CHINA SHENGMU(01432)

Search documents

中国圣牧(01432)拟获现代牧业(01117)溢价约14.75%提全购要约

智通财经网· 2025-10-30 14:33

Group 1 - The core agreement involves Modern Dairy Holdings agreeing to purchase 107.2 million shares of China Shengmu from selling shareholders for a total cash consideration of HKD 37.52 million, representing approximately 1.28% of China Shengmu's total issued share capital as of the announcement date [1] - Following the completion of the share purchase agreements, Modern Dairy Holdings and its concert parties will hold approximately 30% or more of China Shengmu's total issued share capital, triggering a mandatory offer for all outstanding shares not already owned [2] - The acquisition will enhance the scale of Modern Dairy Holdings and China Shengmu's combined herd size to over 610,000 heads, allowing for economies of scale and improved purchasing power for raw materials, thereby reducing unit costs and strengthening market competitiveness [3] Group 2 - The mandatory offer price for the shares will be HKD 0.35 per share, which is a premium of approximately 14.75% over the last closing price of HKD 0.305 [2] - Approximately 576.1 million shares of China Shengmu will be subject to the mandatory offer, with a maximum consideration payable by Modern Dairy Holdings estimated at around HKD 2.0163 billion [2] - The consolidation of operations is expected to solidify Modern Dairy Holdings' leading position in the raw milk supply market and enhance its overall risk resilience [3]

中国圣牧(01432) - (1) 有关买卖中国圣牧待售股份的有条件协议; (2) START GR...

2025-10-30 14:12

香港交易及結算所有限公司及香港聯合交易所有限公司對本公告的內容概不負 責,對其準確性或完整性亦不發表任何聲明,並明確表示,概不對因本公告全部 或任何部分內容而產生或因倚賴該等內容而引致的任何損失承擔任何責任。 本 公 告 僅 供 參 考,並 不 構 成 收 購、購 買 或 認 購 現 代 牧 業 控 股 或 中 國 聖 牧 證 券 的 邀 請 或 要 約,亦 不 在 任 何 司 法 權 區 構 成 任 何 投 票 或 批 准 的 招 攬。本 公 告 不 會 於 或向構成違反相關司法權區相關法律的任何司法權區發佈、刊發或派發。 China Modern Dairy Holdings Ltd. 中國現代牧業控股有限公司 (於開曼群島註冊成立的有限公司) (股份代號:1117) 公 告 (1)有關買賣中國聖牧有機奶業有限公司待售股份的有條件協議 (2)START GREAT授予中國現代牧業控股有限公司 不可撤銷表決代理權 (3)中信里昂證券有限公司代表中國現代牧業控股有限公司 提出的可能強制有條件現金要約以收購中國聖牧有機奶業有限公司 的 全 部 已 發 行 股 份(中 國 現 代 牧 業 控 股 有 限 公 司 ...

乳业股午前普涨

Mei Ri Jing Ji Xin Wen· 2025-10-28 04:11

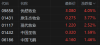

Core Viewpoint - Dairy stocks experienced a significant midday rally, indicating positive market sentiment towards the sector [1] Company Performance - YouRan MuYe (09858.HK) saw an increase of 5.74%, reaching HKD 3.13 [1] - Modern MuYe (01117.HK) rose by 3.36%, trading at HKD 1.23 [1] - China Feihe (06186.HK) gained 1.95%, with a price of HKD 4.18 [1] - China Shengmu (01432.HK) increased by 1.59%, priced at HKD 0.32 [1]

港股异动 | 乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Xin Lang Cai Jing· 2025-10-28 04:04

Group 1 - Dairy stocks experienced a midday surge, with Yurun Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price increasing from CNY 3.02/kg on August 1 to CNY 3.04/kg by the end of September, and prices in Ningxia rising from CNY 2.1-2.2/kg to CNY 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while some regions have seen a rebound in raw milk prices due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% month-on-month decrease in dairy cow inventory in September, following a 0.2% decline in August, totaling an approximate 8% reduction [2] - Despite short-term support for milk prices from holiday factors, the trend of capacity reduction in dairy companies continues, and the end of the capacity reduction cycle may be nearing, making a price cycle turning point worth anticipating [2]

