储能业务

Search documents

马斯克万亿薪酬赌局即将展开股东投票!成功则富可敌国,失败或离开特斯拉

Sou Hu Cai Jing· 2025-11-05 10:45

Core Viewpoint - A significant gamble regarding Elon Musk's future is unfolding, centered around a $1 trillion compensation plan that reflects his career-long bets on ambitious predictions [1][2]. Group 1: Compensation Plan Details - Tesla's board announced a ten-year incentive plan for Musk, potentially worth up to $1 trillion, which is unprecedented in scale [2]. - The plan requires Musk to achieve 12 performance targets, including increasing Tesla's market value to $8.5 trillion, selling 12 million electric vehicles, producing 1 million AI robots, operating 1 million autonomous taxis, and boosting adjusted earnings to $400 billion [4]. Group 2: Shareholder Reactions - The shareholder vote on the plan is scheduled for November 6, with ISS and Glass Lewis urging investors to oppose it due to its excessive scale and lack of effective constraints [5]. - Musk has publicly criticized these recommendations, expressing disbelief that he could be ousted from Tesla due to their suggestions [5]. - Analysts are divided; some view the plan as overly ambitious, while others believe Musk's past performance justifies the potential rewards [5]. Group 3: Financial Performance - Tesla's Q3 revenue reached $28.1 billion, a 12% year-over-year increase, with global deliveries of 497,000 vehicles, up 7.4% [6]. - However, net profit for Q3 was $1.37 billion, down 37% from $2.17 billion in the same period last year, attributed to rising sales and operational costs, ongoing R&D investments, and changes in sales structure [6]. Group 4: Market Challenges - Tesla faced significant challenges in the European market, with new car registrations declining sharply due to aging models, competition from Chinese rivals, and consumer backlash against Musk's political views [7][8]. Group 5: Future Growth Strategies - Musk envisions a grand future for Tesla, focusing on autonomous driving and Robotaxi services, with plans to start production of the Cybercab in Q2 2026 [9]. - The humanoid robot Optimus is expected to become a key product, potentially accounting for 80% of Tesla's value in the future, with production lines set to begin by the end of 2026 [10]. - Tesla's energy storage business is also highlighted as a growth area, with Musk suggesting that battery storage could significantly enhance energy efficiency without new power plants [11][12].

豪鹏科技20251103

2025-11-03 15:48

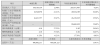

Summary of Haopeng Technology Conference Call Company Overview - **Company**: Haopeng Technology - **Industry**: AI and Energy Solutions Key Financial Performance - **Revenue**: 4.943 billion CNY, up 16% year-on-year [3] - **Net Profit**: 175 million CNY, up 126% year-on-year [3] - **Net Profit (Excluding Non-recurring Items)**: 162 million CNY, up 165% year-on-year [3] - **Operating Cash Flow**: 380 million CNY, up 177% year-on-year [3] - **Debt Ratio**: Decreased from 72.41% to 59.67% [3] - **Weighted Average Return on Equity**: Increased to 6.9%, up 3.84 percentage points year-on-year [3] Strategic Focus and Business Transformation - **AI Edge**: Company is transitioning towards high-value AI edge business, collaborating with leading global AI clients [2][3] - **Product Development**: Focus on AI edge energy solutions, with successful delivery of AI glasses energy solutions and service robot energy modules [2][5] - **Market Expansion**: Plans to launch high-value products in emerging fields like data centers, with expected shipments starting in Q3 2026 [4][8] Product and Technology Advancements - **Energy Solutions**: Solid-liquid solutions have been commercialized in high-end backup power [5] - **Battery Technology**: Laboratory samples of pure silicon anode batteries show energy density improvement of at least 50% compared to traditional graphite anode batteries [5] - **AI Glasses Market**: Anticipated exponential growth in AI glasses market, targeting 20%-30% market share with potential for 60%-70% in specific clients [4][17] Storage Business Performance - **Profitability**: Storage business achieved profitability with a year-on-year growth rate of 185% [6] - **International Orders**: Over 70% of contributions from overseas clients, with orders planned through Q1 2026 [6] - **Future Products**: Plans to introduce differentiated storage products for residential and commercial use [6] Market Challenges and Responses - **Cobalt Lithium Price Increase**: Company is addressing the impact of rising cobalt lithium prices through pricing adjustments and product upgrades [7] - **Supply Chain Management**: Focus on optimizing order structure and enhancing product quality to avoid price competition [7][23] Future Outlook - **Revenue Growth**: Optimistic about achieving double-digit revenue growth and significant improvement in profitability by 2026 [18][20] - **Emerging Applications**: Expectation of strong demand in consumer electronics driven by AI technology, with a focus on innovation and product upgrades [24] Competitive Advantages - **Market Position**: Established trust in overseas high-end markets since 2003 through product quality and timely delivery [22] - **Innovation Focus**: Continuous investment in technology and application innovation to maintain competitive edge [22] Conclusion Haopeng Technology is positioned for significant growth in the AI and energy solutions market, with strong financial performance, strategic partnerships, and a focus on innovation and product development. The company is navigating market challenges effectively while preparing for future opportunities in emerging applications.

