创造性破坏

Search documents

范文仲:“十五五”规划与诺奖经济理论的启示

Sou Hu Cai Jing· 2025-11-06 14:43

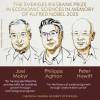

Core Viewpoint - The recent release of the "15th Five-Year Plan Suggestions" by the Central Committee of the Communist Party of China emphasizes technological innovation, deepening reforms, and new productive forces as the core drivers for the next five years, aligning with the recent Nobel Prize awarded to scholars for their contributions to innovation-driven economic growth [3][25]. Summary by Sections Nobel Laureates' Theoretical Insights - The Nobel Prize awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt recognizes their contributions to understanding innovation-driven economic growth, providing valuable theoretical guidance for implementing the "15th Five-Year Plan Suggestions" [4][21]. - Mokyr's theory emphasizes the importance of "useful knowledge" and its integration into economic growth, highlighting the historical context of knowledge accumulation and cultural shifts that foster innovation [5][6][11]. - Aghion and Howitt's model focuses on the role of entrepreneurial-led technological innovation as a key driver of economic growth, emphasizing the dynamics of creative destruction and the importance of market competition for fostering innovation [13][14][15]. Key Elements of the "15th Five-Year Plan Suggestions" - The plan outlines a strategic positioning for the next five years, aiming for high-quality development, significant improvements in technological self-reliance, and deepened reforms [26][27]. - Technological innovation is positioned as the core support for modernization, with a focus on original innovation and tackling key technological challenges [27][29]. - The plan emphasizes the construction of a modern industrial system, prioritizing the real economy and fostering emerging industries such as new energy and advanced manufacturing [28][30]. Alignment with Nobel Laureates' Theories - The emphasis on technological innovation in the "15th Five-Year Plan" aligns with the theories of the Nobel laureates, particularly in the context of transitioning from technology catching up to leading innovation [29][34]. - The plan's focus on enhancing original innovation and integrating technological advancements with industrial innovation resonates with Aghion and Howitt's views on the role of firms in driving innovation [30][31]. - The recognition of the need for a conducive institutional environment for innovation reflects the insights of Aghion and Howitt regarding the impact of social and institutional factors on technological progress [19][20]. Implications for Economic Growth - The plan's strategic focus on technological innovation is seen as essential for overcoming the "middle-income trap" and achieving sustainable economic growth [34][35]. - The integration of technological advancements into the economy is expected to enhance overall productivity and drive quality improvements in economic growth [36][37]. - The emphasis on a balanced competition policy aims to foster an environment conducive to innovation while ensuring fair market practices, aligning with Aghion and Howitt's findings on the relationship between competition and innovation [17][24].

范文仲:“十五五”规划与诺奖经济理论的启示|宏观经济

清华金融评论· 2025-11-04 08:59

Core Viewpoints - The article emphasizes the importance of technological innovation as the core driving force for economic growth in China, aligning with the recent Nobel Prize-winning theories on innovation-driven economic growth [4][6][32]. Summary by Sections Nobel Prize Winners' Theories - Joel Mokyr's theory highlights the significance of "useful knowledge" and its role in driving economic growth through the integration of scientific principles and practical knowledge [7][8]. - Philippe Aghion and Peter Howitt focus on the relationship between economic growth and technological innovation, introducing the concept of "creative destruction" where new innovations replace outdated technologies [14][15][16]. "Fifteen Five" Planning Suggestions - The "Fifteen Five" planning document outlines a strategic framework for China's economic and social development, emphasizing high-quality development and technological self-reliance as key objectives [27][28]. - It identifies the need to strengthen original innovation and tackle key core technologies to support the modernization of the economy [29][32]. Technological Innovation as a Core Driver - The planning document positions technological innovation as the primary driver for achieving high-quality development, reflecting a shift from technology catching up to leading in innovation [32][37]. - It stresses the importance of integrating technological innovation with industrial innovation to enhance the efficiency of the innovation chain [33]. New Quality Productivity - The concept of "new quality productivity" is introduced, which is characterized by technological breakthroughs and innovative resource allocation, aiming to enhance overall productivity [34][35]. - The planning document emphasizes the need for a conducive institutional environment to foster innovation, including effective intellectual property protection and a robust financial system [20][21]. Policy Recommendations - The article suggests specific measures to implement the planning document's goals, focusing on enhancing the innovation ecosystem and addressing the challenges of transitioning to a high-quality growth model [45].

