焦炭

Search documents

日度策略参考-20251024

Guo Mao Qi Huo· 2025-10-24 05:40

Report Industry Investment Ratings - No specific industry investment ratings are provided in the text. Core Views of the Report - The short - term outlook for the stock index is expected to be volatile. As the negative factors of trade frictions gradually ease, the stock index is expected to return to the upward channel. Even if short - term macro uncertainties increase, the adjustment space of the stock index is expected to be limited. The strategy is to go long on the stock index when opportunities arise [1]. - Different commodities have different trends. Some are expected to be volatile, some are expected to be strong, and some are influenced by multiple factors such as supply - demand, policies, and geopolitical situations [1]. Summary by Industry Macro - finance - **Stock Index**: Short - term volatility, expected to return to the upward channel later, with limited adjustment space. Strategy: go long when opportunities arise [1]. - **Treasury Bonds**: Volatile. Asset shortage and weak economy are favorable for bond futures, but the central bank's short - term interest rate risk warning suppresses the upward space [1]. - **Gold**: Short - term wide - range volatility. Geopolitical uncertainties and potential Fed rate cuts support the price, but the new round of Sino - US consultations limit the rise [1]. - **Silver**: Volatile in the short - term, and the physical situation in London needs to be monitored [1]. Non - ferrous Metals - **Copper**: Short - term price fluctuations are intensified, but with continuous supply disturbances and an increasing Fed rate - cut expectation, it is expected to be strong [1]. - **Alumina**: With production still profitable, domestic alumina production capacity continues to be released, and production and inventory are increasing. The spot price is under pressure, and cost support needs attention [1]. - **Zinc**: After a short - term rebound, the export window closes again. It is expected to fluctuate within a range, and changes in domestic and foreign inventories need attention [1]. - **Nickel**: Short - term volatility is mainly influenced by the macro situation and may be strong, but high inventory still suppresses the price. Suggestion: short - term low - buying within the range, and there is still pressure from long - term excess of primary nickel [1]. - **Stainless Steel**: The macro situation improves, and the trade friction eases. The stainless steel futures may rebound in the short - term. It is recommended to operate in the short - term and wait for short - selling opportunities at high prices [1]. - **Tin**: Although the short - term impact of the Indonesian ore ban is not significant, the supply risk is high, and there is demand support. It is recommended to pay attention to long - buying opportunities at low prices in the long - term [1]. Black Metals - **Rebar and Hot - rolled Coil**: The industrial driving force is unclear, and the futures valuation is low. Directional trading is not recommended [1]. - **Iron Ore**: The near - month contract is restricted by production cuts, but the commodity sentiment is good, and the far - month contract still has upward potential [1]. - **Silicon Manganese**: Direct demand is good, but supply is high, and inventory is at a high level. The price is under pressure and volatile [1]. - **Silicon Iron**: Short - term production profit is poor, but cost support is strengthening, and direct demand is good. The price is expected to be volatile and the downward space is limited [1]. - **Soda Ash**: Follows the glass market, with a large supply - surplus pressure, and the price is under pressure [1]. - **Coking Coal and Coke**: After the price rebounded to fill the gap, it reached a relatively high level. It may challenge previous highs, but the breakthrough is difficult. It may be in a wide - range volatile market if there is no new policy on "anti - involution" [1]. Agricultural Products - **Palm Oil**: Indonesia's plan to regulate exports is favorable for the far - month contract. The near - month contract lacks new drivers, and it is advisable to wait for the production area to reduce production and destock [1]. - **Soybean Oil**: The pressure from US soybean prices and the support from domestic de - stocking expectations coexist. There is a lack of new drivers, and it is advisable to wait and see [1]. - **Canola Oil**: The negotiation on Canadian canola anti - dumping may bring negative news. The domestic canola is in short supply, and the inventory is decreasing. It is advisable to wait and see for single - side trading, and the inter - month positive spread is expected to rise [1]. - **Cotton**: There is uncertainty in new - year cotton demand. The downside space of the futures is limited, but the basis and the futures may be under pressure due to high production [1]. - **Sugar**: In the short - term, sugar prices are seasonally strong due to typhoon impacts and the gap between old and new crops. In the medium - term, the rebound space is limited after new sugar is listed [1]. - **Corn**: The current stage still focuses on the selling pressure in November. The C01 contract is expected to be in low - level volatility [1]. - **Methanol**: The MO1 contract is expected to be volatile. It is recommended to wait and see or go long in the short - term, and pay attention to Sino - US trade negotiations and South American weather [1]. - **Paper Pulp**: The trading logic is related to the old warehouse receipts of the 11 - contract. With weak downstream demand, it is recommended to do a 11 - 1 reverse spread [1]. - **Logs**: The log fundamentals have declined, and the spot price is firm. It is advisable to wait and see after a sharp decline in the futures [1]. - **Live Pigs**: The spot price has stabilized, but the futures still have a premium. It is necessary to wait for changes in the slaughter volume and weight, and the short - term trend is volatile [1]. Energy and Chemicals - **Fuel Oil**: Influenced by US sanctions on Russia, geopolitical tensions, and the US attitude towards China's tariffs [1]. - **Bitumen**: Short - term supply - demand contradictions are not prominent, following the trend of crude oil. The "14th Five - Year Plan" construction demand is likely to be disproven, and the supply of Ma Rui crude oil is sufficient [1]. - **SBS Rubber**: Supported by strong raw material costs, decreasing intermediate inventory, and a positive commodity market atmosphere [1]. - **BR Rubber**: The cost support is weak, and the supply of synthetic rubber is loose. Attention should be paid to inventory de - stocking [1]. - **PTA**: The price rebounds slightly due to factors such as a decline in domestic production caused by equipment inspections [1]. - **Ethylene Glycol**: The port inventory in East China is low, the cost support is strengthening, and the polyester market has not declined significantly [1]. - **Short - fiber**: Factory equipment is gradually resuming operation, the basis is strengthening, and the price follows the cost [1]. - **Styrene**: The Asian benzene price is weak, the arbitrage window to the US is closed, and domestic styrene plant inspections are increasing [1]. - **Urea**: The export sentiment eases, and domestic demand is insufficient. There is an upper limit to the price, but there is support from "anti - involution" and cost [1]. - **PE**: The price is volatile and slightly strong due to a slight downward adjustment in the crude oil price center, weakened inspection efforts, and slowly increasing downstream demand [1]. - **PP**: The inspection support is limited, the downstream improvement is less than expected, and the price is volatile and weak [1]. - **PVC**: The supply pressure is large, there are many near - month warehouse receipts, and the price is volatile and weak [1]. - **LPG**: There are problems such as planned alumina production in Guangxi, decreasing inspection concentration, and difficult digestion of warehouse receipts. The international oil and gas fundamentals are loose, and the domestic fundamentals are also loose [1].

