汽车制造业

Search documents

江淮汽车:前三季度实现营业收入308.73亿元

Mei Ri Jing Ji Xin Wen· 2025-10-30 11:15

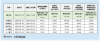

Core Viewpoint - Jianghuai Automobile (600418.SH) reported a decline in revenue and a net loss for the first three quarters of 2025, attributed to complex international conditions and increased competition in the overseas automotive market [1] Financial Performance - For the first three quarters, the company achieved operating revenue of 30.873 billion yuan, a year-on-year decrease of 4.14% [1] - The net profit attributable to shareholders was a loss of 1.434 billion yuan, marking a shift from profit to loss compared to the previous year [1] - In the third quarter, the company recorded operating revenue of 11.513 billion yuan, an increase of 5.54% year-on-year [1] - The net profit attributable to shareholders for the third quarter was a loss of 660 million yuan [1] Contributing Factors - The decline in performance is primarily due to the increasingly complex international situation and intensified competition in the overseas automotive market, leading to a decrease in export business [1] - The high-end intelligent new energy passenger vehicle project is still in the capacity ramp-up phase and has not yet achieved economies of scale [1] - The previous year's asset disposal gains were significantly higher, contributing to the year-on-year decrease in profit [1]

增长4.1%!广州经济“三季报”出炉

Zheng Quan Shi Bao· 2025-10-30 10:21

Economic Performance - Guangzhou's GDP for the first three quarters of 2025 reached 23,265.65 billion yuan, with a year-on-year growth of 4.1% at constant prices [1] - The primary industry added value was 197.94 billion yuan, growing by 4.2%; the secondary industry added value was 5,564.37 billion yuan, growing by 2.7%; and the tertiary industry added value was 17,503.34 billion yuan, growing by 4.6% [1] Industrial Growth - The city's industrial added value for large-scale enterprises grew by 1.4%, an increase of 0.7 percentage points compared to the first half of the year [1] - The automotive manufacturing sector saw a decrease in added value by 2.6%, while new energy vehicle production surged by 20.6%, improving by 11.1 percentage points from the first half [1] - The electronics manufacturing and petrochemical industries continued to grow, with added values increasing by 2.0% and 6.1%, respectively [1] Emerging Industries - The new generation information technology industry is expanding, with display device manufacturing and integrated circuit manufacturing increasing by 19.4% and 37.4%, respectively [1] - Production of liquid crystal display modules, analog chips, and integrated circuit wafers saw significant increases of 130%, 20.5%, and 56.3% [1] Consumer Market - Guangzhou's total retail sales of consumer goods reached 8,157.59 billion yuan in the first three quarters, with a year-on-year growth of 4.1% [2] - Retail sales in categories such as communication equipment (up 2.7%), new energy vehicles (up 3.5%), and home appliances (up 5.7%) showed continued growth [2] - Online consumption remained strong, with physical goods online retail sales growing by 10.1% and restaurant revenues through public networks increasing by 14.9% [2] Investment Trends - Fixed asset investment in Guangzhou grew by 1.3%, an increase of 0.5 percentage points from the first half of the year [2] - Industrial investment rose by 9.6%, infrastructure investment by 2.2%, and real estate development investment increased by 2.4% [2] - Investment in the automotive manufacturing sector grew by 15.8%, with automotive parts manufacturing investment rising sharply by 38.6% [2] - High-tech industry investments in medical equipment and aerospace manufacturing grew by 38.0% and 55.2%, respectively [2] Transportation Development - Guangzhou aims to become a global comprehensive transportation hub by 2035, enhancing its role as a national center city [3] - In the first three quarters, the city recorded a total passenger volume of 254 million, with a year-on-year growth of 6.5% [3] - Baiyun Airport saw a passenger throughput of 61.1 million, an increase of 8.4%, with international passenger volume growing significantly by 20.0% [3]

