稀土

Search documents

中国稀土的前世今生:2025年Q3营收24.94亿低于行业均值,净利润1.95亿不敌头部企业

Xin Lang Cai Jing· 2025-10-30 12:50

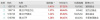

Core Viewpoint - China Rare Earth is a specialized listed platform under China Rare Earth Group, focusing on rare earth smelting separation and technology R&D, with significant resource and technological advantages in the industry [1] Group 1: Business Performance - In Q3 2025, China Rare Earth achieved revenue of 2.494 billion yuan, ranking 4th in the industry, significantly lower than the top player Northern Rare Earth at 30.292 billion yuan and the second player Shenghe Resources at 10.456 billion yuan [2] - The revenue composition includes rare earth oxides at 1.191 billion yuan (63.51%), rare earth metals and alloys at 674 million yuan (35.95%), and other services at 6.61 million yuan (0.35%) [2] - The net profit for the same period was 195 million yuan, ranking 3rd in the industry, again lower than Northern Rare Earth at 2.107 billion yuan and Shenghe Resources at 822 million yuan [2] Group 2: Financial Ratios - As of Q3 2025, the asset-liability ratio for China Rare Earth was 14.04%, up from 9.02% year-on-year, which is significantly lower than the industry average of 34.32%, indicating strong debt repayment capability [3] - The gross profit margin for the same period was 14.21%, an increase from 11.14% year-on-year, surpassing the industry average of 10.15%, reflecting improved profitability [3] Group 3: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 5.61% to 217,100, while the average number of circulating A-shares held per shareholder increased by 5.94% to 4,889.09 [5] - Notable changes among the top ten circulating shareholders include Hong Kong Central Clearing Limited increasing its holdings by 9.4669 million shares, while the Southern CSI 500 ETF reduced its holdings by 270,300 shares [5] Group 4: Management and Corporate Structure - The chairman, Guo Liangjin, has a background in various roles within China Railway and currently serves as the chief accountant of China Rare Earth Group [4] - The general manager, Mei Yi, has extensive experience in the rare earth sector and currently holds a leadership position within the company [4] Group 5: Market Outlook - Analysts from Bohai Securities highlight that China Rare Earth is a specialized platform with significant improvements in H1 2025, including new ion-type rare earth mines and successful operation of new smelting separation projects [5] - Tianfeng Securities emphasizes the company's core position within China Rare Earth Group, with advantages in resource endowment and industry status, projecting net profits of 410 million, 634 million, and 904 million yuan for 2025-2027 [6]

盛和资源的前世今生:2025年三季度营收104.56亿元行业第二,净利润8.22亿元超行业均值

Xin Lang Cai Jing· 2025-10-30 12:24

Core Viewpoint - Shenghe Resources is a leading player in the rare earth industry, with a comprehensive industrial chain and significant resource reserves, positioning itself well for future growth and profitability [1][2][6]. Group 1: Company Overview - Shenghe Resources was established on July 1, 1998, and listed on the Shanghai Stock Exchange on May 29, 2003, with its headquarters in Chengdu, Sichuan Province [1]. - The company specializes in rare earth smelting, separation, deep processing, and trading, as well as zirconium and titanium mining and processing [1]. - It is classified under the non-ferrous metals sector, specifically in rare earths, and is involved in various concept sectors including rare earth permanent magnets and nuclear power [1]. Group 2: Financial Performance - For Q3 2025, Shenghe Resources reported revenue of 10.456 billion yuan, ranking second in the industry, while the industry leader, Northern Rare Earth, reported revenue of 30.292 billion yuan [2]. - The net profit for the same period was 822 million yuan, also ranking second, with Northern Rare Earth leading at 2.107 billion yuan [2]. - The company's gross profit margin for Q3 2025 was 10.09%, an increase from 3.69% in the previous year, although slightly below the industry average of 10.15% [3]. Group 3: Debt and Profitability - As of Q3 2025, Shenghe Resources had a debt-to-asset ratio of 32.59%, lower than the previous year's 35.86% and below the industry average of 34.32%, indicating strong debt repayment capability [3]. - The company has shown significant improvement in profitability, with a notable increase in gross profit margin year-over-year [3]. Group 4: Shareholder Information - As of September 30, 2025, the number of A-share shareholders decreased by 3.24% to 222,900, while the average number of circulating A-shares held per shareholder increased by 3.35% to 7,865.46 [5]. - Among the top ten circulating shareholders, Hong Kong Central Clearing Limited increased its holdings by 12.0087 million shares, while other notable changes included a decrease in holdings by Southern CSI 500 ETF [5]. Group 5: Strategic Developments - The company completed the acquisition of Peak Resources, which includes the Ngualla rare earth mine, one of the largest and highest-grade rare earth deposits globally, expected to produce its first concentrate in Q1 2027 [6]. - The projected average annual production from this project is 16,200 tons of REO, with an estimated total net profit of 390 million yuan [6]. - Analysts have raised profit forecasts for 2025-2027, reflecting the recent surge in rare earth prices and the successful acquisition of key projects [6].