乳业股午前普涨 原奶价格近期迎阶段性稳定 行业下半年去化有望提速

Zhi Tong Cai Jing· 2025-10-28 04:02

Group 1 - Dairy stocks experienced a significant increase, with YouRan Dairy rising by 5.74% to HKD 3.13, Modern Dairy up by 3.36% to HKD 1.23, China Feihe increasing by 1.95% to HKD 4.18, and China Shengmu rising by 1.59% to HKD 0.32 [1] - Guosheng Securities reported that after a four-year decline, raw milk prices have recently stabilized, with the national average price rising from RMB 3.02/kg in August to RMB 3.04/kg by the end of September, and prices in Ningxia increasing from RMB 2.1-2.2/kg to RMB 3.5-3.7/kg [1] - The increase in milk prices is attributed to demand from the Mid-Autumn Festival and National Day gifts, as well as a natural decrease in supply due to the "heat stress" phase for dairy cows from July to September [1] Group 2 - Tianfeng Securities noted that since September, while there has been a rebound in raw milk prices in some regions due to pre-holiday stocking and student milk production demand, overall prices in major production areas remain stable [2] - Current milk prices are still below the cost line, leading to ongoing industry losses and financial pressure from silage, with a 0.18% decrease in dairy cow inventory in September compared to August [2] - The cumulative reduction in dairy cow inventory has reached approximately 8%, and while the holiday factors provide short-term support for milk prices, the trend of capacity reduction continues [2]

港股异动丨乳制品股反弹 优然牧业涨4% 中国飞鹤涨1.5% 机构指奶价拐点仍可期

Ge Long Hui· 2025-10-28 03:45

Core Viewpoint - The Hong Kong dairy stocks have rebounded after a period of decline, with several companies showing positive price movements, although the overall dairy price remains below cost levels, indicating ongoing industry challenges [1]. Group 1: Market Performance - Yurun Dairy increased by 4%, Ecological Dairy by 3.77%, Modern Dairy by 2.5%, China Shengmu by 1.5%, and China Feihe by 1.46% [2]. - The rebound in stock prices is attributed to pre-holiday inventory buildup and increased demand for student milk production [1]. Group 2: Industry Conditions - Despite the short-term support for milk prices due to holiday factors, the trend of capacity reduction in the dairy industry continues [1]. - The overall milk price remains below the cost line, leading to ongoing industry losses and financial pressures from silage [1]. - The number of dairy cows decreased by 0.18% month-on-month in September, following a 0.2% decline in August, with a cumulative reduction of approximately 8% [1]. Group 3: Future Outlook - The capacity reduction trend may be nearing its end, and a turning point in the milk price cycle is anticipated [1].