从蓄力到发力,重估“全能”旭阳集团的投资价值

Zhi Tong Cai Jing· 2025-10-24 04:40

Core Viewpoint - The Federal Reserve's potential shift from a prolonged balance sheet reduction to a new round of quantitative easing is expected to significantly impact the macroeconomy and alter investment styles and preferences in global capital markets. Group 1: Company Overview - Xuyang Group (01907) is highlighted as a potential investment opportunity due to its strong competitiveness in the fine chemicals and coke sectors, particularly as the industry enters a new cycle following a period of low domestic demand for coke [1]. - The company has expanded its operational management service model, achieving high-quality scale expansion through a light-asset approach, and has added 2.6 million tons/year of new managed projects in Shanxi and Jilin [2]. - Xuyang Group's operational scale now includes 8 projects with a total capacity of 7 million tons/year for coke and 660,000 tons/year for chemicals, achieving a business volume of 4.5 million tons [2]. Group 2: Market Dynamics - The investment value of cyclical sectors is approaching a re-evaluation point, with signs of improvement in the coal market, particularly in coke prices, which have seen a recent increase of 50-75 yuan/ton due to rising demand and raw material costs [3]. - The domestic demand is expected to recover, driven by a higher-level "anti-involution" initiative, which is likely to positively impact upstream and midstream sectors, potentially leading to an earlier performance turnaround for Xuyang Group [3]. - Anticipated structural and industry-specific policies from high-level meetings may positively influence cyclical sectors, although the market has yet to fully price in these potential benefits for leading companies like Xuyang Group [4]. Group 3: Future Outlook - With the Federal Reserve likely to initiate a rate-cutting cycle, the subsequent global monetary easing is expected to have profound implications for effective demand stimulation, benefiting cyclical industries such as coke and chemicals [4]. - Xuyang Group has achieved historical highs in both coke and chemical new materials business volumes in the first half of the year, indicating successful transformation towards service-oriented manufacturing and ongoing global strategic expansion [4]. - The company is positioned to experience a "reversal of the investment clock" as market conditions improve, supported by robust fundamentals and growth potential [5].

