A股市场

Search documents

盘中涨超1%,沪指逼近4000点关口

Bei Jing Shang Bao· 2025-10-27 02:31

Core Viewpoint - A-shares experienced a collective rise in the three major stock indices, with the Shanghai Composite Index approaching the 4000-point mark, indicating positive market sentiment and potential investment opportunities [1] Group 1: Market Performance - On October 27, the three major A-share indices opened higher, with the Shanghai Composite Index showing a significant upward trend, rising over 1% at one point [1] - As of the report, the Shanghai Composite Index increased by 0.79%, reaching 3981.71 points, while the Shenzhen Component Index and the ChiNext Index rose by 0.77% and 0.91%, closing at 13391.19 points and 3200.56 points respectively [1]

A股主要指数走强,创业板指涨超2%,沪指涨0.65%,光刻胶、存储芯片、算力硬件领涨,近3400股上涨

Ge Long Hui· 2025-10-27 02:06

Core Viewpoint - The A-share market showed strong performance with major indices rising, particularly the ChiNext Index which increased by over 2% [1] Group 1: Market Performance - The Shanghai Composite Index rose by 0.65% [1] - The Shenzhen Component Index increased by 1.54% [1] - Nearly 3,400 stocks in the Shanghai, Shenzhen, and Beijing markets experienced gains [1] Group 2: Sector Performance - Key sectors that saw significant gains included photoresist, memory chips, and computing hardware [1]

板块轮动到谁了?沪指逼近4000点 机构正大幅买入这些主题ETF

Mei Ri Jing Ji Xin Wen· 2025-10-25 04:54

Market Overview - The Shanghai Composite Index has surged past 3950 points, reaching a nearly ten-year high and approaching the 4000-point mark [1][2] - The total trading volume for the week in the Shanghai and Shenzhen markets was 8.9 trillion yuan, with the Shanghai market accounting for 3.93 trillion yuan and the Shenzhen market for 4.97 trillion yuan [2] ETF Fund Flows - Over 200 billion yuan has flowed out of stock and cross-border ETFs this week, with a net outflow of 212 billion yuan from thematic industry ETFs [2][15] - Major broad-based index ETFs experienced a net outflow of 88.41 billion yuan, with the ChiNext ETF seeing a net outflow of 37.16 billion yuan [8][15] Sector Performance - The brokerage and robotics ETFs have attracted significant capital, with net inflows of 9.87 billion yuan and 7.06 billion yuan, respectively [13][17] - Conversely, the artificial intelligence and new energy vehicle-related ETFs faced substantial outflows, with net outflows of 8.81 billion yuan and 5.93 billion yuan, respectively [15][17] Notable ETF Movements - The brokerage ETF (512000) saw its shares increase by 16.76 billion, reaching a new high of 649.19 billion shares [16][17] - The robotics ETF (562500) also experienced a rise, with shares reaching 226.54 billion, marking a new high [17] Upcoming ETF Issuance - Six new ETFs are set to be issued next week, tracking sectors such as the satellite industry, technology, and photovoltaic industries [25][26]

沪指涨0.71%创10年来新高,全市场成交接近2万亿

Sou Hu Cai Jing· 2025-10-24 07:21

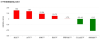

Core Points - The A-share market indices collectively rose on October 24, with the Shanghai Composite Index reaching a new high for the year at 3950.31 points, up 0.71% [1] - The Shenzhen Component Index increased by 2.02%, while the ChiNext Index rose by 3.57% [3] Market Performance - Shanghai Composite Index: 3950.31 points, up 27.90 points (0.71%), year-to-date increase of 17.86% [4] - Shenzhen Component Index: 13289.18 points, up 263.74 points (2.02%), year-to-date increase of 27.60% [4] - ChiNext Index: 1462.22 points, up 60.97 points (4.35%), year-to-date increase of 47.86% [4] - North China 50 Index: 1472.08 points, up 16.71 points (1.15%), year-to-date increase of 41.84% [4] - Total trading volume in the Shanghai and Shenzhen markets was approximately 19742.09 billion yuan, an increase of about 3303 billion yuan from the previous trading day [4] Sector Performance - Sectors with notable gains included memory chips, AMD, HBM, semiconductors, electronic chemicals, and electronics [5] - Sectors with significant declines included Shenzhen state-owned assets, coal, property, coal mining and selection, real estate, and oil and petrochemicals [5]