增长4.1%!广州经济“三季报”出炉

证券时报· 2025-10-30 10:10

Economic Performance - Guangzhou's GDP for the first three quarters of 2025 reached 23,265.65 billion yuan, with a year-on-year growth of 4.1% at constant prices [2] - The primary industry added value was 197.94 billion yuan, growing by 4.2%; the secondary industry added value was 5,564.37 billion yuan, growing by 2.7%; and the tertiary industry added value was 17,503.34 billion yuan, growing by 4.6% [2] Industrial Growth - The city's industrial added value for large-scale enterprises grew by 1.4% year-on-year, an increase of 0.7 percentage points compared to the first half of the year [2] - The automotive manufacturing sector saw a narrowing decline, with a year-on-year decrease of 2.6%; however, the production of new energy vehicles surged by 20.6% [2] - The electronics manufacturing and petrochemical industries continued to grow, with added values increasing by 2.0% and 6.1%, respectively [2] - The new generation information technology industry showed significant growth, with display device manufacturing and integrated circuit manufacturing increasing by 19.4% and 37.4%, respectively [2] Consumer Market - Guangzhou's total retail sales of consumer goods reached 8,157.59 billion yuan in the first three quarters, with a year-on-year growth of 4.1% [3] - Retail sales in categories such as communication equipment (up 2.7%), new energy vehicles (up 3.5%), and home appliances (up 5.7%) continued to grow [3] - Online consumption maintained a strong upward trend, with online retail sales of physical goods increasing by 10.1% [3] Investment Trends - Fixed asset investment in Guangzhou grew by 1.3% year-on-year, with industrial investment increasing by 9.6% and infrastructure investment by 2.2% [3] - Investment in the automotive manufacturing sector increased by 15.8%, with rapid growth in automotive parts manufacturing investment at 38.6% [3] - High-tech industry investments focused on new and advanced sectors, with medical equipment manufacturing and aerospace equipment manufacturing investments growing by 38.0% and 55.2%, respectively [3] Transportation Development - Guangzhou aims to build a global comprehensive transportation hub by 2035, enhancing its role as a national central city [4] - In the first three quarters, the total passenger volume reached 254 million, with a year-on-year growth of 6.5% [4] - Baiyun Airport saw a significant increase in passenger throughput, reaching 61.1 million, a growth of 8.4%, with international passenger throughput increasing by 20.0% [4]

赛力斯2025前三季度净利润53.12亿元 同比增长31.56%

Xin Lang Cai Jing· 2025-10-30 10:09

Core Insights - The company reported a net profit of 5.312 billion yuan for the first three quarters of 2025, representing a year-on-year growth of 31.56% [1] - Total operating revenue for the same period reached 110.534 billion yuan [1] - Cumulative sales of the company's electric vehicles reached 304,629 units from January to September 2025 [1] - The AITO M9 model has achieved cumulative deliveries of over 250,000 units in 21 months, setting a new record for vehicles in the 500,000-unit category [1]

“新三驾马车”发力,上汽集团前三季度营收近4700亿元

Guan Cha Zhe Wang· 2025-10-30 09:24

Core Insights - SAIC Motor Corporation reported a significant increase in revenue and net profit for Q3 2025, with total revenue reaching 169.4 billion yuan, a year-on-year growth of 16.2%, and net profit attributable to shareholders at 2.08 billion yuan, up 644.9% [1][3] Financial Performance - For the first three quarters of 2025, SAIC achieved total revenue of 468.99 billion yuan, reflecting a 9.0% year-on-year increase, while net profit attributable to shareholders was 8.1 billion yuan, a 17.3% increase [1] - The net profit excluding non-recurring gains and losses was 7.12 billion yuan, showing a remarkable growth of 578.6% [1] - The net cash flow from operating activities reached 31.94 billion yuan, up 70.9% year-on-year [1] Sales Performance - In Q3 2025, SAIC's wholesale vehicle sales reached 1.141 million units, marking a 38.7% increase year-on-year, while total wholesale vehicle sales for the first three quarters were 3.193 million units, up 20.5% [1][3] - The sales of SAIC's self-owned brands in the first three quarters totaled 2.044 million units, a 29.2% increase, accounting for 64% of total sales, an increase of 4.3 percentage points compared to the same period last year [3] New Energy Vehicles (NEVs) - SAIC's NEV sales for the first three quarters reached 1.083 million units, a 44.8% increase, with September alone achieving sales of 190,000 units, setting a new record [3] - The launch of several new intelligent electric vehicle models has contributed to the growth in NEV sales, with significant pre-order numbers reported for models like the new IM LS6 and Buick's new model [3] International Market - In the first three quarters, SAIC's overseas sales totaled 765,000 units, a 3.5% increase, with NEV sales abroad reaching 215,000 units, a 69.7% increase [3] - The MG brand achieved over 220,000 terminal deliveries in the European market, maintaining double-digit growth [3] Technological Advancements - SAIC has accelerated the mass production of various intelligent and electric technologies, including semi-solid batteries and a full-stack intelligent vehicle solution, to enhance overall competitiveness [4] - The company has invested over 150 billion yuan in electrification and intelligence, resulting in nearly 26,000 effective patents [4]

