Zhongjin Lingnan and Jiangxi Copper experienced significant price increases [3] - Conversely, the banking and liquor sectors struggled, with stocks like Chengdu Bank and Shanghai Pudong Development Bank declining [3] Investment Strategy - Investors are advised not to chase high prices in the rapidly rising photovoltaic and non-ferrous metal sectors; instead, they should wait for potential pullbacks to key support levels, such as the 5-day moving average [4] - For those who missed the North Stock Exchange 50 rally, it is recommended to wait for stabilization before entering, as the index may experience volatility after a sharp rise [4] - Monitoring trading volume and the stability of the Shanghai Composite Index at the 4000-point level is crucial; maintaining positions is advisable unless there is a significant drop in volume or a breach of the 4000-point support [4]

有色金属行业今日净流入资金59.97亿元,紫金矿业等20股净流入资金超亿元

Zheng Quan Shi Bao Wang· 2025-10-29 09:03

Core Viewpoint - The Shanghai Composite Index rose by 0.70% on October 29, with 24 out of 28 sectors experiencing gains, particularly in the power equipment and non-ferrous metals sectors, which increased by 4.79% and 4.28% respectively [1] Market Performance - The main funds in the two markets saw a net inflow of 5.406 billion yuan, with 12 sectors experiencing net inflows. The power equipment sector led with a net inflow of 16.132 billion yuan, followed by the non-ferrous metals sector with 5.997 billion yuan [1] - Conversely, 19 sectors experienced net outflows, with the electronics sector leading at a net outflow of 6.540 billion yuan, followed by the communications sector with 4.736 billion yuan [1] Non-Ferrous Metals Sector - The non-ferrous metals sector rose by 4.28%, with a total net inflow of 5.997 billion yuan. Out of 137 stocks in this sector, 122 saw gains, and 4 hit the daily limit [2] - The top stocks by net inflow included Zijin Mining with 878 million yuan, Jiangxi Copper with 583 million yuan, and Ganfeng Lithium with 542 million yuan [2] - The sector also had 8 stocks with net outflows exceeding 50 million yuan, led by Antai Technology with a net outflow of 603 million yuan [2][4] Non-Ferrous Metals Sector Inflow Rankings - Key stocks with significant inflows included: - Zijin Mining: +3.75%, turnover rate 1.03%, inflow 877.89 million yuan - Jiangxi Copper: +9.57%, turnover rate 4.96%, inflow 582.99 million yuan - Ganfeng Lithium: +6.22%, turnover rate 9.17%, inflow 541.84 million yuan [2] Non-Ferrous Metals Sector Outflow Rankings - Key stocks with significant outflows included: - Antai Technology: +2.35%, turnover rate 25.88%, outflow -602.59 million yuan - Chuangjiang New Materials: +2.11%, turnover rate 22.94%, outflow -194.99 million yuan - Dongfang Tantalum: -0.87%, turnover rate 13.37%, outflow -107.78 million yuan [4]

