卤制品

Search documents

消费者为什么不愿意进绝味了?

虎嗅APP· 2025-11-18 09:21

Core Viewpoint - The article discusses the decline of the brand "Juewei Duck Neck," highlighting consumer dissatisfaction due to rising prices, safety concerns, and increased competition from local shops and new brands, leading to a significant drop in sales and store closures [6][10][12]. Group 1: Consumer Sentiment - Consumers are increasingly choosing to ignore Juewei Duck Neck, with many feeling that the price does not match the value offered, leading to a decline in visits to the stores [6][8]. - A survey indicated that over 80% of respondents have reduced their frequency of purchasing from chain brands, with 86.67% citing price increases as the primary reason [8]. - Complaints regarding food safety have surged, with over 1,500 complaints logged against Juewei Duck Neck, raising concerns about product quality and safety [8][10]. Group 2: Financial Performance - Juewei Foods reported a revenue of approximately 62.57 billion yuan in 2024, a year-on-year decline of 13.84%, with net profit dropping by 34.04% [10]. - The core duck neck business saw a revenue decrease of about 7 billion yuan, from 42.23 billion yuan to 35.27 billion yuan [10]. - The number of stores has also decreased significantly, with over 4,000 closures reported by October 2025 [10][12]. Group 3: Franchisee Challenges - Franchisees are facing severe challenges, with daily sales dropping significantly and profit margins being squeezed due to rising costs [14][15]. - The franchise model has inherent contradictions, leading to a situation where the headquarters profits while franchisees struggle [15][21]. - Franchise management revenue fell from approximately 83.05 million yuan in 2023 to 61.22 million yuan in 2024, a decline of 26.28% [14]. Group 4: Industry Context - The entire snack food industry, particularly the duck neck segment, is experiencing a downturn, with major brands like Zhou Hei Ya and Huang Shang Huang also reporting declines in revenue and store closures [17][18]. - The industry growth rate has slowed, with a compound annual growth rate of only 6.42% from 2018 to 2023, leading to increased competition and market saturation [17][18]. Group 5: Strategic Responses - Juewei Foods is attempting to revitalize its brand through increased marketing efforts, including hiring a celebrity spokesperson and investing in AI technology for supply chain management [18][19]. - Despite these efforts, the increase in marketing expenses has not translated into revenue growth, with a 13.95% decline in main business income reported in 2024 [18]. - The company is also exploring product diversification, such as introducing milk tea, but faces challenges due to existing competition and operational constraints [18][19]. Group 6: Underlying Issues - The brand's challenges stem from a failure in its business model, particularly an over-reliance on franchise expansion and a disconnect between pricing strategies and consumer expectations [22][24]. - There is a lack of product innovation, making it difficult for the brand to adapt to changing consumer preferences and competition from alternative snack options [25]. - Ongoing food safety issues have severely damaged consumer trust, compounding the brand's difficulties in regaining market share [26][27].

前三季度绝味稳健前行,数智化供应链引领未来

Quan Jing Wang· 2025-11-14 03:26

Core Insights - Juewei Foods reported a net profit of 280 million yuan in the first three quarters of 2025, showcasing its strong and stable leadership in the industry, supported by an advanced supply chain system centered around cold chain logistics [1][2] Supply Chain and Logistics - Juewei has established a nationwide digital cold chain and logistics system, setting a new benchmark for the industry with its transparent and standardized management [1] - The supply chain system is built around a "24-hour freshness commitment," ensuring product quality from raw material processing to store shelving through a fully integrated digital system [1] - The supply chain processes over a million orders daily, maintaining a product defect rate of below 0.03%, demonstrating its operational excellence [1] Production Efficiency - The central factory has introduced multiple intelligent devices that significantly enhance efficiency and quality, including automated storage and customized intelligent equipment [2] - The automated marinating equipment increases labor efficiency by 300%, while continuous marinating devices maintain precise temperature control within ±1℃, overcoming traditional industry bottlenecks [2] - Juewei's electronic batch management system provides traceability for each product, allowing consumers to access complete production information through QR codes, thereby enhancing consumer trust [2] Competitive Advantage - In a market characterized by severe homogenization, Juewei's combination of "cold chain + factory + digitalization" creates a closed-loop capability that is difficult for competitors to replicate in the short term, establishing a unique brand moat [2] - The company is expected to further enhance the value of its supply system, expanding product categories through cold chain and factory developments, and promoting diversified growth in the marinated food sector [2]