英利汽车:拟使用不超1.45亿元闲置募集资金进行现金管理

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-30 09:13

Core Viewpoint - Yingli Automotive announced the approval of a proposal to use part of its idle raised funds for cash management, emphasizing the focus on high safety and liquidity investments [1] Group 1: Cash Management Proposal - The company will utilize up to 145 million yuan of temporarily idle raised funds for cash management [1] - Investments will include products with high safety, good liquidity, and capital protection agreements, with a maximum investment period of 12 months [1] - The cash management initiative is valid for 12 months from the date of board approval and allows for rolling use of funds within the specified limit [1] Group 2: Impact on Operations - The company stated that this cash management will not affect the progress of the raised fund investment projects or the normal production and operation of the company [1]

今年前三季度广州GDP同比增长4.1%,增速继续回升

Sou Hu Cai Jing· 2025-10-30 08:32

Core Insights - Guangzhou's GDP for the first three quarters of 2025 reached 23,265.65 billion yuan, showing a year-on-year growth of 4.1% at constant prices [1] - The economic recovery in Guangzhou is accelerating, with GDP growth improving from 3.8% in the first half of the year to 4.1% in the first three quarters [2] Economic Performance - The primary industry added value was 197.94 billion yuan, growing by 4.2% - The secondary industry added value was 5,564.37 billion yuan, with a growth of 2.7% - The tertiary industry added value was 17,503.34 billion yuan, increasing by 4.6% [1] - The industrial added value for large-scale enterprises grew by 1.4%, an increase of 0.7 percentage points compared to the first half of the year [2] Investment Trends - Fixed asset investment in Guangzhou grew by 1.3%, up by 0.5 percentage points from the first half of the year - Industrial investment surged by 9.6%, while infrastructure investment rose by 2.2% - Real estate development investment increased by 2.4%, driven by urban renewal projects - Investment in the automotive manufacturing sector grew by 15.8%, with a notable 38.6% increase in automotive parts manufacturing investment [2] Contribution to GDP - The tertiary sector contributed over 80% to the city's GDP growth - The financial sector, buoyed by an active securities market, achieved a 6.1% increase in added value, contributing significantly to the overall GDP growth [2] Transportation and Logistics - The total passenger volume for the first three quarters reached 254 million, with a year-on-year growth of 6.5% - Air and rail transport saw passenger volume increases of 2.4% and 0.9%, respectively - Cargo transport also showed stability, with a total cargo volume of 700 million tons, growing by 2.4% [3] Economic Outlook - The overall economic performance in Guangzhou is characterized by steady progress and quality improvement - However, challenges remain, including external uncertainties and structural issues in supply and demand - Future strategies will focus on stabilizing existing economic activities, expanding new investments, and enhancing quality to foster high-quality development [3]

赛力斯启动全球发售:折价或高达27%及基石阵容失衡背后 估值与业绩匹配失衡及独立性挑战凸显

Xin Lang Zheng Quan· 2025-10-30 02:15

Core Viewpoint - The company, Seres, is set to launch a global offering on October 27, with a pricing date of November 3 and listing on the Hong Kong Stock Exchange on November 5. The offering price is capped at HKD 131.50 per share, with a base issuance of approximately 100 million shares, potentially raising up to HKD 174.3 billion if the overallotment option is fully exercised. This IPO could become the third largest in Hong Kong this year and the largest for a complete vehicle manufacturer since 2022. However, the offering features an unusual discount of over 26%, a lack of participation from foreign long-term funds, and a reliance on government and industrial capital, indicating deeper risks related to valuation and performance, particularly the dependency on Huawei [1][5][13]. Pricing Strategy - The pricing strategy for Seres' IPO shows a stark contrast to similar large A to H projects this year, with a discount of 26.9% compared to the A-share closing price of CNY 163.99. This discount is significantly higher than the typical range for comparable projects, where discounts are generally kept below 20% [2][4]. Investor Composition - The IPO attracted 22 cornerstone investors, raising a total of USD 830 million, which accounts for 48.7% of the base issuance. However, the investor composition is heavily skewed towards government and industrial capital, with foreign long-term funds largely absent, raising concerns about the long-term value perception of the company [5][6]. Performance and Valuation Concerns - Seres' sales data indicates a weakening growth trend, with September 2025 sales of 48,000 vehicles showing an 8.33% year-on-year increase, but a cumulative decline of 7.79% for the first nine months. The company's reliance on Huawei is diminishing, as evidenced by its ranking among Huawei's electric vehicle models, where it faces increasing competition from other manufacturers [7][9][12]. Financial Metrics - As of the current valuation, Seres has a market capitalization of HKD 306.9 billion, with projected P/E ratios for 2024, TTM, and 2025 at 47.2x, 38.6x, and 27.9x respectively. These figures are significantly higher than the average P/E ratios of traditional automakers in Hong Kong, which hover around 14.9x to 22x, indicating a potential valuation bubble lacking solid fundamental support [10][11][12]. Dependency on Huawei - The valuation premium associated with Seres is largely attributed to its partnership with Huawei. Prior to this collaboration, Seres had a market value of only CNY 10 billion, which skyrocketed to over CNY 250 billion post-collaboration. However, as Huawei diversifies its partnerships with other manufacturers, Seres risks losing its competitive edge and growth momentum, raising concerns about its long-term sustainability [13].

