Zheshang Securities(601878)

Search documents

京仪装备股价跌5.08%,浙商证券资管旗下1只基金重仓,持有4000股浮亏损失1.88万元

Xin Lang Cai Jing· 2025-10-31 06:08

Group 1 - The core point of the news is that Beijing Jingyi Automation Equipment Technology Co., Ltd. experienced a stock decline of 5.08%, with a current share price of 87.82 yuan and a total market capitalization of 14.754 billion yuan [1] - The company specializes in the research, production, and sales of semiconductor equipment, with its main products including semiconductor temperature control equipment (61.33% of revenue), process waste gas treatment equipment (29.84%), and wafer handling equipment (2.72%) [1] - The company was established on June 30, 2016, and went public on November 29, 2023 [1] Group 2 - Zhejiang Merchants Securities Asset Management has a fund that heavily invests in Jingyi Equipment, specifically the Zhejiang Merchants Dingying Event-Driven Mixed Fund (LOF), which holds 4,000 shares, accounting for 4.4% of the fund's net value [2] - The fund has a total scale of 9.1569 million yuan and has achieved a year-to-date return of 24.71% [2] - The fund manager, Zhang Lei, has been in position for 232 days, with the best and worst fund returns during his tenure both recorded at 20.55% [3]

研报掘金丨浙商证券:维持潮宏基“买入”评级,未来有望保持较快成长速度

Ge Long Hui A P P· 2025-10-31 06:07

Core Viewpoint - Chao Hong Ji reported a significant revenue increase of 49.5% year-on-year in Q3 2025, reaching 2.13 billion yuan, despite a minor net profit loss due to goodwill impairment from Fion [1] Financial Performance - The company achieved a net profit of 160 million yuan in Q3 2025, reflecting an 81.5% year-on-year increase, excluding the impact of Fion's goodwill impairment [1] - The jewelry segment's net profit grew by 86.8% year-on-year, indicating strong performance in the core business [1] Growth Drivers - Revenue growth is primarily driven by same-store sales increases and proactive store openings by distributors [1] - The significant net profit growth, excluding Fion's impairment, is attributed to the strong sales of high-margin brand products and adjustments in direct sales channels alongside accelerated franchise expansion [1] Strategic Adjustments - The company engaged a third-party asset evaluation firm to assess the goodwill related to the acquisition of Fion, leading to a goodwill impairment provision that alleviates future goodwill pressure [1] - The company is optimizing its channel structure and product mix, resulting in a decrease in expense ratios under a light asset operation model [1] Market Position and Outlook - Chao Hong Ji is positioned to benefit from the rise of Eastern aesthetics and the national trend, with ongoing brand momentum [1] - Compared to leading industry brands, Chao Hong Ji has substantial room for growth in revenue scale and store count, with strong certainty in channel expansion, suggesting a potential for sustained rapid growth [1]

42家上市券商前三季度业绩放榜:11家营收超百亿元,3家并购券商经纪增速“狂飙”

Sou Hu Cai Jing· 2025-10-31 05:25

Core Insights - The overall performance of 42 listed securities firms showed significant growth in the first three quarters of 2025, with total operating income reaching 419.56 billion yuan and net profit attributable to shareholders amounting to 169.05 billion yuan, representing year-on-year increases of 42.55% and 62.38% respectively [1][2][3]. Group 1: Revenue and Profit Growth - The brokerage business emerged as the fastest-growing segment, with a year-on-year increase of 74.64%, contributing 111.78 billion yuan to total revenue [2][3]. - Self-operated business revenue also saw substantial growth, reaching 186.86 billion yuan, up 43.83% year-on-year, supported by increased investment returns in a rising A-share market [3]. - Other business segments, including credit and investment banking, also reported growth, with revenues of 33.91 billion yuan and 25.15 billion yuan, reflecting increases of 54.52% and 23.46% respectively [3]. Group 2: Performance Disparities Among Firms - There was notable performance differentiation among the firms, with 11 firms exceeding 10 billion yuan in revenue, while Zheshang Securities dropped out of the "100 billion club" due to accounting policy adjustments, reporting revenue of 6.79 billion yuan [2][6]. - Western Securities was the only firm to experience a revenue decline, with a decrease of 2.17% [4][5]. - Among the leading firms, Citic Securities and Guotai Junan led in net profit, with 23.16 billion yuan and 22.07 billion yuan respectively, while Huatai Securities saw a modest net profit growth of only 1.69% [4][5]. Group 3: Impact of Mergers and Acquisitions - The integration of merged firms has significantly boosted the brokerage business, with Guolian Minsheng, Guotai Junan, and Guoxin Securities achieving remarkable growth rates of 293.05%, 142.80%, and 109.30% respectively [9][10]. - The successful integration of systems and customer bases from mergers has been highlighted as a key factor in these firms' performance improvements [11].