绝味食品营收净利同比下滑 试点门店新模式图突破

Nan Fang Du Shi Bao· 2025-10-30 23:16

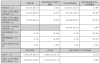

Core Viewpoint - The company, Juewei Foods, reported significant declines in revenue and net profit for the first three quarters of the year, primarily due to a decrease in product sales influenced by the market environment [1][2]. Financial Performance - For the first three quarters of the year, Juewei Foods' revenue decreased by 15.04% to 4.26 billion yuan, and net profit fell by 36.07% to 435 million yuan [1]. - In the latest third quarter, revenue dropped by 13.98% to 1.44 billion yuan, with net profit declining by 26.46% to 105 million yuan [1]. Sales Channels - The sales revenue from Juewei Foods' marinated food products fell by 16.48% to 3.53 billion yuan in the first three quarters [2]. - Revenue from franchise management also decreased by 21.61% to 42.37 million yuan during the same period [2]. - The number of franchise stores has significantly decreased, with over 4,000 stores closed since June 2024, leaving 10,606 stores as of October 18, 2024 [2]. Product Mix and Market Strategy - Fresh products accounted for approximately 75.35% of total sales in the first three quarters, while packaged products generated only 316 million yuan, representing about 7.42% [2]. - The company has limited presence in e-commerce and fresh food e-commerce channels, with online revenue accounting for only 0.82% in 2024 [2]. Compliance and Regulatory Issues - Juewei Foods faced administrative penalties for failing to disclose over 720 million yuan in revenue from 2017 to 2021, leading to a warning and fines for the company and several executives [4]. - The company has been placed under risk warning, with its stock code changed to "ST Juewei" [4]. Management Response - The management has acknowledged the administrative penalties and is taking corrective actions, including forming a special team to enhance internal controls and compliance [5]. - The company expressed sincere apologies to investors regarding the impact of these issues [5].

绝味食品前三季度收入下跌15% 此前因信披违规被公开谴责

Nan Fang Du Shi Bao· 2025-10-29 12:50

Core Viewpoint - Juewei Foods reported a significant decline in revenue and net profit for the first three quarters of the year, primarily due to a decrease in product sales influenced by the industry market environment [2][4]. Financial Performance - For the first three quarters, revenue decreased by 15.04% to 4.26 billion yuan, and net profit fell by 36.07% to 435 million yuan [2][3]. - In the latest third quarter, revenue dropped by 13.98% to 1.44 billion yuan, while net profit decreased by 26.46% to 105 million yuan [2][3]. Sales and Market Challenges - The sales revenue from Juewei's main product, marinated food, declined by 16.48% to 3.53 billion yuan in the first three quarters [4]. - Revenue from franchise management also fell by 21.61% to 42.37 million yuan during the same period [4]. - The number of franchise stores has significantly decreased, with over 4,000 stores closed since June 2024, leading to a total of 10,606 stores as of October 18, 2024 [4]. Strategic Initiatives - Juewei Foods is focusing on enhancing operational efficiency and exploring new store models, including the launch of a fresh marinated supermarket and a plus store that offers a wider range of products [5][9]. - The company aims to innovate its product offerings and improve the quality and taste of its core products [5]. Regulatory Issues - Juewei Foods faced administrative penalties for failing to disclose income from franchise store renovations, resulting in a total of approximately 723 million yuan in understated revenue over five years [7]. - The company and several executives received warnings and fines, and the stock was marked with risk warnings, changing its code to "ST Juewei" [7][9].