今夜业绩利好,暴增4467%

Zheng Quan Shi Bao· 2025-10-30 11:57

Core Insights - Several listed companies reported significant growth in their Q3 2025 financial results, with notable increases in both revenue and net profit across various sectors [1][5][8]. Company Summaries Youzu Interactive (游族网络) - Q3 revenue reached 331 million yuan, up 11.99% year-on-year - Net profit attributable to shareholders was 26.20 million yuan, a staggering increase of 4466.74% - For the first three quarters, revenue totaled 1.02 billion yuan, a 2.20% increase, while net profit was 76.36 million yuan, up 1374.60% [1][2]. Pingtan Development (平潭发展) - Q3 revenue was 287 million yuan, reflecting an 11.78% year-on-year growth - Net profit for the quarter was 16.14 million yuan, a remarkable increase of 1970.63% - Year-to-date revenue was 1.03 billion yuan, down 13.04%, while net profit reached 31.23 million yuan, up 38.39% [3][4]. Fenglong Co., Ltd. (锋龙股份) - Q3 revenue amounted to 122 million yuan, an increase of 8.99% - Net profit for the quarter was 6.20 million yuan, up 1082.14% - For the first three quarters, revenue was 373 million yuan, a 9.47% increase, with net profit at 21.52 million yuan, up 1714.99% [4]. Litong Electronics (利通电子) - Q3 revenue was 946 million yuan, a significant increase of 57.09% - Net profit attributable to shareholders reached 165 million yuan, up 1432.90% - Year-to-date revenue totaled 2.46 billion yuan, a 65.18% increase, with net profit at 216 million yuan, up 309.76% [5][6]. Shanshan Co., Ltd. (杉杉股份) - Q3 revenue was 4.95 billion yuan, up 10.91% - Net profit for the quarter was 76.29 million yuan, a 1253.04% increase - For the first three quarters, revenue reached 14.81 billion yuan, a growth of 11.48%, with net profit at 283.60 million yuan, up 1121.72% [7]. Silan Microelectronics (士兰微) - Q3 revenue was 3.38 billion yuan, reflecting a 16.88% year-on-year growth - Net profit attributable to shareholders was 84.27 million yuan, up 56.62% - Year-to-date revenue totaled 9.71 billion yuan, an 18.98% increase, with net profit at 349 million yuan, up 1108.74% [8]. Shenghe Resources (盛和资源) - Q3 revenue reached 4.28 billion yuan, a 52.59% increase - Net profit attributable to shareholders was 410.70 million yuan, up 154.48% - For the first three quarters, revenue was 10.46 billion yuan, a 26.87% increase, with net profit at 787.60 million yuan, up 748.07% [9].

现货黄金短线走高,稀土股普涨;Q3业绩超预期,谷歌涨超7%;Q3净利润下跌83%,Meta跌超8%【美股盘前】

Mei Ri Jing Ji Xin Wen· 2025-10-30 11:31

Market Overview - Major U.S. stock index futures are down, with Dow futures falling by 0.33%, S&P 500 futures down by 0.17%, and Nasdaq futures decreasing by 0.20% [1] - Chinese concept stocks are experiencing a broad decline, with Alibaba down 1.68%, NetEase down 2.13%, Trip.com down 2.22%, JD.com down 1.48%, and Baidu down 2.58% [2] Commodity and Financial Performance - Spot gold prices have risen by 1.91%, reaching $4003.83 per ounce [3] - Google's Q3 earnings exceeded expectations, with revenue of $102.35 billion compared to the expected $99.85 billion, and a net profit increase of 41% to $28.5 billion, leading to a stock increase of 7.19% [4] - Meta's Q3 net profit plummeted by 83% to $2.71 billion, primarily due to a one-time non-cash tax expense of $15.93 billion, resulting in an 8.82% drop in stock price [4] - Microsoft's investment in OpenAI resulted in a $3.1 billion decrease in net income for Q1 FY2026, although net profit rose to $27.7 billion from $24.67 billion, causing a 3.03% decline in stock price [4] - Rare earth stocks are generally rising, with MP Materials up 2.01% and USA Rare Earth up 2.98% [4] - Stellantis reported a Q3 net revenue of €37.2 billion, a 13% year-over-year increase, but warned of potential additional costs in the second half of the year, leading to a 4.46% drop in stock price [4] Upcoming Events - Apple and Amazon are set to release their earnings reports after the market closes on Thursday [5] - The U.S. Q3 annualized GDP rate is scheduled for release on October 30 at 20:30 Beijing time [6]