从蓄力到发力,重估“全能”旭阳集团(01907)的投资价值

智通财经网· 2025-10-24 04:38

Core Viewpoint - The Federal Reserve's potential shift from a prolonged balance sheet reduction to a new round of quantitative easing is expected to significantly impact the macroeconomy and alter investment styles and preferences in global capital markets. Group 1: Company Overview - Xuyang Group (01907) is highlighted as a potential investment opportunity due to its strong competitiveness in the fine chemicals and coke sectors, particularly as the industry enters a new cycle following a period of low domestic demand for coke [1][2]. - The company has expanded its operational management service model, achieving high-quality scale expansion through a light-asset approach, and has added 2.6 million tons/year of new managed projects in Shanxi and Jilin [2]. Group 2: Business Performance - Xuyang Group's operational scale includes 8 projects with a total capacity of 7 million tons/year for coke and 660,000 tons/year for chemicals, achieving a business volume of 4.5 million tons [2]. - The revenue from the operational management service segment reached 5.095 billion yuan in the first half of 2025, marking a year-on-year growth of 2.01% [2]. Group 3: Market Dynamics - The domestic PPI's year-on-year decline has narrowed, and coal prices, particularly for coke, are showing signs of improvement due to effective capacity governance and market order optimization [3]. - The coke market is expected to see price increases, with a recent rise of 50-75 yuan/ton, and further price hikes are anticipated in the near future [3]. Group 4: Strategic Development - Xuyang Group is accelerating its dual circulation development strategy for the coke business, having established an overseas production park in Indonesia and offices in various countries to enhance its global supply chain [2]. - The company’s international strategy has resulted in a production capacity of 3.2 million tons/year at its Sulawesi park, with projected sales of 2.22 million tons of coke in 2024, covering 51 customers across 17 countries [2]. Group 5: Future Outlook - The anticipated easing of monetary policy by the Federal Reserve and potential structural policies from domestic authorities are expected to positively impact cyclical sectors, including coke and chemicals [4]. - Xuyang Group's performance in the first half of the year has reached historical highs in both coke and chemical new materials, indicating successful transformation towards a service-oriented manufacturing model [4][5].

广发期货《黑色》日报-20251024

Guang Fa Qi Huo· 2025-10-24 02:52

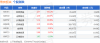

| 钢材产业期现日报 | | | | | | | --- | --- | --- | --- | --- | --- | | 投资咨询业务资格:证监许可 [2011] 1292号 2025年10月24日 | | | 問敏波 | Z0010559 | | | 钢材价格及价差 | | | | | | | 品种 | 现值 | 即值 | 张庆 | 某差 | 单位 | | 螺纹钢现货(华东) | 3220 | 3210 | 10 | 149 | | | 螺纹钢现货(华北) | 3120 | 3110 | 10 | دو | | | 螺纹钢现货(华南) | 3270 | 3250 | 20 | 199 | | | 螺纹钢05合约 | 3128 | 3120 | 8 | 92 | | | 螺纹钢10合约 | 3157 | 3159 | -2 | 63 | | | 螺纹钢01合约 | 3071 | 3068 | 3 | 149 | | | 热卷现货(华东) | 3300 | 3280 | 20 | 44 | 元/吨 | | 热卷现货(华北) | 3220 | 3200 | 20 | -36 | | | 热卷现货(华南) | ...