马斯克挑战1万亿美元天价薪酬,他到底在“挑战”什么?

Mei Ri Jing Ji Xin Wen· 2025-11-03 13:08

Core Points - The upcoming Tesla shareholder meeting on November 6 will vote on Elon Musk's ambitious compensation plan, which is structured over a 10-year period with 12 operational milestones [2][3] - If Musk meets all targets, he could acquire 12% of Tesla's stock, potentially valuing his shares at $1 trillion, contingent on Tesla's market cap reaching $2 trillion within the decade [2][4] - The operational goals include delivering 20 million vehicles, selling 1 million AI robots, commercializing 1 million autonomous taxis, and increasing FSD subscription users to 10 million, alongside a significant increase in adjusted EBITDA from $17 billion in 2024 to $400 billion [2][3] Compensation Plan Details - The plan is described as "super ambitious" and aims to incentivize Musk as a unique and pioneering CEO [2][3] - The board previously approved a similar plan in 2018, which Musk completed ahead of schedule, although a federal judge later nullified the resulting compensation [4][5] - The current plan is seen as a challenge for Musk, who aims to secure greater control over Tesla by increasing his ownership from 12.8% to nearly 25% if successful [4][5] Entrepreneurial Spirit - Musk is characterized as a visionary entrepreneur willing to tackle seemingly impossible challenges, with a history of disrupting industries through innovative approaches [5][6] - His ambition includes long-term goals such as colonizing Mars, integrating various technologies to achieve this vision [6][7] - Musk's approach is rooted in "first principles" thinking, allowing him to break free from conventional constraints and drive significant advancements in sectors like aerospace and electric vehicles [6][7] Innovation and Governance - The compensation plan's vote represents a broader conflict between traditional governance structures and the need for innovative breakthroughs [7] - The outcome of the vote will test the balance between standardized governance and the space required for extraordinary value creation [7][8] - Regardless of the plan's success, Tesla may not suffer significant losses, while Musk seeks to motivate himself through this ambitious compensation structure [7]

观点丨魏天骐 代志新:创新驱动增长的历史逻辑与时代启示——2025诺贝尔经济学奖解读

Sou Hu Cai Jing· 2025-11-02 04:11

Core Viewpoint - The article discusses the significance of the 2025 Nobel Prize in Economic Sciences awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their contributions to understanding the mechanisms of innovation-driven economic growth, highlighting the need for tax reform in the context of the digital economy and structural changes in the global economy [4][12]. Group 1: Innovation and Economic Growth - The article emphasizes that the current global economy is undergoing a profound structural transformation, driven by technological advancements in fields such as artificial intelligence and biotechnology, while facing challenges from de-globalization and geopolitical conflicts [4][12]. - The Nobel laureates' research reveals that innovation is not merely an external factor but an intrinsic driver of economic growth, challenging traditional economic paradigms [6][11]. - Mokyr's work highlights the importance of cultural and institutional factors in fostering innovation, suggesting that the Enlightenment period created a conducive environment for knowledge sharing and technological advancement [7][12]. Group 2: Theoretical Contributions - Aghion and Howitt's mathematical modeling of "creative destruction" provides a framework for understanding the dynamic process of innovation and its dual nature of incentivizing investment while potentially leading to over-competition [8][9]. - Their model illustrates the externalities of innovation, arguing that the social value of innovation often exceeds its private value, which justifies government intervention through subsidies and tax policies [9][10]. - The research indicates that innovation can lead to cyclical economic fluctuations, suggesting that while it is a source of growth, it can also result in periods of economic downturn [10][11]. Group 3: Policy Implications - The article stresses the need for a balanced policy approach to address the complexities of sustainable growth, emphasizing that technological progress must be aligned with institutional frameworks to mitigate issues like environmental degradation and social inequality [12][13]. - It warns that the current global economic landscape poses significant risks to innovation-driven growth, necessitating the maintenance of open knowledge networks and competitive market structures to sustain economic dynamism [13].