煌上煌花5亿收购的立兴食品,9月贡献474万元利润

Guo Ji Jin Rong Bao· 2025-10-21 13:06

Core Viewpoint - The company, Huangshanghuang, reported its worst third-quarter performance in five years, with a revenue decline of 5.08% year-on-year, totaling 1.379 billion yuan [2] Revenue Performance - For the first three quarters, the company achieved revenue of 1.379 billion yuan, a decrease from previous years: 1.933 billion yuan in 2021, 1.618 billion yuan in 2022, and 1.581 billion yuan in 2023, indicating a continuous decline in revenue over four consecutive years [2] Profitability - Despite the revenue decline, the company reported a net profit of 101 million yuan, an increase of 28.59% year-on-year, returning to the level of the same period in 2023 [3] - The improvement in profit was attributed to effective cost control, with sales expenses down by 26.39% to 163 million yuan, management expenses down by 5.7% to 125 million yuan, and R&D expenses down by 16.62% to 44.18 million yuan [3] Acquisition Strategy - The company is seeking new growth avenues through cross-industry acquisitions, having completed a nearly 500 million yuan acquisition of leading freeze-dried food company Lixing Foods, which was valued at a 250% premium [3][5] - Following the acquisition, Lixing Foods contributed approximately 474.31 million yuan to the company's net profit in September, accounting for about 20% of Huangshanghuang's total net profit for the third quarter [5] Financial Impact of Acquisition - The acquisition significantly impacted several financial metrics, with accounts receivable increasing over sixfold to 128 million yuan, and short-term borrowings doubling to 92 million yuan [5] - The company's goodwill surged from 2.242 million yuan in mid-2023 to 33.5 million yuan in the third quarter, marking a nearly 14-fold increase, raising concerns about potential impairment risks [6] Debt and Risk Concerns - The company's debt-to-asset ratio reached a near ten-year high of 24.08% in the third quarter, raising market concerns about the sustainability of its financial health if Lixing Foods' future earnings do not meet expectations [6]

“卤味第一股”商誉飙升!“买来的”净利润高增长能否持续?

Shen Zhen Shang Bao· 2025-10-21 07:54

Core Viewpoint - The financial report of Huangshanghuang (002695) for Q3 2025 shows a mixed performance with a slight revenue increase but significant profit growth, largely driven by non-recurring gains from acquisitions and government subsidies [1][3]. Financial Performance Summary - Q3 revenue reached 394.41 million yuan, a year-on-year increase of 0.62% [2] - Net profit attributable to shareholders was 24.11 million yuan, up 34.31% year-on-year [2] - For the first three quarters, revenue totaled 1.38 billion yuan, a decline of 5.08% compared to the previous year [2] - Net profit for the first three quarters was 101.03 million yuan, an increase of 28.59% year-on-year [2] - The company received government subsidies amounting to 14.21 million yuan in Q3, contributing over 14% to net profit [3] Acquisition Impact - In August 2025, the company acquired 51% of Fujian Lixing Food Co., Ltd. for 495 million yuan, which was included in the consolidated financial statements in September [3] - This acquisition significantly contributed to the net profit growth, with a substantial portion of the increase being "bought" through this transaction [3] - Accounts receivable surged by 603.71% to 128 million yuan due to the consolidation of the new subsidiary [3] Financial Position Changes - Prepayments increased by 64.43%, and short-term borrowings rose from 0 to 91.79 million yuan, attributed to the new acquisition [4] - Goodwill skyrocketed from 22.42 million yuan to 335 million yuan, indicating potential future impairment risks [5] - Other payables increased by 154.27% to 320 million yuan, primarily due to installment payments for the equity acquisition [5] Business Growth Challenges - The company has faced ongoing challenges with sluggish growth in its core business, with revenue declining for several consecutive years [7] - Historical revenue figures from 2021 to 2024 show a consistent downward trend, with 2025 Q3 continuing this pattern [8][10] - Despite attempts to expand through acquisitions, the core processed food business remains slow-growing [10]