【美股盘前】现货黄金短线走高,稀土股普涨;Q3业绩超预期,谷歌涨超7%;Q3净利润下跌83%,Meta跌超8%;因OpenAI投资损失31亿美元,微软跌...

Mei Ri Jing Ji Xin Wen· 2025-10-30 11:05

Market Overview - Major U.S. index futures are down, with Dow futures falling by 0.33%, S&P 500 futures down by 0.17%, and Nasdaq futures decreasing by 0.20% [1] - Chinese concept stocks are experiencing a decline, with Alibaba down 1.68%, NetEase down 2.13%, Trip.com down 2.22%, JD.com down 1.48%, and Baidu down 2.58% [1] Company Earnings Reports - Google's Q3 earnings exceeded expectations, reporting revenue of $102.35 billion against an analyst forecast of $99.85 billion, with a net profit increase of 41% to $28.5 billion. Cloud revenue reached $15.16 billion, surpassing the expected $14.75 billion, leading to a stock increase of 7.19% [2] - Meta's Q3 earnings showed a revenue growth of 26% to $51.24 billion, but net profit plummeted by 83% to $2.71 billion due to a one-time non-cash tax expense of $15.93 billion, raising the effective tax rate to 87%. Total costs rose by 32% to $30.7 billion, resulting in a decline in operating margin from 43% to 40%. Meta's stock fell by 8.82% [2] - Microsoft's latest earnings report indicated a net income decrease of $3.1 billion due to significant investments in OpenAI, impacting earnings per share by $0.41. However, net profit increased from $24.67 billion to $27.7 billion year-over-year, with a stock decline of 3.03% [3] Sector Performance - Rare earth stocks are generally rising, with MP Materials up by 2.01% and USA Rare Earth up by 2.98% [4] - Stellantis reported a Q3 net revenue of €37.2 billion, a 13% year-over-year increase, but warned of potential additional costs in the second half due to strategic adjustments and product planning changes, leading to a stock drop of 4.46% [4] Upcoming Events - Apple and Amazon are set to release their earnings reports on Thursday after market close [5] - The U.S. Q3 annualized GDP rate is scheduled for release on October 30 at 20:30 Beijing time [6]

广晟有色:前三季度净利润1.28亿元 同比扭亏为盈

Ge Long Hui A P P· 2025-10-30 10:53

Core Viewpoint - Guangsheng Nonferrous (600259.SH) reported a significant decline in revenue for Q3 2025, while net profit showed substantial growth, indicating a mixed performance driven by market conditions in the rare earth sector [1] Financial Performance - Q3 revenue was 1.957 billion yuan, a year-on-year decrease of 45.76% [1] - Q3 net profit reached 55.0619 million yuan, a year-on-year increase of 111.25% [1] - Revenue for the first three quarters was 4.634 billion yuan, down 46.97% year-on-year [1] - Net profit for the first three quarters was 128 million yuan, marking a turnaround from loss to profit [1] Market Conditions - The overall rise in the rare earth market during the reporting period contributed to the company's ability to turn a profit in the first three quarters [1]

广晟有色:前三季度净利润1.28亿元 稀土市场行情整体上涨

Mei Ri Jing Ji Xin Wen· 2025-10-30 10:47

Core Insights - Guangsheng Nonferrous (600259.SH) reported a significant decline in revenue for Q3 2025, amounting to 1.957 billion yuan, a year-on-year decrease of 45.76% [1] - The company achieved a net profit of 55.0619 million yuan in Q3, marking a year-on-year increase of 111.25% [1] - For the first three quarters of 2025, total revenue was 4.634 billion yuan, down 46.97% year-on-year, while net profit turned positive at 128 million yuan, indicating a turnaround from losses [1] Financial Performance - Q3 revenue: 1.957 billion yuan, down 45.76% year-on-year [1] - Q3 net profit: 55.0619 million yuan, up 111.25% year-on-year [1] - Year-to-date revenue (first three quarters): 4.634 billion yuan, down 46.97% year-on-year [1] - Year-to-date net profit: 128 million yuan, indicating a turnaround from previous losses [1] Market Context - The overall rise in the rare earth market during the reporting period contributed to the company's ability to turn a profit in the first three quarters [1]