封面新闻专访2025诺贝尔经济学奖得主乔尔·莫基尔:中国对教育和基建投资将有丰厚回报

Sou Hu Cai Jing· 2025-10-30 07:44

Core Insights - Joel Mokyr, along with Philippe Aghion and Peter Howitt, was awarded the 2025 Nobel Prize in Economic Sciences for their contributions to the theory of innovation-driven economic growth, with Mokyr receiving half of the prize for revealing the prerequisites for sustained growth through technological advancement [1][3]. Group 1: Innovation and Economic Growth - The core premise for sustained economic growth is "useful knowledge," which consists of prescriptive knowledge (how to operate technology) and propositional knowledge (understanding the scientific principles behind technology) [4][5]. - The Industrial Revolution marked the first strong feedback loop between these two types of knowledge, laying the foundation for modern economic growth [5]. Group 2: Importance of Understanding Principles - Understanding the principles behind technology is crucial for sustainable innovation; merely knowing how to do something is insufficient [6][8]. - Historical examples, such as the development of agricultural practices and steam engines, illustrate that scientific understanding leads to significant advancements and efficiency improvements [7][8]. Group 3: Measurement of Productivity - Current economic growth rates may not accurately reflect productivity due to outdated measurement methods that fail to account for non-market goods and services that enhance human welfare, such as vaccines [9]. - There is a need for new methods to measure productivity that align with modern economies focused on information and advanced services [9]. Group 4: Openness and Collaboration - For an economy to thrive, it must remain open to trade, talent, and knowledge exchange, emphasizing the importance of a free market for ideas and knowledge [10]. - Collaboration between the public and private sectors is essential for fostering innovation, with the balance depending on industry characteristics [10]. Group 5: China's Investment in Education and Infrastructure - China's significant investments in infrastructure and higher education are expected to yield substantial returns for its economy [11]. - The relationship between state-owned and private enterprises needs to be recalibrated to foster innovation effectively [11]. Group 6: Historical Perspective on Economic Progress - Economic history provides valuable insights into the progress made over time, highlighting that current living standards are unprecedented compared to historical norms [14][15]. - Understanding economic history is essential for comprehending modern economic systems and challenges [14]. Group 7: Lifelong Learning - Young individuals are encouraged to maintain a habit of lifelong learning to adapt to the rapidly changing world, as knowledge becomes outdated quickly [16][17].

夏春:认识创新、竞争与增长的复杂性——深度解读24-25年诺贝尔经济学奖

Sou Hu Cai Jing· 2025-10-30 04:45

Core Insights - The Nobel Prize in Economic Sciences was awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt (KAH) for their research on "innovation-driven economic growth," which is closely related to China's push for new productivity [1][5] - The unexpected aspect of the award is the high overlap of KAH's findings with the anticipated 2024 and 2025 Nobel Prize winners [5][10] - The historical trend shows a preference for macroeconomic and growth fields in Nobel Prize awards, with seven awards given in this area since 2000, indicating a significant focus on these themes [11] Group 1 - KAH's contributions to economic growth theory are significant, particularly in the context of current global technological innovations and competition, especially in AI [5][24] - The research of KAH and the previous winners, Aghion, Johnson, and Robinson (AJR), overlaps significantly, particularly in the area of how innovation and technology impact economic growth and social equality [10][11] - The historical context of the Industrial Revolution and its spread from Britain to Europe is a critical area of study, with various scholars, including AJR and Mokyr, exploring the factors behind this phenomenon [12][13] Group 2 - AJR's research emphasizes the role of inclusive institutions in economic growth, while Mokyr highlights the importance of the combination of theoretical and practical knowledge for sustained growth [12][13] - The integration of geographical, economic, social, and cultural factors into a comprehensive framework for understanding the Industrial Revolution is a notable development in economic thought [15] - The concept of "creative destruction" as a driver of economic growth is explored, with findings indicating that moderate competition fosters innovation, while excessive competition can stifle it [21][28] Group 3 - The decline in total factor productivity (TFP) in various countries, including China, raises questions about the effectiveness of technological advancements in driving economic growth [26][27] - The phenomenon of "superstar firms" dominating markets and potentially hindering innovation among smaller competitors is a critical concern for future economic dynamics [28][30] - The need for policies that promote fair competition and limit the monopolistic practices of large firms is emphasized to ensure a balanced economic environment [33]