天合光能(688599):2025年三季报点评:Q3亏损环比收窄,看好公司储能业务成长性

Minsheng Securities· 2025-11-03 09:29

Investment Rating - The report maintains a "Recommended" rating for the company [3][5]. Core Views - The company reported a revenue of 49.97 billion yuan for the first three quarters of 2025, a year-on-year decrease of 20.87%, with a net profit attributable to shareholders of -4.20 billion yuan [1]. - In Q3 2025, the company achieved a revenue of 18.91 billion yuan, a year-on-year decrease of 6.27% but a quarter-on-quarter increase of 13.12%, with a net profit of -1.28 billion yuan, indicating a narrowing of losses [1]. - The company has demonstrated good cost control capabilities, with significant improvements in various expense ratios, except for a slight increase in financial expense ratio [1]. - The company’s storage business is expected to provide additional growth, with overseas orders accounting for 60% of total orders in 2025 and projected to maintain over 50% growth in 2026 [2]. Financial Forecasts - The company is expected to achieve revenues of 70.85 billion yuan, 93.01 billion yuan, and 108.06 billion yuan for the years 2025, 2026, and 2027 respectively, with net profits of -4.40 billion yuan, 1.92 billion yuan, and 3.08 billion yuan [3][4]. - The projected PE ratios for 2026 and 2027 are 23x and 14x respectively, based on the closing price on October 31 [3][4].

广州发展拟中期分红约3.5亿元,证券事务代表姜云出任董秘

Nan Fang Du Shi Bao· 2025-10-31 03:49

Core Viewpoint - Guangzhou Development Group Co., Ltd. reported a revenue of 37.965 billion yuan for the first three quarters of 2025, marking a year-on-year increase of 5.42%, while net profit attributable to shareholders rose by 36.05% to 2.159 billion yuan [1][4]. Financial Performance - The company achieved a total revenue of 37.965 billion yuan in the first three quarters, with a year-on-year growth of 5.42% [1][4]. - Net profit attributable to shareholders reached 2.159 billion yuan, reflecting a significant increase of 36.05% compared to the previous year [1][4]. - The company plans to distribute approximately 350 million yuan in mid-term dividends, which represents 16.24% of the net profit attributable to shareholders for the first three quarters [7]. Business Operations - Guangzhou Development is engaged in green low-carbon comprehensive smart energy, energy conservation, environmental protection, and energy finance, making it one of the key comprehensive energy enterprises in Guangdong Province [3]. - The company reported a decrease of 43.12% in net profit attributable to shareholders after deducting non-recurring gains and losses, attributed to lower profits from coal trading and reduced investment income from associated enterprises [4][6]. - The company completed a total power generation of 18.915 billion kWh and gas supply of 449.424 million cubic meters in the first nine months, with respective year-on-year growths of 1.70% and 1.83% [6]. Shareholder Activity - The controlling shareholder, Guangzhou Industrial Investment Holding Group Co., Ltd., increased its stake in Guangzhou Development by acquiring approximately 20.55 million shares, raising its total shareholding to 57.94% [3]. - The company appointed Jiang Yun as the secretary of the board and Xu Zilu as the securities affairs representative [7][8]. Strategic Initiatives - Guangzhou Development is actively pursuing the issuance of REITs and has accelerated the establishment of a green low-carbon industry fund to enhance resource integration and industrial collaboration [3]. - The company has made significant progress in its energy storage business, with a total installed capacity of new energy storage projects reaching 196 MW/345 MWh, a year-on-year increase of 830% [6][7].