焦炭板块10月23日涨6.18%,陕西黑猫领涨,主力资金净流入5.74亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-23 08:27

Core Insights - The coke sector experienced a significant increase of 6.18% on October 23, with Shaanxi Black Cat leading the gains [1] - The Shanghai Composite Index closed at 3922.41, up 0.22%, while the Shenzhen Component Index closed at 13025.45, also up 0.22% [1] Sector Performance - Shaanxi Black Cat (601015) closed at 4.57, with a rise of 10.12% and a trading volume of 854,600 shares, amounting to a transaction value of 382 million yuan [1] - Shanxi Coking Coal (600740) closed at 4.59, up 10.07%, with a trading volume of 1,742,800 shares and a transaction value of 779 million yuan [1] - Yunnan Coal Energy (600792) closed at 5.14, increasing by 10.06%, with a trading volume of 620,400 shares and a transaction value of 307 million yuan [1] - Antai Group (600408) closed at 3.19, up 10.00%, with a trading volume of 2,097,600 shares and a transaction value of 640 million yuan [1] - Baotailong (601011) closed at 3.99, with a rise of 3.91% and a trading volume of 3,600,700 shares [1] - Meijin Energy (000723) closed at 5.09, increasing by 3.67%, with a trading volume of 2,192,400 shares [1] - Yunwei Co. (600725) closed at 3.85, down 1.03%, with a trading volume of 686,100 shares [1] Capital Flow - The coke sector saw a net inflow of 574 million yuan from main funds, while retail funds experienced a net outflow of 312 million yuan [1] - The main fund inflows for Shanxi Coking Coal were 173 million yuan, accounting for 22.28% of the total, while retail funds saw a net outflow of 76.96 million yuan [2] - Shaanxi Black Cat had a main fund inflow of 160 million yuan, representing 41.84%, with retail funds experiencing a net outflow of 83.59 million yuan [2] - Antai Group recorded a main fund inflow of 129 million yuan, making up 20.12%, while retail funds had a net outflow of 68.87 million yuan [2] - Meijin Energy had a main fund inflow of 120 million yuan, accounting for 10.84%, with retail funds seeing a net outflow of 98.20 million yuan [2] - Yunwei Co. had a slight main fund outflow of 10.83 million yuan, while retail funds saw a net inflow of 89.10 million yuan [2]

焦炭总的库存较同期偏高 大概率将维持震荡格局

Jin Tou Wang· 2025-10-23 06:14

10月23日,焦炭期货盘面表现偏强,截至发稿主力合约报1743.5元/吨,大幅上涨2.77%。 华闻期货:下游钢厂生产规模稳定,对焦炭的刚性需求构筑价格底部;同时,焦化端受原料成本高企影 响提涨意愿强烈,叠加部分区域环保检修引发的供应收缩预期,进一步强化价格抗跌性。但压制因素同 样突出,终端需求复苏乏力导致钢材市场供需偏弱,成材库存去化承压持续挤压钢厂利润,使得钢厂对 焦炭涨价接受度偏低,采购策略偏谨慎,仅以刚性补库为主,明显限制价格上涨动能。此外,宏观不确 定性、政策扰动及钢材需求走势的模糊性,加剧市场预期分歧,短期焦炭难形成单边行情,大概率维持 震荡格局。 宏观面,欧盟外交消息人士表示,欧盟第19轮对俄罗斯制裁中将包括四家企业,它们被指参与中国石油 行业规避西方制裁的行为。基本面,需求端,本期铁水产量240.95万吨,-0..59万吨,铁水高位震荡, 焦炭总的库存较同期偏高。利润方面,本期全国30家独立焦化厂平均吨焦盈利-13元/吨。技术方面,日 K位于20和60均线上方,操作上,震荡运行对待,请投资者注意风险控制。 据调研获悉,内蒙古自治区各辖区盟市4.3焦炉已于2024年12月31日全部关停,辖区内2 ...