大众品25Q3业绩前瞻:把握新品新渠道中的结构性成长机会

ZHESHANG SECURITIES· 2025-10-12 09:21

Investment Rating - The industry investment rating is "Positive" (maintained) [2] Core Insights - The report highlights structural growth opportunities in new products and channels within the consumer goods sector, particularly in the context of the 25Q3 performance forecast [2] - The performance of various sub-sectors is expected to vary, with specific companies showing significant growth potential due to category advantages and new channel expansions [10][12][14][15][16][19][21][22] Sub-sector Summaries 1.1 Snack Foods - The performance in 25Q3 is expected to be differentiated, with companies like Wanchen Group projected to achieve a revenue growth of 39% and a net profit growth of 382% [2][25] - Emphasis is placed on companies that can leverage category trends and new channel opportunities for sustained growth [10][11] 1.2 Soft Drinks - The energy drink segment is showing improved market conditions, with companies like Dongpeng Beverage expected to see a revenue growth of 31% and a net profit growth of 33% [2][25] - The report suggests focusing on companies with strong brand power and channel capabilities for long-term growth [12][13] 1.3 Dairy Products - The dairy sector is anticipated to experience flat demand in 25Q3, with companies like Yili expected to see only a 2% revenue growth [2][25] - The report indicates that profitability may improve once raw milk prices stabilize [14] 1.4 Tea Drinks - The market is characterized by a leading player, Mixue Group, which is expected to expand its competitive edge through enhanced product offerings [2][15] - The mid-price segment is highlighted as a key growth area, with recommendations for companies like Guming [15] 1.5 Health Supplements - The report notes a trend towards increased concentration in the B-end market, with companies like Xianle Health projected to achieve a revenue growth of 15% [2][25] - The C-end market is advised to focus on high-growth single products [16][17] 1.6 Ready-to-Drink Alcohol - The performance in 25Q3 is expected to be strong, with companies like Bairun expected to see an 8% revenue growth [2][25] - New product launches are anticipated to drive sales growth [18] 1.7 Beer - The impact of the "drinking ban" is expected to be limited, with Qingdao Beer projected to achieve a 2% revenue growth and an 8% net profit growth [2][25] - The report suggests that the beer sector will see stable growth driven by structural upgrades and cost improvements [19][20] 1.8 Condiments - Leading companies like Haitian Flavoring are expected to maintain stable performance, with a revenue growth of 7% [2][25] - The report emphasizes the importance of robust market strategies during periods of flat demand [21] 1.9 Frozen Foods - The sector is facing weak demand, with companies like Anjixin expected to see a 6% revenue growth [2][25] - The report advises monitoring the recovery of the restaurant supply chain for potential investment opportunities [22][23] 1.10 Marinated Products - The focus is on improving store operations as the sector continues to recover from previous challenges [24] Key Company Tracking - The report provides a detailed forecast for various companies across different segments, highlighting expected revenue and net profit growth rates for 25Q3 [25]

长沙首家酱板鸭博物馆!小鸭仙古法炭烤酱板鸭,吃的是肉香,品的是千年食鸭文化

Sou Hu Wang· 2025-10-11 04:32

Core Viewpoint - The company Xiaoyaxian has been recognized as the first "Duck Museum" in Changsha, enhancing its market position in the traditional marinated duck segment and promoting cultural integration with its products [1][5]. Industry Overview - Hunan cuisine, as one of China's eight major culinary traditions, has a significant market presence due to its diverse dishes and unique flavors, which cater to various consumer preferences [3]. - The marinated duck, particularly the sauce-marinated duck, is a representative traditional dish with a rich history dating back to the Spring and Autumn period, becoming a popular choice among consumers for its flavor and convenience [3][4]. Company Positioning - Xiaoyaxian Food Co., Ltd. has established itself as a leading brand in the marinated duck industry, leveraging its strong product quality and market recognition to drive innovation in the category [4]. - The company has built the first duck museum in Changsha, integrating food and culture, which enhances its differentiation in a competitive market [4][11]. Product Strengths - Xiaoyaxian's core product, the traditional charcoal-grilled marinated duck, has achieved national sales leadership in Hunan, utilizing high-quality ingredients and traditional cooking methods without preservatives [8]. - The product line includes various offerings such as whole ducks and small bag series, maintaining a focus on safety, health, and freshness, appealing to different consumer needs [8]. Cultural Integration - The duck museum serves as a cultural hub, showcasing the history and development of marinated duck, and engaging visitors through interactive experiences, thereby strengthening the emotional connection with consumers [11]. - The museum's activities promote the cultural heritage of marinated duck, enhancing brand visibility and consumer engagement [11]. Marketing Strategy - Xiaoyaxian employs a dual strategy of deepening its local market presence while expanding nationally, supported by a diverse marketing matrix that includes online and offline channels [14]. - The company collaborates with various partners and utilizes social media platforms for comprehensive brand promotion, enhancing its market influence [14].