沪指站上4000点,北证50大爆发

Zhong Guo Zheng Quan Bao· 2025-10-29 08:59

Market Performance - The A-share market showed strong performance on October 29, with the Shanghai Composite Index surpassing 4000 points and the ChiNext Index rising nearly 3% [1][2] - The Shanghai Composite Index closed at 4016.33, up 0.7%, while the Shenzhen Component Index rose 1.95% to 13691.38, and the ChiNext Index increased by 2.93% to 3324.27 [2] - The total market turnover exceeded 2.29 trillion yuan [1] Sector Highlights - The new energy sector rebounded, with photovoltaic and energy storage stocks leading the gains. Notable stocks included Longi Green Energy and Tongwei Co., both reaching their daily limit [2][3] - The non-ferrous metals sector also saw activity, with copper and zinc stocks leading the rise, including major gains from companies like Jiangxi Copper and Zhongjin Lingnan Nonfemet Company [2] - The Hainan Free Trade Zone concept maintained strength, with several leading stocks hitting their daily limit [2] Photovoltaic Industry Developments - The photovoltaic and energy storage industry experienced a significant surge, with multiple leading stocks hitting their daily limit [3] - Sunpower's stock price peaked at 194.97 yuan, with a market capitalization exceeding 400 billion yuan, closing at 191.49 yuan and a market cap of 397 billion yuan [6] - Recent announcements from leading companies in the photovoltaic sector indicated strong third-quarter performance, with Sunpower reporting a revenue increase of 20.83% year-on-year [8] Supply Chain and Market Dynamics - The photovoltaic industry is witnessing a recovery in demand, with Chinese companies securing multiple large overseas orders since September [8] - The industry is also seeing a trend towards "de-involution," with regulatory bodies working to standardize competition within the sector [9] - Some leading polysilicon manufacturers plan to reduce production in November, which may impact supply dynamics [9] - Analysts suggest that the worst profitability period for photovoltaic companies has passed, with expectations of price increases and improved market conditions [9]

A股高开高走放量上涨,沪指站上4000点

Sou Hu Cai Jing· 2025-10-29 08:49

Market Overview - The A-share market opened higher on October 29, with the Shanghai Composite Index surpassing 4000 points, closing at 4016.33 points, up 0.7% [2][3] - The ChiNext Index rose by 2.93%, closing at 3324.27 points, while the Shenzhen Component Index increased by 1.95% to 13691.38 points [2] Sector Performance - New energy stocks surged, particularly in the energy storage sector, leading to a wave of limit-up stocks [2] - The non-bank financial sector, including brokerage stocks, saw significant gains, with several stocks hitting the daily limit [5] - Conversely, bank stocks experienced a notable decline, with the banking index dropping nearly 2% [6] Trading Volume and Stock Movement - A total of 2664 stocks rose while 2621 fell, with a trading volume of 22,560 billion yuan, an increase from the previous day's 21,479 billion yuan [3][4] - 112 stocks saw gains of over 9%, while 13 stocks experienced declines of over 9% [4] Investment Sentiment and Future Outlook - Analysts suggest that the A-share market may continue to perform strongly, with the recent breakthrough of the 4000-point level providing a solid foundation for future gains [7][9] - The current market environment is characterized by low valuations and low leverage, which may enhance the sustainability of the current rally compared to previous cycles [10] - The upcoming economic policies and the potential for further interest rate cuts by the Federal Reserve are expected to bolster market confidence [9][10]

大爆发!尾盘,多股30%涨停

Zheng Quan Shi Bao· 2025-10-29 08:47

Market Overview - The A-share market experienced a strong rally on October 29, with the Shanghai Composite Index surpassing 4000 points, reaching a 10-year high, while the ChiNext Index rose nearly 3% [1] - The North Exchange 50 Index surged over 8% in the afternoon session, closing with a significant increase [2] Sector Performance Photovoltaic Industry - The photovoltaic sector saw substantial gains, with Sunshine Power rising over 15% to a new historical high, and other companies like Longi Green Energy and Tongwei Co. hitting the daily limit [5][6] - The industry is expected to benefit from improved supply-demand dynamics and rising prices of polysilicon, leading to a potential valuation recovery [7] Nonferrous Metals - The nonferrous metals sector also performed strongly, with tungsten and aluminum stocks showing notable increases. Zhongtung High-tech hit the daily limit for two consecutive days, while Jiangxi Copper approached the limit [8][10] - The tungsten market is experiencing a price increase due to rising demand and supply constraints, with significant price hikes reported for tungsten concentrate and ammonium paratungstate [10] Securities Firms - The securities sector saw gains, with Huazhang Securities and Northeast Securities reaching their daily limits during intraday trading [1] Banking Sector - In contrast, the banking sector faced declines, with Chengdu Bank dropping nearly 6% and other banks like Xiamen Bank and Shanghai Pudong Development Bank falling close to 5% [1] Regulatory Developments - The China Securities Regulatory Commission emphasized the need to improve the North Exchange's listing mechanism and enhance the quality of listed companies, aiming to stimulate market vitality [4]

大爆发!多股30%涨停!