长芯博创股价跌5.03%,浙商证券资管旗下1只基金重仓,持有1000股浮亏损失5340元

Xin Lang Cai Jing· 2025-10-31 03:37

Group 1 - The core viewpoint of the news is that Changxin Bochuang's stock has experienced a significant decline, with a 5.03% drop on October 31, leading to a cumulative decline of 8.65% over three consecutive days [1] - As of the report, Changxin Bochuang's stock price is 100.72 yuan per share, with a trading volume of 1.48 billion yuan and a turnover rate of 5.36%, resulting in a total market capitalization of 29.32 billion yuan [1] - The company, established on July 8, 2003, and listed on October 12, 2016, specializes in the research, production, and sales of integrated optoelectronic devices in the optical communication field [1] Group 2 - According to data from the top ten heavy stocks of funds, one fund under Zheshang Securities Asset Management holds Changxin Bochuang as a significant investment, with 1,000 shares representing 2.98% of the fund's net value [2] - The fund, Zheshang Huijin Transformation Upgrade A (001604), has incurred a floating loss of approximately 5,340 yuan today, with a total floating loss of 10,000 yuan during the three-day decline [2] - The fund was established on February 3, 2016, with a latest scale of 2.5746 million, achieving a year-to-date return of 19.21% and a one-year return of 21.34% [2]

双乐股份不超8亿可转债获深交所通过 浙商证券建功

Zhong Guo Jing Ji Wang· 2025-10-31 03:05

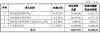

Core Viewpoint - The Shenzhen Stock Exchange's listing review committee approved Shuangle Pigment Co., Ltd.'s issuance of convertible bonds, indicating compliance with issuance, listing, and information disclosure requirements [1] Group 1: Issuance Details - Shuangle Pigment plans to raise up to RMB 80 million through the issuance of convertible bonds, which will be allocated to various projects and working capital [2] - The projects funded by the issuance include high-performance blue-green pigments, high-performance yellow-red pigments, a research center for high-performance functional pigments, and working capital [3] Group 2: Project Investment Breakdown - The total investment for the high-performance blue-green pigment project is RMB 18.5 million, with RMB 16.62 million from the raised funds [3] - The high-performance yellow-red pigment project has a total investment of RMB 46.35 million, with RMB 41.58 million allocated from the raised funds [3] - The research center for high-performance functional pigments requires a total investment of RMB 6 million, with RMB 3.80 million from the raised funds [3] - The working capital will utilize the full RMB 18 million from the raised funds [3] Group 3: Convertible Bond Terms - The convertible bonds will have a duration of six years, with the conversion period starting six months after issuance [3] - The initial conversion price will be determined based on the average stock price over the twenty trading days prior to the announcement of the fundraising plan [4] - The controlling shareholder, Yang Hanzhou, holds 35.23% of the company's shares directly and controls an additional 15.10% indirectly [4]

亿纬锂能股价涨5.17%,浙商证券资管旗下1只基金重仓,持有2.27万股浮盈赚取9.83万元

Xin Lang Cai Jing· 2025-10-31 03:03

Core Viewpoint - EVE Energy Co., Ltd. has seen a significant stock price increase, with a 5.17% rise on October 31, reaching 88.13 CNY per share, and a total market capitalization of 180.29 billion CNY, reflecting a cumulative increase of 8.99% over three days [1] Company Overview - EVE Energy, established on December 24, 2001, and listed on October 30, 2009, is located in Huizhou, Guangdong Province. The company specializes in the research, production, and sales of consumer batteries (including lithium primary batteries, small lithium-ion batteries, and ternary cylindrical batteries) and power batteries (including electric vehicle batteries and energy storage batteries) [1] - The revenue composition of EVE Energy is as follows: power batteries account for 45.26%, energy storage batteries 36.56%, consumer batteries 18.03%, and others 0.16% [1] Fund Holdings - According to data, a fund under Zheshang Securities Asset Management holds a significant position in EVE Energy. The Zheshang Huijin Transformation Growth Fund (000935) held 22,700 shares in the third quarter, representing 3.99% of the fund's net value, making it the fifth-largest holding. The fund has realized a floating profit of approximately 98,300 CNY today and 156,900 CNY during the three-day increase [2] - The Zheshang Huijin Transformation Growth Fund was established on December 30, 2014, with a current size of 51.79 million CNY. Year-to-date returns stand at 44.4%, ranking 1559 out of 8154 in its category, while the one-year return is 37.82%, ranking 1979 out of 8046 [2]

2025年1-10月IPO中介机构排名(A股)