诺奖经济学警钟!观念枷锁拖慢全球增长,民粹正把市场拖入陷阱

Sou Hu Cai Jing· 2025-10-22 13:12

Group 1 - The Nobel Prize in Economic Sciences for 2025 highlights the deep response to global economic development challenges, awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt [1][3] - Mokyr's research emphasizes the link between the Enlightenment's "progressive beliefs" and the encouragement of innovation, which ultimately led to the technological revolution [1][3] - Aghion and Howitt's theory of "creative destruction" underscores the necessity of continuously eliminating old models to embrace new dynamics for economic growth [3][11] Group 2 - The establishment of the British patent system was influenced by societal recognition of "knowledge privatization," supported by Enlightenment thinkers advocating rationality and property rights [5][11] - The concept of "white cat, black cat" in China's reform era legitimized wealth creation, releasing economic vitality, demonstrating the power of ideas in shaping economic outcomes [7][11] - Social media's rise has made public opinion a variable in economic decision-making, as seen in cases where companies faced backlash over perceived exploitation [7][9] Group 3 - The warning from Mokyr about developing countries focusing solely on economic catch-up while neglecting social modernization, risking falling into the "middle-income trap" [11][13] - Argentina's experience illustrates the dangers of excessive welfare and market intervention, leading to economic stagnation and public aversion to innovation [11][13] - The disconnect between public perception and the realities of market dynamics can hinder sectors like the restaurant industry from accessing financing due to misconceptions about capital and food safety [15][16] Group 4 - The rise of economic populism, exacerbated by social media, poses a global challenge, complicating rational discussions about market complexities [18][20] - The need for a "conceptual enlightenment" akin to the Enlightenment movement is essential for contemporary economic growth, emphasizing that market economies thrive on collaboration and innovation [20]

复旦六学者谈2025诺贝尔经济学奖:从创新机制到中国路径

Xin Lang Cai Jing· 2025-10-22 06:59

Core Insights - The 2025 Nobel Prize in Economic Sciences was awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their contributions to understanding innovation-driven economic growth mechanisms, providing a new theoretical foundation for modern economic prosperity [1][5][29] Group 1: Theoretical Contributions - Mokyr emphasizes the importance of cultural and conceptual shifts in driving economic growth, particularly during the Industrial Revolution in Europe, highlighting that knowledge accumulation and intellectual curiosity were crucial [10][11][12] - Aghion and Howitt's work on "creative destruction" mathematically models the concept, suggesting that patent systems and intellectual property protection are vital for fostering innovation and long-term economic development [9][29] - The discussions reflect a broader critique of traditional economic theories that often overlook the complexities and historical contexts of economic development, particularly in non-Western contexts [8][9][10] Group 2: Historical Context and Comparisons - The historical analysis of Europe's rise contrasts with China's development, noting that China's social structure, based on kinship, limited knowledge dissemination compared to Europe's more open academic and professional organizations [12][19][28] - The discussions highlight the limitations of Western economic theories when applied to contemporary China, suggesting that the unique historical and cultural contexts of nations must be considered in economic analysis [19][20][27] - The concept of "catching up" in economic development is explored, emphasizing that strong state capacity and market integration are crucial for latecomer countries like China to achieve rapid economic growth [20][22][30] Group 3: Implications for Modern Economic Theory - The integration of new elements into economic theory is necessary to capture the dynamics observed in China's rapid economic rise, particularly the role of a unified state in fostering innovation and economic growth [30] - The discussions suggest that the historical advantages of fragmented political entities in fostering innovation may not hold in the current global context, where large, unified markets can leverage knowledge more effectively [22][30] - The need for a balanced approach to technology adoption and innovation is emphasized, advocating for institutional frameworks that can absorb and adapt to technological changes while promoting equitable growth [18][30]