黑色建材日报:库存环比下降,钢价有所回升-20251023

Hua Tai Qi Huo· 2025-10-23 02:29

1. Report Industry Investment Rating No information provided on the report industry investment rating. 2. Core Views - The steel market shows a decline in inventory on a month - on - month basis and a slight increase in steel prices. However, the inventory reduction in the peak building materials season is less than in previous years, and the high - production and high - inventory contradiction in the plate market remains prominent. The short - term macro - expectation changes affect the market trend, and attention should be paid to subsequent steel mill production cuts and inventory reduction [1]. - The iron ore market has seen a small rebound. With the successful first shipment from Simandou, the overall iron ore valuation is high, the supply is relatively loose at high prices, and the subsequent demand is expected to weaken as steel mill profit shrinks and production cut expectations increase [3]. - The coking coal and coke (double - coking) market shows that the futures prices are in a wide - range oscillation pattern. The environmental protection in Wuhai, Inner Mongolia is tightening, and the elimination of backward coking capacity is accelerating. The overall supply of coking coal is slightly shrinking, and the demand for coke is showing a marginal weakening trend [5][6]. - The thermal coal market has seen a significant increase in coal prices due to strong downstream demand. Although the recent safety inspections have affected the supply of market coal to some extent, the overall impact is not large, and the short - term coal price is stable and slightly strong [7]. 3. Summary by Related Categories Steel Market Analysis - Futures and spot: The main steel futures contract rose on a month - on - month basis. The production of building materials and hot - rolled coils in the country declined this week, inventory changed from increasing to decreasing, and the apparent demand rebounded on a month - on - month basis. The overall spot steel trading was average, with prices basically stable or slightly rising, and a strong willingness to sell at low prices [1]. - Supply - demand and logic: The inventory reduction in the peak building materials season is less than in previous years. The industrial side needs to reduce prices, compress profits, and cut production to relieve the subsequent inventory accumulation pressure. The high - production and high - inventory contradiction in the plate market is still prominent. Short - term macro - expectation changes affect the market trend, and the steel inventory pressure cannot be ignored [1]. Strategy - Unilateral: Oscillate weakly [2]. Iron Ore Market Analysis - Futures and spot: The iron ore futures price rebounded slightly. The prices of mainstream imported iron ore varieties fluctuated slightly. Traders' quotes mostly followed the market, and steel mills' purchases were mainly for rigid demand. The cumulative transaction volume of iron ore at major domestic ports was 1.229 million tons, a month - on - month increase of 21.56%; the cumulative transaction volume of forward - looking spot was 0.866 million tons, a month - on - month decrease of 50.9%. The first shipment from Simandou was successful recently, and it is expected to achieve the target smoothly in the future [3]. - Supply - demand and logic: The current overall iron ore valuation is high, the supply is relatively loose at high prices. As steel mill profit shrinks, the expectation of steel mill production cuts is increasing, and the subsequent iron ore demand shows signs of weakening. Attention should be paid to the negative impact of the Simandou project's shipments and steel mill production cuts on iron ore prices [3]. Strategy - Unilateral: Oscillate weakly [4]. Double - Coking (Coking Coal and Coke) Market Analysis - Futures and spot: The double - coking futures prices oscillated strongly. In the imported coal market, traders were cautious, and quotes fluctuated with the market, with a general trading atmosphere. The environmental protection in Wuhai, Inner Mongolia is tightening, affecting the local supply decline. Wuhai and Ordos are accelerating the elimination of 4.3 - meter coke ovens, involving a total production capacity of more than 10 million tons [5]. - Supply - demand and logic: For coking coal, the Mongolian coal customs clearance volume remains high, and environmental protection restrictions have affected domestic production, resulting in a slight contraction in overall supply. The downstream blast furnace operating rate and molten iron output have declined slightly, and enterprises mainly purchase for rigid demand with weak restocking willingness. For coke, some coking enterprises are at the break - even point due to rising coal prices, and the production enthusiasm is limited. Coupled with the elimination of backward production capacity in Inner Mongolia, the coke supply is restricted. Steel mills have large inventory pressure, and the molten iron output is declining, so the actual demand for coke shows a marginal weakening trend [5][6]. Strategy - Coking coal: Oscillate [7]. - Coke: Oscillate [7]. Thermal Coal Market Analysis - Futures and spot: In the production area, recent safety inspections are strict, the number of coal mines with production suspension and reduction has increased, the overall supply has tightened, the upstream quotes are firm, and the downstream terminal demand is continuously released, so the pit - mouth coal price continues to rise. At ports, the coal price is running strongly. The Datong - Qinhuangdao Railway is still in the maintenance stage, the shipping volume increase is limited, and the port inventory accumulation speed is relatively slow. In the import market, the recent trend of the imported coal market is stable, the price advantage of imported coal is obvious, downstream tenders are gradually increasing, and the import bid price has increased slightly [7]. - Supply - demand and logic: Although the recent safety inspections have affected the supply of market coal to some extent, the overall impact is not large. The downstream winter storage demand is good, and the non - power coal demand is strong, so the short - term coal price is stable and slightly strong [7].