Sou Hu Cai Jing· 2025-10-31 02:43

Core Insights - In the period from January to October 2025, a total of 87 new companies were listed on the A-share market, representing an 8.75% increase compared to the same period last year, which had 80 new listings [1] - The total net fundraising amount for these 87 new listings reached 833.81 billion yuan, marking a significant 77.02% increase from 471.02 billion yuan in the same period last year [1] Underwriting Institutions Performance Ranking - A total of 29 underwriting institutions participated in the IPOs of these 87 new companies, with a total of 88 deals completed [2] - The top five underwriting institutions by number of deals are: - 1st: Guotai Junan with 11 deals - 2nd: CITIC Securities with 10 deals - 3rd: Huatai United with 8 deals - 4th: CITIC Jianzhong with 7 deals - 5th: China Merchants Securities with 5 deals [2][3] Law Firms Performance Ranking - In the same period, 28 law firms provided legal services for the IPOs of the 87 new companies [6] - The top five law firms by number of deals are: - 1st: Shanghai Jintiancheng with 13 deals - 2nd: Beijing Deheng and Beijing Zhonglun, both with 7 deals - 4th: Beijing Guofeng with 6 deals - 5th: Shanghai Tongli with 5 deals [6][7] Accounting Firms Performance Ranking - A total of 16 accounting firms provided auditing services for the 87 new listings [9] - The top five accounting firms by number of deals are: - 1st: Rongcheng with 20 deals - 2nd: Tianjian with 16 deals - 3rd: Lixin and Zhonghui, both with 11 deals - 5th: Ernst & Young Hua Ming, KPMG Huazhen, and Zhongshen Zhonghuan, each with 4 deals [9][10]

浙商证券:2025年第三季度归属于上市公司股东的净利润同比增长54.61%

Zheng Quan Ri Bao Zhi Sheng· 2025-10-30 13:21

Core Insights - Zhejiang Securities reported a significant increase in revenue and net profit for Q3 2025, with revenue reaching approximately 2.97 billion yuan, representing a year-on-year growth of 105.06% [1] - The net profit attributable to shareholders was approximately 743 million yuan, showing a year-on-year increase of 54.61% [1] Financial Performance - The company's total revenue for Q3 2025 was 2,969,513,934.48 yuan, marking a substantial growth compared to the previous year [1] - The net profit for the same period was 743,036,825.55 yuan, indicating a strong performance relative to the prior year's figures [1]

浙江沪杭甬(00576.HK):浙商证券前三季度净利润约为18.92亿元 同比上升49.57%

Ge Long Hui A P P· 2025-10-30 10:53

Core Insights - Zhejiang Hu-Hang-Yong (00576.HK) reported significant growth in revenue and net profit for its subsidiary, Zheshang Securities, in the first three quarters of 2025 [1] Financial Performance - Zheshang Securities achieved revenue of 6.789 billion yuan, representing a year-on-year increase of 66.73% [1] - The net profit attributable to shareholders of Zheshang Securities was 1.892 billion yuan, reflecting a year-on-year growth of 49.57% [1] - Basic earnings per share stood at 0.42 yuan [1]

经纪、自营业务助力,浙商证券前三季度净利同比增49.57%

Xin Lang Cai Jing· 2025-10-30 10:25

Core Points - Zhejiang Securities Co., Ltd. reported a significant increase in revenue and net profit for the third quarter of 2025, with revenue reaching 2.97 billion yuan, a year-on-year increase of 105.06%, and net profit of 743 million yuan, up 54.61% [2][5] - For the first three quarters of 2025, the company achieved a revenue of 6.79 billion yuan, representing a year-on-year increase of 66.73%, and a net profit of 1.89 billion yuan, up 49.57% [3][5] - The increase in revenue and net profit is attributed to the growth in securities brokerage and proprietary trading business [5] Financial Performance - Basic earnings per share for Q3 2025 was 0.17 yuan, a year-on-year increase of 30.77%, while for the first three quarters, it was 0.42 yuan, up 27.27% [3] - As of the end of Q3 2025, total assets amounted to 219.05 billion yuan, an increase of 42.16% compared to the end of 2024 [4] Shareholder Information - As of the report date, the only shareholder with more than 5% ownership is Zhejiang Shangsan Expressway Co., Ltd., holding 46.46% of the shares [9] - The total number of ordinary shareholders at the end of the reporting period was 157,460 [10] Management Changes - In October 2023, the company appointed Qian Wenhai as the new chairman, succeeding Wu Chenggen, who retired [11] - Qian Wenhai, previously the head of a financial company under the actual controller Zhejiang Transportation Group, has been tasked with overseeing the strategic integration of Zhejiang Securities and Guodu Securities [11]