安克创新储能业务冲刺60亿元年收入,逼近正浩创新

Xin Lang Cai Jing· 2025-10-27 01:20

Core Insights - Anker Innovations anticipates its energy storage business, "Zhongda Charge," to achieve annual revenue of 6 billion yuan by 2025, representing nearly a 100% year-on-year growth [1] - The company reported a total revenue of 24.71 billion yuan for 2024, with energy storage revenue exceeding 3 billion yuan, marking a significant increase of 184% year-on-year [1] - Achieving the 6 billion yuan revenue target would position Anker's energy storage business close to its competitor, Zhenghao Innovation, which is projected to have nearly 8 billion yuan in revenue for 2024 [1] Company Overview - Founded in 2011, Anker Innovations initially focused on power banks and charging accessories, and is now pivoting towards energy storage as its second growth curve [1] - The "Zhongda Charge" encompasses three product lines: portable energy storage, balcony solar storage, and fixed home storage [1]

上海派能能源科技股份有限公司 2025年第三季度报告

Zheng Quan Ri Bao· 2025-10-23 23:17

Core Viewpoint - The company reported significant growth in revenue and net profit for the third quarter of 2025, driven by strong sales in both domestic and international markets, particularly in energy storage solutions [7][8]. Financial Performance - For the first three quarters of 2025, the company achieved operating revenue of 2,012.56 million yuan, a year-on-year increase of 42.52% - The net profit attributable to shareholders was 47.85 million yuan, up 28.05% - In the third quarter alone, operating revenue reached 863.22 million yuan, reflecting a 56.13% year-on-year growth, while net profit surged to 33.94 million yuan, marking a 94.01% increase [7]. Sales Volume - The company sold 2,405 MWh in the first three quarters of 2025, representing a 142.44% increase year-on-year - In the third quarter, sales reached 1,078 MWh, a 156.06% increase compared to the same period last year - Growth was attributed to the recovery of traditional markets, expansion in emerging markets, and breakthroughs in domestic and international commercial energy storage [7]. Shareholder Activity - The controlling shareholder, ZTE New Communications Co., Ltd., increased its stake in the company by purchasing 750,000 shares for 26.76 million yuan on April 22, 2025 - The shareholder plans to continue buying shares within a range of 50 million to 100 million yuan over the next 12 months, without setting a price range for the purchases [8][9]. Asset Impairment Provision - The company recognized a total impairment provision of 25.21 million yuan for the third quarter of 2025, which includes 18.07 million yuan for credit impairment losses and 7.13 million yuan for asset impairment losses - This provision reflects the company's adherence to accounting standards and aims to present a fair view of its financial status as of September 30, 2025 [13][16]. Supervisory Approval - The supervisory board approved the company's third-quarter report and the asset impairment provision, confirming that the procedures followed were in compliance with relevant laws and regulations [22][26].

曼恩斯特:公司储能业务订单相对充足

Zheng Quan Ri Bao Zhi Sheng· 2025-10-23 10:47

Core Insights - The company has established a multi-layered product matrix centered on centralized energy storage, with industrial, commercial, and residential energy storage products as its main offerings [1] - The company has accumulated several core technologies in battery lifecycle value assessment, BMS management technology, and intelligent power station operation and maintenance [1] - The company currently has a relatively sufficient order backlog, and with the ongoing development of the industry and orderly delivery of orders, the profitability of the energy storage business is expected to improve in the future [1]

宁德时代第三季度财报出炉 净利增长超四成

Sou Hu Cai Jing· 2025-10-21 08:54

Core Insights - CATL reported a revenue of 104.186 billion yuan for Q3 2025, a year-on-year increase of 12.90%, and a net profit of 18.549 billion yuan, up 41.21% year-on-year, driven by strong demand in the power battery market and energy storage business [1] - The company is expected to solidify its leading position in the global energy revolution through dual-driven growth from power batteries and energy storage, along with global capacity expansion and technological innovation [1] Financial Performance - For the first three quarters of the year, CATL achieved a revenue of 283.072 billion yuan, a 9.28% increase year-on-year, and a net profit of 49.034 billion yuan, up 36.20% year-on-year [2] - R&D expenses reached 15.068 billion yuan, reflecting a 15.26% increase year-on-year, supported by over 360 billion yuan in cash and financial assets for robust R&D and capacity expansion [2] Energy Storage Business - Energy storage business showed significant growth, with Q3 shipments reaching approximately 180 GWh, where energy storage accounted for about 20% and power batteries for 80% [2] - The energy storage sector is undergoing large-scale expansion, with expectations to become a new profit growth point, particularly with new capacity in Shandong Jining expected to exceed 100 GWh by 2026 [2] Profitability and Market Trends - The increase in sales proportion of energy storage systems is expected to positively impact net profit, although the current contribution remains limited [3] - The energy storage business is anticipated to be the fastest-growing segment, driven by global energy transition and demand from AI data centers, supported by favorable policies [3] Technological Innovations - CATL introduced several new products and technologies, including the Kirin battery, NP3.0 technology, and Shenxing Pro battery, aimed at setting stricter safety standards in the power battery industry [4] - The sodium-ion battery has received new national standard certification, paving the way for its large-scale application [4] Market Position and Collaborations - CATL maintained a market share of 36.8% in the global power battery sector, with a shipment of 25.45 GWh from January to August 2025, reflecting a 31.9% year-on-year increase [6] - The company is expanding collaborations with domestic automakers and international companies like Tesla, BMW, and Mercedes-Benz, enhancing its market presence in both domestic and overseas markets [6]

