矿产

Search documents

美国锗储量全球第一,日本也能生产镓锗锑,中国出口禁令有用吗?

Sou Hu Cai Jing· 2025-11-01 10:12

Core Points - China has implemented an export licensing system for gallium, germanium, and antimony, effective from August 1, 2023, with a ban on exports to the U.S. military announced on December 3, 2023 [1][3][12] - The U.S. heavily relies on imports for germanium, with domestic production nearly zero by 2024, leading to significant supply chain disruptions and increased production costs for military and high-tech applications [5][10][17] - Japan's production capabilities for these materials are insufficient to meet global demand, with a heavy reliance on imports, particularly from China [7][8][12] Industry Impact - The export ban has resulted in a dramatic decrease in China's exports of gallium (down 56%) and germanium (down 44%) from January to October 2024, with prices for these materials skyrocketing on the international market [10][19] - U.S. defense contractors are facing delays and increased costs, with production costs for chips rising by 15% and significant project delays reported [5][10][12] - Chinese companies, such as Yunnan Chihong Zinc & Germanium Co., are benefiting from the situation, with increased sales and profits [12][23] Long-term Outlook - The strategic importance of gallium, germanium, and antimony is expected to grow, with projections indicating a significant increase in global demand for these materials in the clean energy and semiconductor industries [14][19] - The supply chain restructuring is anticipated to be slow, with U.S. and Japanese efforts to increase domestic production unlikely to meet the immediate demand [8][21] - China's dominance in the production and export of these critical materials is expected to continue, with a projected market growth for germanium reaching $267 million by 2025 [19][23]

A subsidiary of Aktsiaselts Infortar signed a share purchase agreement for acquiring a shareholding in OÜ Oisu Biogaas

Globenewswire· 2025-10-31 14:00

Core Points - Aktsiaselts Infortar's subsidiary OÜ Infortar Agro has entered into a share purchase agreement to acquire a 60% stake in OÜ Oisu Biogaas [1][2] - This acquisition follows Infortar's earlier purchase of Estonia Farmid, a major agricultural company in Estonia, which supplies raw materials for the biomethane plant in Oisu [2] - The transaction requires approval from the Competition Authority and completion of additional operations before it can be finalized [2] Company Overview - Infortar operates in seven countries, focusing on maritime transport, energy, and real estate, with a diverse portfolio including a 68.47% stake in Tallink Grupp and a 100% stake in Elenger Grupp [4] - The company has a real estate portfolio of approximately 141,000 square meters and employs 6,866 people across 110 companies, including 101 subsidiaries [4] - Infortar is also involved in construction, mineral resources, agriculture, and printing, showcasing its diversified business model [4]

30省份三季报出炉,这个西部省份为何领跑全国?

Di Yi Cai Jing· 2025-10-31 09:32

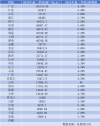

Core Insights - The economic data for the first three quarters of 2025 has been released for 30 provinces, with Guangdong, Jiangsu, and Shandong leading in GDP total, while Gansu, Hubei, and Ningxia are at the top for GDP growth rate [1][3] GDP Total - Guangdong's GDP reached 105,176.98 billion yuan, Jiangsu at 102,811 billion yuan, and Shandong at 77,115 billion yuan [2] - The total GDP for the country in the first three quarters was 1,015,036 billion yuan, reflecting a year-on-year growth of 5.2% [3] GDP Growth Rate - Gansu recorded the highest growth rate at 6.1%, followed by Hubei at 6.0% and Ningxia at 5.8% [3][4] - The growth rates for major provinces like Guangdong and Jiangsu were 4.1% and 5.4% respectively, indicating that most large provinces outperformed the national average [7] Industrial Performance - Gansu's industrial output value increased by 9.6%, ranking third nationally, driven by significant growth in the non-ferrous metals, electricity, and petrochemical sectors [4][5] - Key products in Gansu saw substantial production increases, including gold (49.2%), lead (34.3%), and refined copper (21.1%) [4] Energy Sector - Gansu's energy sector has been a major growth driver, with industrial electricity production reaching 1,697.7 billion kWh, a 7.0% increase year-on-year [5] - The province's external electricity supply increased by 34.1%, indicating a robust expansion in energy exports [5] Economic Contribution of Major Provinces - Major provinces like Guangdong and Jiangsu have shown significant GDP growth, with both surpassing the 10 trillion yuan mark this year [6] - The government has emphasized support for major economic provinces to enhance their roles in national economic growth [6] Regional Performance - The Yangtze River Economic Belt, particularly the Chengdu-Chongqing Economic Circle and the Yangtze River Delta, has demonstrated strong economic performance, with growth rates exceeding the national average [8]

安哥拉启用线上矿产登记系统

Shang Wu Bu Wang Zhan· 2025-10-30 14:54

据《安哥拉日报》报道,安哥拉油气部长阿泽维多在安2025年矿业大会开幕式 上宣布,安线上矿产登记系统(Cadastro Mineiro Digital de Angola)于2025年10月 22日正式启用,旨在推动矿产管理现代化和透明化,提高政府行政效率,增强投资 者信心。 据称,通过该系统,申请人可以线上提交许可证申请、查询审批进度、获取安 境内矿产信息等。 (原标题:安哥拉启用线上矿产登记系统) ...