阿吉翁家族传奇vs.“人生的意义”小吃店

Hu Xiu· 2025-10-20 23:28

Core Insights - The 2025 Nobel Prize in Economic Sciences was awarded to Joel Mokyr, Philippe Aghion, and Peter Howitt for their contributions to the theory of "innovation-driven economic growth" [1] Group 1: Innovation and Economic Growth - Aghion's core ideas emphasize that innovation and knowledge dissemination are central to economic growth [6] - Innovation relies on incentives and property rights, with firms as the main agents of innovation and government acting as an "investor" and "insurer" [6][7] - The increasing difficulty of innovation is highlighted, as the number of researchers needed to achieve advancements like Moore's Law has increased significantly [8] Group 2: Creative Destruction - Aghion's family history exemplifies "creative destruction," with his mother founding Chloé to revolutionize women's fashion, creating a new concept of "luxury prêt-à-porter" [10] - Aghion transformed this family legacy into a theoretical framework for understanding capitalist economic growth through the Neo-Schumpeterian growth paradigm [11] Group 3: Personal and Societal Values - A small eatery in Zhengzhou gained popularity by emphasizing philosophical and poetic values over mere commercial success, showcasing a form of "creative destruction" [14][15] - The owner chose to close the restaurant at peak popularity to maintain personal integrity and a deeper purpose, reflecting a conscious decision to prioritize authenticity over profit [16][17] Group 4: Parallels in Values - The Aghion family represents an "additive" elegance, using resources to create new possibilities, while the eatery owner embodies a "subtractive" elegance, sacrificing immediate gains for deeper truths [19][20] - Both examples illustrate a commitment to "creative destruction," resisting external pressures to maintain their core values and purposes [21][22] Group 5: Philosophical Reflections - The essence of "creative destruction" is rooted in a pure, unwavering internal core, which can manifest in both grand revolutions and quiet retreats [23] - The pursuit of life's meaning is framed as participation in the ongoing cycle of "creative destruction," emphasizing the importance of understanding and engaging with this process [24][25]

经济学诺奖得主的富二代人生:香奈儿老佛爷帮他写作业,AI时代反对向机器人征税

量子位· 2025-10-19 08:10

Core Viewpoint - The 2025 Nobel Prize in Economic Sciences was awarded to three scholars who highlighted the critical role of technological and scientific innovation in driving economic growth, emphasizing the importance of continuous investment in basic research for long-term economic advancement [2][5][3]. Group 1: Nobel Prize Winners and Their Contributions - The prize was shared equally between Joel Mokyr, Philippe Aghion, and Peter Howitt, who revealed how technology and scientific innovation interact with market competition to foster economic growth [5][7]. - Joel Mokyr's research demonstrated the self-reinforcing relationship between scientific breakthroughs and technological applications, which is essential for sustained economic growth [7][11]. - Aghion and Howitt developed a pioneering mathematical model in the 1990s that explains how firms improve production processes and introduce higher-quality products through R&D investments, ultimately replacing established market leaders [8][30]. Group 2: Historical Context and Economic Growth - Historically, economic growth was sporadic, with little change in living standards until the Industrial Revolution in the 18th century, which initiated a self-reinforcing cycle of innovation and economic growth [21][22]. - Over the past two centuries, many countries have maintained an average economic growth rate of about 2%, which, due to compounding effects, results in significant income increases over decades [23][25]. - Joseph Schumpeter's concept of "creative destruction" explains that economic progress is driven by innovation that disrupts existing industries and creates new growth opportunities [26][28]. Group 3: Mechanisms of Innovation and Economic Dynamics - Mokyr identified two types of "useful knowledge" that drive innovation: propositional knowledge (understanding natural laws) and normative knowledge (practical guidelines) [30][29]. - Aghion and Howitt's model illustrates that the continuous replacement of old firms with new ones is a key engine of economic growth, as new companies strive to innovate and outperform established players [34][36]. - The rise of AI is currently instigating another wave of creative destruction, reinforcing the relevance of the Nobel laureates' research [40][41]. Group 4: Implications of Innovation - Innovation leads to the emergence of new winners while potentially sidelining others, raising concerns about job displacement and inequality [41][42]. - A robust policy framework is necessary to manage the effects of innovation and prevent market failures, ensuring that the mechanisms behind creative destruction are maintained [43][44].