每天净赚约1.8亿元,宁德时代三季报出炉:新能源商用车业务增速明显

Mei Ri Jing Ji Xin Wen· 2025-10-21 07:09

Core Viewpoint - CATL (Contemporary Amperex Technology Co., Limited) reported strong financial results for Q3 2023, with significant growth in revenue and net profit, driven by robust demand in the energy storage and commercial vehicle battery sectors [1][4]. Financial Performance - Q3 revenue reached 104.19 billion yuan, a year-on-year increase of 12.9% [2] - Net profit attributable to shareholders was 18.55 billion yuan, up 41.21% year-on-year [2] - For the first three quarters, total revenue was 283.07 billion yuan, reflecting a 9.28% increase, while net profit reached 49.03 billion yuan, a 36.2% increase [2] - Daily net profit averaged approximately 180 million yuan [1] - Operating cash flow for the first three quarters was 80.66 billion yuan, a 19.6% increase [2] Business Segments - Energy storage business accounted for approximately 20% of total shipments in Q3, with total shipments around 180 GWh [4] - The company is expanding its energy storage capacity significantly, with plans for over 100 GWh of new capacity at the Jining base by 2026 [4] - The commercial vehicle battery segment is also growing, with nearly 20% of total shipments attributed to this sector [8] Market Trends - The energy storage market is experiencing rapid growth, with global shipments expected to reach 246.4 GWh in the first half of 2025, a 115.2% increase year-on-year [4][5] - Recent policy changes in China are expected to further boost the energy storage market, with a target of 180 million kW of new energy storage capacity by 2027 [5] Technological Advancements - CATL has introduced new products and technologies, including the Kirin battery and NP3.0 technology, which are expected to enhance its competitive position [6] - The sodium-ion battery has successfully passed new national standards, and development is progressing well with clients [6] Strategic Initiatives - The company is focusing on building a battery swapping ecosystem for heavy-duty trucks, aiming to enhance the electrification of commercial vehicles [8] - CATL plans to collaborate with vehicle manufacturers and energy operators to improve battery swapping standards and network layout, targeting high-energy consumption scenarios [8]

宁德时代日赚超2亿,超1300人接入业绩会

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-21 03:10

Core Insights - In the third quarter, CATL (Contemporary Amperex Technology Co., Limited) reported an average daily revenue exceeding 200 million yuan, indicating strong financial performance [2] - The company achieved a total revenue of 283.07 billion yuan for the first three quarters of 2025, marking a year-on-year increase of 9.28%, while net profit rose by 36.20% to 49.03 billion yuan [2][3] - The third quarter alone saw revenue of 104.19 billion yuan, a growth of 12.90%, and net profit of 18.55 billion yuan, reflecting a significant increase of 41.21% [3] Financial Performance - Revenue for the first three quarters: 283.07 billion yuan, up 9.28% year-on-year [3] - Net profit for the first three quarters: 49.03 billion yuan, up 36.20% year-on-year [3] - Third quarter revenue: 104.19 billion yuan, up 12.90% year-on-year [3] - Third quarter net profit: 18.55 billion yuan, up 41.21% year-on-year [3] - Basic earnings per share for the third quarter: 4.10 yuan, up 37.23% [3] Operational Highlights - The company has a strong cash reserve, with over 360 billion yuan in cash and financial assets as of September 30, 2025 [3] - Inventory increased by 34.05% to 80.21 billion yuan, attributed to business scale expansion [3] - Financial expenses improved significantly, with a reduction in losses by 142.41% due to increased foreign exchange gains and interest income [3] Capacity Expansion - CATL is actively expanding its global production capacity to meet surging customer demand, with significant expansions in domestic bases across various provinces [4] - The German factory has been operational since 2024 and is continuously profitable, while the Hungarian factory is expected to reduce costs by 20% compared to the German facility [4] - The company anticipates that its energy storage business will see increased output, with a projected addition of over 100 GWh of energy storage capacity by 2026 [4] Market Performance - As of October 20, CATL's A-shares rose by 2.33%, with a market capitalization of 1.69 trillion yuan, while its Hong Kong shares increased by 1.25% [4]