晚间公告丨10月20日这些公告有看头

第一财经· 2025-10-20 13:29

Core Viewpoint - The article summarizes important announcements from various listed companies in the Shanghai and Shenzhen stock markets, providing insights for investors regarding significant corporate actions and financial performance. Group 1: Corporate Announcements - Wanrun Technology clarified that rumors about an online roadshow and large orders are false, stating no such investor relations activities have occurred recently [4] - DiAo Micro plans to acquire 100% of Rongpai Semiconductor through a combination of share issuance and cash payment, with stock resuming trading on October 21, 2025 [5][6] - Dongtu Technology is planning to issue shares to acquire assets from Beijing Gaoweike Electric Technology, with stock suspension starting October 21, 2025 [7] - Guangsheng Nonferrous Metals announced the absorption merger of two wholly-owned rare earth subsidiaries to enhance management efficiency and reduce operational costs [8] - Shan Shui Technology's actual controller and chairman was subjected to criminal coercive measures, but the company's operations remain normal [9] - Xingchen Technology completed the acquisition of 53.3087% of Shanghai Furui Kun Microelectronics, which will now be a subsidiary [10] - Yiyi Co. is planning to issue shares and cash to acquire assets, with stock suspension since October 14, 2025 [11] - Yintai Group's acquisition of Huatuo Pharmaceutical received antitrust approval, allowing the transaction to proceed [12] Group 2: Financial Performance - China Mobile reported a net profit of 31.1 billion yuan for Q3 2025, a year-on-year increase of 1.4%, with total revenue of 794.7 billion yuan for the first three quarters, up 0.4% [14] - Alloy Investment's Q3 net profit surged by 4985% to 2.68 million yuan, with revenue of 65.71 million yuan, a 21.61% increase [15] - iFlytek's Q3 net profit increased by 202.4% to 172 million yuan, with revenue of 6.078 billion yuan, up 10.02% [16] - Yonghe Co. reported a Q3 net profit of 198 million yuan, a 485.77% increase, with total revenue of 1.34 billion yuan, up 11.42% [17] - Dazhu CNC's Q3 net profit rose by 282% to 228 million yuan, with revenue of 1.521 billion yuan, a 95.19% increase [18] - Dingtong Technology's Q3 net profit grew by 125% to 61.175 million yuan, with year-to-date revenue of 1.156 billion yuan, up 64.45% [20] - Shenneng Power's Q3 net profit increased by 56.69% to 117 million yuan, with total revenue of 459 million yuan, up 33.38% [21] - Runben Co. reported a slight decline in Q3 net profit by 2.89%, totaling 78.52 million yuan, despite a revenue increase of 16.67% [22] - Dayang Bio's Q3 net profit grew by 56.12% to 29.53 million yuan, with revenue of 248 million yuan, up 5.72% [23] - Kaile Co. reported a significant increase in net profit by 159.14% for the first three quarters, totaling 21.63 million yuan [24] - China Shipbuilding expects a net profit increase of 104% to 126% for the first three quarters, estimating between 5.55 billion to 6.15 billion yuan [25] Group 3: Shareholding Changes - Zhejiang Mining's major shareholders plan to reduce their holdings by up to 3% of the company's shares [27] - Blue Arrow Electronics' shareholders intend to reduce their holdings by up to 3% [28] - Jifeng Technology's shareholders plan to reduce their holdings by up to 3% [29] Group 4: Major Contracts - Dash Smart announced a joint bid for a smart transportation project worth 96 million yuan, which represents 3.03% of the company's projected revenue for 2024 [30]

消费行业四季度个股精选

2025-10-19 15:58

Summary of Key Points from Conference Call Records Industry Overview - **Consumer Industry**: The records focus on various companies within the consumer sector, highlighting their performance and future outlook. Company-Specific Insights 1. Laopu Gold - **Performance Expectations**: Laopu Gold anticipates a revenue of 4.5 to 5 billion RMB for the year, driven by a price increase announced on October 17, which is expected to enhance market activity and sales volume [2][3] - **Price Strategy**: The company has raised its second-hand market buyback prices by at least 10%, indicating strong demand and brand promotion effects [2][3] - **Growth Projections**: Expected performance growth of 30% to 50% in 2026, with a central estimate of around 40%, supported by strong brand growth and pricing power [4] 2. Guming Tea - **Expansion Plans**: Guming Tea plans to open over 3,000 new stores in 2026, maintaining a growth rate of 20% to 25% [6][9] - **Sales Performance**: The company has shown strong same-store sales growth, with a GMV increase of over 20% in July and August, and double-digit growth in September [6][9] - **Marketing Strategy**: Plans to enhance marketing activities in 2026, including collaborations and promotions to drive sales [8] 3. Stone Technology - **Sales Growth**: Stone Technology expects over 60% growth in revenue and profit for Q3, despite recent stock price declines, presenting a buying opportunity [10][11] - **Market Dynamics**: The company is benefiting from a low base in the European market and an increase in new product sales, which supports margin recovery [10] 4. XGIMI Technology - **Product Development**: XGIMI's home projection business is stable, with low-end products benefiting from chip price reductions and high-end products achieving brightness comparable to overseas flagship models [12] - **Profitability Outlook**: Expected gross margins of over 30% for domestic sales and 50%-60% for exports in 2026, with a net profit margin around 12% [12] 5. Xin'ao Co. - **Performance Surge**: Xin'ao Co. expects a 50% increase in Q4 performance, driven by soaring wool prices and low-cost inventory [22] - **Market Conditions**: Anticipates continued high wool prices due to declining production and weak demand, providing support for future earnings [23] 6. Youran Dairy - **Market Position**: Youran Dairy benefits from stable customer channels and significant scale effects, maintaining a high sales-to-production ratio [25][26] - **Cost Control**: The company has achieved superior cost control, with costs per kilogram significantly lower than industry averages [26] 7. Shengmu Company - **Competitive Advantages**: Shengmu Company leverages its unique organic milk scarcity to achieve price premiums of 20%-35% above industry averages [28][29] - **Market Share**: Holds a 35%-40% share of the domestic organic raw milk market, with expectations for further price elasticity as milk prices rise [29] Additional Insights - **Investment Recommendations**: Companies like Laopu Gold, Guming Tea, and Stone Technology are highlighted as having strong growth potential and favorable valuations, making them attractive for investors [4][9][10] - **Market Trends**: The consumer sector is experiencing significant changes, with companies adapting to market dynamics through strategic pricing, expansion, and marketing efforts [2][5][8] This summary encapsulates the key points from the conference call records, providing insights into the performance and outlook of various companies within the consumer industry.