再访荣昌 从“泼天流量”到“产业增量”

Mei Ri Jing Ji Xin Wen· 2025-10-09 14:21

Core Viewpoint - The article discusses the transformation of small cities into popular tourist destinations through social media and the flow economy, focusing on the case of Rongchang, which has experienced a surge in tourism and economic activity due to the popularity of its local delicacy, "Lu Goose" [2][3][11]. Group 1: Impact of Social Media and Flow Economy - The rise of "internet celebrity cities" has led to the rediscovery of many small cities, with Rongchang being a prime example of how online attention can drive local tourism and economic growth [2][3]. - The article highlights the transition from a peak in online attention to the challenge of sustaining economic growth and local industries in the "post-internet celebrity" era [3][6]. Group 2: Economic Performance and Visitor Statistics - During the "May Day" holiday, Rongchang received 2.345 million tourists, selling 290,000 Lu Geese and generating nearly 2 billion yuan in tourism revenue [11]. - In contrast, during the National Day holiday, the number of visitors dropped to 377,600, although this still represented a year-on-year increase of 165.9% [7][11]. Group 3: Brand Development and Market Challenges - Lin Jiang, the face of "Lu Goose," has shifted from being a mere beneficiary of internet fame to actively developing his brand and expanding into new markets, such as opening a franchise in Leshan [4][6]. - The influx of new competitors in the Lu Goose market has led to price wars, raising concerns about product quality and food safety, which could damage the overall reputation of Rongchang's culinary brand [8][9]. Group 4: Industry Transformation and Future Prospects - The local government has initiated a development plan aiming for the Lu Goose industry to exceed 1 billion yuan in output value by 2026, indicating a strategic focus on long-term growth [11][12]. - The success of the Lu Goose brand has spurred investments in related industries, such as feather processing, showcasing a broader economic transformation in Rongchang [12][13].

隐瞒7亿收入,“中国鸭王”被盯上了

商业洞察· 2025-09-29 09:26

Core Viewpoint - The article discusses the recent regulatory issues faced by Juewei Foods, which has been penalized for information disclosure violations, leading to its stock being labeled as "ST Juewei," indicating potential financial difficulties and loss of brand reputation [5][7]. Summary by Sections Regulatory Issues - Juewei Foods has been fined 4 million yuan for information disclosure violations, with additional penalties totaling 4.5 million yuan for its chairman and several executives [5]. - The company has been placed under risk warning, which could hinder its financing and negatively impact sales [7]. Financial Misreporting - Juewei Foods is accused of underreporting revenue by not including renovation income from franchise stores, which accounted for a total of approximately 723 million yuan over five years [8]. - The company's revenue growth has been inconsistent, with significant fluctuations observed from 2019 to 2021, raising concerns about its operational stability [8]. Speculations on Financial Practices - There are speculations that the underreported renovation fees may have been diverted to personal accounts, indicating possible involvement from the company's management [11][14]. - The company may have aimed to create a false impression of profitability for franchisees to attract more investors and franchise partners [15]. Business Performance and Challenges - Juewei Foods has seen a decline in revenue and net profit in 2024, with a projected revenue drop of 13.8% to 6.26 billion yuan and a net profit decrease of 35.7% to 204 million yuan [18]. - The number of franchise stores has also decreased significantly, with a reduction of nearly one-third from its peak [19]. Market Position and Competition - Despite being the industry leader, Juewei Foods faces increasing competition from rivals like Huangshanghuang and Zhouheiya, which have shown significant profit growth [29]. - The company is struggling with consumer perception issues, particularly regarding pricing and food safety concerns, which have led to a decline in consumer trust [23][26]. Future Outlook - The potential for Juewei Foods to recover from its current challenges is uncertain, as it must address fundamental issues related to product quality and brand reputation to regain market share [29].