重磅!西方七国欲掀全球矿产市场牌桌,中国一句话点破真相,引国际社会广泛关注

Sou Hu Cai Jing· 2025-10-30 13:41

Group 1 - The core viewpoint emphasizes that the competition for critical minerals has evolved from traditional trade to a strategic battle over rules and regulations, with significant implications for national development rights [1][3]. - Critical minerals, such as lithium, cobalt, and rare earths, are essential for the digital age and are compared to "oil of the 21st century," highlighting their strategic value in the new energy era [3]. - China's comprehensive industrial chain in critical minerals, developed through years of technological accumulation and market expansion, contrasts with the G7's approach of forming exclusive alliances [3][6]. Group 2 - The G7's initiative to form a minerals alliance reflects a pragmatic attitude towards international rules, which may undermine market order and create a dual standard in global trade [5][6]. - China's advantage in the critical minerals sector is attributed to continuous innovation in extraction technology and environmental processes, rather than trade protectionism [6][8]. - The establishment of a global supply chain network by Chinese companies, from cobalt mines in the Democratic Republic of Congo to nickel mines in Indonesia, showcases a stark contrast to the G7's closed alliance model [8]. Group 3 - The potential negative impacts of the G7's minerals alliance include increased costs for global clean energy, disruption of existing supply chains, and risks of fragmentation in the international trade system [10]. - China's commitment to open cooperation in the face of geopolitical competition is underscored by its focus on maintaining legitimate rights while promoting collaborative efforts for mutual benefit [10][12]. - The future competition in the critical minerals sector will hinge on the ability to build inclusive and equitable global industrial chains, rather than forming exclusive clubs [12].

形势变得严峻!刚拿下稀土大单,特朗普又要开“第二枪”,全球收到通告,中国被做局?

Sou Hu Cai Jing· 2025-10-28 15:28

Core Points - The recent actions by the Trump administration regarding "critical minerals" indicate a strategic move to reduce U.S. dependence on China for these resources, particularly rare earth elements and tungsten [1][6][9] Group 1: U.S.-Australia Agreement - On October 20, Trump signed a significant agreement with Australian Prime Minister Albanese, committing to invest a total of $8.5 billion in rare earth and critical mineral projects, with each country contributing at least $1 billion over the next six months [1][3] - The agreement includes plans to build a facility in Australia capable of refining 100 tons of gallium annually, which is essential for high-frequency chips and military applications [1][3] Group 2: Challenges in U.S. Mineral Production - Despite the agreement, experts highlight that Australia lacks the necessary refining technology, as 90% of global rare earth refining capacity is still in China, making it difficult for the U.S. to achieve self-sufficiency [3][6] - The U.S. has invested nearly $1 billion to rebuild its rare earth supply chain but still relies on China for refining, indicating a long road ahead to establish a domestic industry [3][6] Group 3: U.S. Actions in Kazakhstan - Following the Australia agreement, the U.S. is reportedly assisting an American company in acquiring a significant tungsten mine in Kazakhstan, which has an estimated reserve of 1.3 million tons and is considered a strategic resource for military applications [4][6] - The U.S. government's direct involvement in negotiations, including potential loans to secure mining rights, marks a departure from typical private sector negotiations and raises concerns about double standards in U.S. trade practices [4][6] Group 4: China's Position - China maintains a dominant position in the global supply chain for rare earths and tungsten, controlling 80% of tungsten production and 90% of rare earth refining capacity, making it difficult for the U.S. to replace its role [6][7] - Recent Chinese regulations on the export of rare earth-related products and technologies aim to safeguard national security, further solidifying China's position in the market [7][9] Group 5: Political Implications - The actions taken by the Trump administration appear to be more about political posturing than addressing the underlying challenges in the mineral supply chain, as the timeline for achieving self-sufficiency is projected to take 5 to 10 years [6][9] - The competitive landscape for critical minerals is not solely about acquiring mining rights but also about the decades of accumulated technology and industrial capabilities, which the U.S. may struggle to match [9]

面板显示领域最新人事变动

WitsView睿智显示· 2025-10-28 07:51

Group 1 - Recent personnel changes have occurred in Rainbow Co., Lucky Film, and Luoyang Molybdenum [2] - Rainbow Co. announced the resignation of Vice President Li Yuxiang due to retirement, effective immediately upon submission of his resignation [3][5] - Li Yuxiang was originally set to serve until December 20, 2026, and his departure will not affect the company's normal operations [5][6] Group 2 - Lucky Film's Vice President Zhu Zhiguang also resigned on October 27 due to a job transfer, effective immediately [7] - Zhu Zhiguang has a background in medical materials and previously served as Vice President of Lucky Medical [7] Group 3 - Luoyang Molybdenum appointed Peng Xuhui as the new CEO, who previously served as the Chairman of Tianma Microelectronics [8][9] - Peng Xuhui has extensive experience in the electronics industry, having held various leadership roles at Tianma Microelectronics since 2007 [9] - Luoyang Molybdenum's main business includes mining and processing of basic and rare metals [9]