赛力斯港股招股 预计募资净额129.249亿港元

Cai Jing Wang· 2025-10-30 01:33

Core Viewpoint - The company, Seres Group, has officially launched its IPO process in Hong Kong, aiming to become the largest car company IPO in the region by 2025 if successful [1][6]. Group 1: IPO Details - The IPO will last until October 31, with shares expected to be listed on November 5 under the stock code "9927" [1]. - Seres plans to issue 100.2 million H-shares, with 10.02 million shares available for public sale in Hong Kong and approximately 90.18 million for international sale [3][5]. - The estimated net proceeds from the IPO, assuming the maximum share price of HKD 131.50, would be approximately HKD 12.9249 billion [3]. Group 2: Use of Proceeds - About 70% of the funds raised will be allocated to research and development, 20% for diversifying marketing channels and enhancing global brand recognition, and 10% for working capital and general corporate purposes [3][10]. - The company plans to establish 100 experience centers in Europe and the Middle East by 2026 and collaborate with Huawei to build a supercharging network covering 80% of major international highways [3]. Group 3: Financial Performance - For the first half of the year, Seres reported revenue of CNY 62.359 billion, with a gross profit of CNY 16.531 billion and a gross margin of 26.5% [10]. - The company’s revenue for 2022, 2023, and projected figures for 2024 and the first half of 2025 are CNY 34.056 billion, CNY 35.789 billion, CNY 145.114 billion, and CNY 62.358 billion respectively [10][16]. Group 4: Brand and Market Position - The company has launched four models under the "Wenjie" brand, with projected total deliveries of 387,100 units in 2024, representing a year-on-year increase of 268% [7][12]. - The partnership with Huawei has significantly enhanced Seres' brand image and market performance, with sales from the Wenjie brand accounting for 90.3% of total revenue by the first half of 2025 [14][17]. Group 5: Competitive Landscape - As Huawei expands its partnerships with other automakers, the unique advantages of the Wenjie brand may diminish, leading to increased competition within the Huawei ecosystem [17]. - Seres has also engaged in strategic investments, including a CNY 5 billion capital increase and a 10% stake acquisition in Huawei's subsidiary, indicating active capital management [17].

永茂泰单季净利暴增63倍 主业稳固机器人业务获突破

Chang Jiang Shang Bao· 2025-10-30 00:04

Core Insights - The demand for automotive lightweighting has significantly boosted the performance growth of Yongmaotai (605208.SH) [1][3] - The company reported a revenue of 1.655 billion yuan in Q3 2025, a year-on-year increase of 59.65%, and a net profit of approximately 30.41 million yuan, up 6319.92% [1][3] Revenue Growth - For the first three quarters of 2025, Yongmaotai achieved a revenue of 4.275 billion yuan, representing a year-on-year growth of 54.66%, with a net profit of 50.18 million yuan, up 39.58% [3] - The substantial revenue growth is attributed to the expansion of new customers and projects, leading to a significant increase in the sales volume of main products [3] Automotive Lightweighting - Yongmaotai has excelled in the automotive lightweighting sector, with aluminum alloy product sales reaching 134,000 tons in the first half of 2025, a year-on-year increase of 50.7% [3] - The revenue from components for new energy vehicles accounted for nearly 50% of the company's total component revenue in the first half of 2025 [3] Robotics Sector Development - The company is actively investing in the robotics sector, having secured significant orders from a leading domestic robotics enterprise for 173 core components, which represent over 90% of the client's total orders [4] - This order includes critical systems for humanoid robots, marking a significant milestone in Yongmaotai's strategic layout in the robotics field [4] R&D Investment - Yongmaotai has consistently increased its R&D investment, with expenditures of 73.90 million yuan, 91.84 million yuan, and 100 million yuan from 2022 to 2024, reflecting year-on-year growth rates of 51.06%, 24.26%, and 9.62% respectively [5] - In the first three quarters of 2025, R&D expenses reached 90.61 million yuan, a year-on-year increase of 30.2% [5]