钢材产业期现日报-20251023

Guang Fa Qi Huo· 2025-10-23 01:09

1. Report Industry Investment Rating - Not provided in the content 2. Core Views of the Report Steel Industry - Steel prices are difficult to decline in resonance considering the strong coal prices. It is recommended to wait and see on a single - side basis. One can consider a long - carbon and short - iron arbitrage, such as going long on coking coal and short on hot - rolled coils. The spread between hot - rolled coils and rebar will continue to converge, and steel mill profits will continue to converge before the clearance of steel production and inventory [2] Ore Industry - The iron ore market is shifting from a balanced and tight state to a more relaxed one. Affected by the weak performance of finished steel, it is recommended to wait and see on a single - side basis, with a reference range of 750 - 800. An arbitrage strategy of going long on coking coal and short on iron ore is recommended [5] Coke Industry - Coke futures showed an oscillating upward trend. The second - round price increase by mainstream coking enterprises is in progress. Due to factors such as tight coking coal supply and weak downstream demand, the price increase is not going smoothly. It is recommended to go long on coke 2601 at low levels, with a reference range of 1650 - 1770, and consider a long - coking - coal and short - coke arbitrage [8] Coking Coal Industry - Coking coal futures showed an oscillating upward trend. The spot market is on an upward trend. Due to production cuts in some mines and a decline in Mongolian coal imports, supply is tight. It is recommended to go long on coking coal 2601 at low levels, with a reference range of 1150 - 1300, and consider a long - coking - coal and short - coke arbitrage [8] 3. Summary by Relevant Catalogs Steel Industry Steel Prices and Spreads - Rebar and hot - rolled coil spot and futures prices generally increased. For example, rebar 01 contract increased by 21 yuan/ton, and hot - rolled coil 01 contract increased by 28 yuan/ton [2] Cost and Profit - Steel billet price increased by 10 yuan/ton, while some steel production costs decreased. Profits of various steel products generally decreased, with the East China hot - rolled coil profit decreasing by 6 yuan/ton [2] Supply - Daily average pig iron output decreased by 0.6 tons, a decline of 0.3%. The output of five major steel products decreased by 6.4 tons, a decline of 0.7%. Among them, rebar output decreased by 2.2 tons, a decline of 1.1%, and hot - rolled coil output decreased by 1.5 tons, a decline of 0.4% [2] Inventory - The inventory of five major steel products decreased by 18.5 tons, a decline of 1.2%. Rebar inventory decreased by 18.6 tons, a decline of 2.8%, while hot - rolled coil inventory increased by 6.3 tons, an increase of 1.5% [2] Transaction and Demand - Building materials trading volume increased by 0.6, an increase of 6.3%. The apparent demand of five major steel products increased by 124.0 tons, an increase of 16.5%. The apparent demand of rebar increased by 66.6 tons, an increase of 43.5%, and that of hot - rolled coils increased by 20.5 tons, an increase of 7.0% [2] Ore Industry Iron Ore - Related Prices and Spreads - The inventory cost of various iron ore powders increased slightly, and the basis of some varieties changed. For example, the basis of 01 contract for Jinbuba powder increased by 5.2 yuan/ton, an increase of 8.1% [6] Spot Prices and Price Indexes - The spot prices of various iron ore powders in Rizhao Port increased slightly, with the Jinbuba powder increasing by 9.0 yuan/ton, an increase of 1.2% [6] Supply - The weekly arrival volume at 45 ports decreased by 526.4 tons, a decline of 17.3%, while the global weekly shipping volume increased by 126.0 tons, an increase of 3.9% [6] Demand - The daily average pig iron output of 247 steel mills decreased by 0.6 tons, a decline of 0.2%. The daily average port clearance volume at 45 ports decreased by 20.7 tons, a decline of 6.1% [6] Inventory Changes - The inventory at 45 ports increased by 90.6 tons, an increase of 0.6%, while the imported iron ore inventory of 247 steel mills decreased by 63.5 tons, a decline of 0.7% [6] Coke Industry Coke - Related Prices and Spreads - Coke futures prices increased, with the 01 contract increasing by 38 yuan/ton, an increase of 2.2%. The basis of some contracts decreased, and the spread between 01 and 05 contracts changed slightly [8] Supply - The weekly output of coke decreased, with the daily average output of all - sample coking plants decreasing by 0.8 tons, a decline of 1.3% [8] Demand - The weekly pig iron output decreased, with the pig iron output of 247 steel mills decreasing by 0.6 tons, a decline of 0.2% [8] Inventory Changes - Coke inventory decreased overall, with the inventory of all - sample coking plants decreasing by 6.6 tons, a decline of 10.3%, and that of 247 steel mills decreasing by 11.4 tons, a decline of 1.7% [8] Coke Supply - Demand Gap Changes - The coke supply - demand gap decreased, with a decrease of 1.0 tons [8] Coking Coal Industry Coking Coal - Related Prices and Spreads - Coking coal futures prices increased, with the 01 contract increasing by 33 yuan/ton, an increase of 2.8%. The basis of some contracts decreased, and the spread between 01 and 05 contracts changed slightly [8] Supply - The weekly output of coking coal decreased. Due to safety reasons and other factors, production in some mines decreased significantly. The output of raw coal decreased by 18.2 tons, and the output of clean coal decreased by 11.8 tons [8] Demand - The demand for coking coal is mainly reflected in the coke production, which decreased slightly. The daily average output of all - sample coking plants decreased by 0.8 tons, a decline of 1.3% [8] Inventory Changes - Coking coal inventory decreased in some parts and increased in others. The clean coal inventory of Fenwei mines decreased by 11.0 tons, a decline of 9.9%, while the inventory of all - sample coking plants increased by 38.3 tons, an increase of 4.0% [8]