贸易协议“相当灵活”,未来面临不确定性,美国与东南亚四国“敲定”关税

Huan Qiu Shi Bao· 2025-10-27 22:47

Core Points - The article discusses the trade agreements signed by the United States with Malaysia, Thailand, Cambodia, and Vietnam during President Trump's visit to the ASEAN Summit, focusing on tariffs, supply chain diversification, labor protection, and environmental cooperation [1][2] - The agreements are perceived as more flexible and less legally binding, leading to potential uncertainties in their implementation [3] Trade Agreements - The U.S. has committed to maintaining a 19% tariff rate on exports to Malaysia, Thailand, and Cambodia, and a 20% tariff rate on exports to Vietnam, consistent with previous "reciprocal tariff" rates [1] - Malaysia has received tariff exemptions on 1,711 items, amounting to approximately $5.2 billion, which represents 12% of its total exports to the U.S. [1] Economic Cooperation - Malaysia is expected to invest $70 billion in the U.S. over the next decade, while Vietnam and Thailand have agreed to reduce nearly all import tariffs on U.S. goods [2] - The agreements include cooperation in critical minerals, with Malaysia committing not to ban exports of these minerals to the U.S. [2] Regional Dynamics - Southeast Asian leaders express caution regarding the agreements, emphasizing that the terms are better than previous commitments but do not compromise national sovereignty [2] - The agreements are largely viewed as part of the U.S. strategy to compete with China in the region, as China remains ASEAN's largest trading partner with a projected trade volume of $982.3 billion in 2024 [3]

新力量NewForce总第6889期

First Shanghai Securities· 2025-10-24 10:19

Group 1: Zijin Mining (2899) - Q3 2025 revenue reached HKD 864.89 billion, up 8.14% year-on-year[7] - Net profit attributable to shareholders for Q3 2025 was HKD 145.72 billion, a 57.14% increase year-on-year[7] - For the first three quarters of 2025, total revenue was HKD 2542 billion, up 10.33% year-on-year, with net profit at HKD 378.64 billion, a 55.45% increase[7] - Gold production for the first three quarters reached 65 tons, a 20% increase year-on-year[8] - Target price raised to HKD 43.29, maintaining a "Buy" rating, reflecting a 36% upside potential[10] Group 2: Meituan-W (3690) - Q2 2025 revenue was HKD 918.4 billion, up 11.7% year-on-year, slightly below market expectations[15] - Operating profit dropped to HKD 2.26 billion, down 98% year-on-year, with a margin of 0.2%[15] - Adjusted net profit for Q2 2025 was HKD 14.93 billion, down 89% year-on-year[15] - Target price reduced from HKD 230 to HKD 153, maintaining a "Buy" rating despite short-term profit pressures[18]

美澳签署20亿关键矿产协议,能摇中国供应链地位,改写全球格局吗

Sou Hu Cai Jing· 2025-10-23 13:03

Core Viewpoint - The recent agreement between the US and Australia to invest $2 billion each, totaling $4 billion, in critical mineral projects is a strategic move to reduce reliance on China for key mineral supplies, which are essential for high-end manufacturing and technology [1][3][5]. Group 1: Agreement Details - The agreement involves a total investment of $20 billion in critical mineral projects, covering the entire supply chain from exploration to processing [3]. - The US aims to find an alternative to China in the supply chain, as it currently relies on China for 98% of its rare earth oxide imports [5][11]. - Australia possesses significant mineral resources, including the world's largest lithium mine and the second-largest rare earth mine, making it a suitable partner for the US [5][7]. Group 2: Strategic Implications - The agreement highlights the US's intent to shift part of the mining and processing chain from China to Australia, with a focus on securing priority access to these resources through ownership stakes in processing facilities [8][10]. - The dual ownership model allows the US government to have a say in production, enhancing its control over the supply chain [10]. - Despite the agreement, challenges remain, including Australia's limited processing capacity compared to China's established dominance in the sector [11][15]. Group 3: Economic Context - Australia has significant economic ties with China, with a trade volume exceeding 250 billion AUD, making it cautious about fully aligning with US interests [11][13]. - The agreement reflects a shift in the dynamics of the US-Australia alliance, as Australia reassesses its reliance on the US amid concerns over American trade policies [13][15]. - The cooperation underscores the competitive nature of global supply chains, emphasizing the need for countries to secure critical technologies and resources to maintain their industrial advantages [16].