产业加速期已经到来?商业航天板块掀涨停潮

2 1 Shi Ji Jing Ji Bao Dao· 2025-10-24 06:33

Group 1: Commercial Aerospace Boom - The commercial aerospace sector is experiencing a surge, with stocks like Tongyi Aerospace rising over 22% and several companies including China Satellite and Aerospace Technology reaching their daily price limits [1] - By 2025, the frequency of domestic commercial rocket launches is expected to increase significantly, alongside a faster IPO process for commercial aerospace companies [1] - Jiangsu Tianbing Aerospace Technology Co., Ltd. has completed its IPO counseling registration, marking another unicorn in the commercial rocket sector initiating its IPO process [1] - Several companies, including Lanjian Aerospace and Xinkong Aerospace, have also started their listing counseling processes since July 29, 2023 [1] - The Ministry of Industry and Information Technology has confirmed that satellite IoT is entering the commercial trial phase, which is expected to further advance the development of the commercial aerospace industry [1] Group 2: Positive Outlook for A-Share Market - Zhongyin Securities indicates that a resonance between policy and economic bottoms is forming, which may support an upward shift in the A-share market [2] - The new production power directions, such as technological self-reliance and green transformation, are expected to become the main policy and funding lines over the next five years [2] - There is an expectation for long-term funds, particularly from public offerings and insurance capital, to concentrate on industries with strategic support value [2] - As of October 22, 372 A-share companies have disclosed their Q3 reports, with 73 companies showing QFII as a top ten shareholder, indicating increased foreign investment interest [2] Group 3: Foreign Investment Confidence in China - Goldman Sachs forecasts a slow bull market for the Chinese stock market, predicting a 30% increase in major indices by the end of 2027 [3] - Morgan Stanley highlights that global investors currently have a relatively low allocation to Chinese equities, suggesting potential for increased investment [3] - JPMorgan maintains a positive outlook on the A-share market, anticipating that the shift of household asset allocation towards the stock market will sustain the rebound trend [3]

QFII三季度积极加仓内外资机构看好A股市场

Zhong Guo Zheng Quan Bao· 2025-10-23 20:12

Market Overview - On October 23, the A-share market experienced a slight rebound with a trading volume of 1.66 trillion yuan, marking six consecutive trading days with volumes below 2 trillion yuan [1][2] - The Shanghai Composite Index, Shenzhen Component Index, and ChiNext Index rose by 0.22%, 0.22%, and 0.09% respectively, while the Sci-Tech 50 Index and North China 50 Index fell by 0.30% and 1.07% [1][2] Sector Performance - Active sectors included ice and snow tourism, lithium mining, coal, quantum technology, and operating systems, while sectors like cultivated diamonds, optical modules, and advanced packaging saw some adjustments [2] - The coal sector led gains, with companies such as Shaanxi Black Cat and Shanxi Coking Coal hitting the daily limit [2] QFII Activity - As of October 22, 372 A-share companies had disclosed their Q3 reports, with 73 companies showing QFII as a top ten shareholder [3][4] - QFII increased holdings in 30 stocks and raised positions in 21 others, with total holdings amounting to 3.73 billion shares valued at 8.694 billion yuan [3][4] Investment Sentiment - Analysts suggest that global investors still have low exposure to Chinese assets, indicating potential for increased allocations as policies clarify and economic data improves [5][6] - The overall market sentiment remains cautious, with liquidity tightening and a focus on structural issues and external uncertainties [3][6] Future Outlook - Analysts predict that the A-share market may continue to experience fluctuations, with upward potential driven by policy support and improving fundamentals [6][7] - High dividend, low valuation defensive sectors are recommended for investment, alongside a focus on technology growth areas such as AI and high-end manufacturing [7]

A股晚间热点 | 二十届四中全会公报发布 机构火速解读

智通财经网· 2025-10-23 14:39

Group 1 - The 20th Central Committee's Fourth Plenary Session emphasizes building a strong domestic market and accelerating the new development pattern, focusing on expanding domestic demand and enhancing the internal circulation of the economy [1] - The session is expected to provide new policy expectations and investment clues for the A-share market, potentially boosting market confidence and attracting long-term capital [1] - The session outlines a development blueprint that supports the stable and long-term growth of the A-share market, alongside ongoing reforms in China's capital markets [1] Group 2 - The Chinese government is set to engage in economic and trade consultations with the U.S. in Malaysia, addressing important issues in the bilateral economic relationship [2] - The State-owned Assets Supervision and Administration Commission (SASAC) is focusing on the "14th Five-Year Plan" for central enterprises, aiming to enhance core functions and competitiveness [3] Group 3 - The EU has imposed sanctions on 12 Chinese companies due to their alleged assistance to Russia in circumventing Western sanctions, which has drawn strong opposition from China [4] - China's telecommunications sector has made significant advancements in quantum communication, achieving over 80 kilometers of transmission with a speed exceeding 10 Tb/s, marking international recognition of its technological capabilities [5] Group 4 - The Shenzhen stock market has seen a surge, with 15 stocks hitting the daily limit up, indicating a strong regional market performance [6] - The new consumption sector in Hong Kong has faced a sell-off, with significant declines in stocks like Pop Mart, raising concerns about future growth and valuation [7] Group 5 - The automotive sector has seen over 10 million applications for the vehicle trade-in subsidy in 2025, indicating a robust market response to the policy [14] - Key automotive companies such as BYD, Great Wall Motors, and others are recommended for their strong sales performance and potential for new models [14] - The AI glasses market is gaining attention with Alibaba's AI glasses set to begin pre-sales [15]