焦炭板块10月22日跌2.82%,宝泰隆领跌,主力资金净流出1.63亿元

Zheng Xing Xing Ye Ri Bao· 2025-10-22 08:26

Core Insights - The coke sector experienced a decline of 2.82% on October 22, with Baotailong leading the drop [1] - The Shanghai Composite Index closed at 3913.76, down 0.07%, while the Shenzhen Component Index closed at 12996.61, down 0.62% [1] Sector Performance - Key stocks in the coke sector showed mixed performance, with Yunwei Co. rising by 3.18% to a closing price of 3.89, while other stocks like Yutailong and Shanxi Coking fell by 6.34% and 1.65% respectively [1] - The trading volume for Yunwei Co. was 687,400 shares, with a transaction value of 264 million yuan, while Yutailong had a trading volume of 3,113,100 shares and a transaction value of 1.222 billion yuan [1] Capital Flow - The coke sector saw a net outflow of 163 million yuan from main funds, while retail investors contributed a net inflow of 145 million yuan [1] - Individual stock capital flows indicated that Baotailong had the highest net outflow from main funds at 80.61 million yuan, while Yunwei Co. had a net inflow of 4.28 million yuan from main funds [2]

安泰集团股价跌5.28%,诺安基金旗下1只基金位居十大流通股东,持有481.86万股浮亏损失77.1万元

Xin Lang Cai Jing· 2025-10-22 06:43

Core Points - Antai Group's stock price dropped by 5.28% to 2.87 CNY per share, with a trading volume of 537 million CNY and a turnover rate of 17.85%, resulting in a total market capitalization of 2.89 billion CNY [1] Company Overview - Antai Group, established on July 29, 1993, and listed on February 12, 2003, is located in Jiexiu City, Shanxi Province. The company primarily engages in the production and sale of coke and its by-products, as well as section steel products [1] - The revenue composition of Antai Group is as follows: section steel 73.03%, coke processing and chemical products 18.65%, electricity processing 2.92%, scrap steel 2.05%, and others 1.68% [1] Shareholder Information - Noan Fund's Noan Multi-Strategy Mixed A (320016) entered the top ten circulating shareholders of Antai Group in the second quarter, holding 4.8186 million shares, which accounts for 0.48% of the circulating shares. The estimated floating loss today is approximately 771,000 CNY [2] - Noan Multi-Strategy Mixed A was established on August 9, 2011, with a latest scale of 1.399 billion CNY. Year-to-date return is 66.58%, ranking 308 out of 8160 in its category; the one-year return is 84.66%, ranking 109 out of 8026; and since inception, the return is 221.5% [2]