天天基金网· 2025-10-29 08:38

Market Overview - A-shares experienced a strong rally on October 29, with the Shanghai Composite Index surpassing 4000 points, closing at 4016.33, up 0.7% [3] - The ChiNext Index reached a nearly four-year high, closing up 2.93% at 3324.27 [3] - The North Exchange 50 Index surged by 8.41%, with total trading volume across Shanghai, Shenzhen, and North exchanges reaching 22.909 billion yuan, an increase of approximately 1.25 billion yuan from the previous day [3][5] Sector Performance Photovoltaic Industry - The photovoltaic sector saw significant gains, with major stocks like Sungrow Power rising over 15%, reaching a market capitalization of nearly 400 billion yuan [9] - Other companies in the sector, such as LONGi Green Energy and Tongwei Co., hit their daily price limits [9][11] - The industry is showing signs of recovery, with improved supply-demand dynamics due to rising polysilicon prices and previous production cuts [11] Nonferrous Metals - The nonferrous metals sector also performed strongly, particularly tungsten and aluminum stocks, with companies like China Tungsten High-Tech hitting their daily price limit [13] - The price of tungsten has been increasing, with black tungsten concentrate prices rising to 288,000 yuan per ton, reflecting a supply-demand tightness [15] - Recent production issues in aluminum smelting facilities have led to supply constraints, further supporting price increases in the aluminum sector [16] Regulatory Developments - The China Securities Regulatory Commission (CSRC) announced plans to enhance the North Exchange's listing mechanisms and improve the quality of listed companies [5] - The focus will be on optimizing the entry system and promoting the interconnectivity between the New Third Board and regional equity markets [5][7] Investment Insights - Analysts suggest that the recent downturn in the North Exchange has created new valuation opportunities, particularly for newly listed stocks with strong profit potential [7] - The upcoming third-quarter reports are expected to reveal companies with better-than-expected performance, which could lead to further investment interest [7]

大爆发!尾盘,多股30%涨停!

Zheng Quan Shi Bao· 2025-10-29 08:37

Market Overview - The A-share market experienced a strong rally on October 29, with the Shanghai Composite Index surpassing 4000 points, reaching a 10-year high, while the ChiNext Index rose nearly 3% [1] - The North Exchange 50 Index surged over 8% in the afternoon session, with total trading volume across Shanghai, Shenzhen, and North exchanges amounting to 22.909 billion yuan, an increase of approximately 1.25 billion yuan from the previous day [1][2] Sector Performance - The photovoltaic industry chain stocks saw significant gains, with Sungrow Power Supply (300274) rising over 15% to reach a historical high, and other companies like Longi Green Energy (601012), Tongwei Co. (600438), and JA Solar Technology (002459) hitting the daily limit [1][6] - The non-ferrous metals sector also performed strongly, with companies like China Tungsten High-Tech (000657) hitting the daily limit for two consecutive days, and Jiangxi Copper (600362) approaching the limit [1][9] - The brokerage sector saw gains, with Huashan Securities (600909) and Northeast Securities touching the daily limit during trading [1] - The Hainan Free Trade Zone concept stocks surged, with Hainan Development (002163) and Hainan Airlines (603069) reaching the daily limit [1] Regulatory Developments - The China Securities Regulatory Commission (CSRC) emphasized the need to improve the listing mechanism for the North Exchange and optimize the disclosure requirements for innovative attributes, aiming to enhance market vitality and the quality of listed companies [2][4] Industry Insights - The photovoltaic sector is showing signs of recovery, with third-quarter performance indicating a bottoming out and marginal improvement due to rising polysilicon prices and previous production cuts improving supply-demand dynamics [8] - The non-ferrous metals sector, particularly tungsten, is experiencing a price increase driven by growing demand from industries such as construction and automotive, alongside supply constraints due to environmental regulations and safety inspections [11]