市场分析:能源传媒行业领涨,A股先抑后扬

Zhongyuan Securities· 2025-10-23 11:14

Investment Rating - The industry is rated as "stronger than the market," indicating an expected increase of over 10% relative to the CSI 300 index within the next six months [17]. Core Viewpoints - The A-share market experienced a slight upward trend after an initial decline, with significant support at 3918 points for the Shanghai Composite Index. Key sectors such as coal, energy metals, electricity, and cultural media performed well, while sectors like engineering machinery, mining, bioproducts, and semiconductors lagged [2][3][7]. - The average price-to-earnings (P/E) ratios for the Shanghai Composite and ChiNext indices are currently at 16.02 times and 48.28 times, respectively, which are above the median levels of the past three years, suggesting a favorable environment for medium to long-term investments [3][16]. - The total trading volume on the two exchanges was 16,609 billion, indicating a trading activity level above the median of the past three years. The market is expected to continue its consolidation phase, supported by rising policy expectations and the verification of third-quarter earnings [3][16]. - Investors are advised to maintain strategic focus and actively seek quality assets during this volatile market phase. The technology growth sector remains a long-term focus, with recommendations to balance investments between growth and dividend value [3][16]. Summary by Sections A-share Market Overview - On October 23, the A-share market showed a pattern of initial decline followed by a slight recovery, with the Shanghai Composite Index closing at 3922.41 points, up 0.22%. The ChiNext index rose by 0.09%, while the Sci-Tech 50 index fell by 0.30% [7][8]. - Over 60% of stocks in the two markets saw gains, particularly in coal, energy metals, cultural media, and shipping sectors, while sectors like engineering machinery and semiconductors faced declines [7][9]. Future Market Outlook and Investment Recommendations - The market is expected to maintain a steady upward trend in the short term, with a focus on sectors such as coal, energy metals, cultural media, and electricity for potential investment opportunities [3][16]. - Investors should closely monitor policy changes, capital flows, and external market conditions to make informed decisions [3][16].

10.23:周四午后,A股还有争夺战

Sou Hu Cai Jing· 2025-10-23 05:08

Group 1 - The major indices of A-shares, including the ChiNext Index and the Sci-Tech Innovation 50 Index, experienced significant adjustments, underperforming expectations [1] - The market sentiment is low, with most stocks declining and a lack of strong buying interest [1] - The A-share market is currently in an adjustment cycle, and any potential afternoon rebound will not change this trend [5][8] Group 2 - The Shanghai Composite Index is facing pressure at previous high points, indicating a critical resistance level, and the lack of increased trading volume makes it difficult to break through [5] - The ChiNext Index has returned to an adjustment cycle after a recent rebound, with early signals indicating a potential decline [8] - The current A-share market environment suggests that as long as there is no significant drop in the major indices, structural opportunities for individual stocks will continue to emerge, emphasizing the importance of trend trading for stable profits [8]

市场分析:风电采掘行业领涨,A股蓄势震荡

Zhongyuan Securities· 2025-10-22 13:59

Investment Rating - The industry investment rating is "stronger than the market," indicating an expected increase of over 10% in the industry index relative to the CSI 300 index over the next six months [15]. Core Viewpoints - The A-share market is experiencing slight fluctuations, with sectors such as mining, wind power equipment, home appliances, and computer equipment performing well, while precious metals, coal, jewelry, and shipbuilding sectors are underperforming [2][3]. - The current average price-to-earnings ratios for the Shanghai Composite Index and the ChiNext Index are 16.03 times and 48.58 times, respectively, which are above the median levels of the past three years, suggesting a suitable environment for medium to long-term investments [3][14]. - The market is expected to continue its consolidation phase, supported by rising policy expectations and the verification of third-quarter earnings, with structural opportunities remaining abundant [3][14]. Summary by Sections A-share Market Overview - On October 22, the A-share market faced resistance after a rise, with the Shanghai Composite Index encountering resistance around 3918 points, leading to a day of slight fluctuations [8]. - The total trading volume for the two markets was 16,905 billion, which is above the median trading volume of the past three years [14]. Future Market Outlook and Investment Recommendations - The market is likely to maintain a steady upward trend in the short term, with a focus on sectors such as wind power equipment, mining, home appliances, and computer equipment for investment opportunities [3][14]. - Investors are advised to maintain strategic focus and seek quality assets during this consolidation phase, balancing between technology growth and dividend value [3][14].