牧业股集体走高 短期因素不影响肉奶大周期共振 奶肉联动模式企业盈利能力突出

Zhi Tong Cai Jing· 2025-10-16 04:57

Core Viewpoint - Livestock stocks have collectively risen, with significant gains observed in companies such as YouRan Agriculture, Modern Farming, and China Shengmu, indicating a positive market sentiment despite recent price adjustments in the sector [1][1][1] Group 1: Stock Performance - YouRan Agriculture (09858) increased by 6.71%, trading at HKD 3.34 [1] - Modern Farming (01117) rose by 4.2%, trading at HKD 1.24 [1] - China Shengmu (01432) and Original Ecological Agriculture (01431) also saw gains of 1.45% and 1.82%, respectively [1] Group 2: Market Analysis - CITIC Securities reported that the recent slowdown in the reduction of dairy cow inventory has led to a temporary price correction in livestock stocks, but this will not disrupt the underlying cyclical logic of the industry [1][1] - The dairy cow inventory is expected to continue its downward trend, with the turning point for raw milk prices approaching as seasonal demand weakens and operational pressures on farms increase [1][1] Group 3: Future Outlook - Tianfeng Securities indicated that the current phase of dairy cow capacity reduction may be nearing its end, with Q3 silage procurement potentially accelerating the clearing of marginal stocks [1] - Raw milk prices are anticipated to bottom out and rebound, while beef prices may also see a turning point, although various factors such as funding, confidence, and environmental regulations could impact the pace of restocking [1][1] - Companies with cow resources or those employing a "milk-meat linkage" model are expected to demonstrate stronger profitability [1]

港股异动 | 牧业股集体走高 短期因素不影响肉奶大周期共振 奶肉联动模式企业盈利能力突出

智通财经网· 2025-10-16 03:39

Core Viewpoint - Livestock stocks have collectively risen, with specific companies showing significant gains, indicating a positive market sentiment despite recent price adjustments due to temporary factors [1] Group 1: Stock Performance - Yuran Livestock (09858) increased by 6.71%, reaching HKD 3.34 [1] - Modern Farming (01117) rose by 4.2%, priced at HKD 1.24 [1] - Ecological Farming (01431) saw a 1.82% increase, now at HKD 0.28 [1] - China Shengmu (01432) gained 1.45%, trading at HKD 0.35 [1] Group 2: Market Analysis - CITIC Securities reported that the recent slowdown in dairy cow inventory reduction has led to a temporary price adjustment in livestock stocks, but this will not disrupt the underlying cyclical logic [1] - The dairy cow inventory is expected to continue its reduction trend, with the turning point for raw milk prices approaching as seasonal demand weakens and operational pressures on farms increase [1] Group 3: Future Outlook - Tianfeng Securities indicated that the current dairy cow capacity reduction may be nearing its end, with Q3 silage purchases potentially accelerating inventory clearance, leading to a rebound in raw milk prices [1] - Beef prices may also see a turning point, although various factors such as funding, confidence, and environmental regulations may affect the pace of restocking [1] - Companies with cow resources or those employing a "milk-meat linkage" model are expected to demonstrate stronger profitability, with recommendations to focus on Yuran Livestock, China Shengmu, Guangming Meat, Modern Farming, and Australia Asia Group [1]