美方称中方同意暂停实施稀土出口管制措施,外交部回应

券商中国· 2025-10-30 09:53

Group 1 - The core viewpoint of the article revolves around the recent discussions between China and the United States regarding the suspension of rare earth export control measures, indicating a potential easing of trade tensions [1] - Chinese officials have confirmed that the suspension pertains to the export control measures announced in October, with implications for previous measures from April also being a topic of discussion [1] - The meeting between President Xi Jinping and U.S. officials resulted in a consensus on important economic and trade issues, emphasizing the need for both teams to finalize and implement the agreements reached [1]

机构:看好有色金属板块增配机会

Zheng Quan Shi Bao Wang· 2025-10-30 07:11

Group 1 - The core viewpoint is that the Henan Provincial Government has issued an action plan aimed at upgrading the non-ferrous metal industry, targeting an industrial added value growth rate of over 6% by 2027, with the industry maintaining a leading position in terms of scale and profitability in China [1] Group 2 - Minsheng Securities highlights that copper prices are supported by strong macro sentiment [2] - In aluminum, the demand from automotive companies is increasing, leading to a significant rise in orders and operating rates, which is expected to push aluminum prices to previous highs [2] - Lithium supply is increasing due to new production lines, while demand from the energy storage market is exceeding expectations, supporting strong prices for lithium carbonate [2] - Concerns over cobalt supply have arisen due to lower-than-expected export quotas from the Democratic Republic of Congo, leading to rising prices in the market [2] - Nickel prices are expected to rise due to new resource control policies in Indonesia and increased procurement by smelting plants [2] Group 3 - Zhongyou Securities is optimistic about the non-ferrous metal sector, suggesting that supply disruptions may elevate copper prices and that aluminum still presents investment opportunities despite a clear price ceiling [3] - The price of cobalt intermediate products has surged, with expectations for continued price increases through 2026-2027 [3] - Strengthened regulations on rare earths by two departments may lead to a new upward trend in rare earth prices [3]

稀土概念股午后拉升,稀土ETF、稀土ETF易方达、稀土ETF嘉实上涨

Ge Long Hui A P P· 2025-10-30 07:08

Core Insights - Rare earth concept stocks surged in the afternoon, with Jiuling Technology rising over 12%, and various rare earth ETFs increasing by more than 1% [1] - Year-to-date, rare earth ETFs have seen significant gains, with increases exceeding 85% [1] Company Performance - Jiuling Technology reported a total revenue of 116 million yuan for the first three quarters of 2025, a year-on-year increase of 7.87%, but net profit attributable to shareholders decreased by 24.29% to 13.47 million yuan [2] - China Rare Earth achieved a revenue of 2.494 billion yuan for the first three quarters, a year-on-year increase of 27.73%, with net profit attributable to shareholders rising by 194.67% to 192 million yuan [3] - In Q3, China Rare Earth reported a revenue of 619 million yuan, a year-on-year decline of 22.40%, and net profit of 30.48 million yuan, down 26.43% [3] - Huahong Technology's Q3 revenue was 2.302 billion yuan, up 70.39%, with net profit soaring by 23211.89% to 117 million yuan [3] - For the first three quarters, Huahong Technology's revenue reached 5.461 billion yuan, a 34.94% increase, and net profit grew by 7110.70% to 197 million yuan [3] Industry Trends - China is transitioning from a "resource power" to a "rule power," implementing export licensing and quota management for rare metals, including rare earths, to gain global pricing power [4] - China holds 44 million tons of rare earth reserves, accounting for 40% of global reserves, and produces 210,000 tons, representing 70% of global production [4] - The country has a dominant position in the rare earth industry, with smelting and separation capacity at 400,000 tons, which is 92% of the global total [4] - Export controls on rare earths have become a strategic tool in the US-China trade war, with recent measures announced in April and October 2025 [4] - The supply of rare earths is entering a phase of accelerated optimization, with mining supply growth rates decreasing from 21% to 6% and smelting separation growth rates from 21% to 4% [4]